Instant Approval Fast Loans: Find Out How to Qualify

Need money fast? Fast loans provide speedy funding when time is critical.

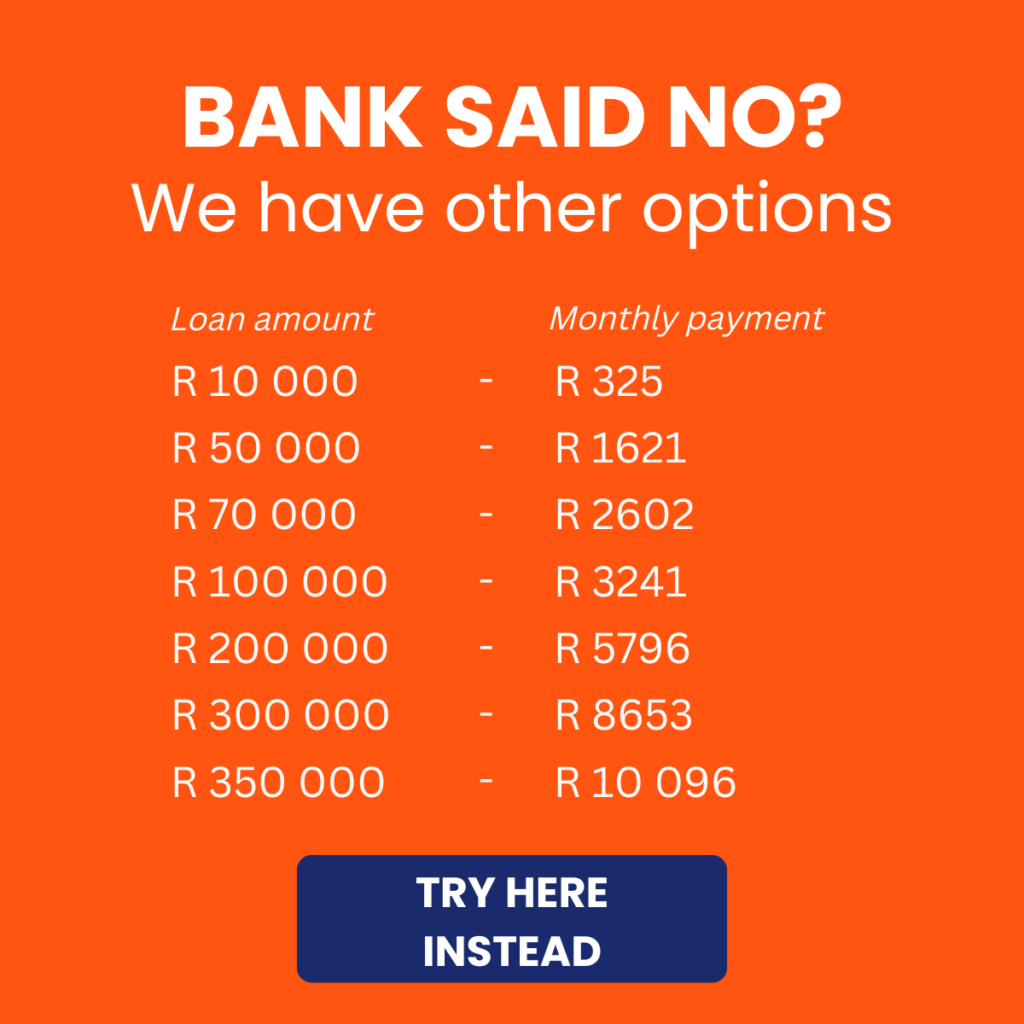

Arcadia Finance helps you in the search of loans from different banks and lenders. Fill in a free application and get loan offers from up to 19 lenders. We work with well-known, trusted, and NCR-licensed lenders in South Africa.

What are Fast Loans?

Fast loans are designed to provide quick access to funds, typically within a matter of hours or a day. What distinguishes a loan as “fast” is its streamlined application and approval process, which prioritises speed. Unlike traditional loans, which often require extensive documentation and lengthy approval times, fast loans usually necessitate minimal paperwork and are approved quickly, making them ideal for situations requiring immediate financial assistance. These loans are generally smaller in size, and the repayment period is shorter, often ranging from a few days to a few months.

Types of Fast Loans Available

There are several types of fast loans available in South Africa, each catering to different financial needs:

Payday Loans: These are among the most common types of fast loans. Payday loans are small, short-term loans designed to be repaid on your next payday. They are typically used for emergencies and require minimal paperwork. However, they often come with high-interest rates and short repayment terms.

Short-Term Personal Loans: These loans offer slightly more flexibility than payday loans, with larger loan amounts and longer repayment terms, usually a few months. The application process remains quick, making them a viable option for urgent needs, but they allow for a bit more time for repayment.

Instant Cash Loans: Similar to payday loans, instant cash loans focus on providing funds almost immediately—often within a few hours. These loans are usually applied for online, and approval is nearly instantaneous if you meet the lender’s criteria. They are ideal for emergencies but also come with high fees and short repayment periods.

Comparison to Traditional Loans

Fast loans differ from traditional loans primarily in terms of speed and convenience. Traditional loans often take days or weeks to process due to stricter checks and more extensive documentation, while fast loans offer quicker access to funds with looser eligibility criteria.

Another significant difference lies in the repayment period. Traditional loans typically have longer terms, often spanning months or years, whereas fast loans are short-term, requiring repayment within weeks or months. Additionally, fast loans usually carry higher interest rates, making them a more costly option, primarily suited for emergencies.

How Fast Loans Work

Fast loans are designed to provide quick and easy access to cash during emergencies. The process is much simpler and faster compared to traditional loans from banks. Here’s how the process typically works:

Application Process

The application process for a fast loan is generally straightforward and can be completed online, making it convenient for most borrowers. Here are the steps involved:

- Choose a Lender

Begin by selecting a reputable lender that offers fast loans. Ensure they are registered with the National Credit Regulator (NCR) in South Africa.

- Fill Out the Application

The application form typically requires basic information such as your full name, contact details, employment status, and income. You’ll also need to upload documents like your ID, proof of income, and bank statements.

- Submit Your Application

After completing the necessary details and uploading your documents, you can submit the application online. The process is usually quick, often taking less than 10 minutes.

Approval Timeframe

One of the main advantages of fast loans is their quick approval. Many lenders approve applications within minutes, although the timeframe can vary. Some lenders provide instant decisions, while others may take a few hours to review your information. As long as your details are accurate and complete, approval is generally swift.

Loan Payout Timing

Once approved, funds are typically deposited into your account quickly, often the same day or within 24 hours. Some lenders offer instant payouts, especially if you have an account with them. The speed of the payout depends on lender policies and your bank’s processing times, with applications earlier in the day often processed faster.

About Arcadia Finance

Arcadia Finance makes securing a loan simple. Benefit from no application fees and a choice of 19 NCR-approved lenders, each dedicated to providing a safe and efficient experience tailored to your needs.

Eligibility Requirements for Fast Loans

Before applying for a fast loan, it’s essential to understand the eligibility criteria that lenders use to determine whether you qualify. While fast loans are often easier to obtain than traditional loans, there are still some basic requirements you need to meet.

Basic Criteria

Most fast loan providers require applicants to meet several basic conditions:

- Age: You must be at least 18 years old to apply for a fast loan in South Africa.

- Employment: You need to provide proof of regular employment or income. This could be a payslip or proof of self-employment earnings. Lenders require assurance that you can repay the loan.

- Income Requirements: Lenders typically set minimum income thresholds to ensure you can afford the loan repayments. This varies between lenders, but you generally need to demonstrate that your income can cover the repayment plan.

Some lenders may also consider your monthly expenses to ensure you can manage the loan without overextending your budget.

Credit Score Considerations

While traditional loans often require a strong credit score, fast loans tend to involve more lenient credit checks. Some lenders may approve applicants with low or no credit history, focusing more on your current income and ability to repay the loan rather than your past financial behaviour.

However, this doesn’t mean your credit score is entirely overlooked. A better credit score can still help you secure more favourable terms, such as lower interest rates or higher loan amounts. Even if your credit score is less than ideal, many fast loan providers will still consider your application as long as you meet the basic criteria.

Documentation Needed

Fast loans typically require minimal paperwork compared to traditional loans, but you’ll still need to provide a few key documents:

- ID: A valid South African ID to confirm your identity and age.

- Proof of Income: Recent payslips or bank statements that demonstrate your income.

- Bank Statements: Usually, the last three months of bank statements are required to verify your financial stability and income patterns.

Pros and Cons of Fast Loans

Fast loans offer several benefits, but they also come with their own set of risks. It’s essential to weigh these carefully to make sure a fast loan is the right choice for your situation.

Advantages

- Quick Access to Cash: Receive funds on the same day, which can be critical in emergencies.

- Less Strict Credit Checks: Easier to qualify for than traditional loans, with more focus on current income.

- Convenience: Applications are typically done online, saving time and hassle compared to visiting a bank.

Disadvantages

- High Interest Rates: Fast loans often have significant costs, making them expensive if not repaid on time.

- Short Repayment Periods: Repayment is usually required within a short time, often a month or a few months, which can be challenging.

- Potential for Debt Cycles: High interest and short repayment periods can lead to repeated borrowing and further debt if not managed properly.

How to Apply for a Loan with Arcadia Finance

At Arcadia Finance, loan applications are simple and convenient. Start on our website, where our dedicated team is available to answer any questions you may have. We’ll need a few details about your income, expenses, desired loan amount, and repayment term. After you submit, our team will quickly review your application and get back to you as soon as possible.

Alternatives to Fast Loans

While fast loans can provide quick access to cash, they aren’t the only option available. Depending on your situation, there may be alternatives that offer better terms or lower costs in the long run. Here are some common alternatives to fast loans:

Personal Loans from Banks

Personal loans from traditional banks typically come with lower interest rates and more flexible repayment terms than fast loans. However, the downside is that the approval process can take longer, often several days or even weeks. This option is ideal if you don’t need the money immediately and prefer to secure a loan with more favourable conditions. Banks also tend to require stronger credit scores and more detailed financial documentation. However, if you qualify, the cost savings over time can be significant compared to a fast loan.

Credit Cards

For smaller, short-term expenses, a credit card can be a practical option. Many credit cards provide an interest-free period if you pay the full balance by the due date, allowing you to avoid interest charges entirely. However, if you cannot settle the balance within this period, interest rates can be high, similar to those of quick loans. Credit cards also offer flexibility, letting you borrow only what you need and repay it gradually.

Borrowing from Family or Friends

If you find yourself in a tight spot and have a close family member or friend willing to lend you money, this can be a great interest-free alternative to a fast loan. Borrowing from someone you know typically doesn’t involve fees or interest and can offer flexible repayment terms. However, it’s crucial to treat this arrangement professionally by agreeing on clear repayment terms to avoid potential strain on your relationship. Communicate openly about when and how you plan to repay the money to maintain trust and avoid misunderstandings.

Steps to Repay a Fast Loan Responsibly

Once you’ve taken out a fast loan, the next step is to manage the repayment process responsibly. Being proactive about repayment is crucial to avoiding further financial stress or falling into a debt cycle.

Setting a Repayment Plan

To repay a fast loan responsibly, start by creating a budget that includes your loan payments. Calculate the amount you need to pay each month and incorporate it into your regular expenses. If possible, allocate extra funds to repay the loan faster and reduce interest costs. Temporarily cutting non-essential spending can also help you stay on track without straining your finances.

Avoiding Late Payments

Late payments can incur additional fees and interest, increasing the overall cost of your loan. Set reminders or arrange for automatic payments to ensure you pay on time, which will help protect your credit score. If you find yourself in difficulty, contact your lender early to discuss alternative arrangements.

Consequences of Default

Missing payments or defaulting on your loan can lead to serious consequences. Lenders may charge fees, increase interest rates, or take legal action, potentially resulting in wage garnishments or asset seizures. Your credit score will also be negatively affected, making future borrowing more challenging. Defaulting can have long-term financial repercussions, so it’s essential to take repayment seriously and reach out to your lender if you need assistance.

Conclusion

Fast loans can provide a helpful solution for South Africans facing urgent financial needs by offering quick access to cash and a straightforward application process. However, they often come with higher interest rates and short repayment terms, making them a costly option if not managed carefully.

Frequently Asked Questions

A fast loan is a short-term loan designed to provide quick access to cash, often within hours of applying. It is typically used for emergencies or urgent expenses and features a streamlined application process, usually completed online.

The approval and payout process for fast loans is very quick. In many cases, you can receive the funds on the same day or within 24 hours, depending on the lender and your bank’s processing times.

Fast loans generally have more lenient credit requirements compared to traditional loans. While some lenders may consider your credit score, many focus more on your current income and ability to repay the loan.

Fast loans usually have short repayment periods, often ranging from a few weeks to a few months. The exact term depends on the lender and the loan amount, but these loans are designed to be repaid quickly.

The main risks of fast loans include high interest rates and short repayment periods, which can make them expensive. Failing to repay the loan on time can lead to additional fees, increased debt, and a negative impact on your credit score.