Loan Calculator – Take your monthly payments under control

The Loan Calculator can help you find the right loan offer for you in just 5 minutes.

Loan amount R100 - R250,000. Repayment terms can range from 3 - 72 months. Minimum APR is 5% and maximum APR is 60%.

Your email address seems invalid. Write the email again or use some other email address.

What is a Loan Calculator?

A loan calculator is an online tool designed to help you estimate the cost of a loan. It calculates important figures like your monthly repayments, total interest payable, and the overall cost of the loan over its term. By inputting key details about your loan, such as the loan amount, interest rate, and loan term, the calculator provides a clear breakdown of how much you’ll need to pay and when.

Loan Basics For Borrowers

Interest Rate

Most loans come with interest charges, which represent the profit earned by banks or lending institutions. The interest rate refers to the percentage applied to the borrowed amount that the borrower must repay to the lender. In nearly every case, this is paid on top of the loan’s original value, known as the principal. The rate is typically presented as the annual percentage rate (APR), which reflects both the interest and any associated fees. In contrast, the annual percentage yield (APY) is a figure commonly quoted for savings and investment products such as fixed deposits and savings accounts. Understanding the distinction between APR and APY is necessary for proper financial planning.

Compounding Frequency

Compound interest refers to interest calculated not just on the initial loan amount, but also on any interest that has previously accrued. This means the amount owed can grow more quickly depending on how often the interest is compounded. In many loan agreements, monthly compounding is applied.

Loan Term

The loan term refers to the length of time over which a loan is repaid, assuming that the borrower makes all required payments each month. The length of this term can significantly impact the overall loan structure. A longer term typically results in more interest accumulating over the life of the loan, increasing the total repayment amount. However, this also tends to lower the monthly instalments, which can make repayment more manageable in the short term.

Why Use a Loan Calculator?

Understanding how loans work and planning your finances can be challenging. A loan calculator simplifies this process by providing clear, instant, and accurate information about your potential loan obligations. Here’s a breakdown of why using a loan calculator is so beneficial:

Benefits of Loan Calculators

- Comparing Different Loan Offers: With various lenders offering different interest rates and loan terms, it can be difficult to determine which loan is the best option for you. A loan calculator makes this easier by allowing you to compare multiple loan offers side-by-side. You can quickly adjust variables such as interest rates and loan terms to see how they impact your overall repayment amount, enabling you to choose the most cost-effective option.

- Understanding Monthly Repayments: One of the most important aspects of borrowing money is knowing how much you will need to pay each month. A loan calculator provides you with an exact figure for your monthly repayment amount, helping you plan your budget accordingly and avoid financial strain.

- Estimating Total Interest Payable: Loans come with interest, which can add up significantly over the repayment term. By using a loan calculator, you can see the total interest cost of the loan, giving you a clearer picture of the actual expense. This information helps you understand the true cost of borrowing and can influence your decision on the loan amount or term.

Receive your loan offers immediately after filling up the loan application. Check what kind of loan offers you will get!

Who Can Benefit from a Loan Calculator?

Loan calculators are incredibly versatile tools and can benefit a wide range of individuals, including:

Homebuyers: First-time or experienced homebuyers can use a loan calculator to estimate their monthly mortgage payments and determine if a specific property is affordable and within their budget.

Car Buyers: Whether you’re financing a new or used vehicle, a loan calculator can help you understand the cost of your car loan, making it easier to plan for future expenses and ensure your car purchase doesn’t exceed your budget.

Personal Loan Seekers: People looking to take out a personal loan for various reasons, such as medical expenses, travel, or debt consolidation, can benefit from seeing how different loan amounts and interest rates affect their repayment plans.

Entrepreneurs and Business Owners: Business owners considering loans to expand their operations or fund new ventures can use loan calculators to assess the affordability of business loans and determine the potential impact on their cash flow.

Anyone Considering Refinancing: If you’re thinking about refinancing an existing loan to get a lower interest rate, a loan calculator can help you compare your current loan terms with new potential offers to see if refinancing will save you money.

No hidden fees, free application – no commitment

Loan Repayment Calculator

The following can be calculated:

- Monthly loan repayment amount

- Total loan amount

- Loan period

What To Keep in Mind While Using A Loan Calculator

A loan calculator offers a simple way to estimate your monthly instalments for various types of credit. When using it, you’ll need to provide the following information:

Loan Amount

The loan amount refers to the total you plan to borrow. A calculator can assist in refining this figure. For example, it can help you compare how your monthly repayments would change on a mortgage refinance depending on whether you include the closing costs or not. It also helps establish the maximum amount you’re prepared to borrow before entering negotiations with a car dealership or property seller.

Loan Term In Years Or Months

You can adjust the loan term to suit your financial goals. Ask yourself: is paying the loan off quickly more important than having a lower monthly repayment? Examples include:

- Paying off a home loan faster to achieve financial freedom sooner.

- Choosing a longer term on vehicle finance to keep repayments low while managing other major expenses, such as a wedding or school fees.

- Selecting a suitable debt consolidation term that helps you clear high-interest card balances while sticking to your monthly budget.

- Considering shorter loan periods, such as three years for a personal or auto loan, or 15 years for a mortgage.

- If you prefer smaller monthly repayments, opt for longer terms like seven-year personal or auto loans, or a 30-year home loan.

- Some lenders may offer terms as short as one year, although these are rare. The calculator will automatically convert the term into months once the years are entered.

Annual Interest Rate

This is the yearly percentage charged on the loan. Interest rates on personal and vehicle finance loans can differ widely depending on the borrower’s credit profile. For instance, someone with a strong credit history might be offered a rate of 6.5 percent for a three-year personal loan, while someone with average credit could face a rate closer to 20 percent for the same term. It’s also worth noting that longer loan durations typically come with higher interest rates, which increases the total interest paid over the life of the loan.

Total Interest Paid

This figure shows how much you will pay in interest over the full loan term. Paying off your loan more quickly can reduce the total interest considerably.

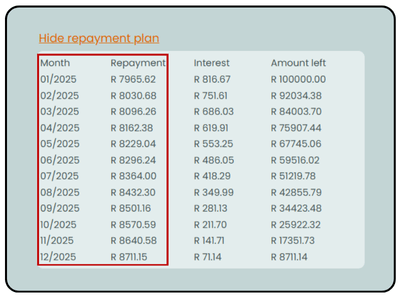

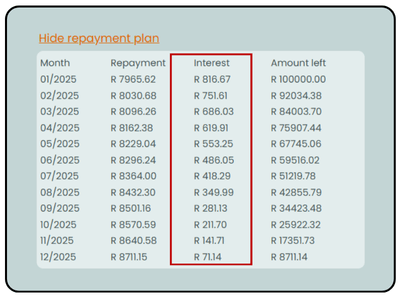

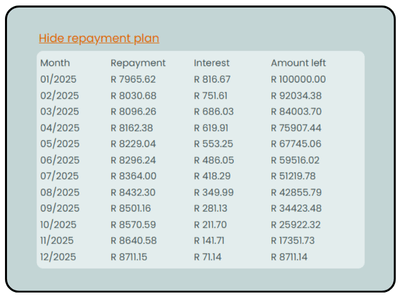

Amortisation Schedule

To examine how your payments are structured, view the amortisation schedule. This breakdown shows:

- Higher interest portions are charged at the start of the loan term, with interest reducing as time goes on.

- The final payment date, which is especially useful for budgeting if you plan to free up funds for a major purchase once the loan is settled.

Adding Extra Payments

If you already have a loan, this feature lets you test the effect of making extra repayments. You can explore how additional payments will impact your loan balance and final payment date. Three options are available:

- Monthly extra payments

- Annual lump sum payments

- One-time payments for applying unexpected funds

You’ll need to select the date of the additional payment and generate the updated amortisation schedule.

Why Use Arcadia Finance?

- 100% free: The application is free and does not include any hidden fees.

- Quick & easy: The whole application process is done online in minutes.

- Convenient: Compare up to 16 banks & lenders with one application.

- Non-binding: You decide if you want to accept or decline your offers.

- Safe: Your personal data is safe with us.

What is Arcadia Finance?

Arcadia Finance helps South Africans in the search for loans from different banks and lenders through our loan broker partners. We provide access to up to 19 reputable banks and lenders. By completing our loan application you will get multiple loan offers, which you can compare and select the most suitable offer. The service we offer is completely free of charge and you will not commit to anything by requesting loan offers via Arcadia Finance. We only work with trusted loan brokers who collaborate with NCR licensed banks and lenders in South Africa.

How to Use the Loan Calculator

Using a loan calculator is straightforward and can provide you with detailed insights into the cost of a loan. Here’s a simple step-by-step guide on how to use it effectively:

Step-by-Step Guide

- Input Loan Amount

Begin by entering the total amount of money you wish to borrow. This is known as the principal. For example, if you are planning to buy a car and need to borrow R200,000, enter that amount in the calculator.

- Select Interest Rate

Enter the annual interest rate offered by the lender. This rate determines how much interest you will pay over the loan term. For instance, if the lender offers an interest rate of 8%, you would input 8% in the interest rate field.

- Choose Loan Term

Select the duration of the loan, typically measured in years or months. For example, if you plan to pay off the loan over 5 years, select or input “5 years” in this field. Some calculators may allow you to choose a term in months, so make sure to adjust accordingly.

19

Banks & Brokers

Comparing

85%

South Africans

Approved for Loans

1 500 000

Users Compared Loans Through Arcadia

Understanding the Results

Once you’ve entered all the necessary details, the loan calculator will generate key figures to help you understand your loan better:

Explanation of Monthly Repayment

The calculator will show your monthly repayment amount, which is the fixed amount you need to pay each month to cover both the loan principal and the interest. This figure helps you determine if the loan is affordable and how it fits into your monthly budget.

Total Interest Breakdown

The calculator will also display the total interest payable over the life of the loan. This is the amount you will pay in interest alone, on top of the original loan amount. Understanding this figure helps you see how much the loan will cost in terms of interest and can motivate you to look for lower interest rates or shorter loan terms to minimise costs.

Total Loan Cost

Finally, the calculator will show the total cost of the loan, which includes both the loan principal and the total interest payable. This gives you a complete picture of how much money you will have paid by the end of the loan term. For example, if you borrow R200,000 with R50,000 in total interest, the total loan cost will be R250,000.

Check your eligibility for FREE!

Tips for Getting the Best Loan Deal in South Africa

- Improve Your Credit Score: Pay your bills on time, reduce existing debt, and check your credit report for errors. A higher credit score can secure you lower interest rates and better loan terms.

- Shop Around for the Best Rates: Compare loan offers from multiple lenders to find the most competitive interest rate and terms. Use online platforms to streamline the comparison process and negotiate with your preferred lender.

- Consider the Loan Term Carefully: Shorter loan terms mean higher monthly payments but lower total interest. Choose a term that balances affordability with the overall cost of the loan.

- Understand Additional Costs and Fees: Be aware of fees like origination charges, prepayment penalties, and mandatory insurance. These can significantly impact the total cost of the loan, so factor them into your decision-making.

Secure your loan effortlessly with Arcadia Finance

The loan application is free, and you can pick from a variety of 16 respected lenders. We only work with trusted loan brokers who collaborate with NCR licensed banks and lenders in South Africa.

After submitting your loan application to Arcadia Finance, we will send it through our loan broker partners to a number of different banks and lenders for review. Within minutes, you’ll receive a variety of loan options that are available for you. Select the one that best fits your needs.

Remember, all offers are no-binding, so if you don’t find what you’re looking for, you’re free to decline.

Conclusion

A loan calculator is an essential tool for anyone considering borrowing money, as it provides clear estimates of monthly payments, total interest, and overall loan costs. By understanding the key factors that influence loan terms, such as interest rates, loan duration, and your credit score, you can make informed decisions and find the best loan deal tailored to your financial situation. Use these calculators to compare offers, plan effectively, and manage your budget, ensuring you approach borrowing with confidence and financial clarity.

Frequently Asked Questions

The loan calculator helps you estimate your monthly repayments based on factors such as loan amount, term, and interest rate. It gives you a clear picture of the total cost of the loan, including interest and any applicable fees.

The loan calculator provides estimates based on the data you input, such as loan amount, term, and interest rate. While it’s a useful tool for planning, remember that actual loan terms may vary based on lender conditions, additional fees, or changes in interest rates.

Yes, the loan calculator allows you to see how additional payments or early repayments will affect your loan. It helps you understand how paying more than the minimum can reduce the interest paid and shorten the loan term.

The ideal loan term depends on your financial stability and goals. If you want to pay less interest over time and can handle higher monthly payments, a shorter-term loan is better. However, if you prefer lower monthly payments to ease your cash flow, a longer-term loan may be more suitable.

Some fees, such as origination or service fees, may not always be included in the basic calculator output. It’s important to review all terms with the lender to get a full understanding of any additional costs associated with the loan.