South Africa has long been a major source of gold, with deposits that have shaped both its economy and global supply. Although production has declined sharply from historic highs, the country still holds some of the largest reserves worldwide and remains an important exporter. From large-scale operations in Gauteng and the Free State to the persistent challenge of illegal mining, gold continues to play a vital role in South Africa’s economy, exports, and financial stability.

Key Takeaways

- Gold Production and Reserves: South Africa produced 100 metric tonnes of gold in 2024, holding around 10 percent of global reserves, with the Witwatersrand Basin remaining a major deposit despite long-term declines.

- Economic Role of Gold: Gold now contributes about 2 percent of GDP and 7 percent of exports, still playing an important role in foreign reserves, currency stability, and investor confidence.

- Challenges Facing the Sector: The industry faces pressures from illegal mining, labour disputes, and production decline, with unlawful operations alone costing the economy an estimated R21 billion annually.

About Arcadia Finance

Get fast, hassle-free access to credit with Arcadia Finance. Skip application fees and compare offers from 19 trusted lenders regulated by the NCR. Benefit from a smooth process and solutions tailored to you.

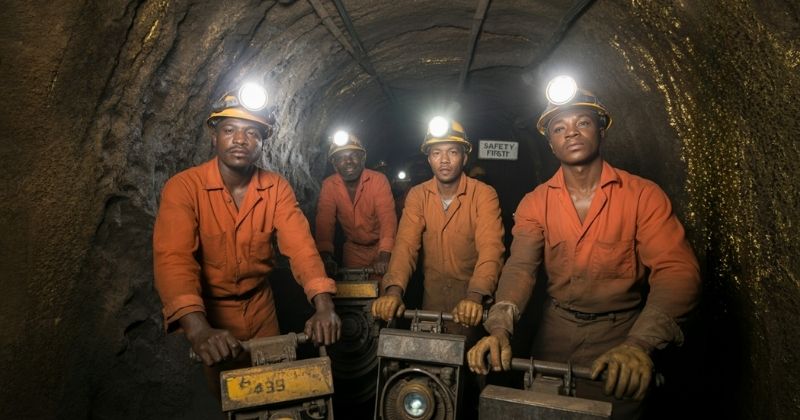

Major Gold Mining Regions in South Africa

Witwatersrand Basin

The Witwatersrand Basin is the world’s largest gold resource and has produced over 40,000 tonnes of gold, which is about 22% of all gold ever mined globally. It stretches across Gauteng, Free State and North West provinces, with gold hosted in ancient conglomerate formations. Even after more than a century of mining, it is estimated that thousands of tonnes remain recoverable.

Free State Goldfields

Gold mining in the Free State began in the mid-20th century and continues to be a significant contributor to South Africa’s output. The region includes active mines such as Kopanang, Target, Unisel, Moab Khotsong and Beatrix, which together account for roughly 30% of the country’s gold production. The discovery of rich ore bodies transformed the area, with towns like Welkom and Virginia growing rapidly around the mining industry.

Mpumalanga and North West Operations

Although smaller than the Witwatersrand and Free State fields, Mpumalanga and North West also contain important gold mining sites. Mpumalanga’s historic mines at Barberton and Pilgrim’s Rest are among the oldest and highest grade in the world and they continue to operate today. In North West province, gold contributes significantly to the regional economy, with several active operations forming part of the broader South African mining landscape.

Estimated Gold Reserves

Total Reserves Still Underground

South Africa is estimated to hold roughly 5,000 tonnes of unmined gold underground, primarily located within the Witwatersrand Basin. These figures place the country among the top holders of untapped gold worldwide.

Proven vs Unproven Reserves

A portion of these reserves is classified as proven, meaning they are economically and technically viable to mine with current methods, although deeper deposits are increasingly costly to extract. The remaining unproven reserves are still significant, but their accessibility depends on future advances in mining technology and shifts in global market prices.

Comparison with Other Leading Gold Producing Countries

| Country | Estimated Gold Reserves | Notes |

|---|---|---|

| Australia | ~10,000 tonnes | Largest identified reserves globally. |

| Russia | ~5,000 tonnes | Second largest reserves, strong global production role. |

| United States | ~3,000 tonnes | Significant reserves but smaller compared to Australia and Russia. |

| South Africa | ~5,000 tonnes | Still a leading holder of reserves despite declining annual production. |

How Much Gold Has Been Mined Already?

South Africa’s cumulative gold output since the discovery of the Witwatersrand Basin in 1886 exceeds 40,000 tonnes, making it the single largest contributor to global gold supply and accounting for close to a quarter of all gold ever mined.

At its peak in the 1970s, South Africa was producing nearly 1,000 tonnes per year, which underpinned its global economic dominance. However, production has declined sharply over time due to ageing, deep-level mines, rising costs and reduced ore grades.

By 2024, total gold production had dropped to approximately 100 tonnes or 100,000 kilograms, a substantial fall from historic highs. The most recent figures indicate that South Africa continues to produce around 100 tonnes of gold a year in 2025.

In terms of corporate output, Harmony Gold, the country’s leading producer, is on track to exceed its target of 1.5 million ounces (around 47 tonnes) for the financial year ending in 2025, despite some dips earlier in the year.

Despite the significant decline in annual production, South Africa’s historical total ensures that it remains a defining force in the global gold story.

The State Of Gold Production In South Africa

In 2024, South Africa’s gold output reached 100 metric tonnes (MT), reflecting a small decline from the 104 MT recorded in 2023. The nation still holds an estimated 10 percent of global gold reserves, with the Witwatersrand Basin continuing to be recognised as one of the most extensive gold deposits in the world.

Key Mining Operations

Among the most significant assets in the country is Gold Fields’ South Deep mine, which produced around 322,000 ounces of gold in 2023. Another leading contributor is Sibanye-Stillwater’s Driefontein mine, with production of approximately 233,000 ounces in the same year.

Long-Term Decline In Output

South Africa was once one of the world’s leading gold producers, but production has decreased considerably. Between 1980 and 2018, the nation’s gold output contracted by nearly 85 percent. This trend has been compounded by ongoing disputes between gold companies and the Association of Mineworkers and Construction Union (AMCU). The union has staged repeated strikes and protests across both gold and platinum operations, focusing on demands for higher wages and resisting mergers that could threaten jobs.

Disruptions In 2024

The sector faced further setbacks in 2024 when access to the Buffelsfontein gold mine west of Johannesburg was blocked by illegal miners. Authorities cut off food and water supplies as a tactic to pressure hundreds of miners working underground to resurface.

Illegal mining remains a significant challenge to the formal sector. It is estimated that 10 percent of South Africa’s overall gold production comes from unlawful operations. Reports suggest that more than 30,000 unauthorised miners are active across roughly 6,000 abandoned mine shafts, highlighting the scale of the problem and the risks it poses to both safety and the economy.

The Five Largest Gold Mines Operating in South Africa

| Mine | Location | Owner | Type of Operation | 2023 Production (ounces) | Expected Lifespan | Description |

|---|---|---|---|---|---|---|

| South Deep Gold Mine | Gauteng | Gold Fields | Underground | 321,500 | Until 2096 | One of the largest gold mines in the world, South Deep has extensive reserves and is central to Gold Fields’ global portfolio. The mine uses advanced mechanised mining methods and is a cornerstone of South Africa’s long-term gold output. |

| Kloof Gold Mine | Gauteng | Sibanye Stillwater | Surface & Underground | 262,190 | Until 2032 | A mature mining complex with multiple shafts, Kloof is known for its high-grade ore and strategic importance to Sibanye Stillwater’s South African operations. |

| Driefontein Gold Mine | Gauteng | Sibanye Stillwater | Underground | 256,020 | Until 2032 | Once part of the legendary West Wits Line, Driefontein has historically been one of the richest gold mines globally. It continues to contribute significantly despite declining ore grades. |

| Mponeng Mine | Gauteng | Harmony Gold Mining | Deep-level Underground | 239,490 | Until 2030 | Famous as the deepest operating gold mine in the world, extending more than 4 kilometres below surface. Mponeng symbolises both the challenges and technical achievements of deep-level mining. |

| Tshepong Mine | Free State | Harmony Gold Mining | Underground | 218,140 | Until 2030 | Located near Welkom, Tshepong is part of Harmony’s Free State operations. It is a significant employer in the region and remains one of the country’s productive underground mines. |

Macroeconomic Role of Gold in South Africa

Contribution to GDP and Exports

Although South Africa’s gold output has declined over the decades, the industry still carries weight within the broader economy. In 1980, gold sales made up around 15 percent of the country’s GDP and accounted for roughly 45 percent of all merchandise exports. Today, these figures are much smaller, with gold representing about 2 percent of GDP and 7 percent of goods exports. Mineral exports as a whole still contribute close to 10 percent of GDP and remain one of the largest sources of foreign exchange earnings and export revenue.

Foreign Reserves and Monetary Policy

Gold revenue strengthens South Africa’s foreign exchange reserves, which provide stability for the national economy. Export earnings from the sector improve the balance of payments and increase the level of foreign currency reserves, both of which are managed by the South African Reserve Bank (SARB). The SARB has maintained a stable holding of around 125 tonnes of gold for more than two decades, giving the country a consistent reserve base.

Impact on Currency and Investor Sentiment

Movements in the gold price often influence the value of the South African rand. When international gold prices increase, the rand typically gains strength against major global currencies. This effect improves investor confidence in both the mining sector and the country’s broader economic outlook. Higher gold prices also boost the profitability of listed mining companies, which in turn supports the Johannesburg Stock Exchange (JSE).

Value of Gold Mining Assets

Despite falling annual production volumes, the value of gold reserves in South Africa remains considerable. Mining companies continue to hold reserves that equate to roughly twenty years of production at current output levels. With gold prices rising in recent years, the combined market value of the four largest gold miners listed on the JSE has more than doubled since the start of 2025.

Conclusion

Gold continues to play a meaningful role in South Africa’s economy, even though production has fallen sharply from historic highs. The country still possesses substantial reserves, and major mines such as South Deep and Mponeng remain globally significant. While gold now contributes a smaller share to GDP and exports compared to past decades, it remains a vital source of foreign exchange, investor confidence, and employment. However, the sector is weighed down by structural challenges that include labour disputes, rising production costs, and widespread illegal mining. Balancing sustainable operations with stricter regulation and community development will determine how strongly gold continues to support South Africa’s economic future.

Frequently Asked Questions

In 2024, South Africa’s mines produced around 100 metric tonnes of gold, showing a slight drop compared with the 104 metric tonnes achieved in the previous year. Although far below the historic highs of the 1970s, this level of output still places the country among the important gold producers globally.

South Africa is estimated to hold about 10 percent of the total global gold reserves, with the majority found in the Witwatersrand Basin. This region has historically been the foundation of the country’s mining industry and continues to be recognised as one of the richest gold deposits in the world.

The sharp drop in gold output, estimated at nearly 85 percent between 1980 and 2018, can be traced to the increasing depth and cost of mining, more complex geology, higher energy expenses, and frequent labour disputes. These factors have collectively reduced the country’s ability to sustain the large-scale production levels of the past.

Although its contribution has diminished compared with earlier decades, gold still accounts for roughly 2 percent of GDP and about 7 percent of goods exports. It plays an important part in supporting foreign exchange reserves, strengthening the rand when prices are high, and providing confidence to investors in both the mining industry and the Johannesburg Stock Exchange.

Illegal mining represents a major obstacle for the sector, accounting for around 10 percent of the country’s overall gold production. The South African economy loses an estimated R21 billion every year due to smuggling, lost tax revenue, and uncollected royalties. Beyond the financial costs, illegal mining creates significant safety hazards, environmental damage, and social risks within mining communities.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.