New figures released by Statistics South Africa indicate that a smaller number of South Africans were dragged before the courts for unpaid debt during November 2025, suggesting some moderation in legal pressure on households.

Key Takeaways

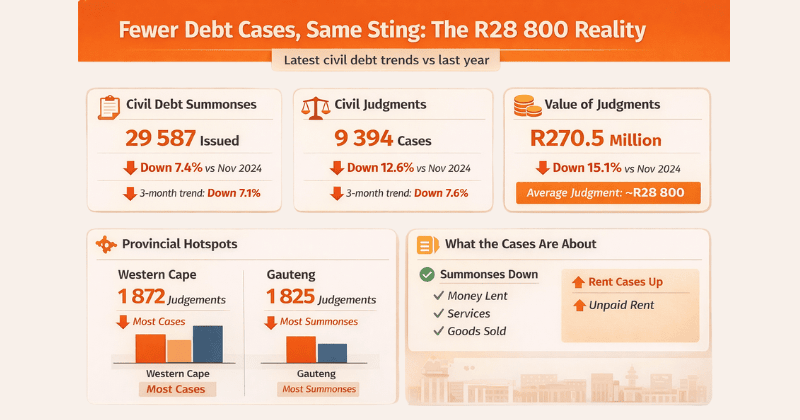

- Fewer Debt Cases: Civil summonses and judgements are declining, pointing to reduced legal action over unpaid debt.

- High Financial Impact Remains: Average court-ordered repayments near R29,000 still place heavy pressure on affected households.

- Regional And Rental Strain Continues: The Western Cape and Gauteng lead in judgements, with rent-related disputes remaining a key pressure point.

About Arcadia Finance

Apply for a loan the easy way through Arcadia Finance. There are no application fees, and you can choose from 19 reputable lenders that follow National Credit Regulator standards. The process is simple, with options matched to your budget and goals.

Fewer Debt Cases, But Court-Ordered Repayments Remain Financially Punishing

When the total value of civil judgements granted during November is divided by the number of cases finalised, the typical court-ordered debt repayment amounted to just under R29 000. This level remains significant relative to average household incomes and continues to pose a serious strain on affected consumers.

Civil judgements often include additional costs such as legal fees and interest, meaning the final amount repaid can exceed the original debt.

Summonses For Debt Show Year-On-Year Decline

The number of civil summonses issued for outstanding debt fell to 29,587 in November 2025. This represents a decline of 7.4% compared with the same month in 2024, pointing to fewer creditors pursuing legal action through the courts.

Over a broader period, the trend remains consistent:

- Summonses issued over the three months ending in November were 7.1% lower year-on-year.

- This suggests a sustained slowdown rather than a once-off monthly dip.

A reduction in summonses may reflect tighter lending standards or increased use of debt counselling and repayment plans before legal action is taken.

Court Judgements Also Trend Lower

Not only were fewer summonses issued, but the number of cases reaching the judgement stage also declined. In November, courts recorded 9,394 civil judgements where repayment of debt was formally ordered.

This figure was:

- 12.6% lower than in November 2024.

- 7.6% down when measured over the three-month period to November.

These declines point to a broader softening in debt-related court activity, even as the financial impact per case remains elevated.

Provincial Breakdown Of Judgements

While overall numbers fell, certain provinces continued to account for a large share of debt judgements.

| Province | Number Of Judgements |

|---|---|

| Western Cape | 1,872 |

| Gauteng | 1,825 |

The Western Cape recorded the highest number of civil judgements during the month, narrowly ahead of Gauteng, highlighting regional differences in credit use, enforcement and household financial stress.

What The Numbers Mean For Consumers

Although fewer people are being taken to court, the high average value of judgements suggests that those who do fall into default are carrying heavier debt burdens.

Overall, the latest data paints a mixed picture. Legal pressure from debt cases appears to be easing, but for households that do face judgement, the financial consequences remain severe and difficult to absorb.

Provincial Court Summons Trends Highlight Regional Differences

This situation unfolded even though Gauteng was responsible for roughly one third of all court summons issued during the month under review, whereas the Western Cape recorded close to 6,000 summons over the same period, underlining notable regional contrasts in legal debt activity.

Tip: Provincial economic conditions, employment trends and housing markets often influence how many civil debt matters escalate to court in each region.

Gauteng Versus Western Cape Activity

- Gauteng remained the largest contributor to total summons volumes

- The Western Cape followed with a significantly smaller, though still substantial, number of cases

- Regional disparities may reflect differences in population size, income levels and urbanisation patterns

Judgement Values Stay Elevated Despite Case Decline

Even with the overall reduction in the number of cases and court judgements, the combined monetary value of judgements stayed elevated, reaching approximately R270.5 million in November, signalling that the financial stakes in active cases remain considerable.

Month On Month And Quarterly Comparisons

The total value recorded represented a decrease of 15.1% compared with November 2024, yet over a broader three-month comparison, the figure showed only a marginal decline of 0.8%, suggesting that the longer-term trend in judgement values is relatively stable rather than sharply downward.

| Comparison Period | Change In Total Judgement Value |

|---|---|

| Versus November 2024 | Down 15.1% |

| Three month comparison | Down 0.8% |

Different Debt Categories Shape The Overall Picture

The statistics further illustrate how various types of debt play distinct roles in shaping civil court activity. Civil actions connected to money lent, services rendered and a broad category labelled other debts were among the most significant downward contributors to the reduction in both summonses and judgements.

Debt Types With Falling Court Activity

- Money lent claims

- Services-related debts

- Other miscellaneous debt categories

These segments collectively helped drive the overall decline in formal legal actions.

Rental Disputes Move Against The Trend

Although summons volumes fell across most debt categories, the number of legal cases relating to unpaid rent edged higher, partially counterbalancing the broader downward movement seen in other areas of civil debt litigation.

Tip: Rising rental cases can sometimes reflect pressure on household budgets, particularly when living costs increase faster than income growth.

Where The Largest Judgement Amounts Originate

Looking specifically at the value of court judgements, debts linked to services and money lent together made up nearly half of the total amount that courts ordered to be repaid during November. A further share of 20% or more was attributed to other debts and promissory notes, highlighting the concentration of large monetary claims in a few key categories.

Breakdown Of Major Judgement Value Sources

- Services-related debts

- Money lent cases

- Other debts

- Promissory notes

Conclusion

The latest figures suggest that while the legal system is seeing fewer debt-related cases, this does not equate to meaningful financial relief for struggling households. The average judgement amount remains high, ensuring that those who do fall into default face severe and often lasting financial consequences. With debt pressure still concentrated in key provinces and rental-related disputes on the rise, the data points to a cautious improvement in trends rather than a full easing of household financial stress.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.