Educational institutions across South Africa are bracing for a significant financial adjustment as government prepares to alter the tax treatment of schools. Authorities have confirmed that from the start of 2026, schools will be pushed out of the Value Added Tax (VAT) system, a move that is expected to have far-reaching financial consequences for many institutions.

Key Takeaways

- Private Schools to Exit VAT System: From 1 January 2026, all schools in South Africa, including private schools, will be required to deregister as VAT vendors under the Draft Taxation Laws Amendment Bill.

- Large Financial Shock Expected: Deregistration will trigger a “deemed supply” tax event, leaving schools with potentially substantial VAT bills at the end of 2025, which could strain budgets and push some institutions to cut costs or increase fees.

- Limited Relief Measures: Treasury has allowed repayment in twelve monthly instalments, but no refunds will be issued for past VAT. Schools have until September 2025 to submit public comments, with concerns about fairness and preparation time dominating the debate.

About Arcadia Finance

Get the loan you need with ease through Arcadia Finance. Compare offers from 19 trusted lenders, all NCR-registered, with zero application fees. Enjoy a smooth process designed to fit your financial needs.

Draft Taxation Laws Amendment Bill

The Draft Taxation Laws Amendment Bill, released for public consultation last week, proposes that all schools will be compelled to deregister as VAT vendors from 1 January 2026. The proposed amendment makes it clear that while every school falls under this measure, the regulations explicitly highlight private schools as being subject to the same requirement. Private schools, which often rely on additional streams of income beyond tuition, are expected to feel the heaviest impact, as their commercial activities have historically justified VAT registration.

A Treasury note accompanying the Bill explained that a considerable number of schools that have long operated as VAT vendors will no longer be able to do so once the changes are enforced.

This will leave many schools scrambling to reconfigure accounting systems, reconcile their tax obligations, and prepare for what could be one of the most disruptive policy shifts in the education sector in recent memory.

Previous VAT Treatment of Schools

For many years, the tuition and boarding fees charged by schools have been exempt from VAT. Section 12(h)(i) of the VAT Act excluded tuition and directly related educational services from taxation. Similarly, section 12(h)(ii) provided further exemptions for goods or services supplied by schools, provided these were incidental to the core function of education and were paid for in the form of tuition, school fees, or board and lodging.

Despite this, the specific wording of the legislation suggested that when schools provided goods or services in exchange for other forms of payment, such as hiring out school halls or charging for uniforms, these activities were classified as taxable supplies. Schools were therefore obliged to charge VAT on such items.

As a result, many schools opted to register as VAT vendors. This allowed them not only to comply with the law by charging VAT on these commercial activities, but also to benefit by claiming input VAT on expenditure such as new building projects, uniforms, and general operating costs. For some well-resourced schools, VAT registration became a valuable tool to reduce the cost of infrastructure expansion, sports facilities, or technology upgrades, effectively making education delivery more affordable in the long run.

Clarification of New Proposals

The draft Taxation Laws Amendment Bill 2025, issued by National Treasury, sets out substantial proposed changes that directly affect schools registered as VAT vendors. Tax specialists have noted that the amendment specifically targets the supply of educational services, creating a new framework that will apply uniformly to all schools.

This marks a decisive policy move by government, signalling an intent to simplify tax treatment but also to close off perceived loopholes that may have given certain schools financial advantages.

The proposal alters the law so that every type of good or service supplied by a school will fall within the scope of VAT exemption, rather than only tuition and boarding fees. This effectively eliminates the legal gap that previously allowed schools to register and recover VAT on non-tuition activities. Experts have explained that the new approach means every supply made by a school, regardless of whether it is in return for traditional fees or other forms of payment, will be considered VAT-exempt. In practical terms, this could cut off an important financial lever that schools have relied upon for decades, reducing their ability to recoup expenses on major projects and operational costs.

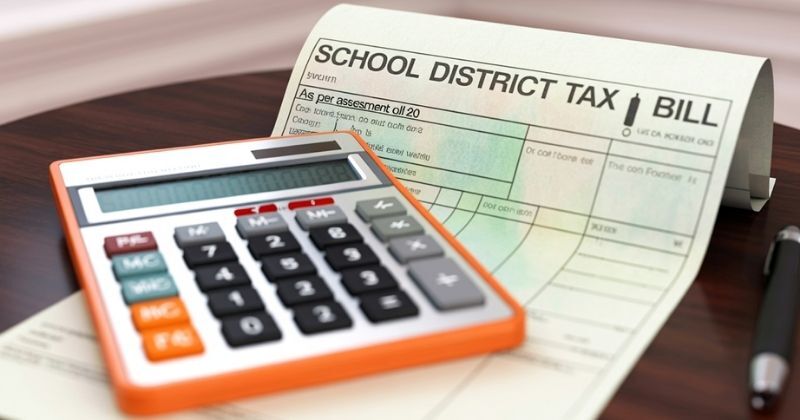

Financial Impact of Deregistration

National Treasury has stated that the objective has always been to exclude schools from the VAT system, but it acknowledged that the reform will have major financial repercussions. Once schools are forced to deregister, the VAT Act interprets this as though they had sold all of their assets immediately before deregistration. This triggers what is referred to as a “deemed supply” event on 31 December 2025, resulting in a potentially large and unexpected tax liability payable to the South African Revenue Service (SARS).

Tax professionals have cautioned that the cost of this deemed supply could be considerable, with schools facing a substantial VAT bill precisely at the point when they are legally required to deregister. This creates a double blow: schools lose the benefit of VAT recovery going forward while also being hit with an immediate once-off liability that could cripple their cash flow. Smaller private schools, in particular, may find it difficult to absorb such a sudden financial shock.

Attempts to Reduce the Burden

In an effort to ease the transition, Treasury has introduced measures allowing schools to settle the tax liability in twelve monthly instalments rather than through a single lump sum. Additional provisions ensure that the tax becomes due with each instalment, which prevents schools from incurring penalties and interest for late payment.

While these relief mechanisms may provide breathing space, they still commit schools to a year-long financial drag, diverting resources away from education delivery, maintenance, and investment in learner support.

However, analysts have warned that while these measures provide some relief, they do not address the wider concern. The greater issue is that schools will have insufficient time to plan, budget, and make financial arrangements to cover the significant VAT liabilities that will arise upon deregistration as vendors. This lack of preparation time could mean that some schools are forced into cutting costs, delaying projects, or even raising fees, sparking concerns about affordability for parents who are already under financial pressure.

No Refunds on Previous VAT

The draft legislation also makes clear that SARS will not revisit past VAT assessments after 1 January 2026. Although schools may apply to amend any assessments that remain open, VAT already collected on services such as facility rentals or uniforms will not be refunded. This effectively closes the door on retrospective claims by schools seeking to recover funds from SARS. This decision effectively protects government revenue but leaves schools that had complied in good faith feeling penalised for following the previous rules.

The proposed reforms have raised broader questions within the education sector. Observers are questioning why the supplies of goods and services made by schools are being treated differently from those made by universities, technikons, and colleges. Concerns have also been raised about why schools that are registered as VAT vendors are not being granted more time to prepare for the changes, which could help to minimise disruption. This perceived inconsistency in tax policy could fuel debates about fairness in the education system, particularly when private schools argue that they are being singled out for harsher treatment.

Deadline for Public Comment

Schools and stakeholders have until 12 September 2025 to provide written submissions on the proposed amendments to National Treasury or SARS. Industry experts have stressed that schools should not postpone taking action, and that they should submit their comments either independently or in collaboration with others before the consultation period ends. The consultation period may become a crucial battleground, with associations of private schools expected to lobby intensively in order to seek concessions, exemptions, or at the very least an extension of the timeline.

Conclusion

The proposed VAT reforms mark a turning point for South Africa’s private education sector, with schools facing both an immediate financial liability and the loss of VAT recovery benefits going forward. While Treasury maintains that schools were never intended to remain in the VAT system, the sudden implementation and the heavy financial consequences could destabilise budgets, delay infrastructure projects, and ultimately place greater pressure on parents. With only a year to prepare and a limited consultation window, the months ahead will be critical as schools and stakeholders push for clarity, concessions, or extended timelines to mitigate the blow.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.