DebtBusters is a registered debt counselling company in South Africa that helps over-indebted consumers manage and repay their debts through a structured process called debt review. Their service combines multiple debts into one affordable monthly repayment, offering legal protection from credit providers. Regulated by the National Credit Regulator (NCR), DebtBusters follows the guidelines of the National Credit Act and has assisted thousands of South Africans since its launch.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by DebtBusters and is based solely on our research.

DebtBusters provides trusted debt counselling services to help South Africans manage their debt through structured and affordable repayment plans. If you’re finding it difficult to keep up with multiple monthly repayments or feeling overwhelmed by financial pressure, this company offers a practical and regulated solution. Keep reading to learn how their debt counselling process works and whether it could be the right fit for your financial situation.

DebtBusters South Africa: Quick Overview

Service Type: Debt counselling and debt review under the National Credit Act by an NCR-registered provider.

Access: Free online debt assessment and financial tools via the DebtBusters website.

Eligibility: South African citizens or permanent residents, 18+, with valid ID and regular income.

Fees: Regulated by the NCR and included in the monthly repayment. No upfront costs.

Additional Services: Debt consolidation planning, interest reduction, legal protection, and financial education.

DebtBusters Full Review

What Makes DebtBusters Unique?

DebtBusters stands out in South Africa’s financial landscape due to its comprehensive approach to debt management. Unlike many competitors, DebtBusters offers a wide range of services tailored to individual needs, including debt counselling, debt consolidation, credit monitoring, and financial education. This holistic strategy ensures clients receive not only immediate relief but also long-term financial guidance. Their commitment to transparency and personalised service has earned them multiple accolades, including being named Top National Debt Counsellor nine times at the Debt Review Awards.

Another distinguishing feature is DebtBusters’ emphasis on client empowerment. Through tools like free credit reports and educational resources, clients gain a clearer understanding of their financial situations. The company’s proactive communication and support systems further enhances the client experience, making the journey to financial freedom more manageable. Their nationwide reach and consistent positive feedback underscores their reputation as a trusted partner in debt management.

Wondering how to prove you’re officially debt-free after undergoing review? Discover how the Debt Review Clearance Certificate serves as your formal ticket to financial freedom and why it’s a critical final step in the debt recovery journey.

About Arcadia Finance

With no application fees and access to 19 trusted lenders, all fully accredited by South Africa’s National Credit Regulator, you can count on a simple and transparent process. Get financial solutions tailored to your needs quickly and confidently.

Types of Services Offered by DebtBusters

DebtBusters provides a suite of services designed to address various financial challenges:

Debt Counselling

Helps individuals who are over-indebted by assessing their financial situation and working with creditors to create a realistic repayment plan. This makes monthly payments more manageable and helps avoid legal action.

Debt Consolidation

Combines multiple debts into a single monthly payment, often at a lower interest rate. This simplifies repayment and can reduce the total amount paid over time, making it easier to stay on top of finances.

Credit Monitoring

Keeps you updated on changes to your credit profile, helping you spot issues early and make informed financial choices. Regular alerts and reports support better credit management and protection against fraud.

Financial Education

Offers practical advice and resources to help you understand how to budget, save, and use credit wisely. This guidance builds financial confidence and supports long-term money management skills.

Requirements for DebtBusters Services

To apply for debt counselling with DebtBusters, you’ll need to provide the following documents:

- Identification: A valid South African ID or passport.

- Proof of Income: Recent payslips and bank statements.

- Credit Information: Statements from your credit providers.

- Expense Documentation: Utility bills, insurance policies, and other relevant expenses.

- Additional Documents: Marriage certificate (if applicable), and any legal notices received.

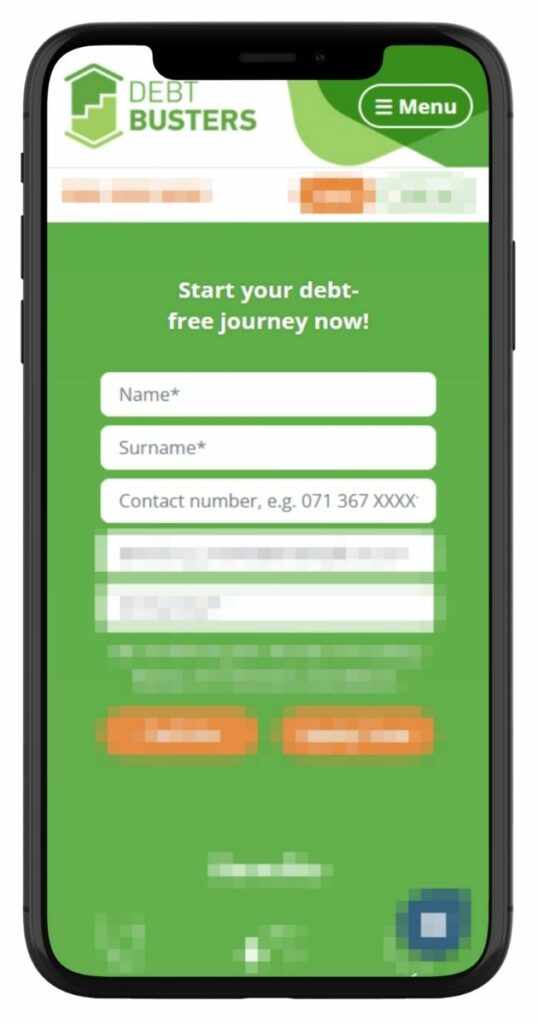

Simulation of an Application to DebtBusters

Step 1. Go to DebtBusters.co.za

Step 2. Enter your name, surname, and contact number to start your debt-free journey.

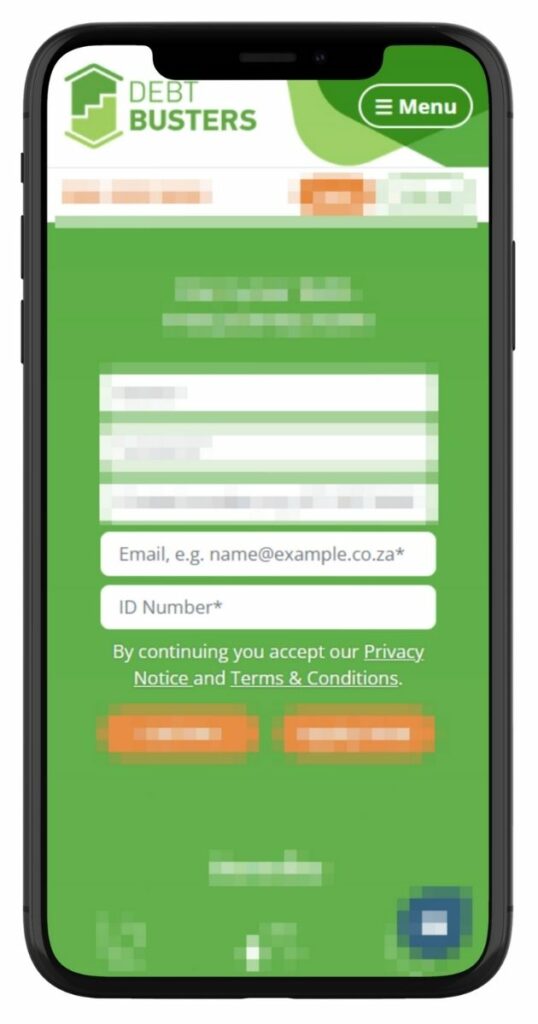

Step 3. Provide your email address and ID number to proceed with your application.

Step 4. Submit your completed form and choose either “Call Me” or “Apply Now” to finalise your request.

Step 5. Provide necessary documents for financial evaluation.

Step 6. If over-indebted, apply for debt counselling.

Step 7. They will then negotiate with creditors on your behalf.

Step 8. Agree on a single, affordable monthly payment.

Step 9. Receive a court order to protect against legal action.

Step 10. Regular updates and support throughout the process.

Eligibility Check

DebtBusters offers a free eligibility assessment to determine if you qualify for debt counselling. By contacting them, you can receive a confidential evaluation of your financial situation. This assessment considers your income, expenses, and debt obligations to ascertain if debt counselling is the appropriate solution for you.

Who Is DebtBusters Best For?

DebtBusters is ideal for South Africans who:

- Are over-indebted and unable to keep up with monthly repayments

- Need legal protection from creditors and repossession

- Have a stable income and can commit to a structured repayment plan

- Want to reduce interest and avoid taking on new credit

- Prefer a registered, experienced provider offering professional support

Is DebtBusters a Safe and Reliable Option?

Yes. DebtBusters is a registered and reputable debt counselling provider in South Africa, fully compliant with the National Credit Act and regulated by the National Credit Regulator (NCRDC2484). The company has a long-standing track record of helping South Africans manage and repay their debts through legally recognised debt review services. This company does not issue loans but works directly with over-indebted consumers and their creditors to restructure debt into a single, affordable monthly repayment, providing legal protection from further credit action.

DebtBusters ensures the safety and confidentiality of all personal and financial information submitted during the application process. All data is handled using secure systems and is only shared with authorised credit providers or Payment Distribution Agencies (PDAs) as required to administer the debt review process. Clients give informed consent before any information is shared, which ensures full transparency and data security throughout their engagement with DebtBusters.

What Services Can I Request from DebtBusters?

DebtBusters offers a comprehensive debt counselling service designed to consolidate all your unsecured debts into a single, manageable monthly payment. This service encompasses various types of unsecured debts, including credit cards, personal loans, and store accounts. There isn’t a strict minimum or maximum amount of debt required to qualify; however, the service is most beneficial for individuals who are over-indebted and struggling to meet their monthly obligations. The key criterion is the ability to demonstrate that your expenses exceed your income, making it challenging to keep up with debt repayments.

How DebtBusters Creates Personalised Services

DebtBusters tailors its debt counselling services to each client’s unique financial situation. Upon application, a certified debt counsellor conducts a thorough assessment of your income, expenses, and outstanding debts. Based on this evaluation, they develop a customised repayment plan that aligns with your financial capabilities. This plan involves negotiating with your creditors to reduce interest rates and restructure payment terms, ensuring that your monthly repayment is affordable while covering essential living expenses. The goal is to provide a sustainable path to becoming debt-free without the need for additional loans.

How Long Does It Take to Complete the Debt Counselling Process with DebtBusters?

The duration of the debt counselling process with them varies depending on the individual’s financial circumstances. On average, clients complete the programme within three to five years. Several factors influence the length of the process, including the total amount of debt, the success of negotiations with creditors, and the client’s adherence to the agreed-upon repayment plan. Consistent, timely payments and cooperation with the debt counsellor can contribute to a more efficient resolution of debts.

DebtBusters – Overview in Detail

| Name | DebtBusters Debt Counselling |

|---|---|

| Financial Institution | DebtBusters (part of the Intelligent Debt Management (IDM) Group) |

| Product | Debt counselling service for over-indebted South African consumers |

| Minimum Age | 18 years |

| Minimum Debt Amount | No specific minimum; based on over-indebtedness |

| Maximum Debt Amount | No fixed maximum; assessed per client’s financial situation |

| Minimum Term | Varies depending on debt profile and repayment structure |

| Maximum Term | Up to 60 months (5 years), depending on the repayment plan |

| Interest Rate | Negotiated with creditors; can be reduced from ~25% to as low as 2.5% per annum |

| Early Settlement | Allowed; may include settlement discounts if negotiated |

| Repayment Flexibility | One affordable monthly repayment via NCR-registered Payment Distribution Agency (PDA) |

| NCR Accredited | Yes – Registered with the National Credit Regulator (NCRDC2484) |

| Our Opinion | ✅ Strong debt relief option with legal protection ✅ Interest reduction potential ⚠️ Long-term commitment needed |

| User Opinion | ✅ Simplifies repayment via consolidation ⚠️ Credit access restricted during the process |

How Do I Pay for Services Provided by DebtBusters?

Payments under DebtBusters’ debt counselling programme are streamlined into a single monthly instalment. This payment is made to a Payment Distribution Agency (PDA) registered with the National Credit Regulator (NCR), which then disburses the funds to your various creditors as per the restructured plan. The payment amount is determined based on your affordability, ensuring that you can meet your essential living expenses while repaying your debts.

Regarding fees, their charges are regulated by the NCR and are incorporated into your monthly repayment. These may include a once-off restructuring fee, monthly after-care fees, and legal fees associated with obtaining a court order for the repayment plan. It’s crucial to adhere to the payment schedule, as missed payments can lead to the termination of the debt counselling agreement, reinstatement of original credit terms, and potential legal action from creditors.

Pros and Cons of Choosing DebtBusters

When considering debt counselling services in South Africa, it’s essential to weigh the advantages and disadvantages. Here’s a balanced overview of what DebtBusters offers:

Pros of DebtBusters

- Legal Protection: Once under debt review, you’re shielded from legal actions by creditors, including asset repossession.

- Reduced Interest Rates: DebtBusters negotiates with creditors to lower interest rates, making repayments more manageable.

- Consolidated Payments: Multiple debts are combined into a single monthly payment, simplifying your financial obligations.

- No Additional Loans: Unlike some consolidation options, DebtBusters doesn’t require you to take out another loan.

- Financial Education: Clients receive guidance on budgeting and financial planning to prevent future debt issues.

Cons of DebtBusters

- Credit Access Restrictions: While under debt review, you cannot access new credit facilities.

- Extended Repayment Period: To reduce monthly payments, the repayment term may be lengthened, potentially increasing the total interest paid.

- Commitment Required: The process demands discipline and commitment over several years to achieve debt freedom.

- Potential Service Variability: Some clients have reported mixed experiences regarding service responsiveness.

Customer Service and Support

DebtBusters provides several ways for clients to get help during the debt review process. For immediate assistance, clients can contact the team by phone. If the query is not urgent, support is also available through email, allowing clients to communicate in their own time. The company’s official website includes detailed guides and a full FAQ section, offering helpful answers to common questions. DebtBusters is also active on social media platforms such as Facebook, where they share updates and respond to general support queries, making it easier for clients to stay informed and connected.

Contact Channels

Phone number:

New Enquiries: 0861 365 914

Customer Services: 086 999 0606

Hours of operation:

Monday to Thursday: 07:00 – 21:00

Friday: 07:00 – 18:00

Saturday: 09:00 – 12:30

Postal address:

4th Floor, Mutual Park, Jan Smuts Drive, Pinelands, Cape Town, 7405, South Africa

Online Reviews of DebtBusters

Many clients have expressed satisfaction with DebtBusters’ services, highlighting the company’s role in providing financial relief and support during challenging times. Testimonials on Hellopeter often mention the assistance in reducing interest costs and improving cash flow, suggesting that DebtBusters can be instrumental in helping individuals regain control over their finances.

Thank you for your service and helping me paid off all my debt i really appreciate it helping me be financially free. it feels good.

Accounts up to date and paid on time. Always available for assistance and advice. Credit report available on the dashboard to track payment behaviour.

However, some clients have reported less favourable experiences. Concerns have been raised about the company’s effectiveness in protecting clients from creditors and the overall impact on financial well-being. Criticisms include issues such as poor communication, lack of follow-up, and dissatisfaction with the debt review process. These criticisms indicate that while DebtBusters has helped many, it may not meet everyone’s expectations. Prospective clients should conduct thorough research, consider alternative options, and consult financial advisors to determine the best course of action for their specific circumstances.

They have been assisting me pay off my debts. Now I receive emails and calls from Capitec that they have not been paid. I contacted them to report this matter.

I have encountered numerous challenges during the proces of settling and getting clearance certificate. Firstly, no response when you communicate with the saud or assigned agent. Finally when i hot the certificare one of my accounts is mot reflecting on the clearamce certificate.

Alternatives to DebtBusters

For individuals exploring debt counselling options in South Africa, several reputable alternatives to DebtBusters exist:

Comparison Table

| Company | Services Offered | Unique Features |

|---|---|---|

| DebtBusters | Debt counselling, consolidation | Extensive experience, award-winning service |

| National Debt Advisors | Debt review, consolidation | Personalised support, nationwide presence |

| DebtSafe | Debt review | Asset protection focus |

| Fincheck | Financial product comparison | Wide range of financial products |

| MyCreditCheck | Credit reports, monitoring | Credit improvement tools |

| DirectAxis | Personal loans, consolidation | Tailored loan solutions |

History and Background of DebtBusters

Established in April 2004, DebtBusters is a leading debt management company in South Africa, operating under the Intelligent Debt Management (IDM) Group. With a team of over 400 employees based in Cape Town, the company has assisted more than 150,000 consumers nationwide in regaining financial stability.

DebtBusters’ mission is to empower individuals to take control of their finances by providing comprehensive debt solutions and expert financial advice. The company aims to alleviate financial stress through services tailored to each client’s unique situation, grounded in transparency and customer-centric practices.

Their vision is to lead and redefine the debt management industry in South Africa by pioneering financial innovation. DebtBusters aspires to offer solutions that not only address immediate financial challenges but also promote long-term financial health and stability for their clients.

Conclusion

DebtBusters remains one of the most established debt counselling providers in South Africa, with over a decade of experience helping individuals manage and repay debt responsibly. By offering structured repayment plans, legal protection from creditors, and expert guidance throughout the process, the company delivers a practical solution for those who are struggling financially. While it is not without limitations such as restricted access to credit during the review period, its personalised service, strong regulatory compliance, and national reputation make it a reliable option for South Africans looking to take control of their finances.

Frequently Asked Questions

Yes. DebtBusters assists clients who are blacklisted or have poor credit records. Being under debt review is not based on your credit score but rather your level of over-indebtedness.

No. While under debt review, you are not allowed to apply for any new credit until you complete the process and receive a clearance certificate.

On average, most clients complete the debt review process in three to five years, depending on the amount of debt and how consistently payments are made.

Missing payments can put your debt review status at risk. It may lead to termination of the agreement and legal action by creditors. It’s crucial to inform your debt counsellor if you face difficulties.

DebtBusters offers a free assessment where they review your income, expenses, and current debt. If your monthly expenses exceed your income, you may qualify for their services.