Lula [Lula.co.za], previously known as Lulalend, is a South African financial service provider focused on helping Small and Medium-sized Enterprises (SMEs) access funding and manage their banking needs. Based in Cape Town, Lula offers quick online access to working capital and business banking tools without the delays or paperwork that usually come with traditional banks. Their services are tailored for South African business owners who need short-term financial solutions to manage cash flow, invest in stock or equipment, or take on new projects.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by Lula and is based solely on our research.

Lula offers fast and flexible business funding solutions designed specifically for South African SMEs that need working capital or support with cash flow. If your business is facing seasonal dips, unexpected expenses, or needs capital to grow, keep reading to see how Lula’s services work and whether they are the right fit for your business financing needs.

Lula South Africa: Quick Overview

Service Type: Unsecured business funding and SME banking services for South African companies

Access: Online application platform available at lula.co.za with same-day funding turnaround

Eligibility: Must be a registered South African business with a valid company registration, trading for at least 1 year, and generating a minimum annual turnover of R500 000

Fees: Fixed monthly costs based on the loan amount and term; no early settlement penalties

Additional Services: Free business banking account, revolving capital facility, cash flow tracking tools, trade finance solutions, and dedicated support for small business owners

About Arcadia Finance

Get your loan the easy way with Arcadia Finance. No application fees, access to 19 trusted lenders, and full compliance with South Africa’s National Credit Regulator. Fast, secure, and tailored to your needs.

Lula Full Review

What Makes Lula Unique?

Lula sets itself apart by focusing exclusively on the needs of South African small and medium-sized enterprises. Unlike traditional banks that often have complex requirements and lengthy approval processes, Lula offers a streamlined, online platform that simplifies both banking and funding. Their services are designed to be accessible, with minimal paperwork and quick turnaround times, making it easier for SMEs to manage their finances and access capital when needed.

Another distinctive feature of Lula is its integration of banking and funding services. By providing both under one platform, businesses can manage their cash flow more effectively. Lula’s approach includes tools like the Lulaflow cash flow manager, which helps businesses track and forecast their financial health. This holistic approach to financial services is tailored to support the growth and sustainability of SMEs in South Africa.

Considering Lula? It helps to compare your options. From big banks to niche lenders, exploring the best loan providers in South Africa gives you a broader view of interest rates, terms, and trustworthiness.

Types of Services Offered by Lula

Lula offers a range of financial products and services tailored to the needs of South African SMEs. These include various funding options and business banking accounts, each designed to address specific financial requirements.

Business Funding Solutions

- Revolving Capital Facility: This facility provides businesses with flexible access to working capital. It functions similarly to a credit line, allowing businesses to draw funds as needed and repay them on their terms. This is particularly useful for managing cash flow fluctuations or unexpected expenses.

- Capital Advance: Lula’s Capital Advance offers a lump sum of up to R5 million, repayable over 3 to 12 months with fixed costs. This product is suitable for businesses looking to invest in growth opportunities, such as purchasing equipment or expanding operations.

- Trade Capital: This service enables businesses to access funds to fulfill large orders or contracts. It ensures that companies can meet their obligations without straining their cash reserves.

- Invoice and Purchase Order Finance: Lula offers financing against outstanding invoices or confirmed purchase orders, providing immediate cash flow to businesses awaiting payment from clients.

Business Banking Services

- Free Business Account: Designed for startups and freelancers, this account has no monthly fees and includes features like earning 1.5% interest on balances and access to the Lulaflow cash flow manager. It’s ideal for businesses with lower transaction volumes.

- Unlimited Business Account: Aimed at established and growing businesses, this account offers unlimited free EFTs, dedicated support, and enhanced features for a monthly fee of R500. It suits businesses with higher transaction needs and a requirement for more comprehensive support.

- Lulaflow Cash Flow Manager: This tool helps businesses monitor and forecast their cash flow, providing insights that aid in financial planning and decision-making.

Requirements for Lula Services

To apply for Lula’s business funding, you need to meet certain criteria and provide specific documents. This ensures that your business is eligible and that the application process proceeds smoothly.

Eligibility Criteria

- Business Registration: Your business must be officially registered in South Africa.

- Trading History: A minimum of one year of trading history is required.

- Annual Turnover: Your business should have an annual turnover of at least R500,000.

- Financial Health: A good credit history and financial stability are essential.

Required Documents

- Identification: Valid ID documents for all directors of the business.

- Business Registration Documents: Proof of business registration from the Companies and Intellectual Property Commission (CIPC).

- Bank Statements: Recent bank statements, typically covering the last three to six months.

- Financial Statements: Income statements, balance sheets, and cash flow statements for the past two to three years.

- Tax Compliance: Up-to-date SARS tax clearance certificates and recent VAT returns, if applicable.

- Proof of Address: A recent utility bill or similar document confirming the business address.

Simulation of a Lula Loan Application

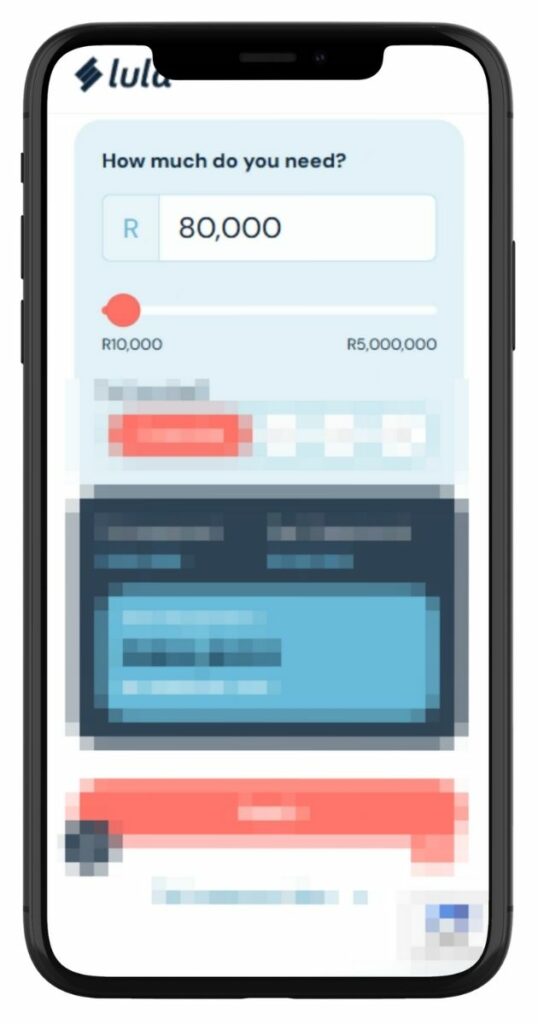

Applying for a loan with Lula is straightforward. Here’s a simple step-by-step guide:

Step 1. Go to Lula.co.za

Step 2. Use the slider or input field to choose how much funding you need

Step 3. Pick the repayment period (e.g. 3, 6, 9, or 12 months).

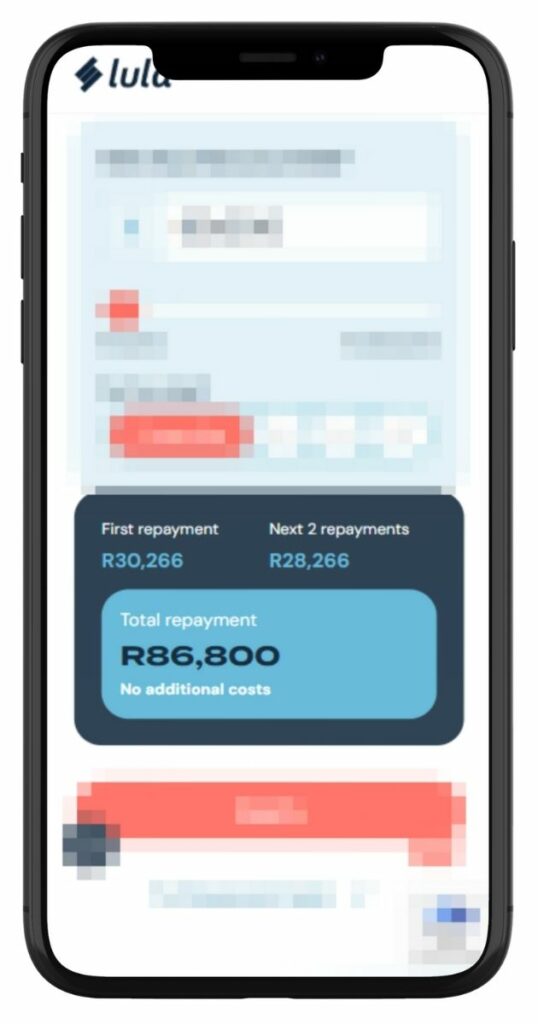

Step 4. View a breakdown of monthly payments and the total repayment amount

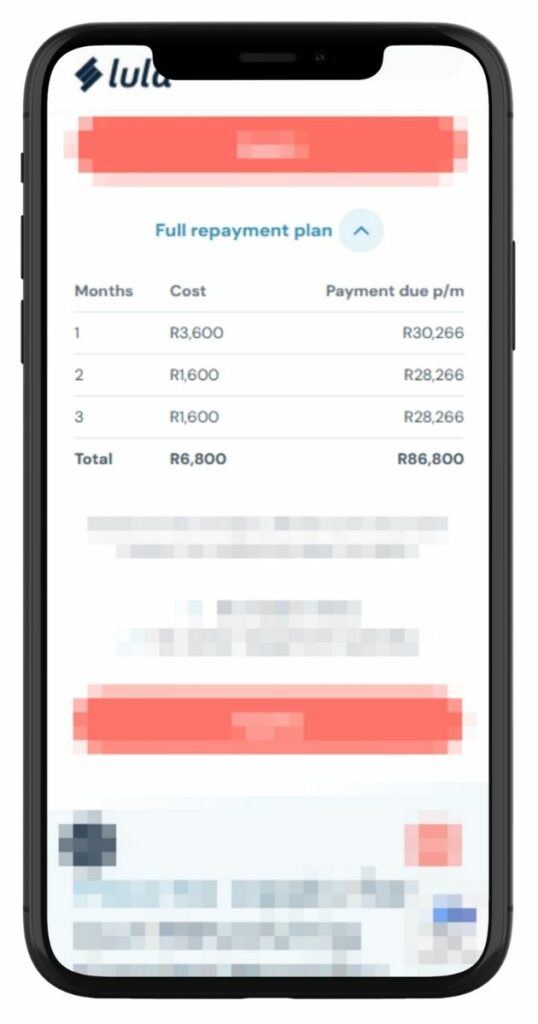

Step 5. See detailed monthly costs and payment breakdown.

Step 6. Confirm there are no hidden fees or penalties, then click Apply to submit your application.

Step 7. Provide basic information about your business.

Step 8. Submit the required documents as listed above.

Step 9. Securely link your business bank account for transaction verification.

Step 10. Review all information and submit your application.

Step 11. Lula will assess your application and provide a funding quote.

Step 12. If satisfied, accept the offer to proceed.

Step 13. Funds are typically disbursed within 24 hours of acceptance.

Eligibility Check Tools

Lula provides two helpful tools to check if your business qualifies for funding before you go through the full application process. The first is the Business Funding Calculator. This allows you to enter the loan amount you need and select a repayment period to get an estimated monthly repayment figure. It gives you a clear picture of the expected costs and helps you decide whether the repayment terms are manageable for your business.

The second tool is the Online Pre-Assessment. By submitting a few basic details about your business, such as how long you’ve been trading and your average turnover, you can get an early indication of if you’re likely to qualify. This check is done without affecting your credit score and can help you decide if it’s worth proceeding with a full application.

Personal loans like those offered by Lula Lender come with both perks and pitfalls. This handy guide on the pros and cons of personal loans breaks down the risks and rewards to help you decide.

Who Is Lula Best For?

Lula is best suited for South African small and medium-sized businesses that:

- Are in need of quick access to working capital without going through complex bank procedures

- Have been trading for at least 12 months with an annual turnover of R500 000 or more

- Prefer an online application process with minimal paperwork and no need for collateral

- Want a clear and structured repayment plan with fixed monthly costs

- Are looking for a reliable, registered financial services provider offering both funding and SME banking tools

Is Lula a Safe and Reliable Option?

Yes. Lula is a trusted financial services provider in South Africa and is an authorised Financial Services Provider (FSP 5865). It complies with all relevant regulations and offers unsecured business funding and SME banking solutions designed specifically for local small and medium-sized businesses. Lula is not a traditional lender and does not offer personal loans. Its focus is on helping registered businesses access working capital and manage their finances through transparent, fixed-cost repayment structures.

To ensure security and confidentiality, Lula uses a secure online application platform that protects your business information. When applying for funding, you link your business bank account in a read-only format, which allows Lula to assess your financial position without compromising access to your funds. All data is kept confidential and shared only with authorised personnel for verification and processing purposes. This approach ensures that your business’s financial data is handled safely throughout the application and funding process.

How Many Products or Services Can I Request from Lula?

Lula allows businesses to request multiple financial products or services depending on their needs. Their two main products include the Capital Advance and the Revolving Capital Facility. The Capital Advance is a once-off loan that provides access to funds ranging from R10 000 up to R5 million, with fixed repayment terms of 3, 6, 9, or 12 months.

In contrast, the Revolving Capital Facility works as a flexible credit line. Businesses can draw from the facility as needed, repay the used amount, and continue to access funds within the approved limit. Both services can be used together, depending on your operational requirements. Lula also offers Lulapay, which is a trade finance solution enabling businesses to get paid immediately while offering customers flexible payment terms of up to six months.

How Lula Creates Personalised Services and Offers

Lula customises funding solutions based on your business’s financial performance and real-time data. During the application, you will be asked to securely link your business bank account, which allows Lula to view your recent transaction history in a read-only format. By analysing this data, the platform determines how much funding your business qualifies for and the most suitable repayment term.

Lula uses this insight to offer realistic and transparent funding terms, ensuring repayments are manageable for your business. This process avoids one-size-fits-all lending and helps deliver funding that reflects your actual cash flow and trading activity.

Lula – Overview in Detail

| Name | Lula |

|---|---|

| Company Type | Private Fintech Company |

| Regulator | Authorised Financial Services Provider (FSP 5865) |

| Services Offered | Unsecured Business Funding and SME Banking Services |

| Minimum Business Age | 1 year |

| Minimum Annual Turnover | R500 000 |

| Maximum Funding Amount | Up to R5 million |

| Repayment Terms | 3, 6, 9, or 12 months |

| Monthly Repayment | Fixed monthly cost based on the principal amount |

| Interest Rate | Fixed cost: 2%–6% (initial months), then 2% monthly |

| Early Settlement | Allowed – no penalties |

| Repayment Flexibility | Monthly repayments; early settlement allowed |

| Collateral Requirement | None – unsecured funding |

| Regulatory Compliance | Yes – Registered FSP (5865) |

| Our Opinion | ✅ Fast online process ✅ No collateral ⚠️ Short-term only |

| User Opinion | ✅ Easy application ✅ Transparent fees ⚠️ Higher monthly cost possible |

How Long Does It Take to Complete a Loan Application from Lula?

Lula’s funding process is known for being fast and efficient. Once your application and required documents have been submitted and your bank account is successfully linked, Lula typically provides a funding quote within minutes. If you accept the offer, the funds are generally transferred to your bank account within 24 hours.

The total time to complete the application depends largely on how quickly you provide the necessary information and how smoothly the bank account linking process goes. Delays can occur if there are missing documents or if the business account information cannot be verified promptly. However, in most cases, businesses receive their funds within one working day of approval.

How Do I Repay My Loan from Lula?

Repayment for Lula’s Capital Advance is done through fixed monthly instalments over a chosen term, usually between three and twelve months. The cost structure is simple, with monthly charges calculated as a fixed percentage of the original loan amount. This means you know upfront how much you will be paying each month, without unexpected charges.

For the Revolving Capital Facility, you only repay what you draw from the facility, with monthly costs applied to the withdrawn amount. The repayment is typically done through debit order, but electronic transfers are also accepted.

Lula does not charge early settlement fees, which gives businesses the flexibility to repay their loans ahead of schedule without penalties. Keeping up with the agreed schedule helps maintain a positive relationship with the lender and may improve access to future funding.

Pros and Cons of Using Lula

Choosing Lula for business funding and banking services comes with clear benefits, especially for South African SMEs, but it also has a few limitations that are worth noting.

Pros of Lula

- Quick Access to Funds: Lula offers fast approval and payout. Once your application is accepted, funds can be paid out within 24 hours.

- No Collateral Needed: All funding is unsecured, which means you don’t need to offer assets to apply.

- Simple Online Application: The entire process can be completed online without visiting a branch or submitting physical paperwork.

- Transparent Costs: Lula uses fixed monthly costs rather than variable interest rates, making it easier to plan repayments.

- Integrated Business Tools: The business account comes with cash flow tracking and analytics features that help manage finances more effectively.

- Flexible Repayment Options: You can repay early without penalties and make use of both lump sum loans and revolving credit.

- Tailored Offers: Lula uses your business data to generate funding offers that match your financial capacity.

Cons of Lula

- Minimum Turnover Requirement: Your business must earn at least R500 000 annually to qualify for funding, which can exclude some smaller or newer companies.

- Short-Term Only: Loans must be repaid in 3 to 12 months, so it may not suit businesses seeking longer repayment terms.

- Fixed Fee Model May Cost More: For some borrowers, fixed fees can work out higher than traditional interest rates if the funds are repaid quickly.

- Limited to Business Use: Lula does not offer personal loans; all services are strictly for registered businesses.

- Not Ideal for Startups: Companies under 12 months old are not eligible, which limits access for brand-new businesses.

Customer Service

Lula provides various support options for South African businesses that require help with applications or have general service queries. Their website includes a detailed FAQs section, where users can find information about available products, repayment terms, eligibility requirements, and other common concerns.

For real-time assistance, live chat is available during business hours directly on their website. While Lula does not display a dedicated phone number on every page, businesses can submit questions or support requests using the contact forms or integrated chat tools. Additionally, Lula offers customer service via WhatsApp, which is convenient for businesses needing quick responses without relying on email or calls.

Contact Channels

Phone number:

Main Office: 087 250 0014

WhatsApp Support: 060 019 7401

Whistleblower Hotline: 067 816 1520

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: Closed

Postal address:

3rd Floor, Pier Place, Heerengracht Street, Cape Town, Western Cape 8001

Online Reviews of Lula

Lula, formerly known as Lulalend, has garnered a mix of feedback from its customer base. On Trustindex.io, Lula boasts a 4.5-star rating based on over 127 reviews. Customers often highlight the platform’s quick application process and transparent pricing. For instance, one user mentioned, “The process for application was extremely easy. Within a couple of hours, we were approved.”

However, some users have expressed concerns. A review on Trustindex.io pointed out issues with the company’s decision-making process, stating that their application was declined based on limited information, despite providing comprehensive financial statements and client assurances. The reviewer felt that Lula’s approach was more suited for personal loans rather than corporate financing needs.

Brilliant service and their Team understand the needs of a business who need support. I highly recommend their service.

“It’s the most amazing service. Lulalend sincerely focuses on your business, no matter how small. Definitely a pillar in my company.”

I would not recommend them at all. Does not do any effort for new clients even though figures are brilliant of client. Sorry but worst customer service and experience.

Spam emails. No unsubscribe link. Just so sketchy. Avoid at all costs.

Alternatives to Lula

For South African SMEs exploring funding options, several alternatives to Lula are available:

Comparison Table

| Feature | Lula | Retail Capital | Bridgement | Fundrr | WesBank |

|---|---|---|---|---|---|

| Loan Amount | Up to R5 million | Varies | Up to R5 million | Up to R5 million | Varies |

| Approval Time | Within 24 hours | 24-48 hours | Within 24 hours | 24-48 hours | Varies |

| Repayment Terms | 3 to 12 months | Flexible | 1 to 12 months | 3 to 12 months | Varies |

| Collateral Required | No | No | No | No | Yes |

| Application Process | Online | Online | Online | Online | Online/In-person |

| Target Audience | SMEs | SMEs | SMEs | SMEs | SMEs and Corporates |

History and Background of Lula

Founded in 2014 by Trevor Gosling and Neil Welman, Lula began its journey as Lulalend, aiming to provide quick and accessible funding solutions to South African SMEs. Recognising the challenges faced by small businesses in accessing traditional banking services, the founders leveraged technology to streamline the lending process.

Over the years, Lula has evolved, expanding its services to include business banking solutions. In 2023, the company rebranded from Lulalend to Lula, reflecting its broader commitment to serving SMEs not just with funding but also with comprehensive banking services. This transition marked Lula’s position as South Africa’s first dedicated SME banking platform.

Lula’s mission is to empower every SME to succeed by providing fast, simple, and human-centric financial solutions. The company’s vision revolves around fostering growth for small businesses, understanding that their success contributes significantly to the broader South African economy.

Conclusion

Lula provides a practical funding and banking solution for South African SMEs looking for fast, short-term finance without the usual paperwork and delays of traditional banks. With its streamlined application process, no collateral requirements, and additional business banking tools, Lula caters specifically to growing businesses that need flexibility and clear repayment terms. While the platform may not suit startups or businesses looking for long-term funding, it remains a strong option for established companies needing working capital, invoice finance, or trade credit. For businesses that meet the criteria, Lula’s service offering is simple, fast, and tailored to meet real cash flow challenges.

Frequently Asked Questions

Any registered South African business that has been trading for at least one year and has a minimum annual turnover of R500,000 can apply.

No, all funding from Lula is unsecured, meaning no assets are needed as security.

Most applicants receive a quote within minutes, and once approved, funds are usually paid out within 24 hours.

Yes, Lula does not charge any early settlement penalties, and repaying early can save on fees.

Lula offers capital advances, revolving capital facilities, invoice and trade finance, and Buy Now, Pay Later services for small businesses.