Loan scams refer to fraudulent or misleading practices that target individuals who need a loan. These scams can take money in many forms, such as phishing scams, advance fee scams, illegal money lending scams, or Ponzi schemes. Reporting loan scams like these makes finding financing safer for all us.

In South Africa, loan scams have become a big problem, with many people falling victim to these fraudulent practices. The aim of this article is to educate the public on the different types of loan scams that exist in South Africa, how to spot them, and what steps to take to prevent them. Additionally, the article will cover how the government and financial bodies combat loan scams, the possible legal consequences for fraudsters, and what to do if you fall victim to a loan scam.

Types of Loan Scams in South Africa

It is important for individuals to be aware of the different types of loan scams to protect themselves and others from falling victim to these fraudulent practices. In South Africa, loan scams can take many forms, including:

Phishing Scams

These scams involve fraudsters posing as legal lenders, often through fake websites or emails, and deceiving individuals into providing sensitive information such as their bank account numbers or personal identification numbers (PINs).

Advance Fee Scams

In these scams, individuals are promised a loan in trade for an advance fee, which is often disguised as a processing fee, security deposit, or insurance. Once the fee is paid, the loan never materializes, and the scammers disappear.

Illegal Money Lending Scams

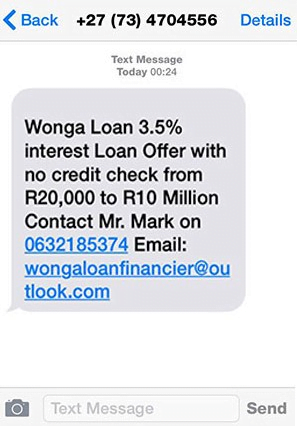

These scams involve individuals or businesses who offer loans at high interest rates, often to individuals with a poor credit score. The loans may be offered with no credit checks or documentation, but the interest rates are exorbitant. This way individuals can quickly become trapped in a cycle of debt.

Ponzi Schemes

In these scams, individuals are promised high returns on their investments, often with the promise of a loan. The returns are paid using the funds of new investors, rather than actual profits. The scheme then collapses when there are not enough new investors to pay the returns promised to existing investors.

Fallen victim to fraud or know someone who has? Learn how today’s scams work by reading Scammers Are Using This New Tactic to Steal Your Savings, a crucial reminder of why quick action and awareness can save your finances from devastation.

How to Identify Loan Scams

When looking for a loan in South Africa, you need to be cautious of potential loan scams. Keep an eye out for lenders who offer loans with no credit checks or documentation. Same with asking for advance fees or security deposits. Also be wary of promises of guaranteed loans, unsolicited loan offers, and unusually high interest rates.

Red Flags:

- Offers of loans with no credit checks or documentation required.

- Requests for advance fees or security deposits

- Unusually high interest rates

- Promises of guaranteed loans

- Unsolicited offers of loans

Verify the Lender:

Another step you can take to identify potential scams is to verify the lender’s identity. Check the lender’s website and contact information, search for reviews online, and confirm their address and phone number. Also check that the lender is registered with the National Credit Regulator (NCR), or authorized by the South African Reserve Bank (SARB).

Follow these steps and stay aware of the red flags to better protect yourself from falling victim to loan scams in South Africa. Always remember to do your research and be careful when seeking a loan. If the offer seems too good to be true, it probably is.

How to Avoid Falling for Loan Scams

An increase in loan scams in South Africa has resulted in fraudsters hitting unsuspecting victims looking for financial help. Luckily, there are several steps you can take to protect yourself from these scams.

Firstly: Do Your Research

Research the lender’s credentials and reputation before accepting any loan offers. Check if they are registered with the National Credit Regulator (NCR) or the South African Reserve Bank (SARB). You should also compare loan offers from multiple sources to ensure you’re getting a fair deal. Finally, read the terms and conditions carefully to avoid any hidden fees or charges.

Secondly: Be Careful of Unsolicited Offers

Stay wary of unsolicited loan offers, especially if they come through email or social media. Scammers often use these channels to target potential victims, so don’t provide any sensitive information to unknown or unverified lenders

Thirdly: Use Secure Channels for Payments

Secure payment methods, such as direct bank transfers or secure online payment platforms, are the best way to make loan payments. Don’t send money to individuals or organizations that you don’t know or trust, and always verify the recipient’s details before making any transactions.

Proactively protecting yourself by following the above steps, lets you minimize the risk of falling victim to loan scams in South Africa. So stay vigilant, keep your finances secure, and report any suspicious or fraudulent activity to the relevant authorities.

» Read more: What’s the Real Cost of a Loan?

Reporting Loan Scams in South Africa

If you suspect that you’ve fallen victim to a loan scam, it is important to report the incident quickly. By reporting loan scams, individuals can help authorities act against fraudulent lenders and prevent others from falling victim to scams. It is important to be proactive in reporting these incidents. Do not be afraid to speak up if you have fallen victim to a loan scam. The following sections tell you who to report to, what to report, and how to report.

Who to Report to:

If you fall victim to a loan scam in South Africa, it’s important to report it to the authorities. You can contact the South African Police Service (SAPS) to report any criminal activity related to loan scams. Additionally, you should report the scam to the National Credit Regulator (NCR). This helps prevent others from being scammed by the same fraudsters. If you suspect that a lender may be operating illegally, report them to the South African Reserve Bank (SARB) for investigation. Remember, reporting loan scams can help protect yourself and others from financial harm.

What Information to Provide When Reporting Loan Scams:

If you need to report a loan scam in South Africa, provide as much information as possible to the authorities. You should provide the lender’s name and contact information, along with any documentation or evidence related to the loan. Be sure to include details of any payments made, as well as any other relevant information that could help the authorities investigate the scam. By providing comprehensive information, you can help the authorities take action against the scammers and prevent others from being defrauded.

How to Report:

If you need to report a loan scam in South Africa, there are several ways to do so. You can contact the relevant authorities, like the South African Police Service, National Credit Regulator, National Consumer Commission, or South African Reserve Bank. You can file a complaint online or in person with these organizations.

The Role of Government and Financial Establishments in Fighting Loan Scams

Individuals can protect themselves through the steps above. But the government and institutions in South Africa also play an important role in fighting loan scams and protecting consumers. Here are some of the ways they are working to combat these scams:

Regulatory Measures:

South African regulatory bodies, like the NCR, SARB, and the NCC, play an important role protecting consumers from loan scams. The NCR oversees the credit industry and enforces regulations to protect consumers. The SARB on the other hand regulates financial establishments and enforces regulations to prevent financial fraud. The NCC is responsible for investigating complaints related to consumer fraud and providing consumers with additional protection.

Public Awareness Campaigns:

The NCR and other organizations run public awareness campaigns educating the public about loan scams and how to protect themselves. These campaigns often include information about the types of loan scams and how to identify them. They also help you find out what steps to take, if you suspect that you have fallen victim to a scam.

Working with Law Enforcement:

The NCR and the NCC work together with the South African Police Service to investigate and prosecute loan scams. This collaboration ensures that individuals, who engage in fraudulent practices, are held accountable for their actions.

About Arcadia Finance

Simplify your loan process with Arcadia Finance for enhanced efficiency. Complete a free application and access offers from 19 lenders. Count on our commitment to only partner with trustworthy lenders compliant with the regulations of the National Credit Regulator of South Africa.

Legal Consequences of Loan Scams in South Africa

The legal consequences for individuals who engage in loan scams in South Africa can be severe and far-reaching. Here are some of the potential consequences:

- Criminal Penalties: Loan scams are illegal in South Africa and individuals who engage in these scams can face imprisonment, fines, or both.

- Civil Lawsuits: Individuals who have fallen victim to loan scams may choose to file a civil lawsuit against the scammers and claim damages from them.

- Reputation Damage: Loan scams damage the reputation of the individuals or organizations involved. This can include long lasting consequences like damage to their credit score, difficulty obtaining future loans or employment, and loss of trust from friends, family, or customers.

The legal consequences of loan scams in South Africa underscore the importance of being vigilant and proactive in protecting yourself from these scams. Reporting loan scams is important to along with reporting any suspicious or fraudulent activity. This can help to hold the fraudsters accountable and prevent others from falling victim to these scams.

Conclusion

Loan scams are a serious issue in South Africa and it is important for individuals to be aware of the different types of scams that exist and how to identify them. By doing your research, being careful of unsolicited offers, and using secure payment channels, individuals can minimize the risk of falling victim to loan scams.

The government and financial establishments also play a crucial role in fighting loan scams, through the implementation of regulatory measures, public awareness campaigns, and collaboration with law enforcement.

However, it is important to remember that individuals have a responsibility to protect themselves and to report any suspicious or fraudulent activity. By working together and reporting loan scams, we can help to combat loan scams and protect consumers in South Africa.

This article has provided important information about loan scams in South Africa and what individuals can do to protect themselves. If you suspect that you have fallen victim to a loan scam, we encourage you to report the incident to the relevant authorities and to seek legal advice if necessary. Together, we can make a difference in the fight against loan scams.

» MORE: Loan calculator – check out how much your loan costs

FAQ

If you suspect that you have been scammed by a loan company in South Africa, you should report the incident to the authorities as soon as possible. You can contact the National Credit Regulator (NCR) or the South African Police Service (SAPS) to report the scam.

To protect yourself from loan scams in South Africa, you should do your research before taking out a loan. Check the lender’s credentials and read reviews from previous customers. Be wary of any lender that asks for upfront fees or requires you to make payments to an individual’s personal bank account.

If you have been scammed by a loan company in South Africa, it may be possible to get your money back. You should contact the NCR or the SAPS and provide them with any evidence you have of the scam. They may be able to assist you in recovering your funds.

Some common loan scams in South Africa include lenders who ask for upfront fees or require payments to be made to an individual’s personal bank account. Scammers may also offer loans with extremely low interest rates or promise loans to individuals with poor credit scores.

Yes, you can report loan scams in South Africa anonymously. The NCR and the SAPS have mechanisms in place to protect the identity of whistleblowers and anonymous tipsters. However, providing your contact details may help authorities investigate the scam more thoroughly.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.