A loan is a financial arrangement in which one party, usually a lender, provides money or assets to another party, typically a borrower, with the expectation of future repayment. Loans can be a useful tool for achieving financial goals, but if not managed correctly, they can also cause financial stress.

Therefore, it is vital to have a clear comprehension of what a loan is, how it works, and the potential advantages and drawbacks of taking out a loan. In this article, we will discuss the various types of loans available to borrowers in South Africa, each with its unique terms and requirements.

Most common types of loans explained:

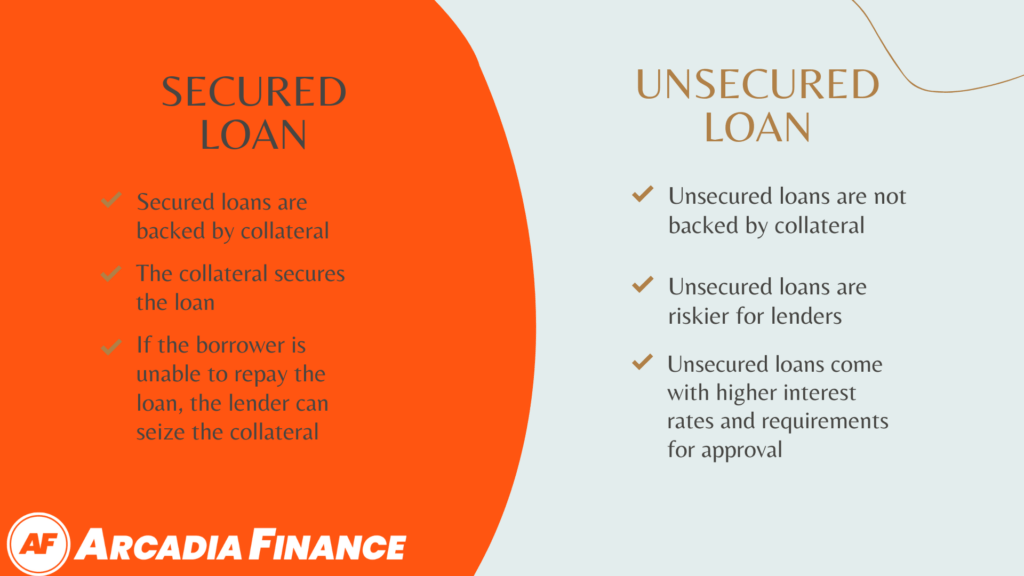

What Are Secured loans?

Secured loans are loans that are backed by collateral, such as a house, car, or other valuable asset. The collateral is used to secure the loan, which means that if the borrower is unable to repay the loan, the lender can seize the collateral to recover their losses.

What are Unsecured Loans?

Unsecured loans are loans that are not backed by collateral. Because these loans are considered riskier for lenders, they often come with higher interest rates and stricter requirements for approval.

What is an Installment Loan?

Installment loans are loans that are repaid in fixed installments over a set period of time. Examples of installment loans include personal loans and car loans.

What is a Payday Loan?

Payday loans are short-term loans that are meant to be repaid on the borrower’s next payday. However, these loans usually come with very high interest rates and fees, and can cause financial stress for borrowers who are unable to repay the loan on time.

What is a Student loan?

Student loans are loans designed to help students pay for college or other educational expenses. These loans can be either federal or private and may have different repayment terms and interest rates.

What are Mortgages?

Mortgages are loans used to purchase a home. These loans are secured by the property being purchased and often have lower interest rates and longer repayment terms than other types of loans.

What are Auto Loans?

Auto loans are loans used to purchase a car or other vehicle. Like mortgages, vehicle financing is often secured by the property being purchased and may have lower interest rates and longer repayment terms than other types of loans.

What are Business Loans?

Business loans are loans used to fund a business or other commercial venture. These loans may be secured or unsecured. They may also have different terms and requirements depending on the type of business and the lender’s policies.

» Read more: Personal Loan Calculator – Find the Right Type of Loan for You

How do Loans Work? Learn The Ins and Outs

Loans are a common financial product that many people use to access money that they don’t have readily available. However, before you take out a loan, it is important to understand how they work.

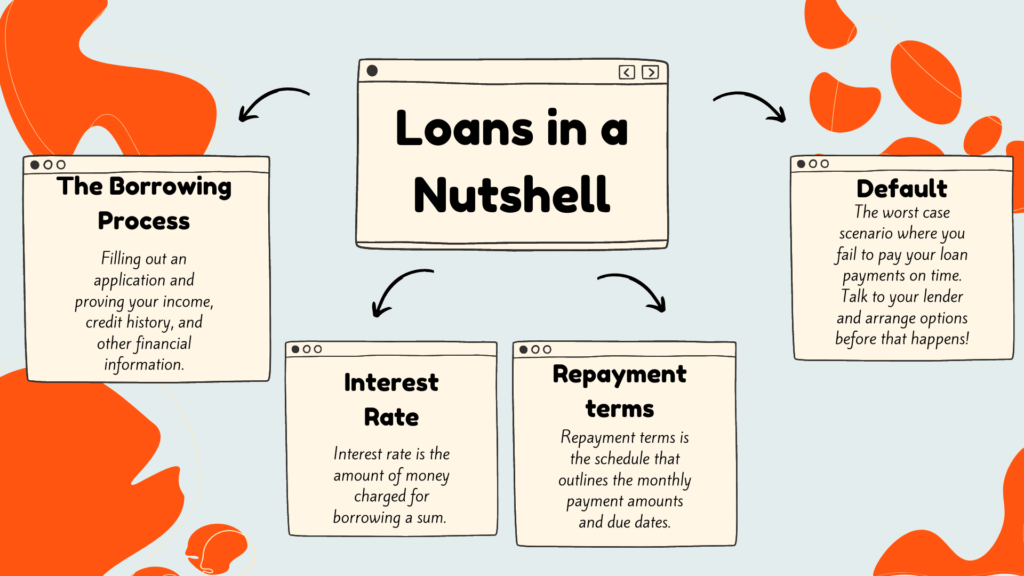

Borrowing Process:

The first step in getting a loan is to apply for one. The borrowing process involves filling out an application and providing documentation that shows your income, credit history, and other financial information. The lender will then review your application and decide whether to approve or deny it. If approved, you will receive the money you borrowed, minus any fees or interest charges. Keep in mind that the repayment terms and interest vary depending on the type of loan and the lender’s policies.

Interest Rates:

Interest rate is the amount of money charged for borrowing a sum. It varies depending on loan type, lender, and credit score. It is also impacted by the Prime Lending Rate set by the South African Reserve Bank. Higher credit score can lead to lower interest rate.

Repayment Terms:

Repayment terms is the schedule that outlines the monthly payment amounts and due dates. This also includes the total loan term length. Longer loan terms can mean lower monthly payments but more interest paid over time.

Consequences of Defaulting on a Loan

Defaulting on a loan can result in serious consequences. These include harm to your credit score, legal action from the lender, and even wage garnishment. If you are struggling to make your loan payments, it is essential to contact your lender and discuss options.

How to Improve Credit to Qualify for a Loan

Having a good credit score is crucial if you want to qualify for a loan with favorable terms. Tips to improve your credit score include: make payments on time, keep your credit utilization low, and dispute any errors on your credit report.

Overall, understanding how loans work is essential before taking out a loan. By comprehending the borrowing process, interest rates, repayment terms, consequences of defaulting, and ways to improve your credit, you can make informed decisions about your financial future.

Pros and Cons of Loans

Like any financial product, loans have their advantages and disadvantages. Understanding these pros and cons can help you determine if a loan is suitable for your needs.

What Are Advantages of Loans

- Access to Funds: Loans can provide access to funds that may not be available otherwise, making it easier to afford big-ticket items such as a car or a house.

- Credit Building: Making regular and timely loan payments can help establish and improve your credit score, which is crucial when applying for future loans or credit products.

- Predictable Payments: With a fixed-rate loan, you can expect consistent payments each month, making budgeting and financial planning more manageable.

- Flexible Repayment Terms: Depending on the type of loan, you may be able to choose a repayment plan that suits your budget and financial goals.

What Are Disadvantages of Loans

- Interest Charges: Loans come with interest charges, which can increase the total cost of borrowing and make it more expensive to repay the loan.

- Additional Fees: Some loans may include origination fees or prepayment penalties, which can add to the overall cost of borrowing.

- Default Risk: If you fail to make your loan payments, you risk damaging your credit score and facing legal action from the lender.

- Impact on Future Finances: Taking out a loan can affect your ability to make future financial decisions, such as getting approved for a mortgage or other loans. It’s important to consider the long-term impact of borrowing before taking out a loan.

About Arcadia Finance

Arcadia Finance streamlines the loan process for simplicity and effectiveness. Submit a complimentary application to receive offers from 19 lenders. Rest assured, all our lending partners adhere to the regulations of the National Credit Regulator of South Africa.

How to Make Loans Work for You

If you decide to take out a loan, there are steps you can take to ensure it works for you:

- Shop Around: Look for the best interest rate and terms by comparing offers from multiple lenders with a loan calculator. This can help you save money on interest charges and lower the overall cost of borrowing.

- Make Timely Payments: Avoid late fees and damage to your credit score by making loan payments on time each month.

- Pay More Than the Minimum: Consider paying more than the minimum payment each month. This reduces the loan balance faster and you pay off the loan sooner.

- Consider Alternatives: Before borrowing, explore other options such as saving up for the purchase or finding alternative sources of funding.

In summary, loans can be a helpful financial tool, but it’s important to understand the risks and costs involved. By making informed decisions, you can make loans work for you and achieve your financial goals. So take the necessary steps to manage your loan responsibly.

Conclusion

Loans can provide access to funds that may be necessary for achieving financial goals such as buying a car or a house. Before taking out a loan, it’s important to understand the various types of loans available and how they work. This includes knowing the borrowing process, interest rates, repayment terms, consequences of defaulting, and ways to improve your credit.

To make loans work for you, it’s important to shop around for the best interest rates and terms, make timely payments, pay more than the minimum payment. Also remember to explore alternatives to borrowing. By making informed decisions and managing loans responsibly, you can use them to achieve your financial goals.

FAQ

Yes, you may still be able to get a loan if you have bad credit. However, it might be more challenging, and you may need to look for lenders that specialize in bad credit loans or consider secured loans that require collateral.

The amount you can borrow with a loan depends on several factors, such as your credit score, income, and the type of loan you are applying for. Generally, the better your credit score and income, the higher the amount you can borrow.

A secured loan requires collateral, such as a house or car, to secure the loan, while an unsecured loan does not. As secured loans pose less risk to lenders, they may offer lower interest rates and higher borrowing limits than unsecured loans.

Yes, most loans allow you to pay off the balance early. However, some loans may have prepayment penalties, so it’s essential to review the loan agreement for details.

A loan might be a good option if you need funds for a specific purpose and have a plan for repayment. Before taking out a loan, consider the interest rate, fees, and repayment terms to ensure it fits within your budget.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 19 banks and find the right loan for you.