Coping with the loss of a loved one is always tough, and it’s normal to experience a range of emotions. But even in the midst of sorrow, it’s crucial to address practical issues like sorting out financial matters. If you’re mourning the loss of a spouse, parent, or another relative, managing your finances can offer some structure and stability during this difficult time.

Key Takeaways

- Immediate Notification and Legal Formalities: It’s vital to promptly obtain a death certificate, inform relevant parties, and officially register the death. This lays the groundwork for addressing other formalities like financial and legal procedures.

- Handling Financial Obligations: This involves canceling non-essential services, managing debts, and updating or closing accounts. These actions help prevent financial complications and potential fraud.

- Estate and Asset Management: It’s crucial to accurately list assets and check for a will. Managing assets, including determining inheritance, must be done carefully to meet all legal requirements and honor the deceased’s wishes.

What to Do When Someone Passes Away: A Checklist

Managing the affairs of a recently deceased loved one can be daunting. Regardless of the circumstances, there are essential steps to help navigate through this tough period. By following the checklist below, you’ll know how to handle the situation, whether your loved one passed away at home, during the night, overseas, suddenly, or after a prolonged illness. Each step is designed to assist you in coping with this difficult process.

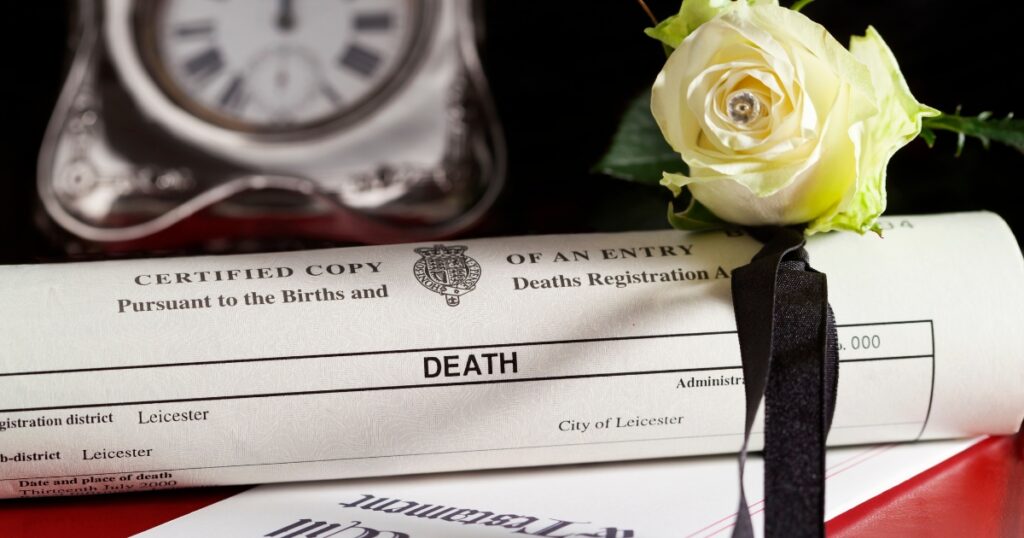

1. Obtain a certificate of death

It is crucial to obtain a death certificate promptly. This entails completing a BI-1663 form, which requires cooperation from three key parties: the person reporting the death, a medical practitioner, and a Home Affairs official. The reporter must provide the necessary details on the form. The medical practitioner then confirms the cause of death and completes their section of the form. Finally, the Home Affairs official checks and verifies all information before issuing the official death certificate.

2. Notify the Necessary Parties After a Passing

When a close family member passes away, it’s important to inform the appropriate individuals promptly. This task requires sensitivity, ensuring that immediate family members hear the news directly rather than through social media.

Start by contacting all family members, friends, coworkers, employer, frequent acquaintances, and professional connections. Additionally, consider reaching out to old friends with whom you may have lost touch over time. This comprehensive approach ensures that a wide network of individuals who may provide assistance or support is informed.

After informing immediate family, friends, and acquaintances, proceed with more formal notifications. This includes informing those connected through financial or business obligations about the death.

A touching and memorable obituary serves as a final tribute to your loved one. Learn how to write an obituary that honors their life and legacy with our thoughtful guide, providing you with tips and examples to ease this emotional task.

3. Report and register the death

Registering the death at the Department of Home Affairs or the South African embassy is mandatory. Subsequently, your undertaker may handle arrangements on your behalf. The Department of Home Affairs will record the death in the National Population Register database.

4. Make Arrangements for the Body

Making final arrangements for a loved one largely depends on their last wishes. If you’re aware of their preferences, it simplifies honoring their vision.

However, if the death was unexpected or preferences were not discussed, the process may be more complicated. Several options are available for services, funerals, wakes, and burials. Begin by considering basics such as a service, gathering, or memorial for your loved one. Options include an open casket viewing, dignified ceremony, graveside burial, or cremation.

Initial steps include:

- Transporting the body – a funeral home can assist with this.

- Ordering a casket – available through funeral homes or online.

- Finding a funeral director – if the deceased was religious, a clergy member such as a pastor or priest can assist; for those not affiliated with a religion, consider an agnostic or non-denominational minister, or perhaps a friend or family member to lead the service.

It’s also important to consider and honor any wishes for organ donation for transplant, science, or research, which doctors need to be informed about promptly after death.

Understand the financial implications of funeral arrangements with our comprehensive guide on average funeral costs.

5. Make Funeral Plans

Planning a funeral can be exhausting, but it’s essential to ensure your loved one is fully honored. Remember, it’s acceptable to seek help during this process.

Write the obituary/death announcement – Crafting an obituary or death announcement can be emotionally challenging yet healing. Numerous resources are available to assist you, but your personal knowledge and heartfelt expressions will capture the essence of your loved one best.

Coordinate funeral arrangements – Decide if you’re organizing a large or small service. Consider logistics such as burial arrangements and transport from the service to the graveside.

Send out invites – Ensure that attendees are informed about the service details. This can be managed through emails, phone calls, or mentions in the obituary published in the newspaper.

Determine the type of memorial – Whether formal or informal, large or intimate, the memorial should ideally reflect the deceased’s wishes.

Arrange for essentials like flowers and refreshments – Decide on aspects like catering and venue, considering the size and scope of the service among other factors.

6. Organise Ongoing Expenses

Make a list of bills: Compile a comprehensive list of ongoing expenses such as the mortgage, taxes, and utilities. Share this list with the executor to ensure these critical payments are maintained while the estate is settled.

Cancel unnecessary digital services: This includes mobile phone plans, streaming subscriptions, cable, and internet services. Also, remember to cancel any recurring home deliveries and services.

Close or update credit card accounts: If the deceased had sole ownership of a credit card, contact the card issuer’s customer service to close the account. You will need a copy of the death certificate. Maintain records of closed accounts and inform the executor of any remaining balances. Credit bureaus will notify issuers of the death in their regular reports, but for quicker communication, you may contact them directly. Destroy the deceased’s credit cards to prevent loss or theft.

Amend joint credit card accounts: If a credit card account was shared with someone who wishes to keep it active, inform the bank to remove the deceased’s name from the account. Ensure any cards bearing their name are destroyed to avoid risks of identity theft and fraud.

About Arcadia Finance

Secure your loan effortlessly with Arcadia Finance. Zero application fees, with a selection of 19 reputable lenders, all compliant with South Africa’s National Credit Regulator standards.

7. Create an Inventory of Assets

The probate process often begins by taking inventory of all assets, such as bank accounts, houses, cars, brokerage accounts, personal belongings, furniture, and jewelry. These details will need to be filed with the court. For valuing physical items within the household, it’s advisable to engage a professional appraiser. This step is crucial to ensure all assets are accurately accounted for and managed according to legal requirements.

8. Check Whether there is a Will and Inheritance

A will of the deceased is an allocation of assets and debts to the dependents. You can draft a will via an attorney, your bank, a chartered accountant, boards of executors, and insurance providers. Under the condition, they are qualified to do so. You may draft your own will as long as it complies with certain guidelines. Additionally, an appointed Executor handles the interests of the deceased’s inheritance. They apply for a letter of Executorship/Authority to the Master of the High Court with a procured death certificate. Thus this enables the executor to access the assets of the deceased.

When dealing with the loss of a loved one, it’s important to understand the complexities of inherited debt. This resource provides clarity on what debts may be passed on to next of kin, helping you navigate the legal and financial ramifications efficiently during this challenging time.

9. Inform Insurers and Other Authorities

Upon death, authorities will either close, or adjust necessary contracts, or bank accounts accordingly. Certain authorities will do this for you, while others will require you to address them yourself. Additionally, these include insurance providers, banks, social benefits authorities, service providers as well as charities.

10. Contact the Home Loan Authority of the Deceased

Regarding a home loan of the deceased, the executor will sell assets to cover any outstanding debts to repay such as a home loan. Afterward, the balance is allocated to the dependants. If there is an outstanding amount on the home loan the dependants are liable to pay. The foreclosure of the home in the case of no dependents.

11. Accept or Reject an Inheritance (beneficial)?

If you are entitled to an inheritance, you may choose to accept or disclaim it. Rejecting the inheritance means forfeiting any claim to the deceased’s assets. However, accepting it also means assuming liability for any outstanding debts. The executor will inform relevant parties of any outstanding debts.

In case of uncertainty about accepting the inheritance, refrain from accepting it immediately. Avoid selling or removing any assets until you can make an informed decision and potentially acquire more information. Unless previously in a community of property with the deceased, the spouse will be liable for outstanding debts.

How to Apply for a Loan with Arcadia Finance

Applying for a loan at Arcadia Finance is straightforward and accessible. Start your application by visiting our website, where our dedicated and experienced team is available to assist you with any inquiries you might have throughout the process. We will require some basic information from you, including details about your income and expenses, as well as your desired loan amount and preferred repayment term. After submitting your application, our team will promptly review the details and respond with a decision as soon as possible.

12. Contact the Pension Provider Regarding the Surviving Spouse

Often the Government Pensions Administration Agency(GPAA) will be aware of a partner’s passing. In time, contact you for confirmation regarding any spousal pension and payments thereof to any dependants.

13. Use of Pension to Finance a Home Loan

Referred to as a pension-backed home loan, many pension providers allow you to utilize a pension fund for a home loan after the death of your partner. This option can be beneficial if the interest on the home loan after the spouse’s death is lower than the long-term home loan interest you will pay.

Note: Contact relevant authorities regarding the use of a pension for a home loan.

14. Check Your Entitlement to Maintenance

A surviving legal spouse may be entitled to claim maintenance from the estate of their deceased spouse. Reviewing the will and relevant legal statutes that might influence their right to such claims is crucial. Consulting with a legal expert can provide clarity and guidance on pursuing maintenance from the estate.

15. UIF Benefits?

If your partner dies in a legal partnership, there is often a significant change in the standard of living. Therefore it is wise to consider whether you are entitled to the UIF(Unemployment Insurance Fund) of the deceased. Thus this can be done through the Department of Labour.

16. Children? Apply for a Foster Child Grant

Children up to the age of 18 can receive a foster child grant from the South African Social Security Agency (SASSA) if both parents are deceased. A legal guardian of the child will only receive a grant if they are a citizen and reside in South Africa. This grant is valued at R1 070 per month for each child.

17. Create a New Overview of Income and Expenses

If your partner has passed away, it’s crucial to acknowledge the significant impact this may have on your financial situation. To manage this change effectively, it is advisable to create a new, detailed overview of all your income and expenses. This involves updating records to reflect any changes in your financial circumstances, such as alterations in household income or shifts in monthly expenses. Carefully reviewing and adjusting your budget will help ensure that you have a clear understanding of your financial position during this challenging time.

Conclusion

Losing a family member is emotionally challenging, and managing financial affairs during this period can compound the stress. However, proactive measures can assist in navigating these complexities. Remember to collect essential documents, such as IDs, contracts, and title deeds. Establishing a budget will aid in comprehending your income and expenses accurately. Seeking guidance from legal and financial professionals is advisable to make informed decisions.

Frequently Asked Questions

To obtain a death certificate, you must fill out the required BI-1663 form with a medical practitioner and a Home Affairs official. Once the form is properly filled and submitted, an official death certificate will be issued.

When a loved one passes away, there are several crucial steps to take. First, notify friends and family to inform them of the loss and seek their support. Attend to any immediate needs, such as caring for pets or securing the home. Additionally, locate important documents like the deceased’s ID, passport, contracts, and title deeds.

Compile a list of all ongoing expenses, such as mortgage, utilities, and taxes. Inform the executor of the estate to ensure these bills continue to be paid while the estate is being settled.

Record all financial information in one place: Compile details about bank accounts, income streams (including pensions), ongoing contracts, and insurance policies. Having this information readily accessible will assist your executor and reduce stress during a difficult time.

Create an income and expenses budget: Understand your new cost of living, especially if you have children. Rebuilding your financial life after a loss requires a clear understanding of your income and expenses.

The process involves creating an inventory of all assets, valuing them, and possibly selling some assets to settle debts. An executor appointed by the court or designated in the will handles this process, ensuring all assets are distributed according to the deceased’s wishes or legal requirements.