Since its inception, Arcadia Finance has been creating a stir in the financial market, garnering numerous clients who willingly share their experiences. These testimonials offer a transparent perspective on Arcadia’s loan services, with the majority expressing positive sentiments. Clients consistently praise the accessibility, expertise, and reliability of Arcadia’s loan advisors. The team’s skill in tailoring solutions to individual needs, coupled with a direct and practical approach, has played a pivotal role in establishing trust among clients.

Expertise at Your Service

Arcadia Finance’s team of loan specialists is not only well-trained but also dedicated to continuous improvement, keeping abreast of industry developments. This commitment to excellence ensures they stay well-informed about the latest trends in the loan sector, providing top-tier advice to clients. The expertise of Arcadia’s team is evident in the superior guidance they offer.

The journey with Arcadia Finance goes beyond positive reviews. The true difference is observed in the clients’ satisfaction throughout their loan process – from exploring options to application and finally, disbursement. It’s more than just a transaction; it’s about the ease and speed with which clients are matched with the ideal loan. The online comparison tool, in particular, has been revolutionary, saving time and leading to more cost-effective decisions. This positive impact isn’t just a fleeting experience; it’s building a loyal client base that is eager to recommend Arcadia Finance and return for their future financial needs.

About Arcadia Finance

Simplify your loan acquisition process using Arcadia Finance. Submit a free application and assess proposals from up to 19 distinct lenders. Rest assured, all our lending partners are trustworthy and governed by the National Credit Regulator, ensuring adherence and reliability in South Africa’s financial industry.

Arcadia Finance: Your Portal to Customised Loan Solutions

As a leading loan comparison service, Arcadia Finance distinguishes itself with an extensive network, collaborating with numerous reputable financial institutions. This partnership offers a comprehensive range of loan products, tailored to meet various financial needs. Your journey to the ideal loan begins with submitting some personal information. This crucial step unlocks a range of loan offers, each customized to your unique requirements. Following this, you receive a personalized summary of these options, simplifying the process of identifying and applying for the perfect loan, all within the convenience of your online environment.

Your Privacy, Our Priority

At Arcadia Finance, your privacy is paramount. We treat your data with the highest level of confidentiality, ensuring encryption during its transmission. We are committed to not sharing your information with third parties without authorization. Your trust in us is essential, and we are dedicated to preserving that trust throughout your journey with us.

Arcadia Finance: Your Extensive Loan Comparison Gateway

Arcadia Finance, a prominent loan comparison platform, proudly showcases partnerships with a multitude of distinguished financial institutions. This extensive network empowers Arcadia Finance to provide an impressive selection of loan products to borrowers. The process begins when you enter your personal details, a crucial step leading to the creation of tailored loan offers. Once you have these offers, you have the freedom to browse through and choose the most appropriate one from your personalized overview. The convenience extends further – you can effortlessly apply for your selected loan online, making your path to financial satisfaction more streamlined.

Your data is handled with the utmost care at Arcadia Finance, ensuring confidentiality and security at every step of your financial journey.

Loan Application Requirements at Arcadia Finance

To secure a loan through Arcadia Finance, certain criteria must be met to ensure comfortable repayment and safeguard both the lender and the borrower from potential financial difficulties.

While specific requirements may vary among different banks, our partner institutions generally expect the following:

- Residency in the relevant country where Arcadia Finance operates.

- Possession of a bank account in the same country is essential.

- Regular income and adequate creditworthiness are crucial factors.

- You must be over 18 years old.

- Employment status with a job duration of more than 6 months.

- Your loan should not exceed 8 times your monthly income.

Want a second opinion straight from real customer experiences? Take a look at our review on Arcadia Finance on HelloPeter to see how this lender fares in public forums and what it reveals about their service quality.

Essential Documents for Arcadia Finance Loan Application

To assess your eligibility for a loan, Arcadia Finance requires additional documentation along with the signed loan agreement. The specific documents needed can vary depending on the bank. You will typically need to provide:

- Recent payslips.

- Bank statements showing salary deposits.

- For employed individuals: a copy of your employment contract.

- For self-employed individuals: relevant tax assessments.

These documents are critical in allowing banks to thoroughly review your loan application through Arcadia Finance.

Step-by-step Guide to Applying for a Loan with Arcadia Finance

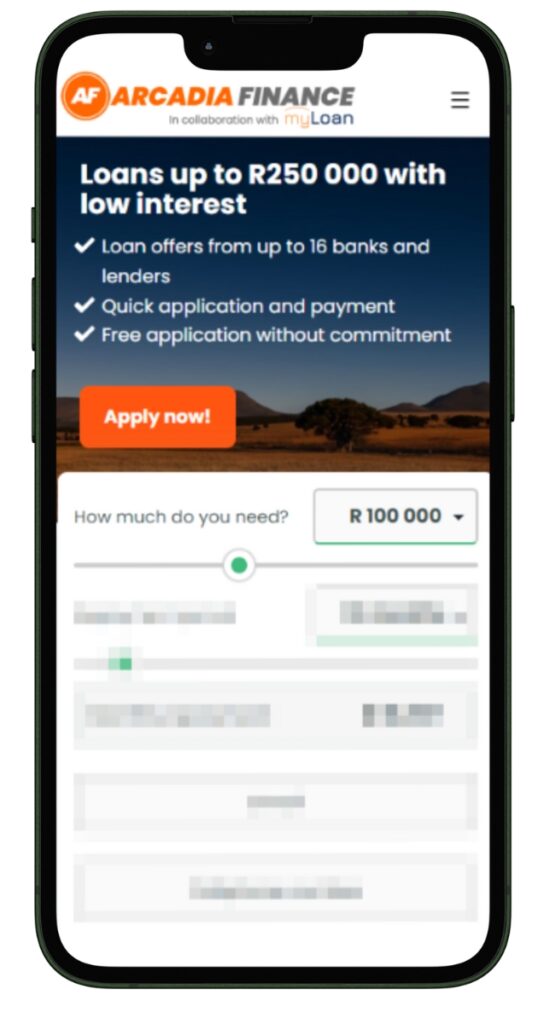

Step 1. Visit the Arcadia Finance Website

Step 2. Select the loan amount you need by adjusting the slider or clicking the dropdown arrow.

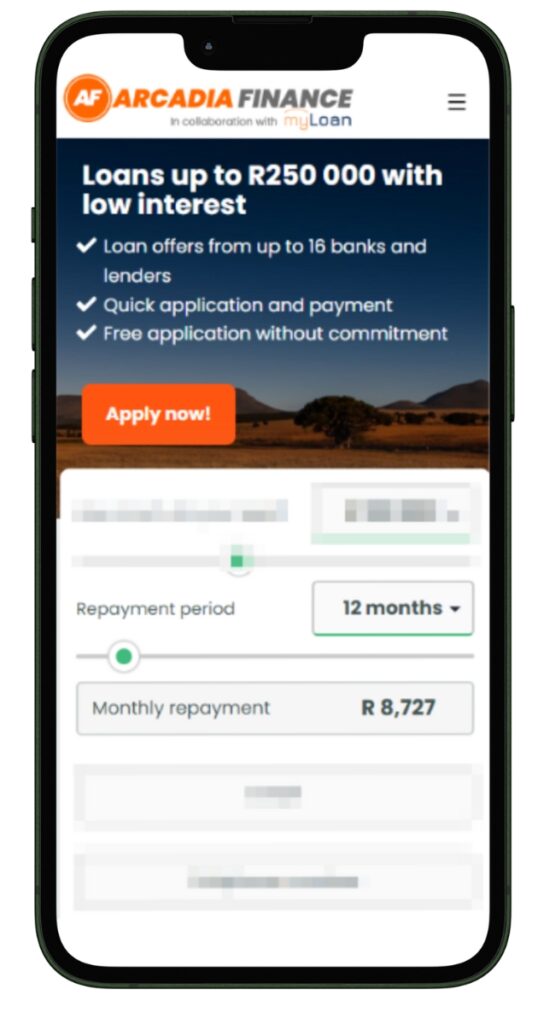

Step 3. Choose your preferred repayment period and check the monthly repayment amount.

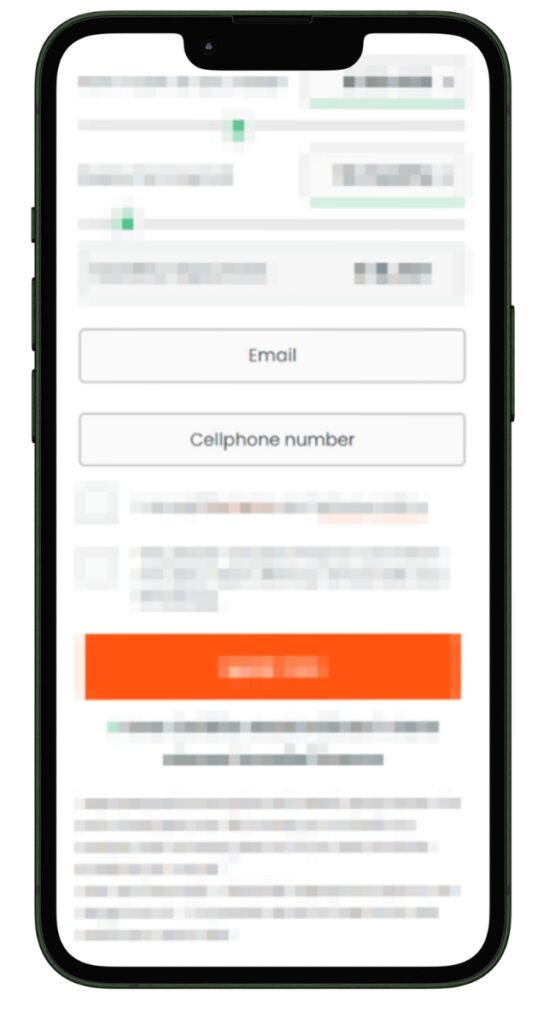

Step 4. Enter your email and cellphone number. Ensure they’re correct for important updates.

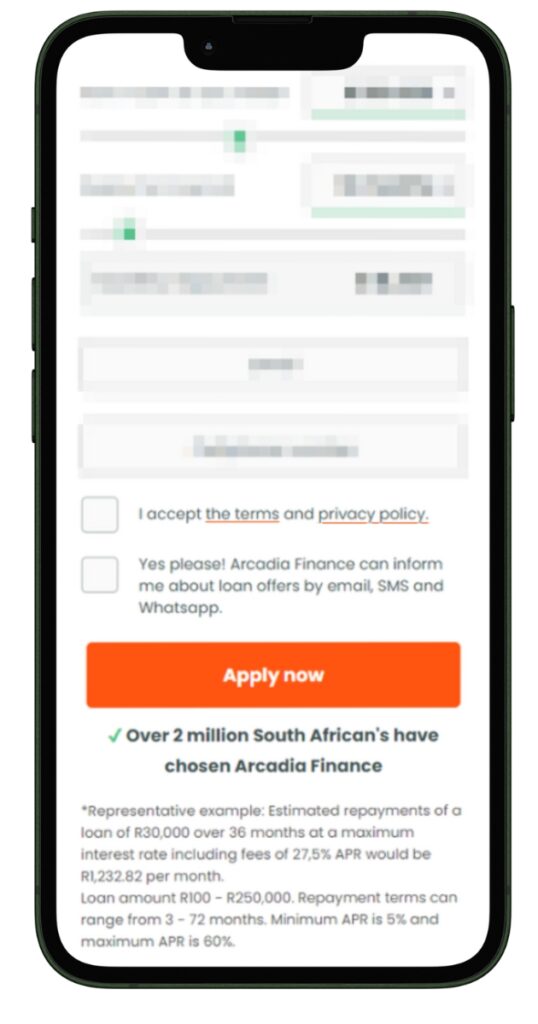

Step 5. Agree to the terms and click “Apply now” to submit your application.

Step 5: If prompted, review any additional details or documentation required for your application.

Step 6: Wait for a response from Arcadia Finance, which will include your loan offers from various lenders.

Arcadia Finance Loan Calculator: Estimate Your Monthly Payments and Interest

Arcadia Finance provides an intuitive loan calculator designed to assist you in easily understanding the potential monthly payments and interest costs associated with a loan. This tool is free to use and non-binding, allowing you to input your desired loan amount and term. As a result, you can estimate a monthly rate and the associated interest charges. It’s important to note that these figures are only indicative, and the actual terms of your loan will be determined based on your specific personal and financial circumstances. To receive customized offers from our partners that meet your needs, we recommend completing our application form. This initial step is crucial in providing you with accurate and tailored loan options.

The Evolution of Arcadia Finance: Loan Services in South Africa Since 2012

Founded in 2012, Arcadia Finance rapidly positioned itself as a trailblazer in South Africa’s loan market by introducing a unique platform that merged comprehensive loan comparisons with personal finance empowerment. This innovative approach empowered consumers to access a curated selection of loans from various banks and financial institutions, customized to their individual needs, marking a departure from the traditional approach to loan acquisition.

In a significant stride in 2015, Arcadia Finance expanded its reach by incorporating personal evaluations and reviews of loan services. This crucial development allowed customers, for the first time, to not only compare but also understand the intricacies of various loan options based on actual user experiences, all accessible online in one centralized platform. This move aligned with the company’s dedication to providing transparent, fair, and user-centric loan services, thereby revolutionizing how South Africans access and manage personal finance.

Is Arcadia Finance Legit?

In today’s financial landscape, the legitimacy of a financial institution is paramount for clients looking to engage with its services. Arcadia Finance, a name that has surfaced in various financial circles, has raised questions regarding its legitimacy. To address these concerns, it’s essential to consider several key factors.

Firstly, the regulatory compliance of Arcadia Finance is a significant indicator of its legitimacy. A legitimate finance company must adhere to the financial regulations and guidelines set forth by the governing bodies within the jurisdiction it operates. These regulations are designed to protect consumers and ensure fair, transparent financial practices.

Secondly, customer reviews and testimonials offer insights into the experiences of those who have interacted with Arcadia Finance. Positive feedback and satisfied customers are indicators of a company’s reliability and legitimacy. However, it’s also crucial to approach reviews critically, as they can vary widely in objectivity.

Lastly, the longevity and track record of Arcadia Finance in the market can provide additional assurance of its legitimacy. A company with a history of consistent performance and growth is likely to be a legitimate entity within the financial sector.

Arcadia Finance Contact Details

For individuals looking to get in touch with Arcadia Finance, whether for enquiries about services, customer support, or other reasons, having the correct contact details is essential. Arcadia Finance typically offers multiple channels through which potential and existing clients can communicate with them.

Arcadia Finance Loans: What Types Available?

Arcadia Finance offers a range of loan products designed to meet the diverse needs of its clientele. Understanding the types of loans available can help potential borrowers make informed decisions about their financing options. Common loan types provided by Arcadia Finance may include:

Personal Loans

Unsecured loans requiring no collateral

- Consolidate debt to manage multiple debt obligations more effectively.

- Fund major purchases, such as appliances, holidays, or weddings.

- Cover unexpected expenses like medical bills or emergency repairs.

Auto Loans

Financing solutions for new or used vehicles

- New car purchases with the latest models.

- Second-hand vehicle financing for cost-effective options.

- Auto loan refinancing for advantageous terms and rates.

Short-Term Loans

Quick financial assistance for immediate needs

- Emergency expenses requiring prompt payment.

- Bridging cash flow gaps between income periods.

- Short-term funding needs without a long-term commitment.

Consolidation Loans

Combining multiple debts into a single loan

- Simplified payment process with a single monthly payment.

- Potentially lower interest rates than original debts.

- Improved debt management and financial planning.

Cash Loans

Immediate cash provision for urgent financial needs

- Emergency cash needs with quick disbursement.

- Small-scale financial requirements without collateral.

- Short-term liquidity support with straightforward repayment.

Each loan type comes with its specific eligibility criteria, interest rates, and terms. Prospective borrowers should contact Arcadia Finance directly for detailed information on the loan products, including the application process, requirements, and any associated fees.

Frequently Asked Questions about Arcadia Finance Loans

To qualify for a loan through Arcadia Finance, several key criteria must be met. Firstly, your residency must be in the country where Arcadia Finance operates. It’s essential to have a bank account in the same country to facilitate financial transactions. Having a regular income and demonstrating adequate creditworthiness are crucial factors in assessing your loan eligibility. You must be over 18 years old to apply. Additionally, it is required that you are employed, with your current employment lasting for more than 6 months. Lastly, the amount of the loan you apply for should not exceed eight times your monthly income, ensuring that the loan remains manageable within your financial situation.

When applying for a loan through Arcadia Finance, you’ll need to provide various documents. Generally, these include recent payslips, bank statements showing salary deposits, a copy of your employment contract if you’re employed, and relevant tax assessments for self-employed individuals. These documents assist the banks associated with Arcadia Finance in thoroughly assessing your loan application.

Arcadia Finance offers numerous advantages for its borrowers. These comprise access to a diverse array of loan products from different financial institutions, tailor-made loan options that align with individual financial circumstances, a straightforward and efficient online application process, and robust privacy and data protection measures. Additionally, all amounts mentioned are presented in Rands for clarity.

The Arcadia Finance loan calculator is a user-friendly tool designed to assist you in estimating your monthly payments and interest costs for a loan. By inputting your preferred loan amount and term, the calculator generates an indicative monthly rate and interest expenses. This functionality enables you to grasp the potential financial commitment before advancing with the loan application. However, it’s important to note that the actual loan terms will be determined by your unique personal and financial circumstances. For precise offers, we recommend completing the application form. All currency values are presented in Rands for clarity.