Acquiring a home marks a significant milestone in one’s life. It’s a journey teeming with dreams, aspirations, and a substantial amount of paperwork. Navigating through the multitude of lenders in the market can be overwhelming, making the selection process quite intricate. SA Home Loans shines brightly as a guiding light for many South Africans, presenting a variety of home financing solutions finely tuned to individual needs.

Experiences with SA Home Loans

Navigating the realm of home financing can be intimidating, but with SA Home Loans, countless South Africans have discovered a partner attuned to their distinctive needs. The testimonials of numerous homeowners underscore the simplicity of the application process, the transparent procedures, and the supportive customer service that SA Home Loans provides.

Who Can Apply for an SA Home Loan?

SA Home Loans extends a warm welcome to a diverse array of applicants. Whether you’re a first-time homebuyer, a seasoned property investor, or someone seeking to switch from another lender, SA Home Loans offers tailored solutions to accommodate various financial situations and home buying objectives.

Criteria for Potential Borrowers

To ensure optimal compatibility between the lender and the borrower, SA Home Loans has established specific criteria for potential applicants. These include a steady income source, a positive credit history, and the capability to make regular repayments. Additionally, the property in question must be situated within South Africa, and the borrower should be a resident of South Africa. While these represent fundamental criteria, SA Home Loans conducts a thorough and fair evaluation of each application, considering individual merits.

Differences from Other Loan Providers

What distinguishes SA Home Loans from other providers is its dedication to simplifying the home loan process. Amidst a landscape where many lenders inundate borrowers with complex terms and jargon, SA Home Loans prides itself on clear communication and transparency. Their user-friendly tools, such as the home loan calculators, empower borrowers to make well-informed decisions. Real-life stories and testimonials from contented homeowners underscore the company’s unwavering commitment to its clients. In a market crowded with lenders, SA Home Loans emerges as a beacon of trust, reliability, and customer-centric service.

About Arcadia Finance

Simplify your loan application process with Arcadia Finance. Apply for free and discover options from up to 10 reputable lenders, all regulated by South Africa’s National Credit Regulator for secure, compliant financial dealings.

SA Home Loan

SA Home Loans has established itself as a distinctive player in the South African home financing market, earning favor among many homeowners due to its customer-centric approach and an array of personalized solutions.

What Sets SA Home Loan Apart?

The uniqueness of SA Home Loans lies in its unwavering commitment to transparency and simplicity. Amidst the potential complexities of the home financing process, SA Home Loans ensures that each step is transparent, straightforward, and devoid of overwhelming jargon. Their user-friendly tools, including the home loan calculators, are crafted to empower borrowers, enabling them to make well-informed decisions aligned with their individual needs.

Advantages of SA Home Loan Comparison

Comparing SA Home Loan with other lenders in the market reveals several distinct advantages. Firstly, their tailored solutions are designed to accommodate a broad spectrum of financial situations, ensuring suitability for both first-time homebuyers and experienced property investors. Secondly, the emphasis on clear communication guarantees that borrowers are never left in the dark about the intricacies of their home loan. Lastly, the abundance of positive testimonials from contented homeowners underscores the company’s unwavering dedication to its clients, reinforcing its position as a trusted and reliable lender in the South African home financing landscape.

Types of Loans Offered by SA Home

SA Home Loans offers a range of loan products, each meticulously designed to cater to specific needs. The cornerstone of their offerings is the home loan, meticulously crafted for those seeking to acquire a new property or refinance an existing one. This loan comes with adaptable repayment choices and competitive interest rates, ensuring that homeowners can effectively manage their finances.

For those with aspirations of upgrading or renovating their current property, SA Home Loans provides a home improvement loan. This particular loan is structured to furnish homeowners with the necessary funds to augment both the value and comfort of their property.

In addition, SA Home Loans extends a personal loan option for individuals seeking to consolidate their debts or cover unforeseen expenses. This loan features a fixed repayment term and is designed to empower borrowers in effectively managing their finances.

Requirements for an SA Home Loan

When evaluating a loan application, SA Home Loans has established specific criteria to ensure a smooth and efficient process for both the lender and the borrower. Meeting these requirements is crucial for a successful loan application.

Documents and Information Required

To apply for an SA Home Loan, potential borrowers need to provide a range of documents and information. Firstly, proof of income is essential. This can take the form of recent payslips or, for self-employed individuals, financial statements and other relevant documentation that showcases a stable income source.

A good credit history is another vital requirement. SA Home Loans will typically request a credit report to assess the borrower’s financial behavior and ensure they have a track record of managing their debts responsibly.

Proof of identification is also necessary. This can be a valid South African ID or, for non-residents, a valid passport or other relevant identification documents.

Additionally, details about the property in question are required. This includes a signed offer to purchase for those buying a new home or, for those refinancing, recent statements of their existing home loan.

Simulation of a Loan at SA Home

Navigating the loan application process can be a journey filled with questions and anticipation. SA Home Loans, with its commitment to simplicity and transparency, has streamlined this process to make it as straightforward as possible for potential borrowers.

Step-by-Step Guide to Applying for a Loan with SA Home Loans

- Initial Research: Before diving into the application, it’s advisable to familiarize yourself with the different loan products offered by SA Home Loans. Their website provides detailed information on each loan type, helping you determine which one aligns best with your needs.

- Contact SA Home Loans: Reach out to SA Home Loans either through their website or by calling their customer service. This initial contact will provide you with a general overview of the loan process and what to expect.

- Submit Preliminary Information: At this stage, you’ll be asked to provide some basic information about yourself, your financial situation, and the property in question. This helps SA Home Loans to get a preliminary understanding of your loan requirements.

- Eligibility Check: Based on the information provided, SA Home Loans will conduct an initial assessment to determine your eligibility for the loan. This includes checking your credit history, income stability, and other relevant factors.

- Document Submission: If the initial assessment is positive, you’ll be asked to submit detailed documentation, including proof of income, identification, property details, and any other relevant documents.

- Loan Assessment: Once all documents are submitted, SA Home Loans will conduct a thorough assessment. This involves evaluating the property’s value, your repayment capability, and other factors to determine the loan amount and terms.

- Loan Approval: If everything is in order, SA Home Loans will approve your loan application. You’ll receive a formal loan offer detailing the loan amount, interest rate, and other terms.

- Finalize the Loan: After accepting the loan offer, the final paperwork is drawn up. Once signed, the loan amount is disbursed, either to you or directly to the property seller, depending on the loan’s purpose.

- Ongoing Communication: Even after the loan is disbursed, SA Home Loans remains in touch, providing you with regular statements, updates, and any other necessary information.

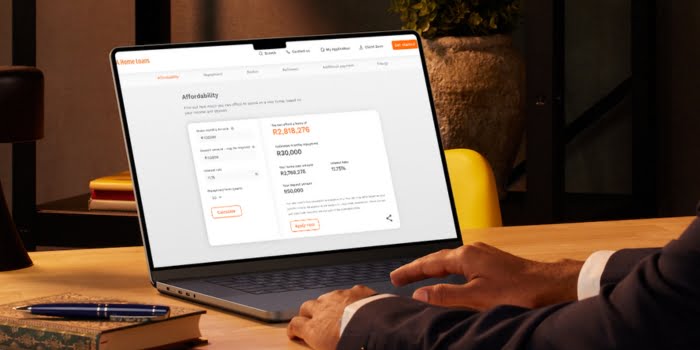

Eligibility Check

SA Home Loans understands the importance of time and the anticipation associated with a loan application. To assist potential borrowers, they offer tools and methods to pre-check eligibility. One of the most notable is their online loan calculator. This tool allows users to input their financial details, such as income and expenses, to get a preliminary idea of the loan amount they might be eligible for. It’s a quick and efficient way to gauge your potential loan without going through the entire application process.

Security and Privacy at SA Home

The security and privacy of personal and financial information are paramount. SA Home Loans recognizes the importance of this and has implemented robust measures to ensure that its clients’ data remains protected at all times.

How SA Home Ensures the Security of Personal and Financial Information

SA Home Loans employs a multi-layered approach to data security. They utilize advanced encryption technologies to ensure that any data transmitted between the client and the company is secure and free from potential interception. This encryption extends to their online portals, application forms, and any digital communication.

SA Home Loans has invested in state-of-the-art cybersecurity infrastructure to protect against potential threats. This includes firewalls, intrusion detection systems, and regular security audits to identify and rectify any vulnerabilities. Their IT teams are continuously trained and updated on the latest security threats and best practices, ensuring that the company’s defenses remain robust.

In addition to digital security, SA Home Loans also places a strong emphasis on physical security. Their data centers, where sensitive client information is stored, are equipped with advanced security measures, including biometric access controls, 24/7 surveillance, and regular security patrols.

Privacy Policies and Data Handling Practices

SA Home Loans is committed to maintaining the privacy of its clients. Their privacy policy outlines in clear terms how client data is collected, used, and stored. They ensure that any personal or financial information provided by clients is used solely for the purpose it was intended for, be it loan processing, customer service, or other related activities.

How much money can I request from SA Home Loans?

When considering a loan from SA Home Loans, the amount you can request largely depends on your financial situation and the value of the property in question.

Minimum and Maximum Amounts

SA Home Loans offers a range of loan amounts tailored to individual needs. While the minimum amount might cater to those looking for smaller home financing solutions, the maximum can extend to substantial sums, suitable for luxury properties or extensive property portfolios. However, the exact amounts can vary based on the applicant’s creditworthiness, the property’s value, and other financial factors.

Receiving Offers

How SA Home Loans Creates Personalized Loan Offers

SA Home Loans takes a personalized approach to loan offers. Instead of a one-size-fits-all solution, they evaluate each applicant’s unique financial situation. This includes assessing credit history, current income, existing financial obligations, and the property’s value. By considering these factors, SA Home Loans can craft a loan offer that aligns with the borrower’s needs and capabilities.

How long does it take to receive my money from SA Home Loans?

Average Processing Times

Once all the necessary documents are submitted and the loan application is approved, SA Home Loans typically processes the loan disbursement swiftly. On average, borrowers can expect to receive their funds within a few business days. However, this can vary based on individual circumstances.

Factors Affecting Withdrawal Speed

Several factors can influence the speed at which you receive your funds from SA Home Loans. These include:

Completeness and Accuracy of Documentation: The speed of fund disbursement is influenced by how complete and accurate the submitted documentation is. Ensuring all required documents are provided in a thorough and accurate manner can expedite the process.

Responsiveness of Third Parties: If there are third parties involved in the property transaction, such as legal representatives or sellers, the responsiveness of these parties can impact the overall processing time.

Internal Processes of SA Home Loans: The internal processes of SA Home Loans also play a role. The efficiency of their internal procedures, reviews, and approvals can affect the speed at which the loan is processed and funds are disbursed.

It’s important for borrowers to stay in communication with SA Home Loans and promptly provide any additional information or documentation requested to facilitate a smooth and timely disbursement process.

How do I repay my loan from SA Home Loans?

Repayment Options and Plans

SA Home Loans provides adaptable repayment options tailored to accommodate various financial situations. Borrowers have the flexibility to choose from monthly installments, which can be customized to align with individual preferences. There is the flexibility to make additional payments or settle the loan ahead of schedule, depending on the terms of the loan. This level of flexibility empowers borrowers to manage their repayments in a way that best suits their financial circumstances.

Possible Fees and Penalties

While SA Home Loans strives to keep its loan products transparent and free from hidden charges, it’s essential to be aware of any fees associated with the loan. This can include processing fees, late payment penalties, or charges related to loan modifications. It’s always advisable to read the loan agreement thoroughly and discuss any potential fees with SA Home Loans before finalizing the loan.

Online Reviews of SA Home Loans

The digital age has made it easier than ever for customers to share their experiences with companies, and SA Home Loans is no exception. A quick online search reveals a plethora of reviews from past and current clients, providing valuable insights into their experiences with this lender.

What Customers Say about SA Home Loans

Many customers praise SA Home Loans for its transparent and straightforward loan application process. They appreciate the company’s commitment to clear communication, ensuring that borrowers are never left in the dark about any aspect of their loan.

Another frequently mentioned positive is the company’s customer service. Many reviewers highlight the friendly and helpful nature of SA Home Loans’ staff, who are often described as going above and beyond to assist clients, whether it’s answering questions, providing advice, or helping navigate the complexities of home financing.

The flexibility of SA Home Loans’ products also earns them accolades. Customers value the range of loan options available, allowing them to find a solution that best fits their individual needs and financial situation.

However, like any company, SA Home Loans also has its critics. Some reviewers mention challenges with the loan approval process or delays in disbursement. Others wished for more competitive interest rates or highlighted areas where they felt the company could improve its offerings.

Customer Service at SA Home Loans

SA Home Loans places a strong emphasis on providing top-notch customer service. They understand that the home financing process can be complex, and they aim to support their clients every step of the way. Whether it’s answering queries, guiding clients through the application process, or addressing any concerns, the SA Home Loans team is always ready to assist.

Do you have further questions for SA Home Loans?

If you have additional questions or need clarification on any aspect of SA Home Loans’ offerings, it’s advisable to reach out to them directly. Their dedicated customer service team is trained to provide accurate and timely information, ensuring that clients have all the details they need to make informed decisions.

Alternatives to SA Home Loans

While SA Home Loans is a prominent player in the South African home financing market, there are other credit comparison portals and lenders that potential borrowers might consider.

Comparison Table: SA Home Loans vs. Top Competitors

| Feature | SA Home Loans | Standard Bank | ABSA Bank |

|---|---|---|---|

| Eligibility | Broad range of applicants | Focus on stable earners | Wide eligibility criteria |

| Loan Products | Home loan, improvement, personal | Home loan, business loan | Home loan, student loan |

| Interest Rates | Competitive, flexible | Market-related rates | Potentially lower for existing customers |

| Repayment Options | Flexible, extra payments allowed | Fixed repayment plan | Flexible, with options for breaks in repayment |

| Loan Approval Time | Swift, few business days | Depends on applicant details | Quick processing for pre-approved customers |

| Additional Fees | Transparent, discussed upfront | Possible administration fees | Transparent fee structure |

| More Info | Standard Bank Review | ABSA Bank Review |

History and Background of SA Home Loans

SA Home Loans has established itself as a leading figure in the South African home financing landscape. Founded in [specific year], the company was born out of a vision to simplify the home loan process and provide tailored solutions to South Africans from all walks of life. Over the years, SA Home Loans has grown exponentially, serving countless homeowners and earning a reputation for transparency, reliability, and customer-centric service.

Company’s Mission and Vision

SA Home Loans operates with a clear mission: to empower individuals to achieve their homeownership dreams by offering flexible, transparent, and customer-focused home financing solutions. Their vision is to be South Africa’s preferred home loan provider, recognized for their innovation, integrity, and unwavering commitment to their clients.

Pros and Cons

Advantages of Choosing SA Home Loans

- Tailored Solutions: SA Home Loans offers a range of products designed to cater to individual financial situations and home buying goals.

- Transparent Processes: The company prides itself on clear communication, ensuring borrowers understand every aspect of their loan.

- Dedicated Customer Service: Many clients highlight the company’s commitment to exceptional customer service, with staff going above and beyond to assist.

Disadvantages of Choosing SA Home Loans

- Limited Physical Presence: While SA Home Loans has a strong online presence, they might have fewer physical branches compared to some traditional banks.

- Competitive Market: With many lenders in the South African market, some might offer promotional rates or terms that could be more attractive in specific scenarios.

Conclusion

SA Home Loans has cemented its position as a trusted and reliable home financing partner for many South Africans. Their commitment to transparency, tailored solutions, and exceptional customer service sets them apart in a competitive market. While there are always areas for improvement and factors to consider based on individual needs, the overall rating for SA Home Loans is overwhelmingly positive. Potential borrowers are encouraged to consider SA Home Loans as a strong contender when exploring home financing options.

Frequently Asked Questions about SA Home Loans

SA Home Loans provides a variety of home financing solutions, including standard home loans for property purchase, home improvement loans for renovations, and personal loans for various needs.

You can start the application process online through the SA Home Loans website or by contacting their customer service. They’ll guide you through the necessary steps and documentation required.

While SA Home Loans strives for transparency, there might be processing fees, late payment penalties, or other charges based on the specific loan product. It’s advisable to discuss potential fees with SA Home Loans before finalizing your loan.

The approval process can vary based on the completeness of the documentation provided and the specifics of the loan application. On average, once all documents are submitted, the approval can take a few business days.

Yes, SA Home Loans offers flexible repayment options, allowing borrowers to make extra payments or settle their loan earlier, depending on the loan terms.