When it comes to navigating the often intricate realm of personal finance, grasping your loan options is crucial. In South Africa, where financial needs and circumstances widely differ, discovering a trustworthy and adaptable loan provider can make a significant difference. This is where Mr. Cash Loans [Mrcashloans.co.za] steps into the spotlight, providing a variety of loan products customised to address diverse financial requirements. This review aims to dissect and discuss the various facets of this lender, from their loan offerings and application process to interest rates, fees, and customer experiences.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by Mr. Cash Loans and is based solely on our research.

Mr. Cash Loans offers a wide range of unsecured loan options, including short-term, payday, and personal loans, with amounts ranging from as little as R500 to as much as R300 000. Repayment terms vary based on the loan type, from 1 month for payday loans to up to 72 months for larger personal loans. If you’re looking for a fast, online lending solution that caters to both urgent cash needs and longer-term financial goals, read on to find out more about Mr. Cash Loans and whether their services suit your situation.

Mr. Cash Loans: Quick Overview

Loan Amount: R500 – R300 000

Loan Term: 1 to 72 months

Interest Rate: Up to 5% per month (0.16% per day)

Fees: Initiation Fee: Up to R1 050 + VAT; Monthly Service Fee: R69 + VAT

Loan Types: Personal Loans, Short-Term Loans, Payday Loans, Online Loans

About Arcadia Finance

Make your loan acquisition easier with Arcadia Finance. Submit an application at no cost and peruse proposals from as many as 19 different lenders. Each lender we collaborate with is esteemed and regulated by the National Credit Regulator, ensuring they uphold standards and reliability in the South African financial environment.

Mr. Cash Loans Full Review

Experiences with Mr. Cash Loans

When considering a loan provider, real-life experiences and customer feedback are invaluable. Mr. Cash Loans, with its emphasis on unsecured loans, has built a reputation for being a flexible and responsive lender. Customers often praise the speed and simplicity of the application process as a significant advantage. Many value the absence of a collateral requirement, making it more accessible for individuals without substantial assets to secure a loan.

Another frequently mentioned benefit is the array of loan options available. Whether it’s a small payday loan to cover an unexpected expense or a more substantial personal loan for larger projects, this lender appears to cater to a broad spectrum of needs. However, as with any service, experiences can vary. Some customers have noted that while the application process is generally quick, the turnaround time can depend on the accuracy and completeness of the submitted documents.

Who can apply for a Mr. Cash Loans?

Mr. Cash Loans positions itself as an accessible lender, but there are still some basic criteria that applicants need to meet:

- Age and Employment: Applicants must be over 18 and under 60 years old. They should be permanently employed for more than six months at the time of application.

- Banking and Contact Details: A personal bank account into which the salary is deposited is essential. Additionally, applicants need to have a valid email address and a contactable cellphone number.

- Credit Rating: While this lender extends loans to individuals with less than perfect credit scores, the specific terms and approval may vary based on the applicant’s credit history.

Criteria for Potential Borrowers

The criteria for borrowing from Mr. Cash Loans are straightforward, concentrating on the applicant’s ability to repay the loan. This includes:

- Stable Income: Providing evidence of a steady, reliable income is crucial.

- Creditworthiness: A fair to good credit score enhances the likelihood of loan approval and potentially better terms.

- Affordability Assessment: Conducts an affordability assessment to ensure that borrowers can comfortably repay their loans.

Mr. Cash Loans: What Makes Them Unique?

Mr. Cash Loans stands out in the South African loan market primarily due to its focus on unsecured loans. This unique selling point is particularly significant for borrowers who might not have, or prefer not to risk, assets as collateral. The company’s approach to lending is designed to be as inclusive and accessible as possible, catering to a wide range of financial needs and backgrounds.

One of the key advantages they offer is the sheer convenience and speed of their service. The entire loan process, from application to receiving funds, is streamlined and digital. This means that applicants can complete the process from the comfort of their home or office, without the need to visit a branch. This online model not only saves time but also makes the loan process less intimidating and more accessible for many people.

Another notable aspect is the range of loan products offered. This lender provides options that cover various financial needs, from short-term emergencies to larger, more planned expenses. This flexibility allows potential borrowers to find a loan product that closely matches their specific requirements.

Types of Loans Offered by Mr. Cash Loans

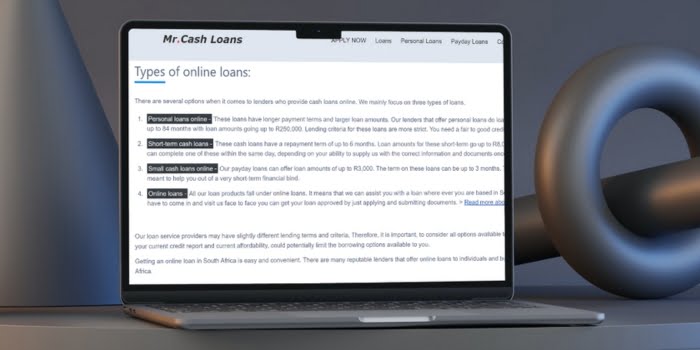

Mr. Cash Loans offers a variety of loan products tailored to meet different financial needs:

Personal Loans

Suitable for larger expenses such as home renovations, education, or debt consolidation. Personal loan amounts can range up to R300 000, with repayment periods extending up to 72 months.

Short-Term Loans

Ideal for covering unexpected expenses like medical bills or urgent repairs, short-term loans offer amounts up to R8 000 with repayment terms up to 6 months.

Payday Loans

Designed to bridge the gap until your next salary, payday loans provide quick access to funds up to R4 000, repayable within 3 months.

Online Loans

Encompassing all the above categories, online loans offer the convenience of applying and managing your loan entirely through Mr. Cash Loans’ digital platform, catering to various financial situations without the need for in-person interactions.

Each loan type is designed with specific purposes in mind, ensuring that borrowers can find a financial solution that aligns with their individual needs and circumstances.

Requirements for a Mr. Cash Loans

Applying for a loan with Mr. Cash Loans involves meeting certain criteria and providing specific documents and information. The company aims to make the process straightforward, ensuring that potential borrowers can quickly ascertain whether they qualify for a loan and what they might need to proceed.

To apply for a loan, applicants typically need to provide the following:

- Proof of Income: This is usually in the form of recent payslips or bank statements, demonstrating a stable income. It is crucial for the lender to assess the applicant’s ability to repay the loan.

- Identification: A valid South African ID document or Smart ID card is required to verify the applicant’s identity.

- Bank Details: Since the loans are processed and disbursed electronically, applicants must provide details of a bank account into which their salary is deposited.

- Proof of Residence: A recent utility bill or similar document can be used to verify the applicant’s address.

- Contact Information: A current cellphone number and email address are essential for communication throughout the loan process.

Step-by-Step Guide to Applying for a Loan with Mr. Cash Loans

Mr. Cash Loans typically provides a loan calculator on their website, enabling potential borrowers to estimate their loan terms before applying. This tool can be incredibly useful for planning and budgeting.

Step 1. Go to Mrcashloans.co.za

Step 2. Click the “Apply Now” button on the homepage.

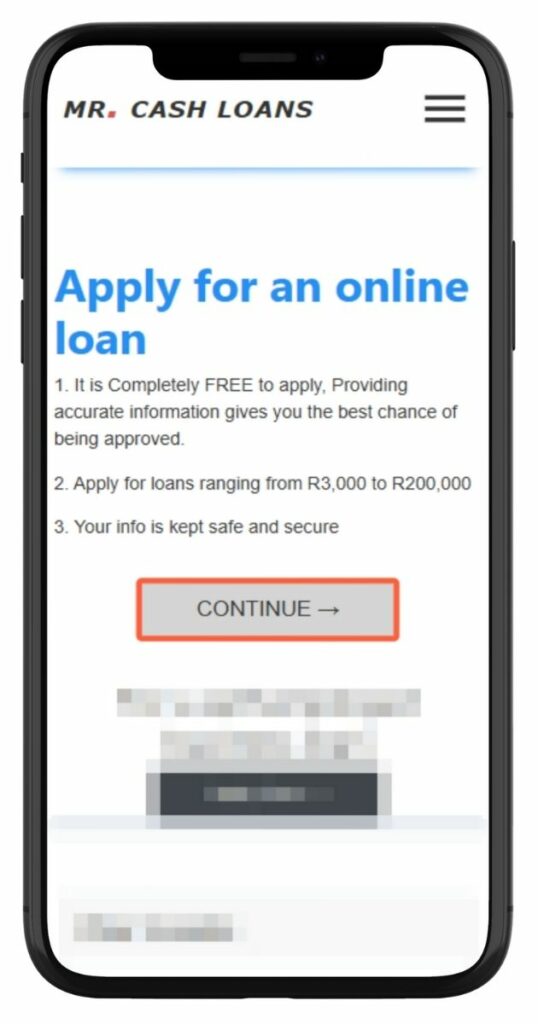

Step 3. Click “Continue” after reading the basic loan application info.

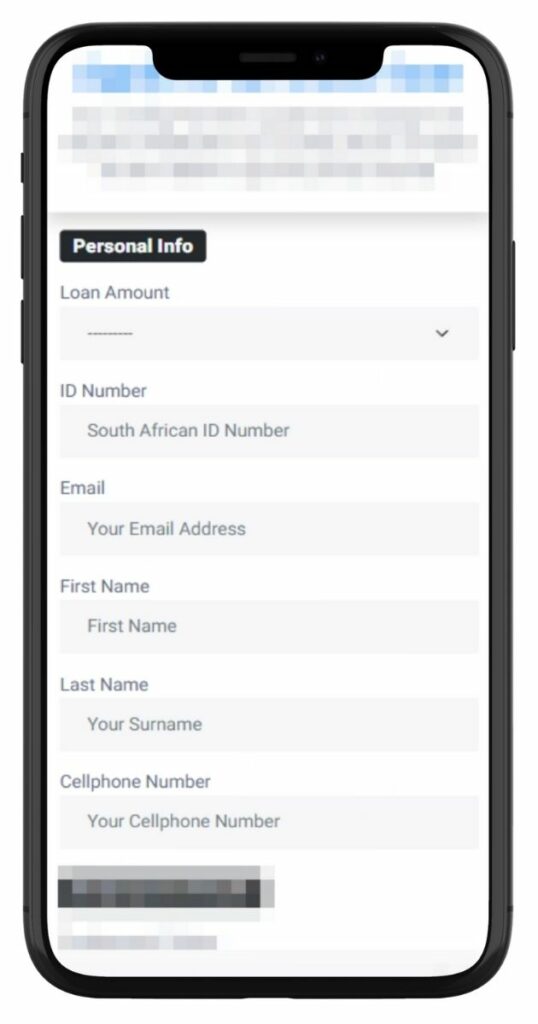

Step 4. Fill in your personal information including ID, email, name, and number.

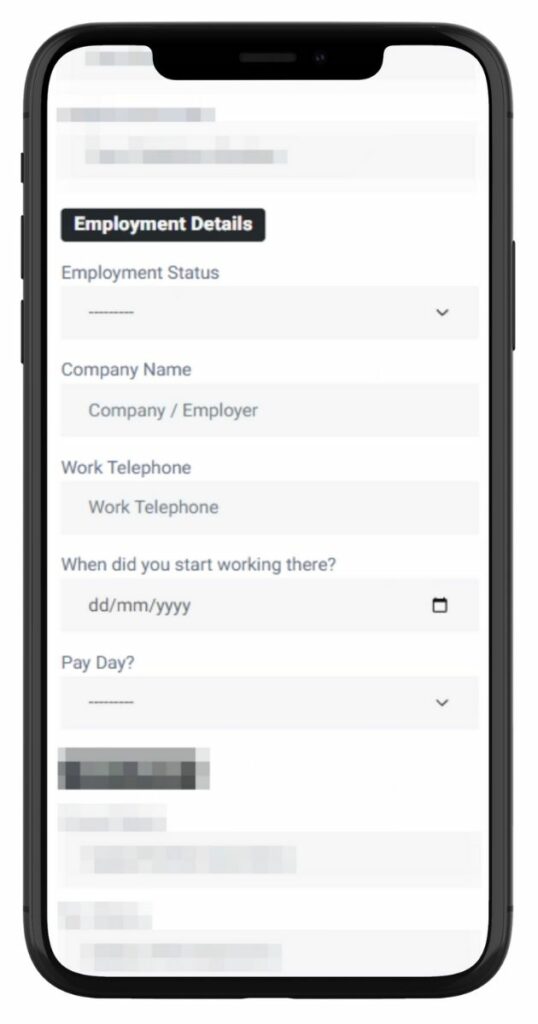

Step 5. Provide your employment details such as job status, company name, and start date.

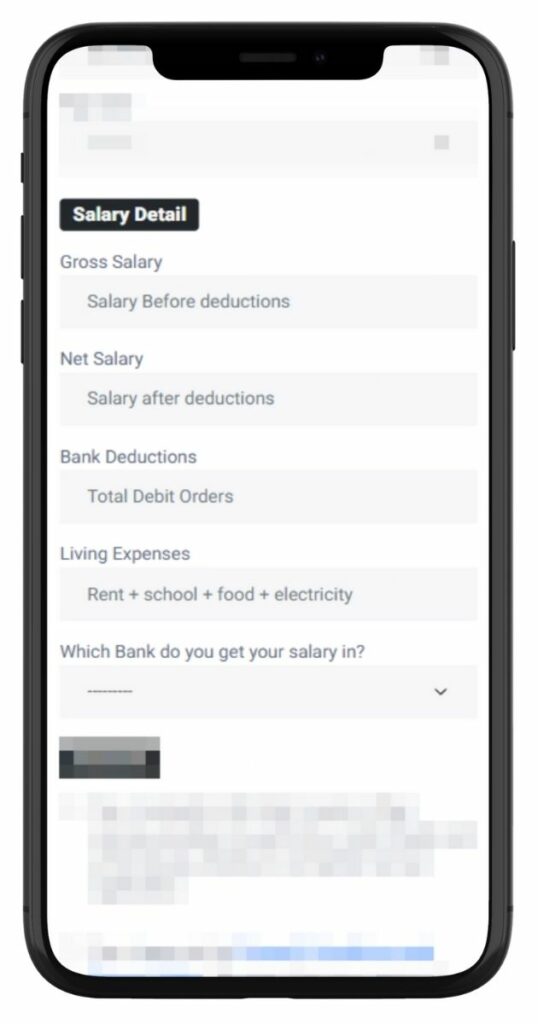

Step 6. Enter your salary information, expenses, and the bank you use for receiving your income.

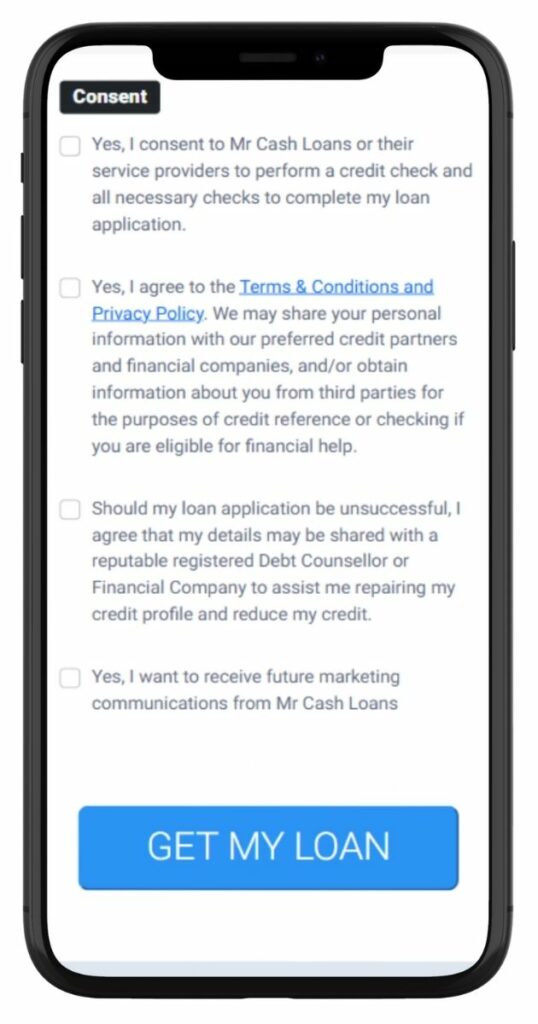

Step 7. Tick the required consent checkboxes and click “Get My Loan” to submit your application.

Step 8. Upload or email the necessary documents: ID, proof of income, bank statements, and proof of residence.

Step 9. Once your application and documents are submitted, Mr. Cash Loans will review the information to determine your eligibility and the loan amount you qualify for.

Step 10. If approved, you’ll receive a loan offer with terms and conditions. Upon acceptance, the loan amount is typically deposited into your bank account within a specified timeframe.

Eligibility Check

Online Loan Calculator: Before initiating the application process, potential borrowers can utilise Mr. Cash Loans’ online calculator. This tool provides an estimate of loan terms, including repayment amounts and duration. It offers a preliminary insight into the expected loan size and repayment structure.

Pre-Qualification Form: Mr. Cash Loans provides a pre-qualification form on their website. By completing this form with basic financial information, individuals can receive a quick indication of their likelihood of loan approval and the potential loan amount.

Security and Privacy at Mr. Cash Loans

Mr. Cash Loans employs advanced security protocols to safeguard the personal and financial information of its clients. This includes the use of encryption technologies during data transmission, preventing unauthorised access or interception of sensitive information. When you submit your application and accompanying documents online, these security measures are in place to protect your data from being compromised.

The company’s IT infrastructure is designed to shield against potential cyber threats, with regular updates and security patches applied to maintain high levels of protection. Additionally, internal controls and policies are in place to ensure that only authorised personnel have access to personal data, and only for legitimate business purposes.

Privacy Policies and Data Handling

Privacy is another critical aspect of Mr. Cash Loans’ operations. The company adheres to strict privacy policies in compliance with relevant South African laws and regulations, including the Protection of Personal Information Act (POPIA). This act governs how personal information must be processed, ensuring that it’s done lawfully, minimally, and securely.

Looking for another fast loan option? Before deciding, you might want to explore our detailed Lula Lender Review to see how it stacks up in terms of turnaround time and customer satisfaction.

Who Are Mr. Cash Loans Best Suited For?

Mr. Cash Loans are well-suited for South African individuals who:

- Require Quick Access to Funds for emergencies, everyday expenses, or once-off purchases

- Have a Regular Income and can provide recent payslips and proof of employment

- Need Flexible Loan Options, from small payday loans to larger personal loans up to R300 000

- Prefer a Fully Online Application Process, without the need to visit a physical branch

- Are Looking for Repayment Terms ranging from 1 to 72 months, depending on the loan type

Is Mr. Cash Loans a Safe and Good Option?

Mr. Cash Loans is a registered and compliant credit provider in South Africa, operating under the regulations of the National Credit Act. It offers unsecured loans ranging from small payday advances to larger personal loans through a fully online application platform. Applicants must provide standard documents such as a valid South African ID, proof of income, and a recent utility bill.

The lender is known for its quick application turnaround, with funds often disbursed within hours of approval. Mr. Cash Loans provides transparent information on interest rates, fees, and repayment terms, and conducts affordability assessments to ensure responsible lending. For those seeking fast, convenient, and collateral-free financial support, Mr. Cash Loans is a reliable option.

Loan Amounts and Processing Times at Mr. Cash Loans

Mr. Cash Loans offers a range of loan amounts to suit various financial needs. The minimum and maximum amounts you can request depend on the type of loan you’re applying for. For instance, small cash loans or payday loans typically offer smaller amounts, ideal for short-term financial needs, while personal loans are designed for larger amounts and longer repayment periods.

- Payday Loans: Generally available for smaller, immediate expenses. You can typically request amounts up to R4 000.

- Short-term Cash Loans: For slightly larger amounts, short-term cash loans can go up to R8 000.

- Personal Loans: The most substantial loans offered by Mr. Cash Loans, with amounts available up to R300 000, depending on your financial situation and creditworthiness.

Personalised Loan Offers

Mr. Cash Loans tailors its loan offers to individual applicants. This personalisation means that the loan amount, interest rate, and repayment terms you’re offered will be based on your specific financial circumstances, including your income, credit history, and existing financial commitments. This bespoke approach helps ensure that the loan you receive is manageable and suited to your needs.

Receiving Your Money

Average Processing Times

The time it takes to receive your money after applying for a loan with Mr. Cash Loans can vary. Typically, the company aims to process applications swiftly, with the possibility of disbursing funds within hours of loan approval. This quick turnaround is one of the key advantages of choosing Mr. Cash Loans, especially when funds are needed urgently.

Factors Affecting Withdrawal Speed

Several factors can influence how quickly you receive your loan:

- Application Accuracy: Providing accurate, complete information during the application process can speed up approval times. Missing or incorrect details can lead to delays.

- Document Submission: Promptly submitting all required documents, such as proof of income and identification, can help expedite the process.

- Approval Time: The time taken to review and approve your application can vary depending on the complexity of your financial situation and the loan amount requested.

- Bank Processing Times: Once approved and the loan agreement is signed, the disbursement of funds also depends on bank processing times, which can vary between different banks.

Mr. Cash Loans – Overview in Detail

| Name | Mr. Cash Loans |

|---|---|

| Financial | Privately Owned |

| Product | Unsecured Personal, Short-Term, and Payday Loans |

| Minimum Age | 18 years |

| Minimum Amount | R500 (for short-term loans) |

| Maximum Amount | Up to R300 000 (for personal loans) |

| Minimum Term | 1 month |

| Maximum Term | Up to 72 months (for personal loans) |

| APR | 36% – 60% (short-term); up to 28% (personal loans) |

| Monthly Interest Rate | Up to 5% (short-term); varies for personal loans |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Fixed terms with monthly instalments via debit order |

| NCR Accredited | Yes |

| Our Opinion | ✅ Wide range of loan amounts and terms ✅ Fully online application process ⚠️ Interest rates can be high for short-term loans |

| User Opinion | ✅ Quick and efficient service ⚠️ Interest rates may be higher for low credit scores |

Repaying Your Loan from Mr. Cash Loans

Repayments for loans from Mr. Cash Loans are typically made in monthly instalments, which include the principal amount plus interest. The exact structure of the repayment will depend on the specific terms of your loan, such as the loan amount, interest rate, and the repayment period agreed upon.

- Direct Debit Orders: The most common method for repaying loans is through a direct debit order. This automatic process ensures that the repayment amount is deducted from your bank account on a specified date each month, aligning with your payday to ensure convenience and avoid missed payments.

- Electronic Transfers: Some borrowers might prefer making repayments via electronic funds transfer (EFT). This method gives you a bit more control over the payment process but requires you to remember the due dates and amounts.

Possible Fees and Penalties

Mr. Cash Loans, like most lenders, will have specific fees and penalties associated with late or missed payments. These can include additional interest charges, late payment fees, and potential impacts on your credit score. It’s important to read and understand the terms and conditions of your loan agreement to be aware of these potential charges. Staying on top of your repayment schedule is crucial to avoid these additional costs and to maintain a good credit history.

Pros and Cons of Mr. Cash Loans

Pros of Choosing Mr. Cash Loans

- Variety of Loan Products: Mr. Cash Loans offers a diverse range of loan types, including personal loans, short-term cash loans, and small cash loans, catering to various financial needs.

- Convenience: The entire loan process, from application to approval, can be completed online, providing a convenient and time-saving option for borrowers.

- Fast Processing: The company is known for its quick loan approval and disbursement, particularly beneficial for those in urgent need of funds.

Cons of Choosing Mr. Cash Loans

- Interest Rates: As with many unsecured loans, the interest rates might be higher compared to secured loans, especially for borrowers with less-than-perfect credit histories.

- Eligibility Criteria: The lending criteria, especially for larger personal loans, can be strict, requiring a fair to good credit rating, which might not be feasible for all potential borrowers.

- Limited Information: The lack of detailed information about the company’s history, mission, and vision might make it difficult for potential customers to fully understand the company’s ethos and approach to lending.

Online Reviews of Mr. Cash Loans

While Mr Cash Loans offers a legitimate lending service, potential borrowers should be aware of the mixed reviews and consider these experiences when making a decision. It’s advisable to thoroughly read the terms and conditions, and perhaps explore multiple lending options to find the most suitable and transparent service for your needs.

It’s worth noting that individual experiences can vary based on personal financial circumstances, the type of loan taken, and other factors. Therefore, while online reviews can be helpful, they should be considered as part of a broader research process when choosing a loan provider.

I applied for a small loan at the Business above. They declined it, and I ask them for a reason why they declined the application. The email I received back was discriminating and very unprofessional.

I WILL NEVER CALL THEM AGAIN. THE MANAGER IS TERRIBLE. DONT GO THERE STAY AWAY

applied for loan every excuse given

Customer Service at Mr. Cash Loans

When it comes to financial services, customer service plays a pivotal role in ensuring a smooth and positive experience for clients. At Mr. Cash Loans, the emphasis on customer service is evident in their commitment to addressing queries, concerns, and feedback in a timely and efficient manner.

For those who have further questions or need clarification on any aspect of their loan, Mr. Cash Loans provides multiple channels of communication. Whether it’s through their dedicated helpline, email support, or the live chat feature on their website, the company ensures that customers have easy access to assistance when they need it. The trained customer service representatives are equipped to handle a range of queries, from loan application status and repayment details to general information about the company’s products and services.

Contact Channels

Phone number:

Office: 087 822 1779

Hours of operation:

Monday to Friday: 08:00 – 16:00

Saturday to Sunday: Closed

Postal address:

Alberton, Gauteng, 1450, South Africa

Alternatives to Mr. Cash Loans

Exploring different options and comparing loan offers is crucial to ensure you find the most suitable and cost-effective solution for your financial needs. It’s recommended to consider factors such as interest rates, repayment terms, and any associated fees when evaluating different loan options.

Comparison Table

To make an informed decision, it’s beneficial to have a comparison table that lists down the key features, interest rates, and terms offered by different lenders. Here’s a basic structure for such a table:

| Feature | Mr. Cash Loans | Loan4Debt | EC Finance | Ezi Finance |

|---|---|---|---|---|

| Loan Amount Range | R500 to R300 000 | Up to R1 000 000 | R1 000 – R120 000 | Up to R8 000 |

| Interest Rate | Up to prime + 17.5% (max) | 60% APR | Starts from 10%, up to 32% | Approx. 32.1% p.a. |

| Repayment Period | 1 to 72 months | Up to 72 months | 1 – 60 months | 2 to 6 months |

| Loan Types | Personal, Short-term, Payday Loans | Personal, Debt Consolidation, Short-Term | Personal, Student, Payday, Car Loans | Personal, Blacklisted, Debt Consolidation |

| Unique Features | Online loans, no branch visits | Quick response, Customer-centric | Customer-centric, variety of loan types | Bad credit options, online application |

| Approval Time | Within hours of final approval | Quick | Quick approval | Quick |

| More Info | Loan4Debt Review | Ezi Finance Review |

History and Background of Mr. Cash Loans

Mr. Cash Loans has positioned itself as a prominent player in the South African online lending market, specialising in various cash loan options. The company primarily deals in unsecured online cash loans, offering personal loans, short-term cash loans, and small cash loans (commonly known as payday loans). These loans are designed for quick online approval, eliminating the necessity for in-person branch visits.

The range of loan products provided by Mr. Cash Loans caters to diverse financial needs, offering small amounts for short-term requirements and larger personal loans with extended repayment terms. The company’s lending philosophy revolves around convenience and accessibility, aiming to serve a broad clientele, including individuals who may face challenges obtaining loans from traditional banks.

Company’s Mission and Vision

While specific mission and vision statements for Mr. Cash Loans are not explicitly provided, the company’s operational approach indicates a commitment to delivering accessible, fast, and convenient loan services. By focusing on unsecured loans, Mr. Cash Loans aims to provide financial solutions without requiring collateral, thereby expanding loan accessibility to a wider customer base. The company’s emphasis on online processes and swift approval times aligns with a vision to modernise and streamline the personal lending experience.

Conclusion

Mr. Cash Loans provides a fast, convenient, and accessible lending service, catering to individuals in need of quick financial assistance without the complexities associated with traditional bank loans. The company’s strengths lie in its diverse range of loan products and the ease of the online application process, making it a suitable option for those seeking swift solutions to their financial needs.

Frequently Asked Questions about Mr. Cash Loans

Loans are often processed and approved swiftly, with the possibility of funds being disbursed within hours of approval.

Requirements typically include being over 18 years old, having a steady income, a good credit rating for larger loans, and meeting the company’s specific eligibility criteria.

No, the loans offered by Mr. Cash Loans are unsecured, meaning you don’t need to provide any collateral.

While a good credit rating is required for larger loans, there may be options for those with less-than-perfect credit histories, though this might affect the interest rates and terms offered.

Consider the interest rates, your ability to repay the loan, the loan amount you need, and whether the loan product aligns with your financial needs and situation.