Finding the right loan online can feel overwhelming, especially with so many options and not much clarity on who’s actually lending the money. In this ShowTime Finance [Showtimefinance.co.za] Comparison Review, we take a down-to-earth look at what it actually offers. They’re not a direct lender, but rather a service that matches you with lenders who might be a good fit for your needs. We’ll break down how it all works, what sets them apart from similar services, and whether they’re worth considering if you’re on the hunt for a loan in South Africa.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by ShowTime Finance and is based solely on our research.

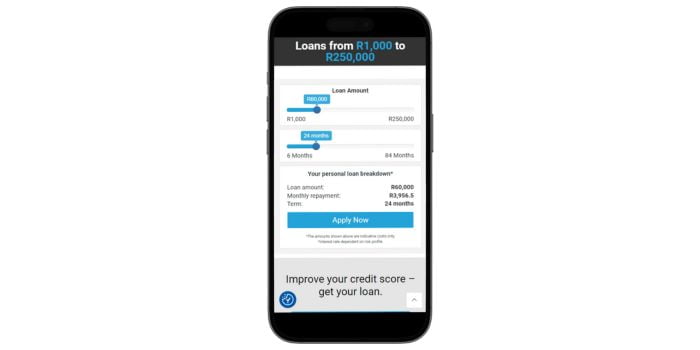

ShowTime Finance offers personal loans ranging from R1 000 to R250 000, with repayment terms available from 6 to 84 months. If you are looking for a practical and accessible loan solution, whether for urgent short-term needs or more substantial financial goals. Read on to see how this company’s services could be a suitable option based on your circumstances.

ShowTime Finance: Quick Overview

Loan Amount: R1 000 – R250 000

Loan Term: 6 to 84 months

Interest Rate: Personalised rates up to 27.75% per annum, based on credit profile and loan type

Fees: Initiation fee up to R1 207.50; monthly service fee of R69

Loan Types: Unsecured personal loans, including emergency, payday, short-term, long-term, consolidation, and bridging loan.

ShowTime Finance Full Review

What Makes ShowTime Finance Unique?

ShowTime Finance distinguishes itself in the South African lending market by offering tailored financial solutions to individuals who may have been declined by traditional banks. With over a decade of experience, the company has developed strong partnerships with local lenders and brokers, enabling them to assist clients with varied credit histories, including those with judgements, defaults, or garnishee orders. Their commitment to compliance with the Consumer Protection Act ensures that clients receive transparent and fair service throughout the loan process.

A notable feature of them is their 3-in-1 Service Plan, which provides clients with a monthly comprehensive credit report, credit score rating, and credit repair assistance. This subscription-based service not only helps clients understand their financial standing but also offers tools to improve their credit profiles, potentially leading to better loan terms in the future. By focusing on both immediate financial needs and long-term financial health, this company offers a holistic approach to personal finance management.

About Arcadia Finance

Arcadia Finance is your gateway to easily securing loans from diverse banks and lenders. Complete our free application and receive loan offers from up to 19 distinct financial sources. We ensure that all our lending partners are reputable and authorised by South Africa’s National Credit Regulator (NCR).

Types of Loans Offered by ShowTime Finance

Emergency Loans

Designed for urgent financial needs, these emergency loans offer quick access to funds, typically repayable within 90 days. They are suitable for unexpected expenses such as medical bills or emergency repairs.

Payday Loans

Short-term loans intended to cover expenses until the next payday. Ideal for bridging temporary cash flow gaps, these loans usually have a repayment period aligned with the borrower’s salary schedule.

Short-Term Loans

With repayment terms of 4, 6, or 12 months, short-term loans cater to medium-sized expenses like school fees or minor home improvements. They offer a balance between quick repayment and manageable instalments.

Long-Term Personal Loans

Offering repayment periods ranging from 24 to 84 months, long term loans are suitable for significant financial commitments such as purchasing a vehicle or funding a small business. The extended term allows for lower monthly repayments.

Consolidation Loans

These loans combine multiple debts into a single loan with one monthly repayment, potentially at a lower interest rate. They are beneficial for managing existing debts more effectively and reducing financial stress.

Bridging Loans

Short-term loans that provide immediate funds while waiting for expected income, such as proceeds from a property sale. They are useful for maintaining cash flow during transitional financial periods.

Who Can Apply for a ShowTime Finance Loan?

ShowTime Finance caters to a broad spectrum of borrowers, especially those without a perfect credit history. Here’s a basic overview of who can apply:

- Individuals with Past Credit Issues: If you’ve experienced credit history problems, such as defaults, judgements, or being blacklisted, ShowTime Finance is open to considering your application.

- South African Residents: Applicants must be residents of South Africa, possessing a valid ID and proof of residency.

- Stable Income: Potential borrowers should have a stable income, either from employment or another consistent source, ensuring they can meet repayment terms.

Criteria for Potential Borrowers

ShowTime Finance has established criteria to ensure responsible lending while accommodating those with less-than-perfect credit histories. The criteria include:

- Age: Applicants must be 18 years or older.

- Income: A steady income is crucial. This company evaluates income sources to determine the ability to repay the loan.

- Credit History Review: While they specialise in assisting those with poor credit histories, they still review your credit history. This review helps understand your financial behaviour and tailor the loan offer to your specific situation.

Differences from Other Loan Providers

ShowTime Finance stands out from other loan providers in several key areas:

Focus on Bad Credit Histories: Unlike many traditional lenders that demand a pristine credit history, ShowTime Finance is willing to collaborate with individuals who have faced financial challenges in the past.

Personalised Loan Offers: ShowTime Finance goes beyond a one-size-fits-all approach by offering personalised loan solutions. This customisation allows for more flexible terms, providing a better fit for individual financial situations.

Transparency and Customer Support: ShowTime Finance is renowned for its transparent lending practices and supportive customer service. The company ensures clarity by providing comprehensive information on all their loan products, fees, and repayment terms. This commitment to transparency ensures that borrowers fully comprehend their commitments.

Step-by-Step Guide to Applying for a Loan with ShowTime Finance

Step 1. Go to Showtimefinance.co.za

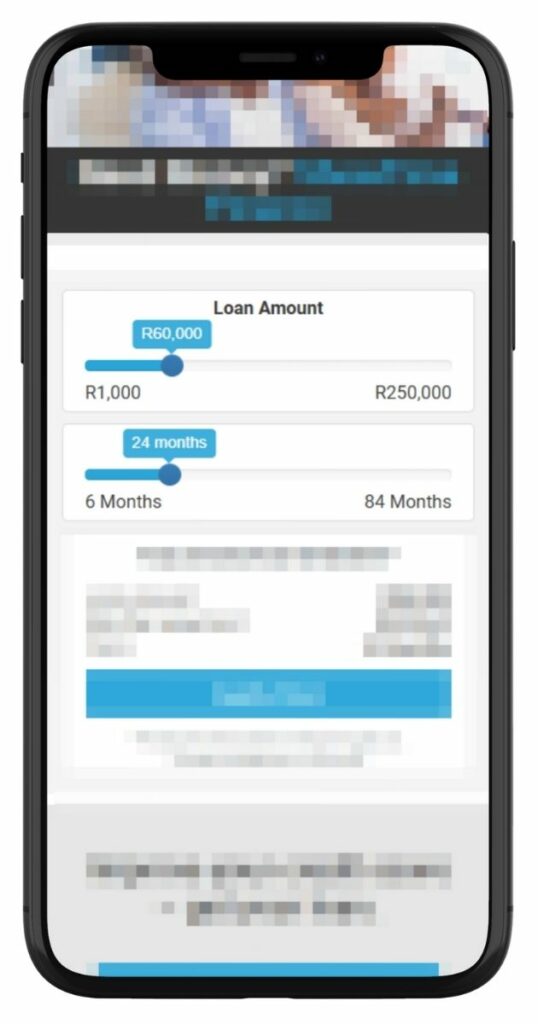

Step 2. Choose your loan amount and repayment term using the sliders.

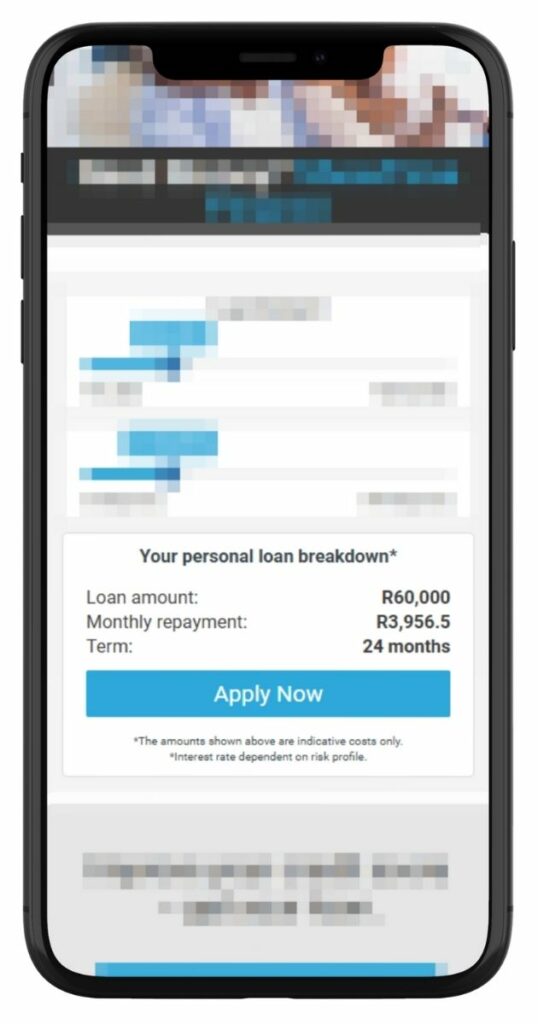

Step 3. Review your estimated monthly repayment before moving forward.

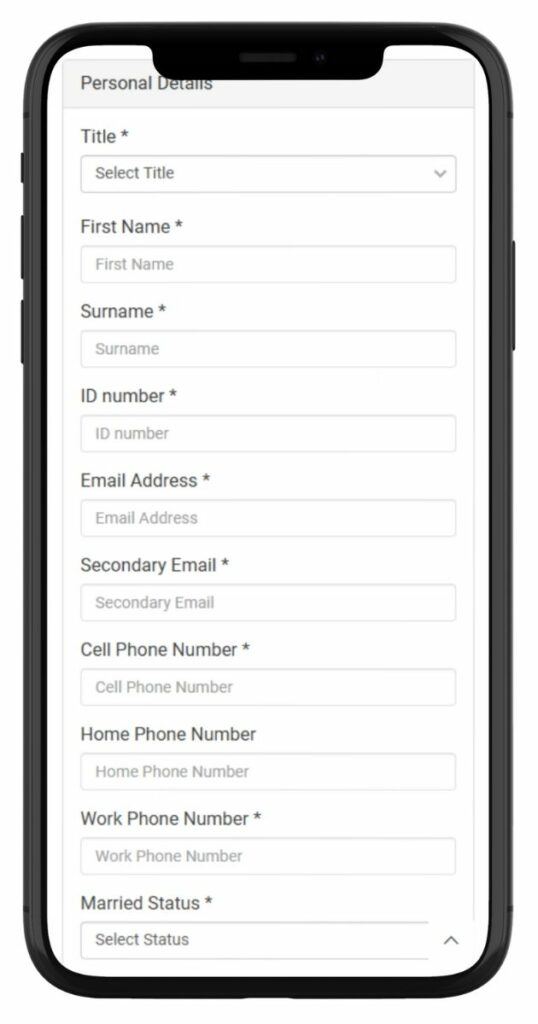

Step 4. Fill in your personal details including name, ID number and contact info.

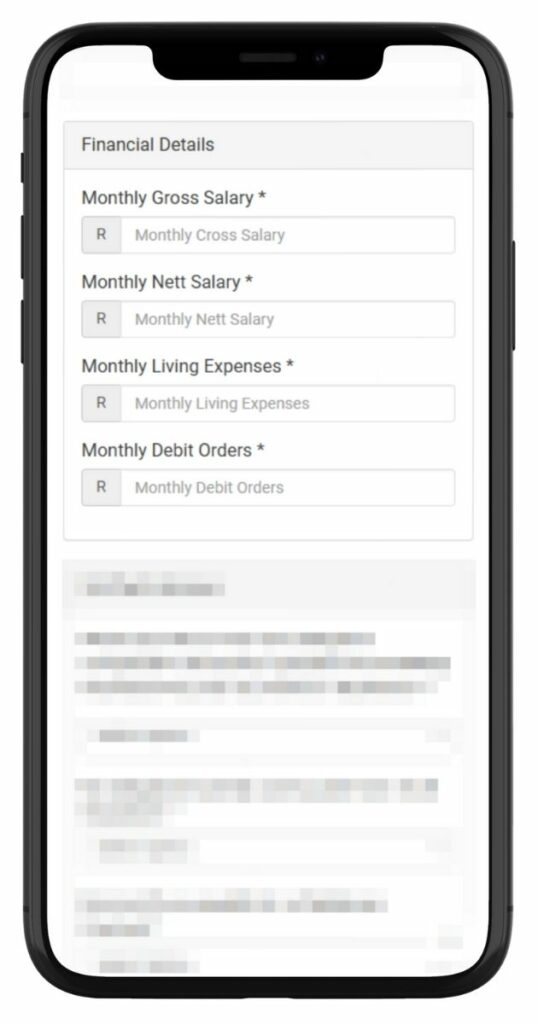

Step 5. Provide your financial details like income, expenses and debit orders.

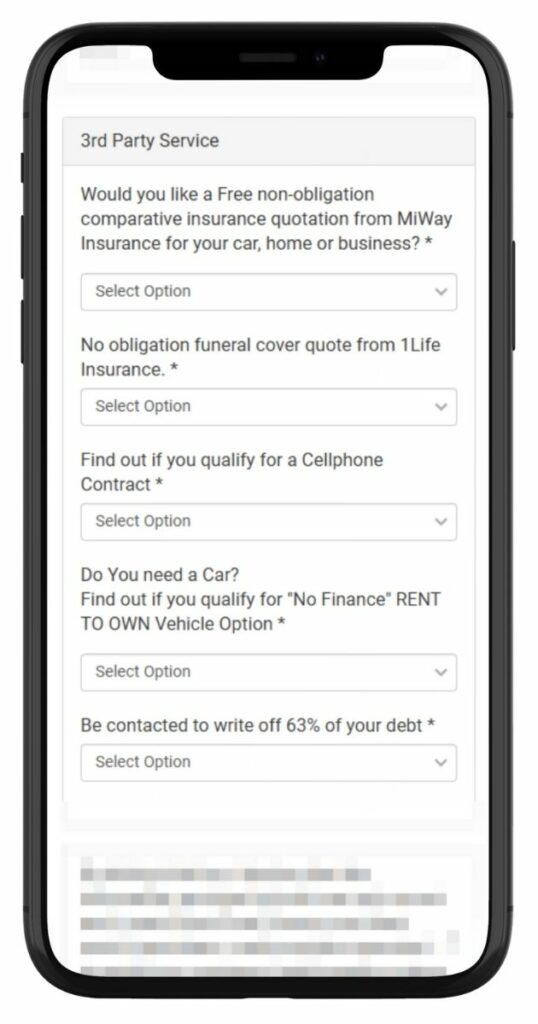

Step 6. Select any optional third-party services you’re interested in.

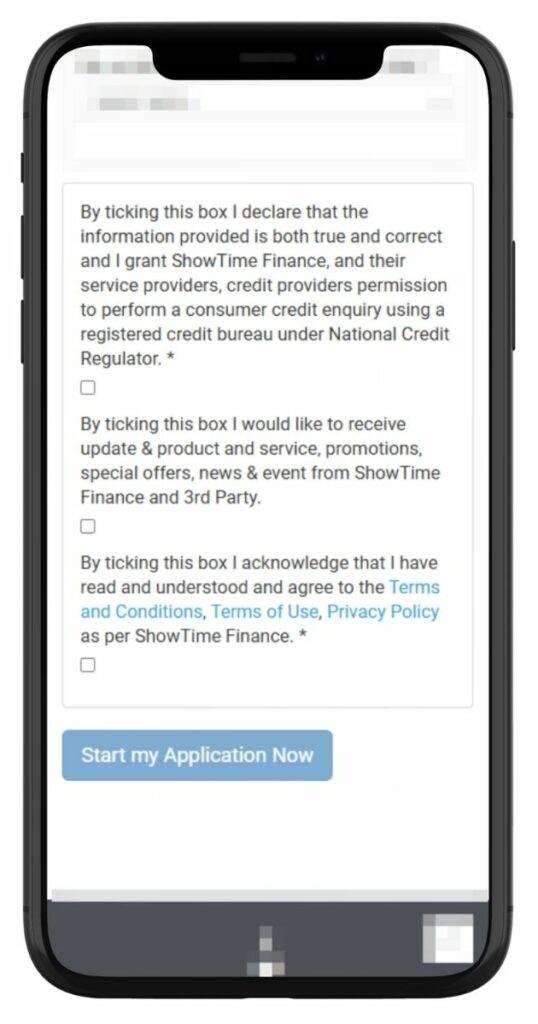

Step 7. Agree to the terms and submit your application to get started.

Step 8. Submit the required documents.

Step 9. ShowTime Finance reviews your application and conducts a credit check.

Step 10. Wait for loan approval, with ShowTime Finance aiming for quick processing.

Step 11. Review and accept the loan offer if terms are agreeable.

Step 12. Repay the loan in monthly instalments as per the agreed terms, ensuring timely payments.

Eligibility Check

Tools or Methods Offered by ShowTime Finance to Pre-Check Eligibility:

- Online Eligibility Quiz or Calculator: Check if ShowTime Finance provides an online tool to assess eligibility before applying.

- Pre-Application Inquiry: Submit a pre-application inquiry online or contact customer service. This typically does not affect your credit score and gives an idea of your eligibility.

- Informal Assessment: Review eligibility criteria on ShowTime Finance’s website and assess your financial situation against these criteria to gauge eligibility.

Security and Privacy at ShowTime Finance

Protecting your personal and financial info is a big deal, especially when you’re applying for a loan. ShowTime Finance takes this seriously and uses secure encryption and HTTPS to keep your data safe during online transactions. They follow South African laws like POPIA, regularly update their systems, and only allow trained staff to access sensitive info. Everything is designed to keep your details private and secure at every step.

Privacy Policies and Data Handling Practices

ShowTime Finance takes a clear and responsible approach to privacy and data handling. Their privacy policy is easy to understand and explains how and why your information is collected, used, and stored. They always ask for your consent before using your data and only collect what’s necessary for things like processing loan applications or managing your account. You also have full rights to access your data, correct any errors, opt out of marketing, or request deletion, as long as it aligns with legal requirements. Everything is handled with transparency and care.

Who Are ShowTime Finance Loans Best Suited For?

ShowTime Finance loans are ideal for South Africans who:

- Need loans from R1 000 to R250 000 for personal or urgent expenses.

- Have a stable, verifiable income

- Want a repayment terms from 6 to 84 months

- Have a poor or limited credit history

- Prefer a quick, online application with tailored loan offers.

Is ShowTime Finance a Safe and Good Option?

ShowTime Finance is a legitimate financial service provider in South Africa that works with NCR-registered lenders to assist individuals with various credit profiles, including those with poor credit histories. The company complies with the National Credit Act and is known for its transparent, responsible lending approach.

Loan amounts range from R1 000 to R250 000, with repayment terms of 6 to 84 months. Applications can be submitted online with basic documents such as a South African ID, recent payslips, proof of residence, and bank statements. While a credit check is conducted, ShowTime Finance looks beyond credit scores, making it a suitable option for those previously declined by traditional banks.

How Much Money Can I Borrow from ShowTime Finance?

ShowTime Finance offers loans ranging from a minimum of R1 000 to a maximum of R250 000. This broad range allows for various financial needs to be met, from smaller, short-term loans to larger amounts for more significant expenses or debt consolidation.

Receive Offers

The amount you qualify for with ShowTime Finance is dependent on your financial situation. They provide tailored financial aid, and the terms, including the amount, are determined based on your borrowing power and agreed-upon terms and conditions.

How ShowTime Finance Creates Personalised Loan Offers

ShowTime Finance’s vision is to offer relevant and up-to-date financial services that are tailored to individual needs. They utilise technology and innovation to provide personalised financial aid. The amount you qualify for and the terms of the loan, including the interest rate and fees, are tailored based on your financial situation and risk profile. They aim to be leaders in the market by providing these tailored services, ensuring that each customer gets an offer that suits their unique financial circumstances.

How Long Does It Take to Receive My Money from ShowTime Finance?

After you submit your loan application, ShowTime Finance will let you know the outcome by SMS and email. While exact timelines for approval and payout aren’t clearly stated, they aim to move quickly. Once approved, the money is sent straight to your bank account. How fast it lands depends on your bank’s processing times, which can vary.

ShowTime Finance – Overview in Detail

| Name | ShowTime Finance Personal Loans |

|---|---|

| Financial Institution | ShowTime Finance (123 Loans Pty Ltd) |

| Product | Personal loans (emergency, payday, short-term, long-term, consolidation, bridging) |

| Minimum Age | 18 years |

| Loan Amount Range | R1 000 – R250 000 |

| Repayment Terms | 6 to 84 months |

| Interest Rate | Up to 27.75% per annum (based on credit profile and loan type) |

| Initiation Fee | Up to R936 |

| Monthly Service Fee | R69 |

| Early Settlement | Allowed – full balance can be paid anytime (confirm any related charges) |

| Repayment Flexibility | Fixed monthly instalments over chosen term |

| NCR Accredited | Yes (loans arranged through registered providers) |

| Our Opinion | ✅ Accessible to individuals with varied credit histories, including those with past credit challenges ✅ Offers a diverse range of loan products to suit different financial needs ⚠️ Interest rates may be higher compared to traditional banks, reflecting the risk profile of borrowers |

| User Opinion | ✅ Appreciated for assisting individuals who have been declined by other lenders ✅ Noted for transparent communication and supportive customer service ⚠️ Some users have expressed concerns about interest rates and fees |

How Do I Repay My Loan from ShowTime Finance?

Repaying a loan from a bank associated with ShowTime Finance is designed to be straightforward and manageable. Understanding available repayment options, as well as potential fees and penalties, is crucial for effective financial planning and avoiding additional costs.

Monthly Instalments

Loans are generally repaid through fixed monthly instalments. The amount depends on the loan size, interest rate, and repayment term. Payments are usually set up via direct debit from your bank account, making it easy to stay on schedule.

Flexible Terms

You can choose a repayment term between 6 and 84 months to suit your budget. In many cases, you’ll also have the option to repay early, which can reduce the total interest paid, though it’s best to check with ShowTime Finance if any early settlement fees apply.

Fees and Charges

There is typically a one-time initiation fee when your loan is approved, which covers the setup and is capped by regulation. A small monthly service fee is also included, as permitted under the National Credit Act.

If you miss a payment, late fees may apply, and your credit score could be affected. Repeated missed payments might lead to additional interest charges, and in more serious cases, legal fees if the loan goes into default.

Pros and Cons of Choosing ShowTime Finance

Pros of Choosing ShowTime Finance

- Accessibility: Offers loans to individuals with poor credit histories, expanding financial inclusion.

- Variety of Products: Provides a range of loan products with flexible terms to suit different needs.

- Quick Processing: Known for rapid loan approval and disbursement, crucial for urgent financial needs.

- Customer Service: Generally receives positive feedback for personalised support and clear communication.

Cons of Choosing ShowTime Finance

- Higher Costs: Interest rates and fees may be higher due to servicing higher credit-risk clients.

- Credit Score Impact: Risks of debt cycles and negative impact on credit scores due to late payments.

- Complex Terms: Some customers need clearer explanations of loan terms and conditions.

- Geographical Limitation: Services are restricted to residents within South Africa.

Customer Service at ShowTime Finance

ShowTime Finance is renowned for its unwavering commitment to customer service, a cornerstone of its business model. The company places significant emphasis on delivering personalised assistance, transparent communication, and effective problem-solving.

Contact Channels

Here are the contact details for ShowTime Finance:

Phone number:

Office: 021 300 6395

Hours of operation:

Monday to Friday: 08:00 – 18:00

Saturday & Public Holidays: 09:00 – 13:00

Postal address:

Inspan Street, Bellville South, Bellville, 7530, South Africa

Online Reviews of ShowTime Finance

Online reviews play a crucial role in assessing customer satisfaction and the overall reputation of a company. In the case of ShowTime Finance, customer reviews shed light on various aspects of their service, spanning from the application process to customer support and loan management.

My experience was exceptional, I was assisted by a consultant by the name of Nathan and he went the extra mile to ensure that I was assisted in every step of the application process.

Showtime Finance is an honest company, I applied for a personal loan and they kept me up to date until my loan was approved. My loan was approved within a week.

The company has been deducting money from my account which I never authorised. Been trying to get hold of someone to assist with no success.

I’m utterly disgusted how scammers can sleep throughout the night. Please cancel my subscription as i sent emails for my subscription to stop since I haven’t received any loan.

Alternatives to ShowTime Finance

When considering alternatives to ShowTime Finance, it’s beneficial to explore other credit portals. These portals typically provide information on various lenders, comparing rates, terms, and eligibility criteria.

Comparison Table

| Feature | ShowTime Finance | African Bank | Capitec Bank | Lime24 |

|---|---|---|---|---|

| Loan Amount Range | R1 000 – R250 000 | Up to R350 000 | Up to R500 000 | R500 – R8 000 |

| Repayment Terms | 6 – 84 months | 7 – 72 months | Up to 84 months | Up to 37 days |

| Interest Rates | Tailored to individual | From 15% | From 13% | 28.9% – 39.8% |

| Application Process | Online application | Online application | Online/app-based application | Fully online application |

| Credit Profile Consideration | Accommodates poor credit histories | Requires good credit standing | Requires good credit standing | Accommodates various credit profiles |

| Special Features | 3-in-1 Service Plan (credit report, score, and repair assistance) | Debt consolidation options | Credit insurance options | Quick approval for payday loans |

History and Background of ShowTime Finance

ShowTime Finance has become a familiar name in the South African credit space, especially for people who have had trouble getting approved by traditional banks. While the exact year they started isn’t clear, they have been around for several years and have steadily expanded what they offer. They began by helping more people access loans, even those with less-than-perfect credit, and have since grown to include everything from quick emergency loans to longer-term financing. Their growth shows a genuine effort to meet the real needs of everyday South Africans and stay in step with what people are looking for in a lender.

Company’s Mission and Vision

Mission: ShowTime Finance’s mission revolves around providing accessible, responsible, and flexible financial solutions to South Africans. The company focuses on offering financial products that are not only accessible to a wider audience but also structured in a way that promotes responsible borrowing and financial stability for its clients.

Vision: The vision of ShowTime Finance is to be a leading and trusted financial services provider in South Africa, known for its customer-centric approach, innovative financial solutions, and commitment to financial inclusion. The company aims to empower its customers by providing financial products that are both accessible and tailored to meet their individual needs, thereby contributing to their overall financial well-being.

Conclusion

ShowTime Finance, with its commitment to providing accessible loan options to a wide range of customers, including those with less-than-perfect credit histories, stands out in the South African financial services market. The company’s variety of loan products, flexible terms, and quick processing times are significant advantages that cater to immediate and diverse financial needs. Coupled with its strong customer service ethos, ShowTime Finance positions itself as a reliable and customer-focused lender.

Frequently Asked Questions

ShowTime Finance offers a variety of loan products, including personal loans, emergency loans, debt consolidation loans, and more, catering to different financial needs and situations.

Yes, ShowTime Finance specialises in providing loans to individuals with poor credit histories. However, they still perform credit checks and base their loan approval on a comprehensive assessment of your financial situation.

The loan amounts from ShowTime Finance range from as little as R1 000 to as much as R250 000. The amount you can borrow depends on your individual financial situation and creditworthiness.

Interest rates for loans from ShowTime Finance vary based on the loan amount, term, and your credit profile. Rates are competitive but may be higher than traditional banks, especially for borrowers with higher credit risks.

Loan processing times at ShowTime Finance are generally quick. Once approved, you can typically expect to receive the loan amount in your bank account within 24 to 48 hours.