Education is the key to unlocking a world of opportunities. However, let’s be honest, education can be costly. That’s where Fundi [Fundi.co.za] steps in. Established in 1996, Fundi has carved a niche for itself as South Africa’s go-to education finance provider. This review aims to shed light on what Fundi offers, how it stands out, and why many South Africans trust it for their educational financial needs.

Fundi offers specialised education loans to cover tuition, accommodation, study devices, and essential learning tools. Whether you are pursuing a degree, enrolling in a short course, or managing study-related expenses, Fundi provides flexible solutions to make education more accessible. If you are seeking financial support for your academic journey, read on to see if Fundi’s services are the right fit for you.

Fundi: Quick Overview

Loan Amount: Based on tuition, accommodation, devices, or course-related expenses (customised per educational need)

Loan Term: Flexible terms aligned with course duration or borrower’s repayment capacity

Interest Rate: Customised according to loan type and financial profile (details provided during quotation)

Fees: Initiation fees and service charges apply as per loan agreement; disclosed upfront during application

Loan Types: Study loans, short course loans, accommodation loans, executive education loans, MBA funding, study device loans, educational tools loans

About Arcadia Finance

Arcadia Finance offers an efficient route to loan acquisition. Just fill in a complimentary application, and get connected to a range of banks and lenders, receiving offers from up to 19 different entities. Our commitment to your security is evident as we partner only with lenders licensed by the National Credit Regulator (NCR) in South Africa.

Fundi Full Review

When it comes to securing an education loan, the experience matters as much as the financial assistance itself. Over the years, this company has consistently prioritised the needs of its clients, ensuring a smooth and hassle-free loan application process. Many who have availed of this lender’s services commend the transparency, ease, and support they’ve received throughout their journey. From the initial stages of understanding the loan options to the final steps of disbursement, their dedicated team is there to guide borrowers every step of the way.

Who Can Apply for a Fundi Loan?

Fundi’s services are not limited to just one group of individuals. If you’re a student pursuing higher education, a parent securing a bright future for your child, or an institution supporting employee learning, Fundi has a solution for you. Their inclusive approach ensures that anyone with a genuine educational need can seek financial assistance.

Criteria for Potential Borrowers

While Fundi is dedicated to making education accessible to all, there are certain criteria that potential borrowers must meet:

- Proof of Admission: If you’re a student or an institution, you’ll need to provide proof of admission or affiliation with a recognised educational body in South Africa.

- Financial Stability: While they are here to assist, they also need to ensure that loans are granted to those who have the means to repay. This doesn’t mean you need to be wealthy, but a stable source of income or a guarantor might be required.

- South African Residency: Caters primarily to the South African community. As such, proof of residency or legal status in South Africa is a must.

- Valid Documentation: This includes, but is not limited to, identity documents, proof of address, and bank statements.

Types of Loans Offered by Fundi

Fundi’s commitment to education is reflected in the diverse range of loans they offer:

Study Loans

Their study loans cover a broad spectrum of educational pursuits, from undergraduate degrees to postgraduate qualifications. These loans are designed to finance tuition fees, registration costs, and other associated expenses, ensuring that financial constraints don’t hinder academic aspirations.

Short Course Loans

For individuals aiming to enhance their skills or pivot careers, this lender offers loans specifically for short courses. These loans provide quick access to funds, enabling learners to enroll in programs that bolster their expertise and employability.

Accommodation Loans

Recognising the challenges of securing student housing, this lender provides accommodation loans to help cover rental costs. This financial support allows students to focus on their studies without the added stress of housing expenses.

Executive Education Loans

Professionals seeking to advance their careers through specialised courses can benefit from Fundi’s executive education loans. These loans are tailored to finance programs that enhance leadership skills and industry-specific knowledge.

MBA Funding

Pursuing an MBA is a significant investment. Fundi offers dedicated MBA funding solutions to support future business leaders in achieving their academic and professional goals.

Study Device Loans

This lender provides device loans for laptops, tablets, and smartphones, ensuring students have the necessary tools to succeed academically.

Educational Tools Loans

Beyond tuition and devices, they offer loans for essential educational tools, including textbooks, scientific calculators, musical instruments, and safety equipment. This comprehensive support ensures students are well-equipped for their specific fields of study.

Who Are Fundi Loans Best Suited For?

Their loans are ideal for individuals who:

- Need Financial Support for Educational Costs, including tuition, devices, accommodation, and tools.

- Have Proof of Admission at a Recognised Institution and the required supporting documents.

- Prefer Tailored Loan Solutions based on their specific academic expenses.

- Value a Simple, Supportive Application Process, available online or through campus offices.

- Want Flexible Repayment Options, such as monthly debit orders or electronic transfers.

Is Fundi a Safe and Good Option?

Fundi is a registered credit provider regulated by the National Credit Regulator, making it a legitimate and trusted lender in South Africa. Specialising in education finance, they offer a wide range of tailored loans to support tuition fees, accommodation costs, study devices, and other essential educational expenses. Applicants can apply online through Fundi.co.za, with standard documentation such as a valid South African ID or passport, proof of admission to an accredited institution, proof of address, and recent bank statements typically required.

This lender places a strong emphasis on transparent and responsible lending, providing clear information about loan terms, interest rates, and repayment structures before finalising any agreements. All loan applications undergo affordability checks to ensure responsible borrowing, and approved funds are typically disbursed directly to educational institutions or towards specific educational expenses. With its dedicated focus on education, clear processes, and commitment to supporting students and professionals alike, they are a suitable option for individuals seeking specialised financial assistance for their educational journey.

Requirements for a Fundi Loan

Securing a loan with them is a straightforward process, but like all financial institutions, there are certain prerequisites and documents that applicants need to provide to ensure a smooth transaction.

Documents and Information Needed

- Proof of Admission: A confirmation letter or document from the educational institution you’re enrolled in or intend to join.

- Identity Verification: A valid South African ID or passport for international students with a valid study permit.

- Proof of Residency: This could be a recent utility bill, rental agreement, or any official document showing your current address.

- Financial Documents: Recent bank statements, typically from the last three months, to give an overview of your financial standing.

- Guarantor Details: If you’re a student, details of a guarantor (usually a parent or guardian) might be required. This includes their ID, proof of residency, and financial documents.

- Course Details: Information about the course or programme you intend to pursue, including its duration and fees.

Simulation of a Loan Application at Fundi

Here’s a step-by-step guide to help you navigate the process:

Step 1. Start by heading to Fundi.co.za

Step 2. Tap “Get a Fundi loan” to start the application process.

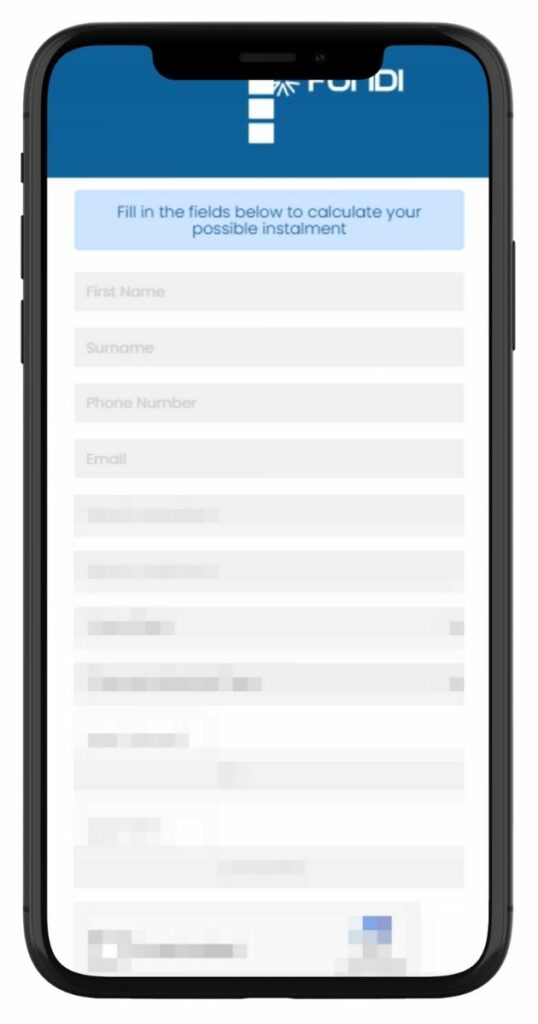

Step 3. Fill in your First Name, Surname, Phone Number, Email, and other required personal details.

Step 4. Enter your employer’s name and educational institution in the provided search fields.

Step 5. Select your Loan Type and Payment Method Type.

Step 6. Tick “I’m not a robot.” Tap “Calculate Instalment” to proceed.

Step 7. Use the platform to securely upload all the documents mentioned in the requirements section.

Step 8. Once submitted, Fundi’s team will review your application and documents. This process ensures all information is accurate and meets their criteria.

Step 9. If your application is approved, you’ll receive a loan quote detailing the amount, interest rate, and repayment terms.

Step 10. If you’re satisfied with the quote, accept it. Fundi will then finalise the loan details and set up a repayment plan.

Step 11. Once everything is in order, the loan amount will be disbursed either directly to the educational institution or to the account provided, based on the loan type.

Eligibility Check

Before diving into the application process, it’s always wise to check if you meet Fundi’s criteria. To assist potential borrowers, Fundi offers tools and methods to pre-check eligibility:

Online Eligibility Checker

On the Fundi website, there’s a tool where you can input basic details like the type of course, your age, and financial details. This tool provides a preliminary assessment, letting you know if you’re likely to qualify for a loan.

How Much Money Can I Request from Fundi?

Fundi’s loan amounts are tailored to cater to a wide range of educational expenses. The minimum amount typically covers smaller courses or short-term educational needs. On the other hand, the maximum amount is designed to accommodate more extensive programmes, such as university degrees or specialised courses. It’s worth noting that the exact figures can vary based on individual circumstances and the specific educational institution or course in question.

Receive Offers

Fundi’s approach to loan offers is personalised. They understand that every student’s journey and financial situation is unique. When you apply for a loan, they assess your specific needs, the course you’re enrolled in, and your financial standing. Based on this assessment, they craft a loan offer that aligns with your requirements. This ensures that you’re not just getting a generic loan but a financial solution tailored to your situation.

Fundi – Overview in Detail

| Name | Fundi |

|---|---|

| Financial | Privately Owned |

| Product | Education-Specific Loans (Study, Short Courses, Accommodation, Executive Education, MBA, Study Devices, Educational Tools) |

| Minimum Age | 18 years |

| Minimum Amount | Varies depending on loan type (small loans for devices and textbooks available) |

| Maximum Amount | Based on tuition or educational cost (MBA and executive loans available for high amounts) |

| Minimum Term | Typically based on course or repayment structure (short courses from a few months) |

| Maximum Term | Depends on loan agreement (generally aligned with course duration or repayment capacity) |

| APR | Customised based on loan type and financial profile (not openly listed on website) |

| Monthly Interest Rate | Customised; tailored to borrower risk profile and loan size |

| Early Settlement | Allowed, terms subject to loan agreement |

| Repayment Flexibility | Flexible options including debit orders, electronic transfers, and customised plans |

| NCR Accredited | Yes (Fundi is a registered credit provider) |

| Our Opinion | ✅ Ideal for financing all aspects of education from tuition to devices and accommodation ✅ Broad range of specialised education loans ⚠️ Only suitable for education-related needs (not for general personal expenses) |

| User Opinion | ✅ Quick and supportive loan application process ✅ Clear communication about loan terms and obligations ⚠️ Application processing can vary depending on documentation and verification |

How Long Does It Take to Receive My Loan Payout from Fundi?

Once you’ve gone through the application process and your loan has been approved, the next step is the disbursement of funds.

Average Processing Times

They pride themselves on its efficient processing times. On average, once a loan is approved, it can take a few business days for the funds to be disbursed. This timeframe allows them to ensure all the necessary checks are in place and that the funds are directed to the right accounts, be it the educational institution’s account or the borrower’s personal account.

Repaying Your Fundi Loan

Securing a loan is only half the journey; repaying it is equally crucial. This lender ensures that the repayment process is as seamless as the application, offering flexibility and clarity to its borrowers.

Repayment Options and Plans

Borrowers have a range of repayment options to choose from, catering to different financial situations:

- Direct Debit Orders: This is a hassle-free method where monthly repayments are automatically deducted from your bank account on a specified date.

- Electronic Transfers: Borrowers can opt to make electronic payments via their online banking platforms.

- In-Person Payments: For those who prefer traditional methods, payments can be made at their offices or designated payment centres.

Fundi offers various repayment plans, from monthly to quarterly instalments, allowing borrowers to choose a schedule that aligns with their financial flow. The duration and terms of repayment are typically determined based on the loan amount and the borrower’s financial assessment.

Possible Fees and Penalties

Transparency is at the heart of their operations. While they strive to keep fees to a minimum, there are certain charges borrowers should be aware of:

- Service Fees: A nominal monthly service fee might be charged for the maintenance and administration of the loan.

- Late Payment Penalties: To encourage timely repayments, they might impose penalties for missed or late payments. It’s always advisable to stay updated with your repayment schedule to avoid such charges.

Pros and Cons of Fundi

Pros of Fundi

- Specialised Focus: Uniquely concentrates solely on education, enabling a deep understanding of the distinctive needs of students and institutions.

- Comprehensive Offerings: From tuition fees to devices and even MBA programs, they provide a broad range of loans tailored to various educational needs.

- Transparent Operations: Prides itself on transparency, ensuring borrowers are always well-informed about terms, conditions, and any associated fees.

Cons of Fundi

- Limited to South Africa: While they provide exceptional services, its primary focus is on the South African community. International students or institutions outside South Africa might find limited offerings.

- Focused Loan Types: While their commitment to education finance is commendable, those seeking diverse loan types, such as personal or auto loans, will need to explore alternative options.

Online Reviews of Fundi

The general consensus among many reviewers is appreciation for Fundi’s dedicated focus on education. Many commend the ease of the application process and the support they received throughout their loan journey. The transparent fee structure and flexible repayment options are also frequently highlighted.

What’s great about Fundi is that they don’t cost too much. Their student loans helped me pay for my education and also my son’s. They keep things affordable, making education easier for many of us.

Always ready with the best advice. Answer emails immediately and gives wonderful advise on the best options available.

However, like any service, there are occasional critiques. Some reviewers mention delays in disbursement or communication hiccups. It’s worth noting that while these reviews provide valuable insights, they represent individual experiences, and it’s always a good idea to approach them with an open mind.

I am unable to get anyone to assist me with a statement so that I may see how much I still need to pay, I cant even get anyone to call me back or reply to my emails.

I’ve contacted Fundi and their credit verifications department was told two days ago by their company’s executive to email me regarding my application. There is still no email from their department, I’m here panicking about my varsity funding.

Their online reputation paints a picture of a company committed to its mission of making education accessible. Their transparent operations, combined with a genuine understanding of the educational landscape, make them a preferred choice for many in South Africa.

Customer Service at Fundi

When it comes to financial matters, especially loans, having a responsive and knowledgeable customer service team is crucial. They recognise this and have invested in building a customer service team that’s both approachable and adept. Whether you have queries about your loan application, repayment terms, or just need general information, their team is there to assist. They offer multiple channels of communication, from phone lines to email support, ensuring that customers can reach out in a way that’s most convenient for them.

Contact Channels

Phone number:

Call Centre: 0860 55 55 44

Reception: 011 670 6100

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: Closed

Postal address:

Fundi’s head office is located in Roodepoort, Johannesburg

Alternatives to Fundi

A Side-by-Side Comparison of Fundi with Top Competitors

When evaluating education finance options, it’s advantageous to compare them with some of the other leading providers in the market. Here’s a detailed comparison based on various factors:

| Criteria | Fundi | NSFAS (National Student Financial Aid Scheme) | Standard Bank Student Loan | Absa Study Loan | Peerfin Loan |

|---|---|---|---|---|---|

| Focus Area | Education-specific financing | Government-funded student support | General banking services with a student loan option | General banking services with a student loan option | Online financial services with a focus on personal loans |

| Loan Coverage | Tuition, accommodation, books, and devices | Tuition and living expenses for qualifying students | Tuition fees and related costs | Tuition fees and related costs | Personal loan amounts ranging from R10,000 to R50,000 |

| Repayment | Starts after graduation or upon gaining employment | Repayment starts once the student starts earning a certain amount | Interest repayments start immediately, capital repayments start after graduation | Flexible repayment options, with competitive interest rates | Flexible repayment terms from 12 to 72 months |

| Eligibility | South African students, proof of admission, financial documents | South African citizens, means-tested | Must be studying at a recognised tertiary institution, surety required | Must be studying at a recognised tertiary institution, surety required | Applicants must be over 18 years of age, hold a South African ID, provide the last three receipts of payment, the latest three bank statements, and proof of residence |

| Customer Service | Phone, Email, FAQ | Phone, Email, In-person at universities | Phone, Email, In-person at branches | Phone, Email, In-person at branches | Email or by phone |

| More Info | Standard Bank Review | Absa Review | Peerfin Review |

History and Background of Fundi

Brief History and Establishment of the Company

Fundi, founded in 1996, has served as a beacon of hope for many South Africans in pursuit of education finance. Over the years, the company has evolved from a small startup to a prominent name in the education finance sector. Their journey is characterised by innovation, dedication, and an unwavering commitment to making education accessible to all.

Company’s Mission and Vision

Fundi’s mission is straightforward: to offer financial solutions that address every educational need. They believe in the transformative power of education and are devoted to ensuring that financial constraints do not impede this transformation.

Their vision is expansive. Fundi aspires to see a South Africa where every individual, regardless of their financial background, has access to quality education. They strive to be the bridge that connects aspirations with reality, ensuring that dreams are not hindered by financial limitations.

Conclusion

Fundi, with its rich history and steadfast commitment to education, has undeniably left a significant impact on the South African education finance sector. Their comprehensive offerings, coupled with a transparent approach, establish them as a reliable choice. However, like any service, prospective borrowers should evaluate their individual needs, compare options, and make an informed decision.

Frequently Asked Questions about Fundi

Primarily, yes. Fundi primarily caters to the South African community, although they do extend their services to international students studying in South Africa.

No, Fundi’s primary focus is on education finance. They specialise in loans related to tuition, devices, and specific programs like MBAs.

The approval process can vary based on individual circumstances, but typically, once all required documents are submitted, it can take a few business days.

No, Fundi prides itself on its transparency. All charges, fees, and terms are clearly communicated to borrowers.

Yes, Fundi does offer the option to prepay loans. It’s advisable to discuss this with their customer service to understand any terms associated with prepayment.