Future Finance is a South African financial services provider offering short-term credit solutions tailored to individuals and businesses needing fast access to funds. The company is known for bridging finance for property sales, personal loans, and credit repair services. With a user-friendly online platform, Future Finance aims to make applying for a loan simple and accessible, especially for clients who need urgent cash flow while waiting for property transactions or who are struggling with their credit profiles.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by Future Finance and is based solely on our research.

Future Finance provides tailored financial solutions for South Africans dealing with short-term cash flow issues or credit challenges. Whether you need a personal loan, bridging finance during a property sale, or help repairing your credit profile, Future Finance offers practical and regulated options. If you’re struggling to access credit or need quick financial support, their services may be a suitable fit. Keep reading to find out how they work and whether they meet your needs.

Future Finance South Africa: Quick Overview

Service Type: Personal loans, bridging finance for property sellers, and credit repair services.

Access: Online applications with fast turnaround (personal loans in minutes, bridging payouts in 24 hours).

Eligibility: South African citizens aged 18+, with valid ID, proof of income, and a bank account. Additional criteria apply per product or service.

Fees:

- Interest: 36%–60% APR (5% per month)

- Initiation fee: R165 + 10% of loan over R1 000 (max R1 050) + 15% VAT

- Monthly service fee: R60 + 15% VAT

- Insurance: R4.50 per R1 000 borrowed/month

- Bridging loans: Fixed fees, no hidden costs

Additional Services: Credit repair plans, flexible repayments (FlexPay), and support in securing new credit.

Future Finance Full Review

What Makes Future Finance Unique?

Future Finance distinguishes itself in South Africa’s financial sector through its commitment to fast, transparent, and client-focused lending. The company offers a streamlined online application process that can be completed in under five minutes, ensuring quick access to funds for clients in need. This efficiency is particularly beneficial for individuals requiring immediate financial assistance, such as during property transactions or unexpected expenses. Moreover, Future Finance’s transparent fee structure, including detailed breakdowns of interest rates and service fees, allows clients to make informed decisions without hidden costs.

Another aspect that sets Future Finance apart is its inclusive approach to creditworthiness. Unlike traditional lenders that heavily weigh credit scores, Future Finance considers a broader range of factors, such as income and employment stability, when assessing loan applications. This approach enables individuals with fair or even low credit scores to access financial solutions tailored to their circumstances. Additionally, the company’s dedicated customer support ensures that clients receive personalised assistance throughout the loan process, from application to repayment.

Hunting for competitive loan rates? Our breakdown of low-interest loans gives you clarity on the best deals in the market, helping you avoid paying more than necessary over the long term.

About Arcadia Finance

Arcadia Finance makes loan applications simple and stress-free. Choose from 19 reputable NCR-compliant lenders, with zero application fees and a quick, secure process designed around your needs.

Types of Services Offered by Future Finance

Personal Loans

Future Finance provides unsecured personal loans ranging from R500 to R50 000, with repayment periods of up to 24 months. These loans are designed to address various financial needs, such as covering unexpected medical bills, home improvements, or educational expenses. The application process is entirely online, requiring minimal documentation, including a South African ID, recent payslip, and three months’ bank statements. Interest rates are competitive, with a maximum APR of 60%, and the fee structure is clearly outlined, ensuring transparency.

Property Bridging Finance

For individuals involved in property transactions, Future Finance offers bridging finance solutions. This service provides sellers with access to a portion of their property’s sale proceeds before the transfer is finalised, helping to cover immediate expenses such as moving costs or settling outstanding debts. The application process involves verifying the sale agreement and expected proceeds, ensuring a tailored solution that aligns with the client’s specific needs.

Credit Repair Services

Recognising the challenges faced by individuals under debt review, Future Finance offers credit repair services aimed at restoring financial stability. The company’s Future FlexPay Plan is a structured program that assists clients in managing their debts over a six-month period, with the goal of improving their credit profiles. Eligibility criteria include being formally employed, receiving a monthly salary into a bank account, and banking with major South African banks. This service empowers clients to regain control over their finances and access new credit opportunities.

Requirements for a Future Finance Product or Service

To apply for a service with Future Finance, you need to provide specific documents and meet certain criteria. For personal loans, the required documents include:

- South African ID

- Latest payslip

- Three months’ bank statements

These documents can be uploaded through the online application platform. If any files are too large, Future Finance recommends using online tools like Smallpdf or TinyPNG to reduce their size.

For property bridging finance, additional documentation may be necessary, such as the sale agreement and proof of the expected proceeds from the property sale. This ensures that the bridging finance aligns with the specific details of the property transaction.

In the case of credit repair services, applicants should be formally employed, receive a monthly salary into a bank account, and bank with major South African banks. These criteria help tailor the credit repair solutions to the individual’s financial situation.

Step-by-step Process on Applying for a Loan at Future Finance

Applying for a service with Future Finance involves a straightforward process:

Step 1. Visit Future-finance.co.za

Step 2. Tap “Personal Loans” on the Future Finance homepage to start your application.

Step 3. Choose your desired loan amount using the slider or input field.

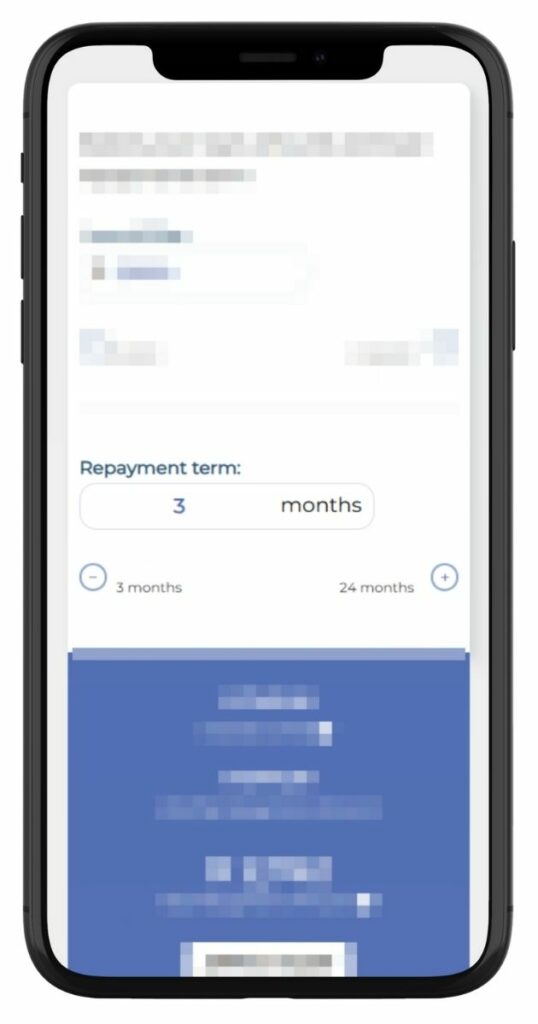

Step 4. Select your preferred repayment term between 3 and 24 months.

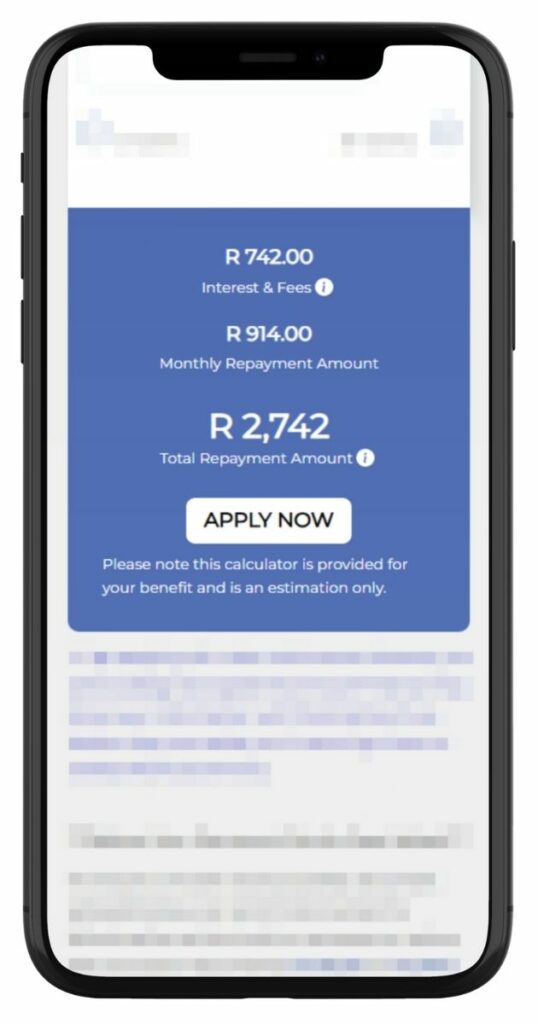

Step 5. Review the interest, fees, and total repayment, then click “Apply Now.”

Step 6. Fill in the required personal and financial information.

Step 7. Upload the necessary documents (ID, payslip, bank statements).

Step 8. Submit the application for review.

Step 9. Await feedback from the Future Finance team regarding the application status.

Eligibility Check

Future Finance provides tools to help applicants assess their eligibility before applying. For personal loans, the online loan calculator allows users to input the desired loan amount and repayment term to view estimated monthly repayments and total repayment amounts. This helps in understanding the financial commitment involved.

Additionally, the application form includes preliminary questions to determine basic eligibility, such as age, employment status, and banking details. This initial check ensures that applicants meet the fundamental criteria before proceeding with the full application.

Who Is Future Finance Best For?

Future Finance is a good choice for South Africans who:

- Need fast access to short-term personal loans

- Are selling property and need bridging finance

- Are under debt review and want to improve their credit

- Have a steady income and valid supporting documents

- Prefer a registered provider with clear fees and online applications

Is Future Finance a Safe and Reliable Option?

Yes. Future Finance is a registered and reputable credit provider in South Africa, offering financial services in compliance with the National Credit Act. The company is accredited by the National Credit Regulator (NCR) and operates under regulated lending conditions to ensure that loans and related services are issued responsibly. Future Finance focuses on short-term personal loans, property bridging finance, and credit repair solutions, helping clients who need urgent funding or are working to improve their financial standing.

Future Finance uses secure systems to protect all personal and financial information submitted during the application process. The platform is designed to ensure that documents, such as ID copies and bank statements, are handled confidentially and are only used for the purpose of evaluating and processing loan or credit repair applications. All information is treated with care, and applicants are informed of how their data will be used before submitting anything. This transparent process ensures that clients are aware of their rights and can trust that their details will remain protected when dealing with Future Finance.

How Much Money Can I Request from Future Finance?

At Future Finance, you can apply for a personal loan ranging from R500 to R50 000, with flexible repayment terms of 1 to 24 months. The loan amount you qualify for depends on your income, credit profile, and submitted documentation. This range is designed to accommodate both small, short-term needs and larger financial requirements, with a straightforward online application process and fast payout times.

How Future Finance Creates Personalised Services

Future Finance tailors its services to match individual financial situations. For personal loans, the company evaluates factors such as income, employment stability, and credit history to determine suitable loan amounts and repayment terms. This approach ensures that the loan aligns with your ability to repay, providing a manageable financial solution.

In the case of property bridging finance, Future Finance assesses the specifics of your property sale, including the expected proceeds and transfer timelines. This allows them to offer a bridging loan that fits your unique circumstances, helping you cover expenses while awaiting the finalisation of the sale.

Future Finance: Overview in Detail

| Name | Future Finance Personal Loans |

|---|---|

| Financial Institution | Future Finance (South Africa) |

| Product | Unsecured Personal Loans |

| Minimum Age | 18 years |

| Minimum Loan Amount | R500 |

| Maximum Loan Amount | R50 000 |

| Minimum Term | 1 month |

| Maximum Term | 24 months |

| APR | 36% to 60% |

| Monthly Interest Rate | Varies based on credit profile |

| Early Settlement | Full balance can be paid at any time without penalties |

| Repayment Flexibility | Fixed monthly repayments over the chosen term |

| NCR Accredited | Yes |

| Our Opinion | ✅ Quick online application process ✅ Transparent fee structure ⚠️ Higher interest rates compared to traditional banks |

| User Opinion | ✅ Appreciated for fast fund disbursement ⚠️ Some concerns about interest rates |

How Long Does It Take to Receive My Loan Payout from Future Finance?

Future Finance typically processes and pays out approved loans within 24 hours. Once your application is submitted with all required documents and approved, the funds are usually transferred to your bank account on the same or next business day, depending on your bank’s processing times.

How Do I Repay for My Loan from Future Finance?

Loan repayments to this lender are made via monthly debit orders from your bank account. When you apply, you agree to a repayment schedule based on your chosen loan term (1 to 24 months), and the amount is automatically deducted each month until the loan is fully repaid.

Pros and Cons of Choosing Future Finance

Pros of Future Finance

- Quick Access to Funds: Offers a streamlined online application process, allowing clients to receive funds promptly after approval.

- Transparent Fee Structure: The company provides clear information on interest rates and service fees, enabling clients to make informed decisions without hidden costs.

- Inclusive Credit Assessment: Considers a broader range of factors beyond credit scores, such as income and employment stability, making financial solutions accessible to a wider audience.

- Specialised Services: Offering services like property bridging finance and credit repair, this lender caters to specific financial needs, such as accessing funds during property transactions or improving credit profiles.

- Customer Support: Clients have access to dedicated customer support via phone, email, and WhatsApp, ensuring assistance throughout the loan process.

Cons of Future Finance

- Limited Physical Presence: With offices primarily in Durban, clients outside the area may rely solely on online or phone communication.

- Eligibility Requirements: Certain services, like credit repair, require specific criteria such as formal employment and banking with major South African banks, which may exclude some applicants.

- Service Scope: The company’s focus on specific services means it may not cater to all financial needs, such as long-term loans or investment products.

Customer Service

Future Finance offers support through phone on +27 031 830 5205 and email at info@future-finance.co.za. Clients can also visit their office at 2 Ncondo Place, Umhlanga Ridge, Durban for in-person assistance. Additional updates and service information are available on their website and social media platforms, including Facebook and LinkedIn.

Contact Channels

Phone number:

Office: +27 31 830 5205

Email:

info@future-finance.co.za

Postal address:

2 Ncondo Place, Umhlanga Ridge, Durban

Please note that specific hours of operation are not listed on their official website. For the most accurate and up-to-date information regarding their operating hours, it is recommended to contact them directly via phone or email.

Online Reviews of Future Finance

Customer feedback for Future Finance is mixed. Some clients appreciate the company’s quick and efficient service, particularly in providing fast access to funds. However, there are also negative reviews highlighting issues such as unexpected fees and communication challenges. For instance, a review on HelloPeter mentions dissatisfaction with the service, stating concerns about misleading promises and difficulties in withdrawing funds.

It’s advisable for potential clients to thoroughly read and understand the terms and conditions before engaging with this lender. Additionally, reaching out directly to the company for clarification on any concerns can help ensure a smoother experience.

Your team have been very helpful through my financial crisis caused by my illness, and have been supportive at every stage.

Response was quick and efficient. Friendly and helpful staff. Highly recommend.

Fake promises and they are full of lies and deceit, kept asking for money, denied my withdrawal.

Do not apply by them, its a waste of time. I applied for a loan last week, and I’m still waiting for them to get back to me. All it says online is “your application is still being processed”. They have not even responded to my email yet.

Alternatives to Future Finance

For those exploring other financial service providers in South Africa, several alternatives offer similar products:

Comparison Table

| Company | Services Offered | Loan Amount Range | Notable Features |

|---|---|---|---|

| Future Finance | Personal loans, bridging finance, credit repair | R500 – R50 000 | Quick online application, credit repair services |

| Bayport Financial Services | Unsecured loans, insurance, financial wellness | Varies | Broad product range, technology-driven risk assessment |

| Capfin | Micro-lending solutions | Up to R50 000 | Accessible loans, focus on affordability |

| DirectAxis | Personal loans, insurance | Up to R300 000 | Emphasis on responsible borrowing |

| Wonga South Africa | Short-term credit solutions | Varies | Focus on financial inclusion |

History and Background of Future Finance

Established in 2003, Future Finance has been providing financial services to South Africans for over two decades. The company focuses on offering quick and accessible financial solutions, including personal loans, property bridging finance, and credit repair services.

This lender’s mission is to address short-term and urgent cash flow problems with responsible solutions. They aim to serve the underbanked and underserved population by providing innovative financial services that are both reliable and efficient.

With a commitment to transparency and customer service, they continue to adapt their offerings to meet the evolving needs of its clients, ensuring that financial assistance is accessible to those who need it most.

Conclusion

Future Finance provides practical short-term financial solutions for South Africans needing fast access to credit. With offerings such as personal loans, property bridging finance, and credit repair services, the company targets individuals facing temporary cash flow challenges or those looking to improve their credit profiles. The online application process is straightforward, and services are tailored based on individual financial situations. While customer reviews are mixed, Future Finance remains a relevant choice for those who need accessible funding outside of traditional banking. However, as with any financial product, it’s best to review the terms carefully and compare alternatives before committing.

Frequently Asked Questions

You can apply online by visiting the official website and completing the application form. You’ll need to upload documents such as your South African ID, recent payslip, and bank statements.

For personal loans, funds are usually paid out within 24 to 48 hours after approval. Bridging finance may be paid out even quicker, depending on the transaction details.

Yes, Future Finance considers more than just your credit score. They assess your income and employment status to determine affordability.

You can apply for personal loans of up to R50 000, depending on your financial profile and supporting documents.

Yes, Future Finance is a registered credit provider and follows regulations set by the National Credit Regulator.