Capfin [Capfin.co.za], a well-known microfinance lender, offers accessible personal loans to individuals seeking short-term financial solutions. Tailored for simplicity, their loans appeal to those needing quick access to funds, with straightforward application processes, minimal paperwork, and flexible repayment options. This lender operates through partnerships with retail giants, making it convenient for customers to apply in-store or online.

Capfin offers personal loans ranging from R1 000 to R50 000, with repayment terms of 6, 12, or 24 months, depending on the loan amount and your credit profile. If you are looking for a straightforward and accessible loan to manage short-term financial needs, whether it’s for home improvements, education, or unexpected expenses, read on to see how Capfin’s services may suit your requirements.

Capfin: Quick Overview

Loan Amount: R1 000 – R50 000

Loan Term: 6, 12, or 24 months

Interest Rate: Fixed rates, up to a maximum of 28% per annum (5% monthly for shorter terms)

Fees: Initiation and monthly service fees apply; total costs disclosed upfront during application

Loan Types: Unsecured personal loans for general use (e.g. education, home improvements, emergencies)

Capfin Full Review

Navigating through Capfin’s loan options reveals a fusion of simplicity and practicality. The company prioritises streamlining the loan application process, ensuring potential borrowers aren’t hindered by overly complex procedures or excessive paperwork. This aligns with their broader aim of making financial services more accessible and less daunting.

Considering the overall experience involves assessing the different stages of engagement with this lender, from the initial application to the repayment process. The application process is notably easy, with Capfin.co.za offering multiple application channels, including in-store options at retail partners, enhancing convenience.

Clear disclosure of repayment terms, interest rates, and fees ensures borrowers have a comprehensive understanding of their loan terms. This transparent approach contributes to a more positive and informed borrower experience with them.

Who Can Apply for a Capfin Loan?

Capfin’s loans aim to be accessible, but certain criteria must be met for eligibility:

- Age Requirement: Applicants must be at least 18 years old.

- Identification: A valid South African ID is required to ensure services are limited to genuine residents and citizens.

- Employment Status: Applicants must have a stable income. Verification through recent payslips or bank statements is required, reflecting their commitment to responsible lending.

This loan provider distinguishes itself by integrating loan services within retail spaces, enhancing accessibility and convenience for borrowers. This allows customers to access financial services where they conduct other business.

Their emphasis lies in simplicity and transparency, aiming to demystify the loan processes. Capfin focuses on providing straightforward financial solutions, removing the often intimidating complexities and jargon typical in the financial sector.

About Arcadia Finance

Experience hassle-free loan procurement with Arcadia Finance. Our service links you to multiple banks and lenders after you fill out a no-cost application. Expect proposals from up to 19 diverse lending sources. We ensure each lender we work with is accredited by South Africa’s National Credit Regulator (NCR).

Types of Loans Offered by Capfin

Capfin specialises in unsecured personal loans tailored to meet various individual needs. These loans can be utilised for purposes such as home improvements, education expenses, or personal milestones. The flexibility in loan usage allows customers to address specific financial goals without the need for collateral.

The loan amounts range from R1 000 to R50 000, with repayment periods of 6, 12, or 24 months, depending on the borrower’s risk profile. Capfin’s approach ensures that loans are tailored to the individual’s financial situation, promoting responsible borrowing. By focusing on simplicity and customer-centric services, Capfin provides a reliable option for those seeking personal loans in South Africa.

Requirements for a Capfin Loan

Navigating the requirements for a loan application can often feel like a hefty task, laden with paperwork and myriad details to keep track of. But with Capfin, the process is streamlined to be as simple and uncomplicated as possible.

Firstly, it’s crucial to ensure that you have all the necessary documents and information ready before starting the application process. Preparation significantly smoothes the process, making it more seamless and less stressful.

- Valid Identification: You’ll need a valid South African ID (green barcoded ID, smart card ID, or passport) to verify your identity and ensure secure, legitimate transactions.

- Proof of Income: Provide proof of stable income, such as recent payslips or bank statements, so they can assess your ability to repay the loan and offer suitable terms.

- Contact Information: Make sure you have a valid cell phone number and email address to ensure they can communicate with you throughout the application process.

- Residential Address: Providing your current residential address adds another layer of security and verification to the loan application process.

Step-by-step Guide to Applying for a Loan with Capfin

Step 1. Visit Capfin.co.za , SMS service, or go to a participating retail store like PEP or Ackermans.

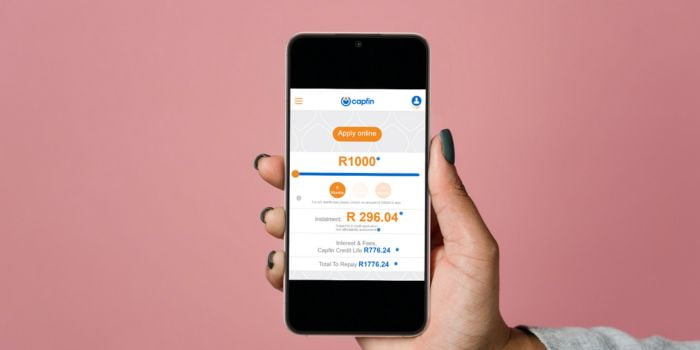

Step 2. Select your desired loan amount using the slider

Step 3. Choose a repayment period (e.g., 6, 12, or 24 months)

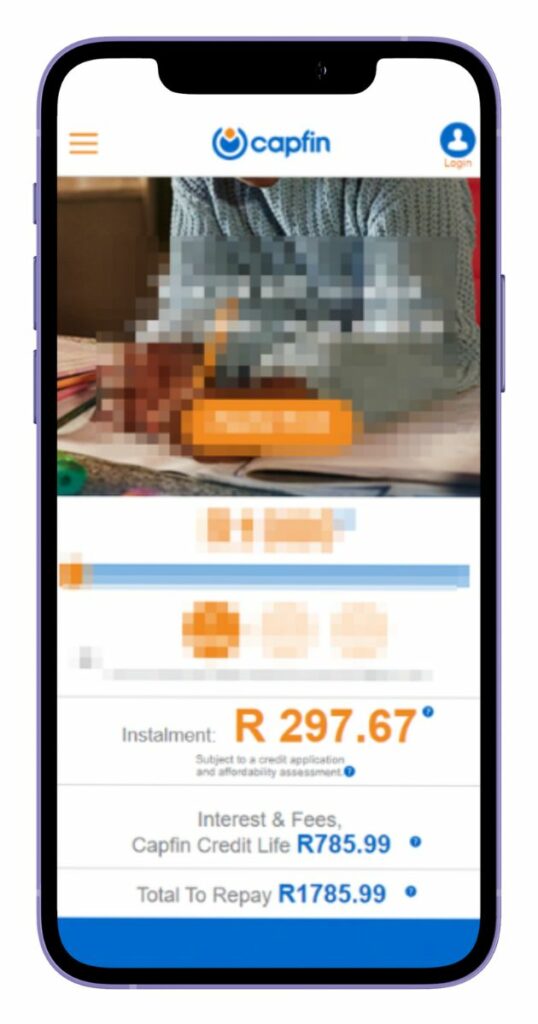

Step 4. Review the breakdown of instalments, including interest, credit life fees, and the total repayment amount.

Step 5. Complete the loan application by providing your personal details and South African ID number.

Step 6. Upload or present proof of income, such as recent payslips or bank statements.

Step 7. Submit the application for an affordability and credit assessment.

Step 8. Once approved, review the loan terms and conditions carefully.

Step 9. Accept the offer and sign the loan agreement electronically or in-store.

Step 10. Receive the loan amount directly into your bank account.

Eligibility Check

Before starting the application process, it’s beneficial to have an idea of whether you meet Capfin’s eligibility criteria. This lender offers tools and methods for potential borrowers to pre-check their eligibility, ensuring they meet the basic requirements necessary to apply for a loan.

- Online Tools: Capfin.co.za may offer tools that allow potential borrowers to gauge their eligibility. These tools often involve entering basic financial information for a preliminary assessment.

- Customer Service: Reach out to their customer service for guidance on eligibility criteria. They can help potential borrowers understand whether they meet the necessary requirements.

- Retail Partners: Given their association with various retail partners including PEP and Ackermans, potential borrowers can seek guidance in-store. Staff at these locations can assist with queries related to eligibility, providing clarity on proceeding with the application process.

Security and Privacy

Capfin places the utmost priority on safeguarding clients’ personal and financial information. Understanding the critical necessity of a secure environment in handling financial transactions and personal details, this lender employs robust measures to shield against unauthorised access and misuse of information.

Their online platforms are fortified with secure socket layer (SSL) encryption, ensuring that sensitive data, like ID numbers and bank details transmitted during the loan application and management processes, are meticulously protected. This encryption technology acts as a strong barrier, reducing the risk of malicious interception.

This loan provider encourages a culture of security awareness, urging customers to remain vigilant and take a proactive stance in safeguarding their information. They facilitate avenues for the prompt reporting of any suspicious activities, fostering a collaborative security approach where both the company and its customers actively participate in fortifying the integrity of financial and personal data.

Who Are Capfin Loans Best Suited For?

Capfin loans are ideal for individuals who:

- Need R1 000 to R50 000 for personal expenses, emergencies, or education.

- Have a stable income and can provide payslips or bank statements.

- Prefer repayment terms of 6, 12, or 24 months.

- Want to apply online, via SMS, or in-store at PEP or Ackermans.

- Value transparent terms and a lender regulated by the NCR.

Is Capfin a Safe and Good Option?

Capfin is a registered credit provider in South Africa, operating under Pepkor Trading (Pty) Ltd and regulated by the National Credit Regulator (NCRCP13053). This accreditation confirms that Capfin operates legally and adheres to responsible lending standards. The company specialises in unsecured personal loans ranging from R1,000 to R50,000, with repayment terms of 6, 12, or 24 months, depending on the loan amount and affordability assessment. Customers can apply for a loan online via Capfin.co.za, by SMS, or in person at participating retail outlets such as PEP and Ackermans, making the application process widely accessible.

Capfin is known for its emphasis on clear, upfront communication about loan costs, including interest, service fees, and total repayment amounts. All loan applications go through an affordability and credit check process to ensure responsible lending. Once approved, funds are paid directly into the applicant’s bank account, usually within a short time. The combination of simple application channels, transparent terms, and flexible repayment structures makes Capfin a suitable option for South Africans seeking short-term personal credit.

How Much Money Can I Request From Capfin?

Capfin offers personal loans of up to R50 000, available with repayment terms of 6 or 12 months, depending on the loan amount. If you opt for a loan above R8 000, the repayment period must be 12 months. This structure is designed to provide flexibility while ensuring that the loan terms are manageable and align with the borrower’s financial situation, subject to affordability assessments to promote responsible lending

How Long Does it Take to Receive my Loan Payout from Capfin?

The speed at which you can access the funds from your loan is another crucial aspect to consider. This lender aims to make this process as swift and straightforward as possible, recognising the often urgent nature of financial needs. The average processing times are optimised to ensure that borrowers can access their funds with minimal delay.

Various factors can influence the withdrawal speed, including the verification of provided information and the processing of the application. Capfin endeavours to navigate these factors efficiently, streamlining the process to facilitate quicker access to funds. The objective is to ensure that the money is in your hands as swiftly as possible, allowing you to address your financial needs without undue delay.

Capfin: Overview in Detail

| Attribute | Detail |

|---|---|

| Financial | Capfin, a division of Pepkor Trading (Pty) Ltd |

| Product | Personal Loans |

| Minimum age | 18 years |

| Minimum amount | R1 000 |

| Maximum amount | R50 000 |

| Minimum term | 6 months |

| Maximum term | 24 months |

| APR | Up to 28% PA |

| Monthly Interest Rate | Up to 5% PM |

| Early Settlement | Allowed, no penalties |

| Repayment Flexibility | Flexible repayment plans |

| NCR Accredited | Yes |

| Our Opinion | ✅ Efficient online application |

| ✅ Transparent fees and charges | |

| ❌ Limited to personal loans | |

| User Opinion | ✅ Convenient online and in-store applications |

| ❌ Higher rates for shorter terms |

How Do I Repay My Loan from Capfin?

- Debit Order: This lender sets up an automatic debit order from your bank account for monthly repayments.

- In-store Payments: Visit any PEP or Ackermans store to make cash payments towards your loan.

- Electronic Transfer: You can also repay through EFT (Electronic Funds Transfer) using their banking details.

- Settlement in Advance: If you want to pay off your loan early, you can request a settlement quote by contacting their support team. The settlement amount will include the balance along with interest and fees up to the chosen settlement date.

- Manage Payments via USSD: Dial 1346454# to check your loan balance or make repayment arrangements.

Online Reviews of Capfin

Online reviews of Capfin loans present a mix of positive and negative experiences. Customers appreciate the convenience of applying online or at retail partners like PEP and Ackermans, which makes loans accessible to those without internet access. The straightforward application process and quick approvals are additional highlights for many borrowers.

Helpful, efficient, reliable and overall a great company to deal with. I had a great experience. It was really a pleasant online application. Seamless and no fuss with regards to my paperwork. I was approved and the loan was paid in before the end of the business day.

Capfin is a trustworthy, reliable and reputable financial institution. There’s no upfront fees or hidden costs. Capfin is transparent from start to finish. Capfin has played a huge role in my life in getting me by when times are tough.

However, customer service seems to be a significant pain point. On platforms like HelloPeter, this loan provider has a low rating of 1.5 out of 5 stars, with users frequently citing poor communication and challenges in resolving queries. Similarly, Google reviews reflect a polarised experience, with ratings ranging from high satisfaction to frustration over issues such as delayed responses or billing problems.

I settled my Capfin loan this morning, expecting that to be the end of the matter. To my shock, a debit still went off from my bank account this evening, even though the loan was fully paid just hours earlier. This is unacceptable and suggests a serious issue with Capfin’s payment processing system.

Why am I getting SMSs indicated that I will be debited twice on the 20th yet I gave never missed payments. Your agent also says I made an arrangement. How can I make an arrangement when I have never missed payments.

Customer Service

If you have lingering questions or uncertainties, reaching out to their customer service is a viable option. They are equipped to provide clarifications, offer guidance, and assist in resolving any challenges you might encounter during the loan process. A responsive and helpful customer service team is essential in ensuring that the loan journey is as smooth and hassle-free as possible, fostering a sense of reliability and trust between the borrower and the lender.

Capfin’s Contact Channels

Phone number:

Office: 087 354 0000

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: Closed

Postal address:

Capfin Head Office, 1 Industrie Street, Kuils River, Cape Town, 7580, South Africa

Alternatives to Capfin

When considering alternative personal loans in South Africa, there are several notable competitors to explore. Each offers unique features and terms that cater to different financial needs and situations. Below is a side-by-side comparison table with three top competitors: Absa, African Bank, and Capitec Bank.

Comparison Table

| Feature/Company | Capfin | Lime24 | Absa | African Bank | Capitec Bank |

|---|---|---|---|---|---|

| Loan Amount | R1 000 to R50 000 | R 500 – R 8 000 | R2 000 – R350 000 | R2 000 – R350 000 | R1 000 – R250 000 |

| Loan Term | 6, 12 or 24 months | Up to 37 days | 2 – 84 months | 7 – 72 months | 7 – 84 months |

| Interest Rate | 5% per month (6 months), 28% max (12 months) | 28.9% – 39.8% | Prime + 17.5% per annum | Fixed at 12% | 13.75% – 28.75% per year |

| Application Process | Online, SMS, in-store at PEP and Ackermans | Online | Online and branch | Online, phone, branch | Online, app-based |

| Eligibility | 18+ years, SA ID, stable income, active SA bank account | 18+ years, SA ID, active SA bank account | 18+ years, R2000 monthly income | 18+ years, proof of income, SA citizen | 18+ years, steady income, credit profile review |

| Repayment Options | Debit order, bank deposit, in-store payment | Debit order, early repayment option | Flexible terms, early settlement benefits | Fixed monthly repayments | Fixed monthly repayments, consolidation option |

| Additional Services | Death benefit | Discounts on subsequent loans, referral program | Insurance coverage, online/mobile banking | Competitive fixed interest rates, flexible loan terms | High customer satisfaction, instant loan approval for app users |

| More Info | Lime24 Review | Absa Review | African Bank Review | Capitec Review |

Pros and Cons of Capfin

Pros of Capfin

- Easy Application: Accessible through online, SMS, or in-store channels.

- Fast Approval: Decisions are typically made within minutes.

- Unsecured Loans: No need to provide collateral.

- Flexible Repayment: Terms between 6, 12 and 24 months suit various budgets.

- Transparent Fees: Clear breakdown of interest and service charges.

Cons of Capfin

- High Interest Rates: Can be more expensive than traditional banks.

- Loan Limits: Maximum loan capped at R50,000.

- Debt Risk: Easy access could lead to over-borrowing.

- Limited Product Range: Focuses only on personal loans.

- Customer Service Issues: Some users report service quality concerns.

History and Background of Capfin

Capfin has carved out its place in the financial landscape as a dependable and accessible personal loan provider. Founded with a vision to simplify the loan acquisition process, this loan provider has concentrated on creating a system that is straightforward and free from unnecessary complexities. Their journey started with a goal to make financial services more approachable, ensuring that customers can navigate their loan processes with ease and clarity. The company’s collaboration with various retail partners further demonstrates their commitment to accessibility, enabling customers to integrate their financial needs into their regular retail experiences. This connection between financial services and retail spaces highlights their innovative approach, showcasing their dedication to customer convenience and optimising service.

Conclusion

When contemplating Capfin as a loan provider, it’s crucial to assess the aspects covered in this review and match them with individual needs and financial circumstances. Their overall rating mirrors its approach to simplifying the borrowing process, ensuring that loans are accessible and manageable for a diverse range of individuals. While each borrower’s needs are unique, their offerings appear to accommodate a variety of financial requirements, solidifying its position in the competitive landscape of personal loan providers.

Frequently Asked Questions

They specialise in personal loans. They offer unsecured loans, meaning you don’t need to provide any collateral, such as property or a car, to secure the loan. The loan amounts and repayment terms are flexible, allowing borrowers to choose an option that best suits their financial situation.

Applying for a loan with them is a simple process. You can apply online through their website, via SMS or at a PEP or Ackermans store. During the application process, you will be required to provide some personal and financial information, such as your ID number, employment details, and banking information. Ensure that you have all the necessary documents ready to make the application process smoother.

The maximum loan amount offered by them can vary based on various factors such as your creditworthiness, income, and repayment ability. It’s advisable to visit their website or contact their customer service for the most accurate and up-to-date information regarding the maximum loan amounts available.

Once your loan application is approved, they typically disburses the funds quickly. The exact time may vary, but borrowers often receive the funds within a short period after approval. It’s always a good idea to confirm the disbursement timeline with them directly to have a clear expectation.

They offer various channels to contact them for any queries or support related to loans. You can reach out to them through email, phone, or visit one of their partner stores for in-person assistance. Detailed contact information is available on their website, ensuring that you can easily access support whenever needed.