FNB [Fnb.co.za], a well-established financial institution, offers a range of personal loans tailored to meet diverse needs. Whether you are looking to cover unexpected medical bills, finance home improvements, or consolidate debts, FNB seems to have a solution. Their loans come with various features and benefits, aimed at providing flexibility and convenience to the borrowers.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by FNB and is based solely on our research.

FNB offers unsecured personal loans to help South Africans manage expenses such as home improvements, debt consolidation, or emergencies. Qualified applicants can borrow between R1 000 and R360 000, with repayment terms of up to 72 months. With personalised rates, no early settlement fees, and a simple online application, FNB provides a flexible and transparent lending option. If you’re seeking a trusted loan provider with convenient features, read on to see if FNB suits your financial goals.

FNB Loans: Quick Overview

Loan Amount: From R1 000 up to R360 000, depending on your income and credit profile

Loan Term: Flexible repayment periods ranging from 1 to 60 months

Interest Rate: Personalised fixed interest rate based on your creditworthiness; aligned with the National Credit Act

Fees: Includes a once-off initiation fee and a monthly service fee; all charges are transparent and disclosed in the agreement

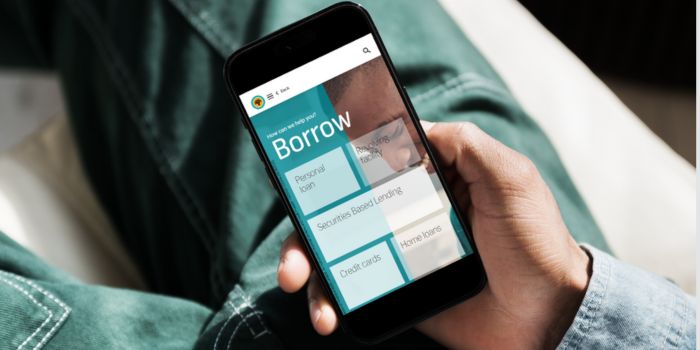

Loan Types: Unsecured personal loans, revolving loans, temporary loans, student loans, home loans, and business loans

FNB Full Review

Experiences with FNB Loan

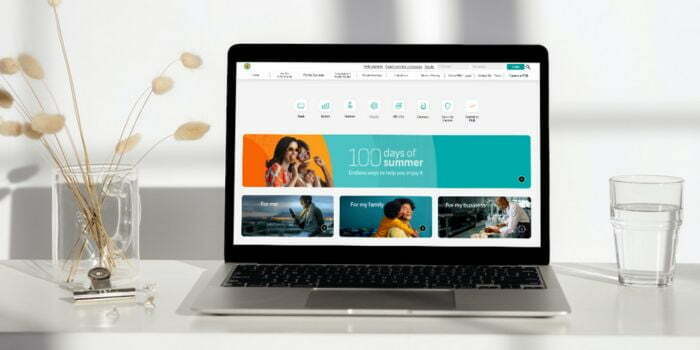

Navigating through the loan process can often be filled with uncertainty and confusion. However, FNB seems to have streamlined its processes to create a user-friendly experience for potential borrowers. The online application process is straightforward, allowing applicants to receive personalised credit offers quickly. Their website is also equipped with detailed information and resources that guide users through various aspects of the loan, ensuring that they have clarity on what to expect.

Feedback from users indicates that their loans can be a viable option for various needs, such as medical emergencies, home renovations, or consolidating debts. The flexibility in repayment terms and the option to take a payment break in January are features that many borrowers find appealing. However, like any financial product, it’s essential to consider the interest rates and terms to ensure that the loan aligns with your financial capacity and goals.

Who Can Apply for an FNB Loan?

Criteria for Potential Borrowers

FNB’s loans are accessible to a wide range of individuals. However, there are certain criteria that one must meet to be eligible. Applicants must be between 18 and 64 years old and should be permanent residents or citizens of South Africa. A consistent monthly income is also a requirement, ensuring that the borrower has the means to repay the loan over the agreed period. The documentation necessary for the application includes valid identification, proof of residence, and proof of income, such as recent payslips or bank statements.

Differences from other loan providers

When comparing FNB to other loan providers, certain differences become apparent. This bank offers a ‘Take-A-Break’ feature, allowing borrowers to skip the January repayment, and providing a brief respite from the repayment schedule. This feature is unique and not commonly offered by other lenders. Additionally, they do not charge penalty fees for early loan settlement, offering flexibility to those who wish to pay off their loan ahead of schedule. The personalised interest rates and fixed monthly repayments also contribute to making this bank’s offerings distinct, providing borrowers with a clear understanding of their financial commitment throughout the loan term.

Looking for a lender that caters to high-income professionals or private banking clients? Our Investec Lender Review explores how this elite bank compares to traditional institutions like FNB, especially when it comes to service and exclusivity.

About Arcadia Finance

Arcadia Finance assists in finding loans from various banks and lenders. Simply complete a no-cost application to receive loan proposals from as many as 19 lenders here. Our partners are reputable, reliable, and licensed by the National Credit Regulator (NCR) in South Africa.

What makes the FNB loan unique?

FNB’s approach to personal loans is somewhat distinctive in the financial market. One of the standout features is the personalised interest rate offered to borrowers. This means that the interest rate you receive is tailored based on your credit profile, ensuring that it aligns with your financial standing. Another unique aspect is the ‘Take-A-Break’ feature, which allows borrowers a payment holiday in January, offering a brief financial reprieve after the festive season.

They also ensure that borrowers are not penalised for settling their loans early. This flexibility is a significant advantage, allowing individuals to manage their loans in a way that suits their financial strategies and capabilities. The bank also provides a clear and straightforward online application process, enhancing the user experience and ensuring that applicants can access the funds they need with minimal hassle.

Types of Loans Offered by FNB

FNB provides a comprehensive suite of loan products designed to meet various financial needs:

Personal Loans: These unsecured loans offer amounts ranging from R1 000 to R360 000 with flexible repayment terms up to 72 months. Suitable for consolidating debt, funding significant purchases, or covering unexpected expenses.

Home Loans: FNB’s home financing options cater to purchasing, building, or renovating properties. With competitive interest rates and terms up to 30 years, these loans are ideal for individuals aiming to invest in real estate.

Student Loans: Designed to support tertiary education, these loans cover tuition, textbooks, and accommodation costs. They offer flexible repayment options, making higher education more accessible to students and their families.

Business Loans: Tailored for small to medium enterprises, FNB’s business loans provide funding for expansion, equipment purchases, or working capital. Loan amounts and terms are structured to align with the specific needs of the business.

Revolving Loans: This flexible credit facility allows customers to access funds up to a predetermined limit, with the ability to reuse the credit as repayments are made. Ideal for managing cash flow or covering recurring expenses.

Temporary Loans: Short-term loans designed for immediate financial needs, offering quick access to funds with repayment typically due on the borrower’s next payday. Suitable for emergencies or bridging short-term cash shortages.

Requirements for an FNB Loan

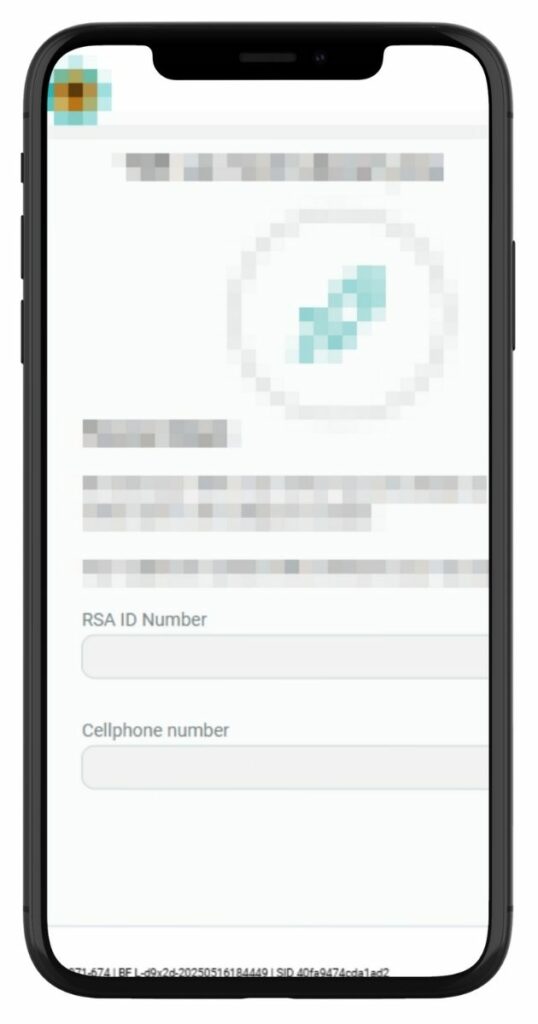

When considering a loan with FNB, it’s essential to be prepared with the necessary documentation to ensure a smooth application process. Applicants must provide valid identification, which can be a South African ID book or card. Proof of residence is also required, which can be any utility bill or a similar document that confirms your address.

Another crucial requirement is proof of income. This can be in the form of recent payslips or bank statements, which will give them an insight into your financial standing and ability to repay the loan. These documents help the bank assess your creditworthiness and determine the loan amount and terms that can be offered to you.

Step-by-Step Guide to Applying for a Loan with FNB

Step 1. Start by navigating to the personal loans section at Fnb.co.za.

Step 2. Depending on your needs, select the appropriate loan product.

Step 3. Click “Apply Now” to begin your loan application.

Step 4. Enter your RSA ID and cellphone number.

Step 5. Fill in the online application form with your details, employment information, and the loan amount and term you’re interested in.

Step 6. Upload or provide the necessary documents, including ID, proof of residence, and proof of income.

Step 7. Once they review your application and documents, they will provide a personalised loan offer, detailing the interest rate and monthly repayments.

Step 8. If you’re satisfied with the offer, you can accept it, and the loan amount will be disbursed to your bank account.

Eligibility Check

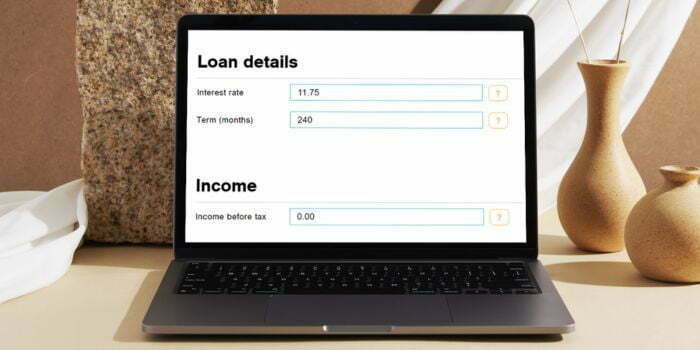

FNB understands the importance of knowing where you stand before diving deep into the loan application process. To assist potential borrowers, this bank offers tools on their website that allow you to pre-check your eligibility. By inputting some basic information, these tools provide an initial assessment of the loan amount and terms you might qualify for. This preliminary check does not impact your credit score and gives you a clearer picture of what to expect when you proceed with the full application. It’s a valuable resource, ensuring you don’t waste time on loan products that might not align with your financial profile.

Security and Privacy

FNB prioritises the security and privacy of customers’ personal and financial information. Utilising robust security measures, they ensure the safeguarding of your data against unauthorised access and potential vulnerabilities. Encryption technology is employed to secure sensitive data during transmission over the internet, protecting it from malicious interceptions.

Their adherence to stringent privacy policies ensures the responsible handling and usage of your data, preventing unwarranted third-party disclosures except in service provision or legal requirements. Personal vigilance, such as maintaining the confidentiality of login credentials and regular password updates, is also crucial in bolstering the security of your interactions with this bank’s loan services.

Who Are FNB Loans Best Suited For?

FNB loans are a suitable option for South Africans who:

- Require loan amounts of up to R360 000, with flexible repayment terms of up to 60 months.

- Earn a regular income and are seeking an unsecured loan with personalised interest rates.

- Prefer fixed monthly repayments that make budgeting easier, with no penalties for early settlement.

- Want a fully online application process via a secure and user-friendly website or mobile app.

- Choose to borrow from a trusted, NCR-registered lender with a long-standing reputation in South Africa’s financial sector.

Is FNB a Safe and Good Option?

First National Bank (FNB), a division of FirstRand Bank Limited, is a well-established and trusted financial institution in South Africa. As a registered credit provider operating under the National Credit Act, this bank offers personal loans from R1 000 to R360 000 with flexible terms. Applications can be completed online or via the mobile app, with standard documentation such as a valid South African ID, proof of income, and proof of residence. Once approved, funds are usually disbursed within one to two business days.

This bank focuses on responsible lending by conducting thorough affordability checks and offering personalised interest rates with fixed monthly repayments. There are no penalties for early settlement, and all loan terms are clearly outlined upfront. With user-friendly digital tools, transparent practices, and a strong track record in financial services, FNB is a reliable option for South Africans seeking secure and flexible personal finance solutions.

How Much Money Can I Request from FNB?

FNB offers a range of loan amounts to suit various needs and financial situations. Borrowers can request a minimum amount that suits their immediate needs, up to a maximum of R360 000. This flexibility allows for the accommodation of various financial requirements, whether it be for a minor expense or a significant financial undertaking.

They also provide personalised loan offers. This means that the offer you receive is tailored to align with your creditworthiness and financial standing. This bank evaluates your credit profile, income, and other relevant factors to determine the loan amount and interest rate that you qualify for, ensuring that the offer aligns with your repayment capabilities.

How long does it take to receive my money from FNB?

The time it takes to receive funds from FNB can vary based on several factors. However, FNB strives to ensure that the process is as swift and efficient as possible. On average, once your loan application is approved, the funds are made available within a short period. The bank’s online application process is designed for quick decision-making and fund disbursement.

Factors such as the accuracy of the information provided, the completeness of the application, and the bank’s internal processes can affect the speed at which funds are released. Ensuring that all necessary documentation is accurate and submitted promptly can facilitate a smoother and quicker process.

FNB Loan – Overview in Detail

| Name | First National Bank |

|---|---|

| Financial Institution | First National Bank (FNB), a division of FirstRand Bank Limited |

| Product | Unsecured Personal Loan with Flexible Terms and Features |

| Minimum Age | 18 years |

| Minimum Loan Amount | R1 000 |

| Maximum Loan Amount | Up to R360 000 |

| Repayment Term | 1 to 72 months |

| Interest Rate | Personalised, based on credit profile; subject to affordability assessment |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Fixed monthly repayments; ‘Take-A-Break’ option in January |

| NCR Accredited | Yes |

| Our Opinion | ✅ Tailored interest rates ✅ Flexible repayment terms ✅ No early settlement penalties ⚠️ Rates may be higher for low credit scores |

| User Opinion | ✅ Easy online application ✅ Appreciated payment holiday ⚠️ Rates may be high for some borrowers |

How do I repay my loan from FNB?

Repaying your loan to FNB is made convenient through various available options. Borrowers can opt for fixed monthly repayments, which provide clarity and consistency, aiding in better financial planning. The repayment terms are flexible, allowing for adjustments based on the borrower’s financial capability.

In terms of fees and penalties, this bank stands out by not charging penalty fees for early loan settlement. This approach offers borrowers the flexibility to repay their loans ahead of schedule without incurring additional costs. However, it’s advisable to be aware of the terms and conditions related to repayments, ensuring that you are well informed of any potential fees or charges that may apply during the repayment process. Understanding the repayment structure and any applicable fees is crucial in managing your loan effectively and avoiding any unexpected costs.

Online reviews of FNB

Online reviews offer valuable insights into customer experiences and satisfaction levels. For FNB, customer feedback appears mixed, reflecting various aspects of their loan services. Borrowers often highlight the ease of the application process and the clarity of information provided by this bank as positive aspects. The flexibility in repayment options, including the absence of penalties for early settlement, is also frequently appreciated by customers.

The service is excellent and I was surprised every time at the detailed knowledge that the personnel has.

Your swift response and attention to our inquiries ensured that our needs were met with professionalism and courteousness.

However, like any service, there are also areas where customers feel there could be improvements. Some reviews point towards customer service experiences and communication as areas where enhancements could be made. It’s essential to consider that individual experiences can vary, and online reviews often represent a snapshot of customer interactions and satisfaction.

You can’t do a simple thing as getting your eBucks pin and must go to a branch. I need to pay something today, a Saturday at the convenience of my home, but now I must wait for Monday to go to a bank to have my eBucks reset.

Not happy as my law on call policy was cancelled due to my account in arrears. It’s taken 6 months to get papers to court and now the policy is cancelled due to financial distress.

Pros and Cons of FNB Loans

Pros of FNB

- Personalised Interest Rates: Offers interest rates that are tailored based on the borrower’s credit profile.

- Flexible Repayment Terms: Borrowers have the flexibility of choosing repayment terms that suit their financial situation.

- No Early Settlement Penalties: Does not charge penalties for settling the loan amount before the end of the term.

- Take-A-Break Feature: A unique offering that allows a payment break in January, giving borrowers financial breathing space.

Cons of FNB

- Interest Rates: While personalised, the interest rates might be higher for those with a lower credit score.

- Loan Amount: The maximum loan amount offered is R360 000, which might not be sufficient for some borrowers’ needs.

- Online Focus: The bank has a strong focus on online banking, which might not be suitable for those who prefer traditional banking methods.

Customer Service

Customer service is a crucial aspect of any financial service, providing support, guidance, and answers to customer queries and concerns. If you have further questions or need assistance regarding FNB loans, there are various ways to reach out to their customer service team. FNB offers support through its website, telephone, and in-branch services, ensuring that customers have multiple avenues to seek help and information.

Having access to reliable and responsive customer service enhances the overall experience, ensuring that you have the necessary support throughout the loan application and repayment process. Effective customer service ensures that your queries are addressed promptly, providing clarity and guidance as you navigate through your loan journey.

Contact Info

Phone number:

Office: 087 575 9404

Hours of operation:

Monday to Friday: 8:00 AM – 7:00 PM

Saturday: 8:00 AM – 1:00 PM

Sunday and Public Holidays: Closed

Postal address:

First National Bank, P.O. Box 1153, Johannesburg 2000, South Africa

Alternatives to FNB

There are several alternatives to FNB when it comes to personal loans. Various banks and financial institutions offer competitive loan products, each with its unique features and benefits.

Comparison Table

Here is a side-by-side comparison of FNB with some top competitors in the personal loan sector:

| Lender | Maximum Loan Amount | Interest Rate | Repayment Term | Unique Features |

|---|---|---|---|---|

| FNB | R360 000 | personalised | Up to 60 months | Take-A-Break in January, No early settlement penalty |

| Absa | R350 000 | personalised | 12-84 months | Credit Protection Plan, Flexible repayment |

| Standard Bank | R300 000 | personalised | Up to 72 months | Fixed interest rate, Quick online application |

| Nedbank | R300 000 | From 10.5% | Up to 72 months | Online loan management, Credit life assurance |

| ShowTime Finance | R250 000 | personalised | 6 – 84 months | Focus on bad credit loans |

History and Background of FNB

First National Bank (FNB), a division of FirstRand Bank Limited, has a rich history that dates back to 1838. Established in Grahamstown, South Africa, it has evolved over the decades, adapting to the changing financial landscape and growing to become one of the leading banks in South Africa. The bank has been instrumental in pioneering various innovative banking solutions, always aiming to meet the dynamic needs of its customers effectively.

Their mission revolves around creating a better world by providing helpful solutions to clients, enabling them to manage their financial lives seamlessly. The bank’s vision is to be the most helpful bank, driven by a strong customer focus, innovation, and a commitment to making a difference in the communities they serve. FNB aims to offer value to its customers through a range of financial products and services that are tailored to meet diverse needs and preferences.

Conclusion

FNB presents a robust offering in the personal loans sector, marked by flexibility, innovation, and customer-centric features. The bank’s approach to personal loans is nuanced, with a focus on personalised interest rates and a variety of loan amounts to cater to a wide spectrum of financial needs. The unique features such as the ‘Take-A-Break’ option in January and no penalties for early settlement further enhance the attractiveness of FNB’s loan products.

Considering the comprehensive features, flexibility, and customer-focused approach, this bank garners a commendable position in the personal loans market. The bank’s commitment to providing tailored solutions, clear terms, and supportive features create a conducive environment for borrowers to manage their loans effectively. While there are areas where improvements could enhance the borrower experience further, their overall offerings resonate with reliability, innovation, and a strong understanding of customer needs in the realm of personal loans.

Frequently Asked Questions

You can borrow up to R360 000, depending on your creditworthiness and financial standing. The bank assesses your credit profile, income, and other relevant factors to determine the loan amount you qualify for.

Once you have submitted all necessary documents and completed the application, you can expect a response within a short period. The funds are disbursed promptly upon approval.

No, they do not charge any penalties for settling your loan early. This flexibility allows you to manage your loan according to your financial capabilities and strategies.

The ‘Take-A-Break’ feature allows borrowers to skip the January repayment, providing a brief financial break. This feature is automatically available for loans with repayment terms over six months and accounts that are up to date with repayments.

To apply for a personal loan with FNB, you will need valid identification, proof of residence, and proof of income, such as recent payslips or bank statements. Ensure that all documents are accurate and up-to-date to facilitate a smooth application process.