Nedbank [Nedbank.co.za] is one of South Africa’s leading banking institutions, with a rich history and a strong presence in the financial landscape. When it comes to loans, many South Africans see it as a go-to option. In this review, we’ll take a closer look at the various loan products available, exploring their features, customer experiences, and how they compare with other major banks in the country. If you’re considering a personal loan for unexpected expenses, a home loan for your dream house, or a business loan to grow your venture, this overview offers a clear and unbiased look at what’s available.

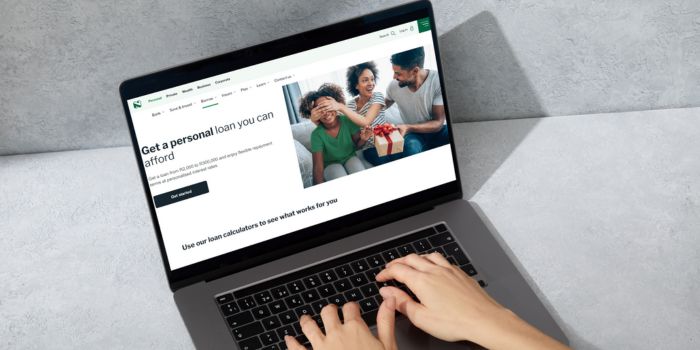

Nedbank offers personal loans from R2 000 up to R400 000, with repayment terms ranging from 6 to 72 months. If you’re looking for a trusted and flexible loan solution to manage anything from urgent expenses to planned purchases, continue reading to see whether Nedbank’s offerings align with your financial needs.

Nedbank: Quick Overview

Loan Amount: R2 000 – R400 000

Loan Term: 6 to 72 months

Interest Rate: Personalised rates based on credit profile; typically ranging from 11% to 28.25% per annum

Fees: Initiation Fee: R165 plus 10% of the loan amount above R1 000, capped at R1 207.50 (VAT inclusive) / Monthly Service Fee: R69 (VAT inclusive)

Loan Types: Personal loans, short-term loans, home loans, vehicle finance, student loans, overdraft facilities, solar finance

Nedbank Full Review

Experiences with Nedbank Loan

Many individuals and businesses across South Africa have turned to this bank for their borrowing needs. Experiences vary, but a common thread among most borrowers is a strong commitment to clarity and customer service. From the initial application process to the final repayment, customers are kept well-informed and comfortable with their loan terms. The digital platforms, along with an extensive branch network, make the loan application and management process smooth for most. Additionally, feedback from many borrowers highlights a transparent fee structure and competitive interest rates, which are often cited as reasons for choosing this lender over others.

Who Can Apply for a Nedbank Loan?

South African residents, both salaried and self-employed, can apply for a loan with Nedbank. The bank also offers specialised loan products for students and vehicle financing, ensuring that a broad spectrum of financial needs is covered.

Nedbank Loan Eligibility Criteria

Firstly, the applicant must be a legal resident of South Africa and be at least 18 years old. They should have a valid South African ID and provide proof of a stable income, which can be through payslips or bank statements. The bank also assesses the applicant’s credit history to determine their creditworthiness. A good credit score increases the chances of loan approval and might also fetch better interest rates. However, Nedbank also considers other factors, such as the applicant’s current financial situation and their ability to repay the loan.

About Arcadia Finance

Arcadia Finance is your pathway to easy loan access. Fill out our cost-free application and get offers from up to 19 various lenders. We ensure a reliable process by collaborating with only NCR-licensed, established lenders in South Africa.

Nedbank Loan

Nedbank, as one of South Africa’s premier banking institutions, has carved a niche for itself in the loan market. With a blend of innovative products and customer-centric services, Nedbank loans stand out in a crowded marketplace.

Types of Loans Offered by Nedbank

Nedbank offers a diverse range of loan products to cater to the varied needs of its customers. These include:

Personal Loans: Borrow between R2 000 and R400 000 with flexible repayment terms ranging from 6 to 72 months. These loans come with personalised interest rates and the potential to earn Greenbacks rewards for timely repayments.

Short-Term Loans: Exclusive to existing Nedbank clients, these loans offer amounts up to R6 000 with zero percent interest. An initiation fee of 8% applies, and the loan is repayable on the borrower’s next salary date, providing a quick and cost-effective solution for immediate financial needs.

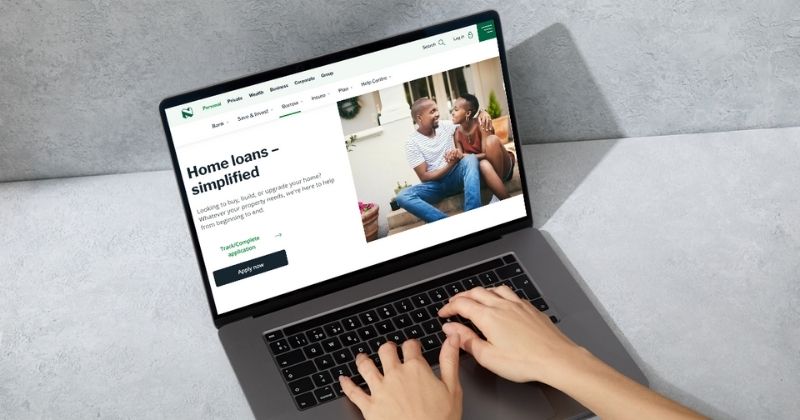

Home Loans: Finance up to 109% of your property’s value, with options for first-time buyers and those looking to upgrade. Nedbank also offers up to R20 000 cashback when applying online, making homeownership more accessible.

Vehicle Finance: Obtain financing for new or used vehicles, with competitive interest rates and flexible repayment options. Nedbank’s vehicle finance solutions are designed to suit various budgets and vehicle types.

Student Loans: Cover tuition, accommodation, and study-related expenses with loans up to R400 000. Nedbank rewards students who achieve good grades by offering discounted interest rates, supporting academic success.

Solar Finance: Invest in renewable energy solutions with financing options tailored for solar installations. Nedbank’s solar finance supports sustainable living and long-term savings on energy costs.

Requirements for a Nedbank Loan

These requirements are in place to ensure that both the bank and the borrower have a clear understanding of the loan terms and that the borrower is in a position to repay the loan without undue financial strain.

Documents and Information Needed

- Proof of Identity: A valid South African ID card or passport is essential. This confirms the applicant’s identity and legal status in the country.

- Proof of Income: This can be in the form of recent payslips for salaried individuals or bank statements for self-employed individuals. This helps the bank assess the applicant’s financial stability and ability to repay the loan.

- Proof of Residence: A recent utility bill or a lease agreement can serve as proof of residence. This confirms the applicant’s current address.

- Credit History: While you don’t need to provide this yourself, they will conduct a credit check to assess your creditworthiness. A good credit history can enhance your chances of loan approval and might result in more favourable interest rates.

- Details of Existing Financial Commitments: If you have other loans or financial obligations, you’ll need to provide details of these. This helps them assess your overall financial health and ensures that taking on another loan won’t overburden you.

- Purpose of the Loan: Depending on the type of loan you’re applying for, you might need to provide details about the purpose of the loan. For instance, if it’s a home loan, details about the property, its value, and any down payment you’re making will be required.

Simulation of a Loan Application at Nedbank

Step 1. Visit Nedbank.co.za

Step 2. Tap “Borrow”, select the loan type and tap “Apply now” to begin your loan application.

Step 3. Select “Apply online” to continue the process.

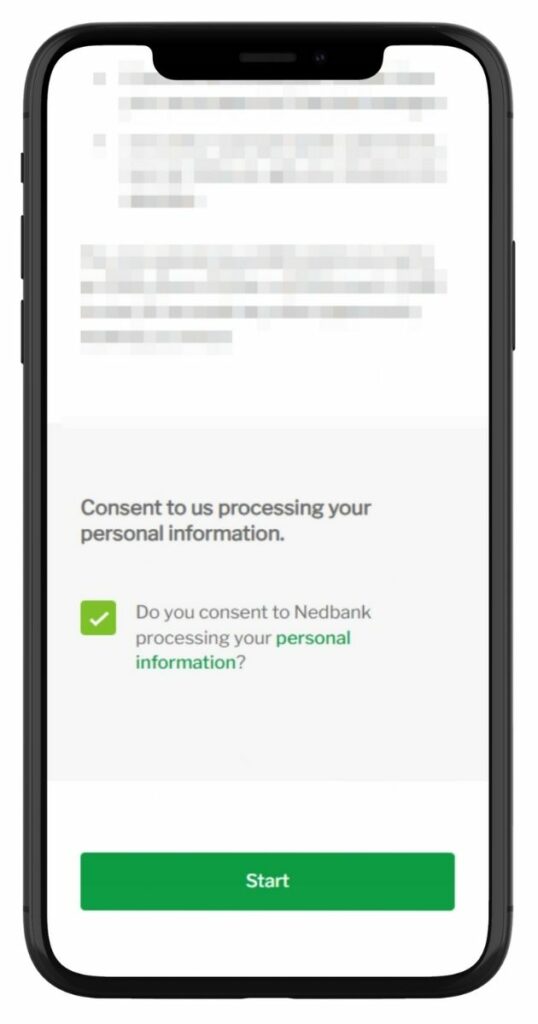

Step 4. Consent to Nedbank processing your personal information and click “Start.”

Step 5. Enter your ID number and phone number, then click “Next” to proceed.

Step 6: Verify your identity with a one-time password (OTP) sent to your phone.

Step 7: Fill in your personal details, including address and employment information.

Step 8: Specify your loan amount and preferred repayment term.

Step 9: Upload supporting documents such as payslips and bank statements.

Step 10: Review your application details and confirm everything is correct.

Step 11: Submit your application and wait for Nedbank’s approval decision.

Pre-check Eligibility

This bank recognises the importance of time and provides customers with tools to streamline the loan application process. An online eligibility checker is available on the website. Potential borrowers can enter basic information such as income, current financial commitments, and the desired loan amount to receive a preliminary indication of their eligibility. The tool delivers an immediate response and empowers customers to proceed with confidence. This proactive approach helps ensure a hassle-free experience from the start.

Security and Privacy at Nedbank

Multi-factor authentication is used for both online and mobile banking platforms. This adds an extra layer of security to ensure that only the rightful account holder has access. Customers are also educated on secure banking practices, including not sharing passwords or PINs and being cautious of phishing attempts.

The privacy policy clearly explains how customer data is collected, used, and stored. Personal information is handled exclusively for its intended purpose, such as processing loan applications or providing banking services.

Who Are Nedbank Loans Best Suited For?

- Borrowers needing R2 000 to R400 000 for personal, home, education, or debt-related expenses.

- Individuals earning at least R5 000/month with electronically deposited income.

- South African residents aged 18 to 65 with valid ID and proof of income.

- Those seeking flexible repayment terms from 6 to 72 months.

- Applicants preferring online, app, or in-branch applications.

Is Nedbank a Safe and Good Option?

Nedbank is a licensed financial services provider in South Africa, regulated by the National Credit Regulator (NCRCP16). It offers a wide range of lending options, including personal loans, home loans, vehicle finance, student loans, short-term credit, overdrafts, and solar finance. Personal loan amounts range from R2 000 to R400 000, with repayment terms between 6 and 72 months. Applications can be completed online, via the Nedbank Money app, internet banking, or at a branch. Required documents include a valid South African ID, proof of income, proof of residence, and recent bank statements.

The bank prioritises responsible lending by offering clear information on interest rates, fees, and repayment terms. All applications are subject to affordability checks. Once approved, funds are typically disbursed within 24 to 48 hours. With its strong reputation, broad product range, and focus on security and transparency, Nedbank is a reliable option for South Africans seeking flexible credit solutions.

How Much Money Can I Request from Nedbank?

You can request a personal loan starting at R2 000 up to a maximum of R400 000, depending on your income, credit history, and affordability assessment. Approval and the amount you qualify for are influenced by your monthly income (with a minimum requirement of R5 000), your credit score, and your current expenses and debts. Flexible repayment terms are available, usually ranging from 6 to 72 months, with interest rates determined by your risk profile.

How Nedbank Creates Personalised Loan Offers

The bank uses a combination of factors to craft personalised loan offers, including your credit score, income level, existing financial commitments, and the purpose of the loan. By thoroughly analysing these details, the most suitable loan amount, interest rate, and repayment term can be determined for each applicant. This approach ensures that borrowers receive offers that are tailored to their individual financial needs and capabilities.

How Long Does It Take to Receive My Loan Payout from Nedbank?

Average Processing Times

Once your loan application is approved, Nedbank typically disburses the funds promptly. For personal loans, the money can be in your account within a few business days. Home loans and business loans might take a bit longer due to the additional documentation and verification processes involved.

Factors Affecting Withdrawal Speed

Several factors can impact the speed at which you receive your loan amount. These include the completeness and accuracy of the documentation provided, the type of loan applied for, and any bank-specific processing times. Additionally, any discrepancies in the application can lead to delays, emphasising the importance of providing accurate and complete information.

Nedbank: Overview in Detail

| Name | Nedbank Limited |

|---|---|

| Financial Status | Public Company (Listed on Johannesburg Stock Exchange) |

| Products | Personal Loans, Home Loans, Vehicle Finance, Student Loans, Overdrafts, Solar Finance |

| Minimum Age | 18 years |

| Minimum Loan Amount | R2 000 |

| Maximum Loan Amount | R400 000 (Personal Loans) |

| Minimum Term | 6 months |

| Maximum Term | 72 months |

| Interest Rate (APR) | Personalised; up to 34.05% per annum |

| Monthly Interest Rate | Based on individual credit profile |

| Early Settlement | Allowed with no penalties |

| Repayment Flexibility | Fixed monthly repayments via debit order; term selected by borrower |

| NCR Accreditation | Yes (NCRCP16) |

| Our Opinion | ✅ No early settlement penalties ✅ Flexible terms ✅ Rewards & cashback ⚠️ Higher rates possible with poor credit record |

| User Opinion | ✅ Easy application process ✅ Strong support channels ⚠️ Some delays in disbursement reported |

How Do I Repay My Loan from Nedbank?

Repayment Options and Plans

Nedbank offers multiple repayment options to accommodate the diverse needs of its borrowers. Customers can set up automatic monthly debits from their accounts, ensuring timely repayments. Alternatively, borrowers can use the bank’s online and mobile platforms to make manual payments. For those who prefer offline methods, payments can also be made at Nedbank branches.

Possible Fees and Penalties

While Nedbank is transparent about its fee structure, it’s essential to be aware of any potential fees and penalties associated with loan repayments. Late payment fees might be levied if a borrower misses a repayment deadline. Additionally, early repayment of the loan might attract a fee, depending on the terms of the loan agreement. It’s always advisable to read the loan agreement carefully and clarify any doubts with the bank to avoid unexpected charges.

Pros and Cons of Choosing Nedbank

Advantages of Choosing Nedbank

- Long-standing Reputation: With over a century of experience, the bank has a proven track record in the banking industry.

- Diverse Services: From personal banking to corporate solutions, the bank offers a comprehensive range of services.

- Innovative Solutions: The bank has been known for its forward-thinking approach, often being early adopters of new banking technologies.

- Community Focus: The bank has numerous initiatives aimed at community development and sustainability.

Disadvantages of Choosing Nedbank

- Size Can Be a Drawback: Being a large institution, some customers feel that the bank lacks the personal touch of smaller banks.

- Digital Platform Issues: Some users have reported glitches and issues with the bank’s online and mobile platforms.

- Customer Service Variability: While many praise the bank’s customer service, others have had less than satisfactory experiences.

Online Reviews of Nedbank

Nedbank, one of the prominent financial institutions in South Africa, has received a mix of reviews from its customers. On Trustpilot, a platform where customers can share their experiences, Nedbank has garnered a range of feedback.

Some customers have praised the bank for specific services, mentioning successful refund processes and the efficiency of certain departments. For instance, one customer mentioned a swift refund process, expressing satisfaction with the outcome.

Many thanks to Nedbank for the speedy payment of my funeral insurance claim, you made it possible for me to give my mom a decent send off. Many many thanks.

I have been dealing with Nedbank for over 20 years and have had no problems. I’m extremely happy with Nedbank.

However, like any large institution, Nedbank has also faced criticism. Some customers have expressed dissatisfaction with the bank’s responsiveness, especially regarding the mobile app. Issues with transaction references and OTPs not coming through have been highlighted, causing inconvenience to the users.

Another area of concern for some has been the bank’s credit card division. There were instances where customers felt that the bank added unnecessary service costs, making the process of closing accounts challenging.

Despite the challenges, there were also positive reviews. Some customers have had long-standing relationships with Nedbank and have appreciated specific services, especially in the savings department. They’ve highlighted offerings like the “Just Invest” feature, which provides a 7% return, as particularly beneficial.

Still not recieved my refunds. Lame excuse of not paying my refund.

They don’t care about clients and will play the delay tactic everytime you need help……Please stay away from them.

Customer Service at Nedbank

Contact Channels

Phone number:

Office: 0800 555 111

Hours of operation:

Monday to Friday: 08:00 – 16:30

Saturday to Sunday: Closed

Postal address:

Nedbank Group Limited, 135 Rivonia Road, Sandown, Sandton, 2196, South Africa

PO Box 1144, Johannesburg, 2000

Alternatives to Nedbank

While Nedbank is a prominent financial institution in South Africa, there are other banks and financial service providers in the region. Some of the notable alternatives include:

Comparison Table

| Bank Name | Services Offered | Unique Feature |

|---|---|---|

| Nedbank | Personal banking, business banking, wealth management, and investment solutions. | Greenbacks rewards program focusing on sustainable and eco-friendly rewards. |

| Standard Bank | Personal and business banking, wealth creation, and insurance. | UCount Rewards program offering points for everyday spending. |

| ABSA | Retail, business, corporate, and investment banking. | ABSA Rewards program where customers earn cash back for using their debit or credit card. |

| First National Bank (FNB) | Personal, business, and private banking, along with wealth and investment services. | eBucks rewards program, one of the most popular loyalty programs in South Africa. |

| Fundi | Education-specific financing, Tuition, accommodation, books, and devices | Fundi card |

History and Background of Nedbank

A name synonymous with banking in South Africa, this institution has roots dating back to the early 19th century. Established in 1888 as the Netherlands Bank of South Africa, it was originally formed to serve the booming gold industry. Over time, through mergers, acquisitions, and strategic growth, it evolved into one of the country’s four largest banking groups.

The organisation’s rich history reflects a deep commitment to the economic development of South Africa. For decades, it has been at the forefront of financial innovation, continually adapting to meet the changing needs of its clients.

Company’s Mission and Vision

The mission is to use financial expertise to do good for individuals, families, businesses, and society as a whole. The bank aims to align its objectives with the dreams, aspirations, and financial goals of its customers. The vision is to be the most admired financial services provider in Africa, recognised for excellence, value creation for stakeholders, and meaningful societal impact.

Conclusion

Nedbank, with its rich history and commitment to excellence, remains a formidable force in the South African banking landscape. Its dedication to innovation, coupled with its focus on community and sustainability, makes it a preferred choice for many. However, like all institutions, it has its challenges. Potential customers should weigh the pros and cons, considering their individual needs, before making a decision.

Frequently Asked Questions

You can visit any of their branches with the required documents, such as proof of identity and proof of address. Alternatively, some account types might be available for online registration via the Nedbank website.

Nedbank offers a range of digital banking solutions, including online banking, a mobile banking app, and various digital payment methods.

Nedbank provides multiple channels for customer support, including a helpline, email support, and in-person assistance at their branches.

Yes, like most banks, Nedbank might have monthly maintenance fees for some account types. It’s best to check their official website or contact their customer service for detailed information.

If your card is lost or stolen, it’s crucial to report it immediately. You can do this by calling Nedbank’s helpline or using their mobile app.