FinChoice [Finchoice.co.za] offers a range of financial solutions tailored to meet the needs of individuals seeking quick and convenient loan options. This review aims to provide a comprehensive and unbiased look at what FinChoice brings to the table in terms of loan offerings, customer service, and overall reliability.

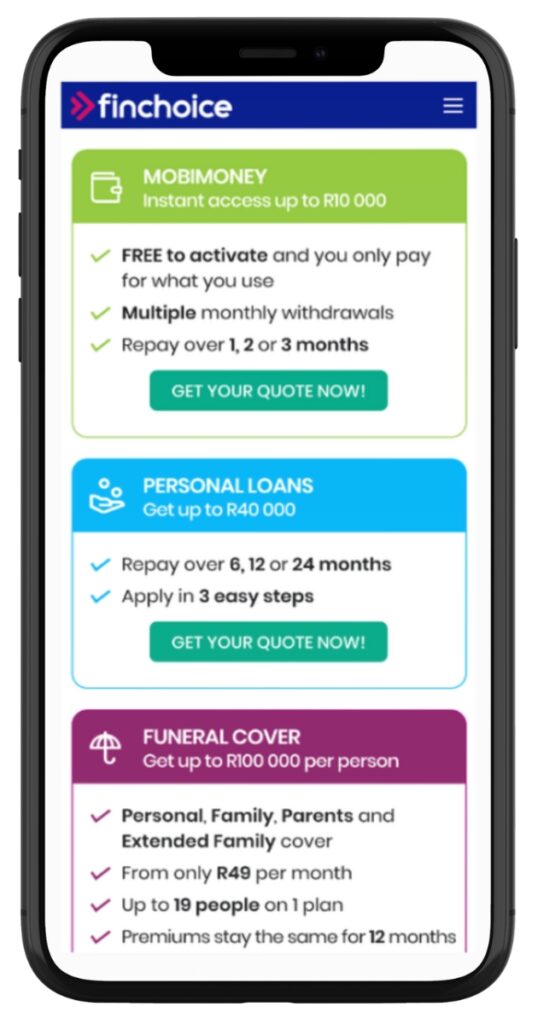

FinChoice offers loan amounts ranging from R500 to R25 000, with some customers qualifying for up to R40 000. Repayment terms span from 1 to 3 months for smaller loans to 6, 12 or 24 months for personal Flexi loans. If you’re looking for a mobile-friendly loan option to cover anything from urgent costs to planned expenses, FinChoice may be a suitable choice.

FinChoice: Quick Overview

Loan Amount: R500 – R25 000 (up to R40 000 for select clients)

Loan Term: 1 to 24 months

Interest Rate: Based on credit profile; capped per National Credit Act (up to ±27.75% p.a.)

Fees: Initiation and monthly service fees apply; amounts depend on loan size and term

Loan Types: Personal Flexi Loans, MobiMoney™, KwikAdvance, optional Funeral Cover

FinChoice Full Review

Experiences with FinChoice Loan

Navigating through the loan application process can often feel like a tumultuous journey. With FinChoice, the experience seems to be designed with the customer’s ease in mind. From the initial application stages to the final loan approval, this lender appears to prioritise simplicity and clarity. Customers have access to a variety of loan options, each tailored to meet different financial needs and circumstances. The feedback from customers illustrates a level of satisfaction that speaks volumes about the company’s dedication to customer service. Testimonials often highlight the ease of the application process, the responsiveness of customer service, and the overall reliability of the loan services provided.

Who Can Apply for a FinChoice Loan?

Criteria for Potential Borrowers

FinChoice is quite inclusive with its eligibility criteria, ensuring that a broad spectrum of individuals can access their loan products. To apply for a loan, an applicant must be 18 years or older and a resident of South Africa. A consistent source of income is also a prerequisite, ensuring that the borrower has the means to repay the loan. Documentation such as proof of income, identification, and details of a valid bank account are necessary to facilitate the application process. The emphasis here is on accessibility, ensuring that the loans are not just limited to a specific demographic but are available to a wider audience who may need financial assistance.

Differences from Other Loan Providers

When comparing Finchoice.co.za to other loan providers, certain distinctions come to the forefront. One notable difference is the flexibility in their loan offerings. FinChoice provides a range of loan options with various repayment terms, allowing borrowers to choose a loan that aligns with their financial circumstances. Additionally, the application process is streamlined and user-friendly, enabling customers to apply and receive feedback with minimal hassle. The company also places a significant emphasis on customer service, ensuring that customers receive the necessary support and guidance throughout the loan application and repayment process. This customer-centric approach appears to be a defining feature that sets FinChoice apart from other lenders in the financial landscape.

About Arcadia Finance

Arcadia Finance facilitates the process of securing loans from a range of banks and lenders. Fill out a free application and get loan offers from up to 19 different lenders. We collaborate with well-established, trustworthy lenders who are licensed by the National Credit Regulator (NCR) in South Africa.

FinChoice Loan

What makes the FinChoice loan unique?

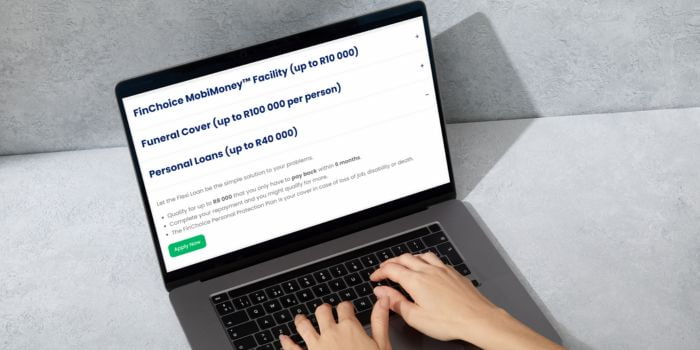

FinChoice offers a standout approach in the South African lending sector thanks to its flexibility and user-centric design. Its MobiMoney facility operates like a credit card on your phone, allowing borrowers to access R500 up to R10 000 with repayment terms of 1 to 3 months, ideal for those needing quick, small‑scale funding. More substantial personal loans can be drawn up to R25 000, repaid over six, 12 or 24 months, with the facility to draw more funds as you repay, granting borrowers ongoing access to credit as needed. The application process for both options is entirely online via the Mobi portal, providing rapid approval and disbursement without the need to visit a physical branch.

FinChoice also sets itself apart through its all‑round commitment to customer control. Borrowers can skip a repayment in months of financial strain and track progress via the same online platform. Every stage, from application through repayment, is managed through the FinChoice portal, which offers real-time updates, payment flexibility, and no data‑charge usage for its mobile site. These features, combined with regulated oversight as an NCR-registered lender, ensure borrowers enjoy both convenience and protection while managing their loan more intuitively

Types of Loans Offered by FinChoice

FinChoice offers the following types of loans:

Personal / Flexi Loan

This loan allows you to qualify for up to R8 000, repayable within 6 months. If you complete your repayment, you may qualify for up to R40 000. The loan is designed to be a simple solution for immediate financial needs.

Comes with a Personal Protection Plan for cover in case of loss of job, disability, or death).

MobiMoney™ Facility

- Offers access to up to R10 000, with the flexibility to repay over 1, 2, or 3 months. The unique feature of this facility is that you only pay for what you use.

- Provides same-day withdrawals of between R100 and R10 000, and allows for the purchase of airtime, data, and electricity 24/7

Reloan (Loan Top-Up)

Existing customers can top up their current facility for extra funds. Useful for recurrent expenses or situations where a little extra financial breathing room is required.

Requirements for a FinChoice Loan

Getting a loan from this lender involves a process that requires applicants to provide certain documents and information. The necessary documentation primarily includes a valid South African ID and proof of income to validate the applicant’s ability to repay the loan. Additionally, applicants must provide details of a valid bank account where the loan amount can be deposited.

More:

- Affordability Assessment: FinChoice conducts an affordability assessment as per the National Credit Act (NCA) guidelines. This assessment ensures they lend you only what you can afford to repay. During this process, they will ask questions about your income and expenses.

- Proof of Income: To complete the loan application, you need to provide proof of income. This can be in the form of:

- The 3 most recent payslips

- Bank statements

- Pension slips

- Documentation Submission: You are encouraged to submit your proof of income documents monthly, even if you are not planning on taking another loan. This allows for instant approval when you do need a loan.

- Bank Statements: If you bank with ABSA, Nedbank, or Standard Bank, FinChoice can request your bank statements directly with your permission.

- Mobile Number: KwikServe® services are accessed with your registered cell phone, indicating the need for a mobile number during the application process

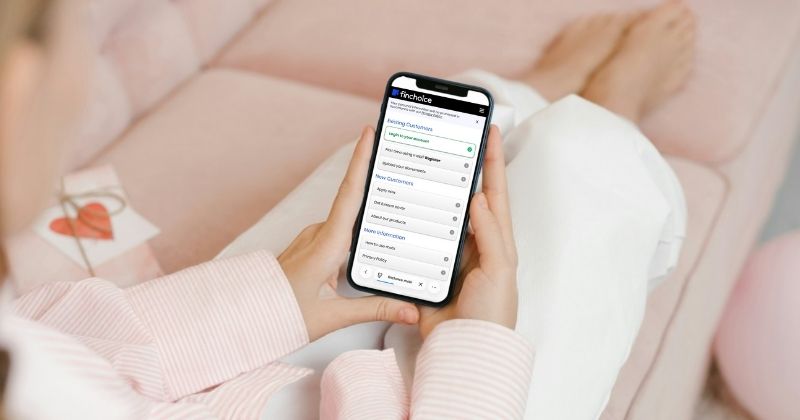

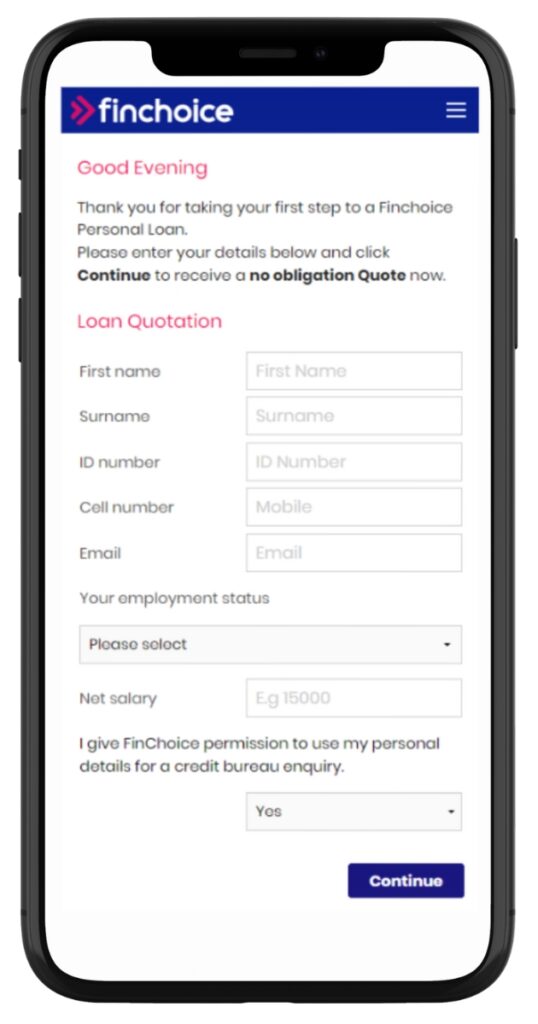

Step-by-Step Guide to Applying for a Loan with FinChoice

To apply for a loan at FinChoice, follow these steps:

Step 1. Visit Finchoice.co.za

Step 2. Apply up to R40 000 instantly or Reapply via “Manage Account.”

Step 3. Choose between MobiMoney and Personal Loans.

Step 4. Provide personal and employment details for a quote.

Step 5. Submit the required documents, such as proof of income.

Step 6. Wait for the approval decision, which may include an affordability assessment.

Step 7. Once approved, the loan amount will be disbursed to your account.

Eligibility Check

FinChoice offers tools that allow potential borrowers to pre-check their eligibility for a loan. These tools are designed to provide applicants with preliminary insights into their loan options, helping them understand what to expect in terms of loan amounts and repayment terms. Utilising these tools can be a valuable first step in the loan application process, enabling applicants to gauge their eligibility before proceeding with the formal application. This approach enhances the transparency of the process, allowing applicants to make informed decisions based on their eligibility status.

Security and Privacy

The company utilises secure technologies and practices to ensure that the data shared by customers during the loan application and management processes remains protected against unauthorised access and breaches.

This lender’s privacy policies further reinforce its commitment to data security. These policies delineate how customer information is handled, used, and protected, ensuring that customers have clarity and confidence in the company’s data management practices. The policies are crafted to comply with legal regulations and standards, ensuring that data handling practices align with established norms and expectations.

Who Are FinChoice Personal Loans Best Suited For?

- Borrowers seeking R1 000 to R25 000 for personal, household, education, or debt consolidation expenses.

- Individuals with electronic income (e.g. salary, pension) and a reliable repayment history.

- South African residents aged 18 and above with valid ID, confirmed bank account, and proof of income.

- Those preferring repayment terms between 6 and 24 months, with an option to redraw as they repay.

- Applicants who value a fully online experience, through the mobi portal, with no need to visit a branch.

Is FinChoice a Safe and Good Option?

FinChoice is a registered credit provider in South Africa, regulated by the National Credit Regulator (NCRCP 8162). It offers flexible personal loans such as MobiMoney™, KwikAdvance, and Flexi loans, with amounts ranging from R100 to R25 000 and repayment terms from 1 to 24 months. Applications are completed entirely online via the FinChoice Mobi portal. To apply, you’ll need a valid South African ID, proof of income, and an active bank account.

FinChoice conducts affordability assessments in line with the National Credit Act and provides clear details on interest rates and fees. Loans can be settled early without penalties, and approved funds are usually paid out shortly after verification. With its online convenience, responsible lending approach, and regulated status, FinChoice is a practical option for South Africans needing short- to medium-term credit.

How Much Money Can I Request from FinChoice?

You can apply for a personal loan from FinChoice starting at R8 000 up to R40 000, depending on the loan type and your credit profile. Repayment terms range between 6 and 36 months, and you also have access to short-term options like KwikAdvance (up to R3 500 repayable on your next payday) and MobiMoney (up to R10 000 with 1–3 month terms). The exact amount you’re eligible for will be based on your income, credit history, and affordability assessment in line with responsible lending practices.

How FinChoice Creates Personalised Loan Offers

FinChoice takes a personalised approach to loan offerings. The company assesses each application on an individual basis, considering various factors such as the applicant’s income, credit history, and repayment capacity. This detailed evaluation allows them to create loan offers that are customised to meet the specific needs and financial circumstances of each borrower, enhancing the likelihood of loan approval and successful repayment.

FinChoice Personal Loans: Overview in Detail

| Name | FinChoice Loans |

|---|---|

| Product | Personal & short-term loans (MobiMoney™, KwikAdvance, Flexi loans) |

| Maximum Loan | Up to R25 000 (varies by product); up to R40 000 for select clients |

| Minimum Loan | R500 |

| Loan Terms | 1–3 months (MobiMoney); next payday (KwikAdvance); 6–24 months (Flexi) |

| APR | Typically 20%–60%; regulated by NCR (max ~27.75% for personal, monthly caps for short-term) |

| Repayment Frequency | Revolving or instalments with flexible options including early settlement |

| Early Settlement | Allowed; borrowers repay without penalty |

| Repayment Flexibility | Options to skip a repayment; redraw as repayments are made |

| NCR Accredited | Yes; fully compliant under the National Credit Act |

| Our Opinion | ✅ Strong online convenience, skip-payment feature, no collateral required ⚠️ Best suited for small to mid-sized loans; no physical branches |

| User Opinion | ✅ Fast processing; flexible repayment ⚠️ Some complaints regarding app issues or repayment communication |

How Long Does It Take to Receive My Loan Payout from FinChoice?

The processing time for receiving money from them is relatively efficient. The company aims to facilitate a swift and smooth transaction process, ensuring that approved loans are disbursed promptly. However, the actual time may vary based on several factors, including the verification of provided information and documents, as well as banking processes.

How Do I Repay My Loan from FinChoice?

Repaying a loan from them is facilitated through various repayment options, allowing borrowers to choose a method that is most convenient for them. The company provides detailed information on the repayment terms, ensuring that borrowers are well-informed about their obligations. Additionally, it’s essential to be aware of any potential fees or penalties that may apply, such as those associated with late or missed payments, to manage the repayment process effectively and avoid any unnecessary costs.

Pros and Cons of FinChoice

Navigating through the world of loans and financial services often involves weighing the benefits against the drawbacks. With FinChoice, there are several pros and cons to consider when evaluating their loan offerings.

Pros of FinChoice

- Flexibility: FinChoice offers a variety of loan products with different repayment terms, allowing borrowers to choose options that align with their financial situations.

- Customer Service: The company prioritises customer satisfaction, ensuring that borrowers receive adequate support and guidance throughout the loan process.

- Ease of Application: The application process is streamlined and user-friendly, facilitating a smooth and efficient experience for applicants.

Cons of FinChoice

- Loan Amounts: The maximum loan amount offered by FinChoice might not be sufficient for borrowers looking for substantial financial assistance.

- Interest Rates: While competitive, the interest rates can vary, and borrowers need to assess whether the rates align with their repayment capabilities.

- Eligibility: The eligibility criteria, while inclusive, might still limit access for some potential borrowers, particularly those without a consistent source of income.

Online Reviews of FinChoice

Online reviews offer a window into the customer experiences with FinChoice. These reviews, often a mix of positive and negative, provide insights into various aspects such as the application process, customer service, and the overall satisfaction levels of the borrowers. Customers commonly highlight the ease of application and the responsiveness of the lender’s team. These reviews can be a valuable resource for potential borrowers, offering a more nuanced understanding of what to expect when considering FinChoice as a loan provider.

Flexible financial support… convenient.Thank you so much.

Helpful and user friendly system that cuts the fuss and bother of accessing short term finance. I thoroughly recommend FinChoice.

Their communication skills are terrible. Applied for an urgent loan and they decided to pay me out 1 day before I get my salary. Do not bother with these guys.

My account was double debited and they simply refuse to pay me back. I simply refuse to give you another cent.

Customer Service

Customer service is a pivotal aspect of the borrowing experience, and FinChoice appears to place a significant emphasis on ensuring that customers receive the necessary support and assistance. If there are further questions or if any clarification is needed, they provide various channels:

Finchoice Contact Channels

Phone number:

Office: 0861 346 246

Hours of operation:

Monday to Friday: 07:30 – 19:00

Saturday: 08:00 – 17:00

Sunday: 09:00 – 14:00

Public Holidays: 08:30 – 15:00

Closed: Christmas Day, New Year’s Day, Good Friday

Alternatives to FinChoice

Comparison Table

Here’s a comparison table of FinChoice and four other lenders in South Africa:

| Criteria | FinChoice | Sunshine Loans | RCS | ShowTime Finance |

|---|---|---|---|---|

| Loan Amount | R500 – R40 000 | R500 – R4 000 | R2 000 – R250 000 | R1 000 – R250 000 |

| Interest Rate | 5% | 10% | 15% | Varies |

| Loan Term | 1 – 24 months | 4 – 49 days | 12 – 60 months | 6 – 84 months |

| More Info | Sunshine Loans Review | RCS Review | ShowTime Finance Review |

History and Background of FinChoice

FinChoice has established itself as a reputable financial services provider, carving a niche in the competitive landscape of personal loans. The company’s inception was rooted in a vision to offer flexible and accessible financial solutions tailored to meet the diverse needs of customers. Over the years, this credit provider has cultivated a commitment to delivering quality services, fostering a relationship of trust and reliability with its customers. The company’s mission revolves around providing financial products that resonate with the individual needs and circumstances of its borrowers, ensuring that they receive solutions that are both practical and manageable.

Conclusion

Taking into consideration various aspects such as loan offerings, customer service, and overall user experience, FinChoice deserves a commendable rating. Their dedication to providing tailored loan solutions that meet individual needs and circumstances is a significant strength. The positive customer testimonials and the company’s focus on transparency and integrity further bolster its standing as a reliable lender.

Frequently Asked Questions

FinChoice offers a variety of loans to cater to different financial needs. These range from short-term loans for immediate financial requirements to more substantial loans for significant expenses or investments. The diversity in loan offerings ensures that borrowers can find a loan that aligns with their specific financial needs and repayment capabilities.

This lender aims to process and approve loans promptly. Once a loan is approved, the funds are disbursed efficiently, ensuring that borrowers have access to the funds within a reasonable timeframe. However, the actual disbursement time may vary based on various factors such as verification processes and banking procedures.

The maximum loan amount offered by them varies based on the borrower’s financial assessment and the type of loan chosen. Borrowers can access loan amounts that align with their repayment capabilities and financial needs, ensuring that the loan terms are manageable and practical.

FinChoice provides tools and resources that allow potential borrowers to pre-check their eligibility for a loan. These tools offer preliminary insights into the loan options available based on the borrower’s financial circumstances, enabling them to gauge their eligibility before proceeding with the formal application process.

Applying for a loan with FinChoice requires various documents such as proof of identity, proof of income, and bank account details. These documents facilitate the application process, enabling a smooth and efficient loan approval journey.