Known for its straightforward application process and competitive interest rates, African Bank [Africanbank.co.za] provides personal loans tailored to a wide range of financial needs, from debt consolidation to unexpected expenses. In this review, we explore the bank’s loan features, eligibility requirements, customer experience, and how it compares to other lenders, helping you decide if it’s the right choice for your financial journey.

African Bank offers personal loans ranging from R2 000 to R350 000, with flexible repayment terms from 7 to 72 months. The application process is simple and accessible, featuring fast credit checks and affordability assessments to provide prompt loan decisions.

African Bank: Quick Overview

Loan Amount: R2 000 – R350 000

Loan Term: 7 to 72 months

Interest Rate: From 12% per annum, based on individual credit profile

Fees: Initiation fee (once-off), monthly service fee (included in repayment schedule), optional Credit Life Insurance premium

Loan Types: Personal loans, debt consolidation loans, 12% loan

About Arcadia Finance

Navigate the loan landscape effortlessly with Arcadia Finance. Our free application connects you to a selection of up to 19 different lenders. We ensure peace of mind by only working with lenders who are accredited by the National Credit Regulator in South Africa.

African Bank Lender Full Review

African Bank’s customers often commend the simplicity and swiftness of the application process as a significant advantage. Many appreciate the bank’s straightforward approach, with no concealed clauses and just a clear and concise process. Borrowers also highlight flexibility, particularly with customisable repayment terms spanning from 7 to 72 months. This adaptability empowers borrowers to tailor their loans to their financial situations, alleviating the stress associated with repayments.

However, it’s not all smooth sailing. Some customers point out that the higher interest rates can pose a challenge, especially for longer-term loans. It’s essential to note that although the bank advertises rates starting at 15%, these can escalate to 24.50% based on your credit profile. Consequently, for some individuals, the loan may end up being more costly than initially anticipated.

What emerges prominently in customer feedback is the bank’s dedication to transparency and customer support. Borrowers frequently highlight the helpfulness of this bank’s staff, who are willing to go the extra mile to explain the intricacies of the loan, ensuring that customers fully comprehend the terms they are agreeing to.

Types of Loans Offered by African Bank

Below is a breakdown of the different types of loans offered by African Bank, along with their features and suitable purposes:

Personal Loans

African Bank’s personal loans are unsecured, meaning no collateral is required. Customers can borrow amounts ranging from R2 000 up to R350 000, with repayment terms spanning from 7 to 72 months. These loans are versatile and can be used for various purposes, such as education, home improvements, or unexpected expenses. Interest rates are fixed, providing predictability in monthly repayments.

Consolidation Loans

Designed to simplify debt management, African Bank’s consolidation loans allow customers to combine up to five existing debts into a single loan. This approach can lead to a lower overall monthly repayment and a fixed interest rate, making it easier to manage finances. Borrowers can consolidate debts up to R350 000, streamlining their financial obligations into one manageable payment.

12% Loan

African Bank offers a special loan product known as the 12% Loan, which provides a fixed interest rate of 12% per annum. This loan is ideal for customers seeking predictability in their repayment amounts over the loan term. The fixed rate ensures that monthly payments remain consistent, aiding in effective budgeting.

Who Are African Bank Loans Best Suited For?

Their personal loans are ideal for individuals who:

- Need access to flexible funding for personal expenses, education costs, home improvements, or debt consolidation

- Have a stable source of income and can provide proof of employment and regular earnings

- Prefer borrowing larger loan amounts, with options ranging from R2,000 up to R350,000

- Value a straightforward, convenient application process, available online, through the mobile app, or at a branch

- Require flexible repayment terms between 7 and 72 months with predictable, fixed monthly instalments

Is African Bank a Safe and Good Option?

African Bank is a registered credit provider regulated by the National Credit Regulator (NCRCP7638), making it a legitimate and reliable lender in South Africa. The bank offers personal loans ranging from R2,000 to R350,000, with flexible repayment terms of 7 to 72 months. Borrowers can apply easily online, via the their app, or at one of their branches nationwide, with basic documentation such as a valid South African ID, proof of income, and three months’ bank statements required.

This bank focuses on transparent and responsible lending, providing clear information on interest rates, fees, and repayment terms upfront. Loan applications are subject to affordability assessments, and once approved, funds are typically paid directly into the borrower’s bank account. With its commitment to customer service, flexible loan options, and strong digital platforms, this bank is a suitable choice for individuals seeking reliable personal loan solutions.

Requirements for an African Bank Loan

Acquiring a loan from African Bank is a straightforward procedure, yet, as with any financial commitment, it involves specific prerequisites. Grasping these requirements is crucial for a successful loan application. Here’s what you need to know:

Basic Eligibility Criteria

- Age: You must be at least 18 years old. This is a standard requirement for any financial contract in South Africa.

- Employment: Steady employment is essential. This bank will scrutinise your employment history to ensure a consistent income that supports your loan repayments.

- Income: Your income level plays a vital role in determining your borrowing limit and your ability to repay the loan. They necessitate proof of a stable income.

- Credit Score: A positive credit history signals to the lender that you are a responsible borrower. They will assess your credit score during the loan application process.

Documents and Information Needed

To apply for a loan with African Bank, you’ll need to provide several key documents and pieces of information:

- Identification: A valid South African ID book or Smart ID card is essential, verifying your identity and age.

- Proof of Income: Recent payslips, usually the most recent one, are required. If you’re self-employed, additional documentation like bank statements or tax returns may be necessary to validate your income.

- Bank Statements: This bank typically requests your latest three months’ bank statements. These should reflect consistent income deposits and provide an overview of your financial behaviour.

- Proof of Residence: A recent utility bill or a similar document showing your current address is needed. This is a standard requirement for most financial institutions in South Africa.

- Additional Information: Depending on the loan type and amount, they might require further details, such as your current financial obligations (other loans, credit card debts, etc.), monthly expenses, and the purpose of the loan.

It’s important to have all these documents handy when applying for a loan. This bank, like many lenders, has transitioned many of its services online, enabling the submission of documents digitally for a more convenient and faster process.

Step-by-Step Guide to Applying for a Loan with African Bank

Step 1. Check if you meet the basic requirements like ID, income, and bank statements.

Step 2. Choose to apply online, via the app, by phone, or at a branch.

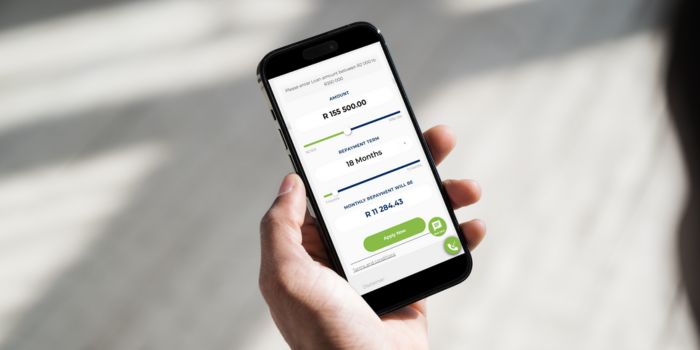

Step 3. Use the loan calculator to estimate your repayment.

Step 4. Tap “APPLY NOW” to start your loan application.

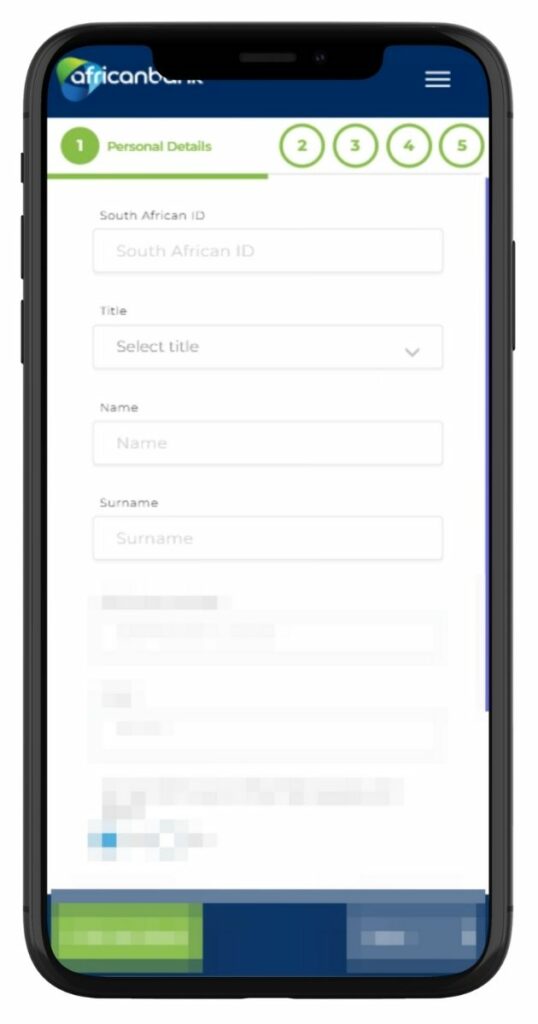

Step 5. Enter your South African ID, title, name, and surname.

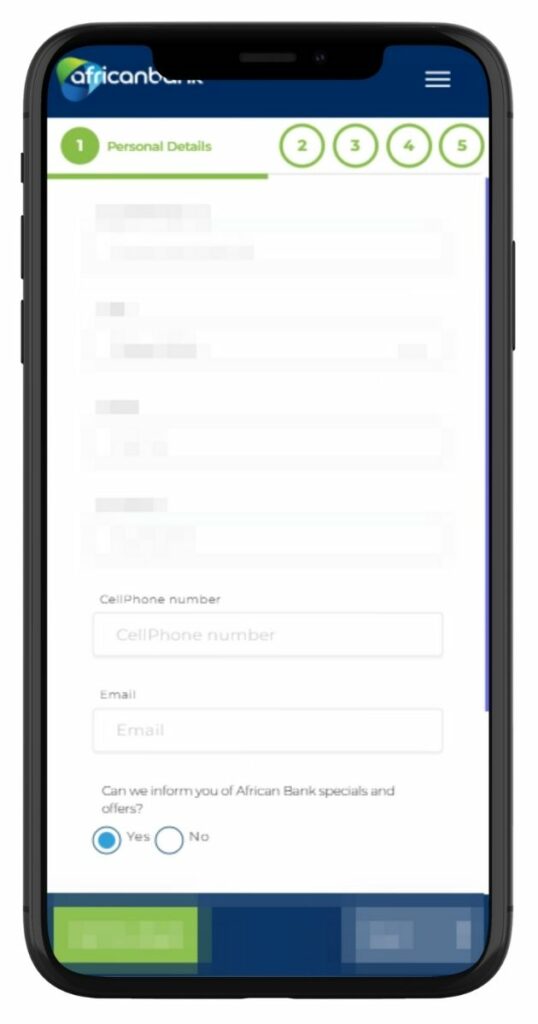

Step 6. Fill in your cellphone number and email address, then choose if you want to receive offers.

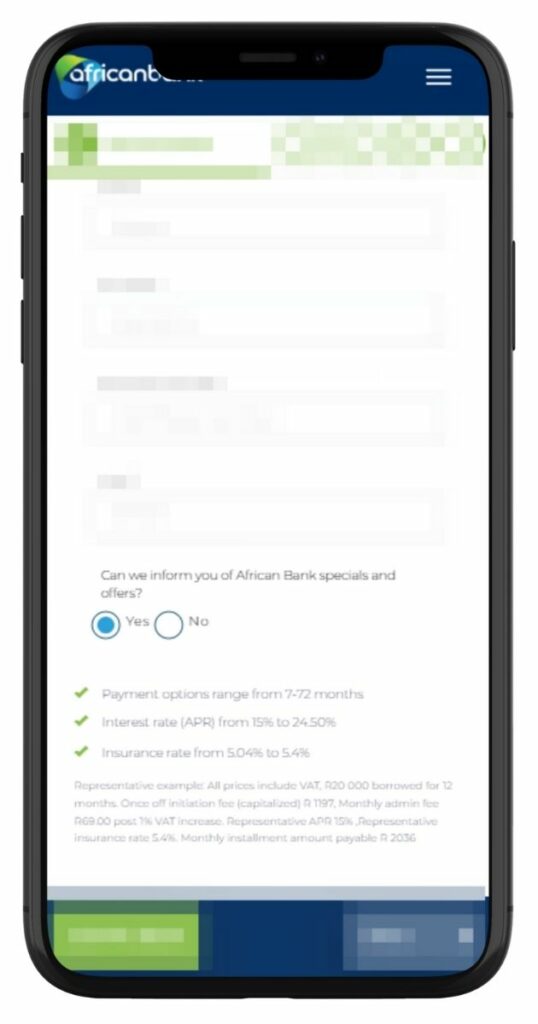

Step 7. Review available payment options, interest rates, and insurance details.

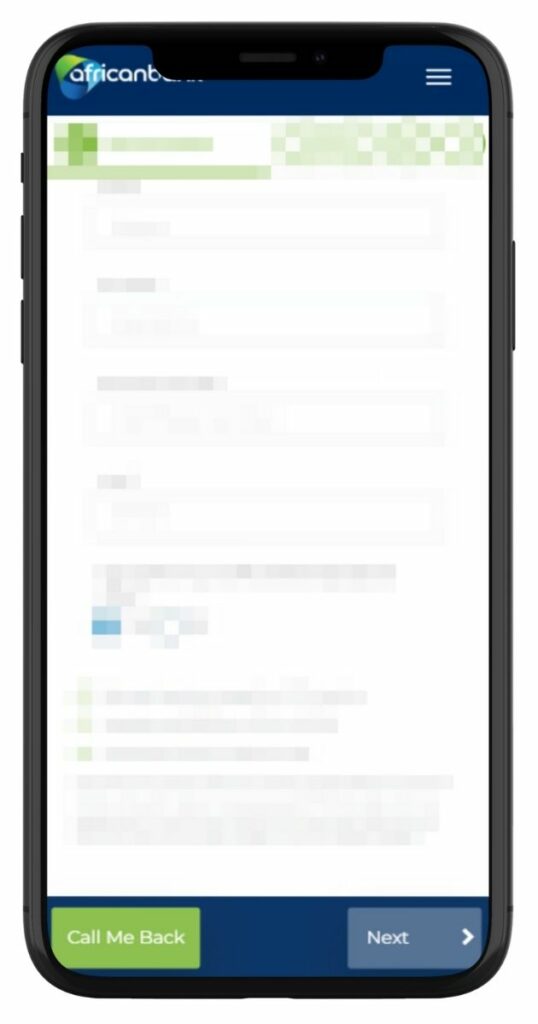

Step 8. Click “Next” to continue or “Call Me Back” if you need assistance.

Step 9. Fill out the whole application form and upload your documents.

Step 10. Wait for approval after a credit check and document review.

Step 11. Review and accept the loan offer once approved.

Step 12. Receive funds in your account, usually within 24 hours.

Step 13. Repay the loan via monthly debit orders.

Security and Privacy at African Bank

African Bank prioritises the security and privacy of its customers and has implemented robust measures to protect sensitive data. Here’s how African Bank ensures the security and privacy of its clients:

- Data Encryption: Employs advanced encryption technologies to secure data transmissions between your device and their servers. This ensures that personal and financial information captured is converted into codes that are challenging for unauthorised parties to decipher.

- Secure Online Platforms: If you’re applying for a loan or managing your account, their online platforms are built with security in mind. They use secure protocols and systems to protect your information from unauthorized access.

- Regular Security Audits: To uphold high security standards, this bank conducts regular audits and checks on their systems. This proactive approach helps identify and rectify any vulnerabilities promptly.

- Fraud Monitoring and Prevention: Has systems in place to monitor transactions for suspicious activities. If any unusual patterns indicating fraud are detected, the bank takes immediate action to protect the customer’s account and personal information.

How Much Money Can I Request from African Bank?

When considering a loan from African Bank, it’s crucial to grasp the range of loan amounts available and how the bank determines the amount you can borrow.

Minimum Loan Amount: African Bank offers personal loans starting from as low as R2 000. This minimum amount provides convenience for those seeking a small financial boost to cover minor expenses or emergencies.

Maximum Loan Amount: On the higher end, African Bank can provide loans up to R350 000. This maximum limit is beneficial for covering significant expenses such as home renovations, higher education, or consolidating large debts.

Receiving Offers

African Bank tailors its loan offers based on individual financial situations. When you apply for a loan, the bank considers your income, credit history, and existing financial obligations to determine how much you can responsibly borrow.

How African Bank Creates Personalised Loan Offers

Assessment of Financial Profile: The bank examines your income, employment stability, and monthly expenses. This assessment helps in understanding your financial capacity and determining how much you can afford in terms of loan repayments.

Credit Score Analysis: Your credit score plays a crucial role. A higher credit score might enable you to borrow more money at better interest rates, indicating a lower risk to the lender.

Debt-to-Income Ratio: This ratio measures how much of your income is already allocated towards debt repayment, influencing the amount African Bank is willing to lend.

African Bank – Overview in Detail

| Name | African Bank Personal Loan |

|---|---|

| Financial | Privately owned by the South African Reserve Bank, the Government Employees Pension Fund and a consortium of other banks; Regulated by SARB; Registered with NCR (NCRCP7638) |

| Product | Unsecured Personal Loans |

| Minimum Age | 18 years and older; must be a South African citizen or permanent resident |

| Minimum Amount | R2 000 |

| Maximum Amount | R350 000 |

| Minimum Term | 7 months |

| Maximum Term | 72 months |

| APR | From 12% per annum (based on individual credit profile) |

| Monthly Interest Rate | Approximately from 1% per month |

| Early Settlement | Allowed without heavy penalties; small admin fees may apply |

| Repayment Flexibility | Flexible terms (7–72 months); “Choose Your Break” option available once per year |

| NCR Accredited | Yes |

| Our Opinion | ✅ High maximum loan (up to R350 000) ✅ Flexible repayment terms ✅ Transparent fee structure ⚠️ Higher rates for low credit |

| User Opinion | ✅ Good for education, debt consolidation, emergencies ✅ Easy online/app applications ⚠️ Approval timelines can vary |

How Long Does It Take to Receive a Loan Payout from African Bank?

Application Review: After submitting your loan application and all required documents, African Bank typically processes applications within a few business days. However, the timeline can vary depending on the complexity of your financial situation and the completeness of your application.

Loan Approval and Disbursement: Once approved, the loan amount is usually disbursed promptly. In many cases, funds can be available in your account within 24 to 48 hours of loan approval.

Factors Affecting Withdrawal Speed

- Application Accuracy: If your application is accurately filled out and all necessary documents are provided promptly, processing can be expedited.

- Verification Process: The time taken for African Bank to verify your information can impact how quickly you receive your funds. Delays in verification may occur if there’s any discrepancy in your application or documents.

- Banking Procedures: The disbursement speed also depends on banking processes. For instance, interbank transfer times can influence how quickly you access the funds.

How Do I Repay My Loan from African Bank?

Repaying your loan from African Bank is designed to be as straightforward and flexible as possible, with various options to suit different financial situations. Understanding these repayment options, along with any potential fees and penalties, is crucial for managing your loan effectively.

Repayment Options and Plans

- Direct Debit Orders: The most common and convenient way to repay your African Bank loan is through a direct debit order. This automatic payment method ensures your loan repayment is deducted from your bank account monthly on a specified date, helping you avoid late payments.

- Electronic Funds Transfer (EFT): You can also choose to make payments via EFT from your bank account to African Bank. This method gives you more control over the payment timings but requires you to remember the due dates.

- At African Bank Branches: If you prefer making payments in person, you can do so at any African Bank branch. This option is useful if you’re depositing cash or need personal assistance.

- Online Banking: Using your bank’s online banking platform, you can set up payments to African Bank. This method is both convenient and allows you to keep a digital record of your transactions.

- Mobile App: On the African Bank banking app, payments can be made to your loan account.

Choosing Your Repayment Plan

Flexible Terms: African Bank offers repayment terms ranging from 7 to 72 months, allowing you to choose a term that aligns with your financial capacity.

Choose Your Break: African Bank might offer a unique feature like “Choose your Break,” where you can opt to take a break from your loan repayment once a year for a month. This can be particularly helpful during financially tight periods.

Possible Fees and Penalties

If a borrower misses a loan payment and delays in notifying the bank or filing an insurance claim, penalties may be applied. It’s important to communicate promptly with the bank to avoid such charges.

African Bank may recover from the customer any fees, taxes, or penalties imposed on either the bank or the customer under applicable laws or regulations.

Online Reviews of African Bank

Online reviews are a valuable resource for gaining insights into a company’s performance and customer satisfaction levels. They provide real-world experiences and opinions from various customers. Here’s a summary of what customers typically say about African Bank, based on online reviews:

Never have I ever received such quality service going above and beyond with kind friendly service.

Their respond is very fast. I was so happy with the way they respond. i can actually say. I was not ignored, they where very professional and acknowledge when they are wrong.

I have a loan with African bank and I paid up all the amount even asked for settlement letter so they give into me now my challenge is I cannot apply any loan to any banks anywhere they blacklisted me at African bank when I need clarity the give me different numbers of attorney which is not fair to me as a client want them to remove my name because I don’t owe them at all

I settled a loan with African Bank in full after it was handed over to their appointed attorneys. I received a formal settlement letter confirming that the debt was paid and the matter was closed.

Pros and Cons of African Bank Personal Loans

Pros of African Bank Personal Loans

- Flexible amounts and terms: Borrow between R2 000 and R350 000 over 7 to 72 months.

- Quick approval: Fast online or in-branch applications with speedy payouts.

- Transparent costs: Fees and charges clearly disclosed upfront.

- Built-in loan protection: Includes credit life insurance for peace of mind.

- Payment holiday option: Some loans allow a break from repayment when needed.

Cons of African Bank Personal Loans

- High interest for some: Rates can reach up to 24.5% based on credit score.

- Limited insurance choice: Must use the bank’s credit life cover.

- Added fees: Initiation and monthly service charges increase total cost.

- Strict credit checks: Poor credit history may lead to rejection.

- Customer service issues: Some report delays and poor communication.

Customer Service at African Bank

Customers can expect to receive assistance through:

Phone number:

Office: 0861 111 011

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday: 08:00 – 13:00

Sunday & Public Holidays: Closed

Postal address:

123 Oxford Road, Corner Cotswold Drive, Saxonwold, Johannesburg, Gauteng, 2196, South Africa

Alternatives to African Bank

When considering alternatives, you might explore other financial institutions in South Africa, such as:

- Standard Bank

- Nedbank

- First National Bank (FNB)

- Capitec Bank

Each of these banks offers a range of financial products and services that may suit different needs. It’s advisable to compare the offerings, terms, and customer reviews of these institutions to find the one that aligns best with your requirements and preferences.

Comparison Table

| Lender | Loan Amount Range | Repayment Terms | Interest Rates |

|---|---|---|---|

| African Bank | R2 000 – R350 000 | 7 to 72 months | 12% to 24.50% APR |

| Standard Bank | Varies | 1 month to 10 years | Varies between 6.55% and Prime plus 17.5% |

| Nedbank | R2 000 to R300 000 | N/A | 11.75% to 29.25% (Average 18.75% to 29.25%) |

| First National Bank | R1 000 to R300 000 | 1 month to 60 months | 13.00% APR |

| Capitec Bank | Up to R250 000 | 1 month to 10 years | Starting at 12.9% |

| Capfin Loan | Up to 50 000 | Up to 12 months | 5% per month (6 months), 28% max (12 months) |

| FairBanker | Up to R350 000 | Varies by lender | Depends on lender; fully personalised |

History and Background of African Bank

African Bank Limited, colloquially known as African Bank, boasts a rich history dating back to the mid-20th century in South Africa. Founded with a mission to provide accessible and affordable banking services, the bank targeted areas and communities historically underserved by the mainstream financial sector. Throughout its journey, this bank has navigated economic landscapes and regulatory environments, transforming from a modest institution into a significant player in the South African banking sector. Notable phases, including a restructuring in the mid-2010s, have contributed to enhancing financial stability and service offerings.

Mission and Vision

Their mission is deeply rooted in financial inclusion and empowerment. It strives to offer financial solutions accessible and tailored to meet the unique needs of each customer. The bank is committed to delivering products and services that enhance the financial well-being of its customers, spanning personal loans, savings accounts, and financial advice. Beyond traditional banking, the vision of this bank transcends to become a transformative force in the financial services industry, driving change and innovation to enable more individuals to achieve their financial goals.

Conclusion

When selecting a bank or financial service provider, careful consideration of your specific financial needs, preferences, and circumstances is crucial. African Bank presents numerous advantages, especially for those seeking flexible loan terms, competitive savings rates, and digital banking convenience. However, potential customers should also be mindful of interest rates, fees, and the bank’s physical branch network. As with any financial decision, conducting thorough research, comparing options, and reading all terms and conditions carefully is advisable.

Frequently Asked Questions

African Bank offers a variety of financial products including personal loans, savings accounts, fixed deposit accounts, and investment products tailored to meet different financial needs and goals.

You can apply for a personal loan from African Bank through their online platform, by visiting a branch, or over the phone. The process involves filling out an application form and providing necessary documentation such as proof of income, identity, and residence.

The interest rates for loans from African Bank vary based on the loan amount, term, and the borrower’s credit profile. Rates are competitive and are in line with regulatory guidelines.

Yes, African Bank offers digital banking services through its online banking platform and mobile app, allowing customers to manage their accounts, make transactions, and apply for products online.

African Bank is known for offering competitive interest rates on savings accounts and fixed deposits, making it a popular choice for savings and investment products. However, as with any financial decision, it’s recommended to review their offerings in comparison to your personal financial goals.