When it comes to selecting a loan in South Africa, the choices can be overwhelming. One prominent name that often surfaces is MPOWA Finance [Mpowafin.co.za]. This company has established itself in the personal loan market, but what truly distinguishes it from its competitors? In this comprehensive review, we’ll delve into MPOWA Finance loans, examining everything from their loan products and application process to interest rates, fees, and customer service.

MPOWA Finance offers short-term personal loans ranging from R500 to R7 000, designed to cover immediate cash flow needs with repayment due by your next payday. If you’re considering a fast, online loan with same-day payout options, keep reading to see if this lender is the right fit for your financial situation.

MPOWA Finance Loans: Quick Overview

Loan Amount: R500 – R7 000 (up to R8 000 for returning customers)

Loan Term: 30 to 45 days

Interest Rate: 4.5% per month (3% for subsequent loans in the same calendar year)

Fees: Initiation fee up to R165 (for loans ≤ R1 000), 10% for loans > R1 000; Monthly service fee of R60

Loan Types: Short-term unsecured personal loans

About Arcadia Finance

Arcadia Finance offers an easy route to securing loans. Fill in a no-cost application and explore offers from a range of 19 lenders. We pride ourselves on collaborating with dependable lenders, all licensed by the NCR in South Africa, for a trustworthy service.

MPOWA Finance Full Review

Experiences with MPOWA Finance Loan

Many users appreciate the speed and simplicity of the application process. Their commitment to quick, short-term loans is often met, with funds typically becoming available on the same day of approval. This swift turnaround is a significant advantage for those urgently in need of cash.

However, it’s not always smooth sailing. Some borrowers have highlighted the higher interest rates compared to traditional banks. The convenience and speed come at a cost, and for them, this is reflected in their pricing. It’s crucial for potential borrowers to weigh this against their immediate need for funds and their ability to repay swiftly.

Another aspect frequently mentioned is customer service. The majority of users report positive interactions, noting that their team is helpful and informative. This can be particularly reassuring for those new to borrowing or those facing a challenging financial situation.

Who Can Apply for a MPOWA Loan?

MPOWA Finance ensures that its loan products are accessible to a broad range of individuals, although there are still some basic criteria that applicants must meet:

- Age: Applicants must be at least 18 years old.

- Employment: A steady income is crucial, and they typically require proof of employment.

- Banking: An active bank account is necessary for the loan deposit and repayments.

- Credit History: While this lender does consider applicants with less-than-perfect credit, the final approval and loan terms might be influenced by one’s credit history.

Criteria for Potential Borrowers

The criteria set by MPOWA Finance are fairly straightforward, focusing primarily on the applicant’s ability to repay the loan. This includes:

- Income Stability: Consistent income reassures your ability to meet repayment obligations.

- Creditworthiness: While not as stringent as traditional banks, this lender does assess your credit score. This doesn’t mean you need a perfect credit history, but a better score can improve your chances of approval and possibly affect your loan terms.

- Residency: Applicants should be residents of South Africa, with relevant documentation.

Documents and Information Needed

When applying for a loan with MPOWA Finance, you will be required to provide the following:

- Proof of Identity: A valid South African ID or smart card.

- Proof of Income: Recent payslips or bank statements showing consistent income.

- Banking Details: Information about your active bank account.

- Contact Information: This includes both your physical address and contact numbers.

MPOWA Finance Loan

What Sets MPOWA Finance Apart?

MPOWA Finance has established a unique position in the South African loan market, primarily due to its distinctive approach to lending. Unlike traditional banks, this lender’s focus is on short-term, smaller loans, processed and disbursed rapidly. This rapid turnaround is a standout feature, especially beneficial for those in immediate need of financial assistance. The entire application process is conducted online, providing a hassle-free experience for borrowers who may not have the time or means to visit a bank in person.

Another unique aspect of MPOWA Finance is their relatively lenient approach towards credit scores. While they do conduct credit checks, their criteria are not as stringent as those of traditional lenders. This opens doors for individuals with less-than-perfect credit histories who might otherwise struggle to secure a loan.

Types of Loans Offered by MPOWA Finance

This lender specialises in offering short-term personal loans designed to address immediate, short-term cash flow needs rather than long-term financial planning or substantial purchases. These loans are commonly used for covering unexpected medical expenses, home repairs, or other urgent costs that cannot be deferred.

In contrast to other financial institutions, it does not provide a diverse range of loan products such as home loans, auto loans, or long-term personal loans. Their exclusive focus remains on short-term, unsecured personal loans. This specialisation ensures that they cater specifically to a market segment seeking quick, temporary financial relief rather than extensive financial commitments.

Who Is MPOWA Finance Best Suited To?

MPOWA Finance is an ideal option for South Africans who:

- Need Small, Short-Term Loans for Urgent Cash Flow Gaps

- Are Employed and Can Provide Proof of Regular Income

- Prefer a Fully Online, Fast Application Process

- Seek Loan Amounts from R500 to R7 000 (or R8 000 for returning clients)

- Can Repay the Loan in 30 to 45 Days via Debit Order

Is MPOWA a Safe and Good Option?

MPOWA Finance is a registered credit provider in South Africa, accredited by the National Credit Regulator (NCRCP6666). As a trusted lender specialising in short-term unsecured loans, they offer fast, convenient credit solutions to individuals needing urgent financial assistance. Loan amounts typically range from R500 to R7 000, with repayment terms of 30 to 45 days, making them suitable for immediate, short-term cash flow needs.

The application process is fully online and user-friendly, requiring only a valid South African ID, proof of income, and active bank account. This lender ensures transparency by clearly outlining interest rates, initiation and service fees, and repayment terms upfront. Affordability checks are conducted in line with credit regulations to promote responsible borrowing. With same-day approvals and disbursements for applications submitted early in the day, this lender provides a reliable alternative to traditional bank loans for short-term financial relief.

Step-by-Step Guide to Applying for a Loan with MPOWA Finance

Step 1. Go to Mpowafin.co.za

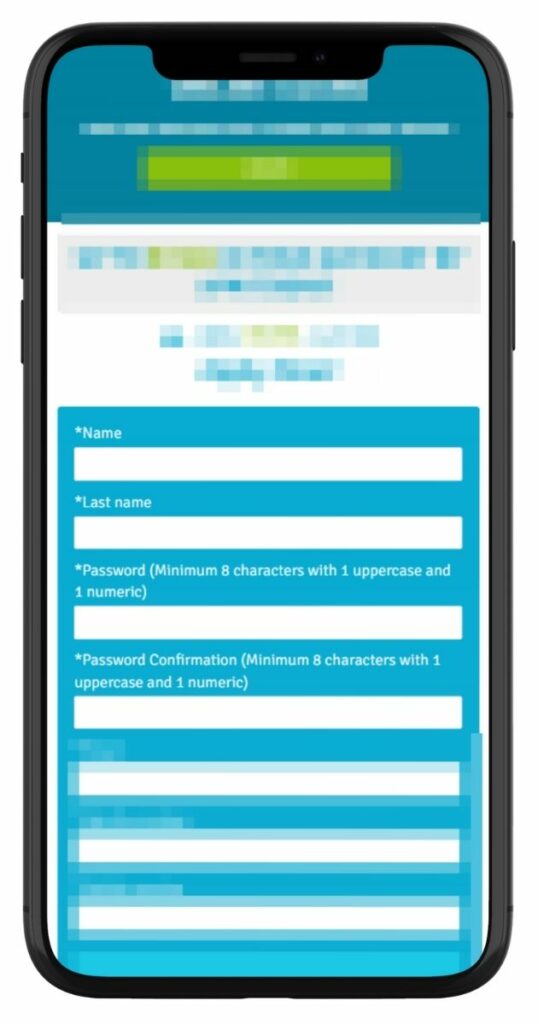

Step 2. Enter your name, last name, and create a secure password.

Step 3. Fill in your email, identity number, mobile number, and select required options.

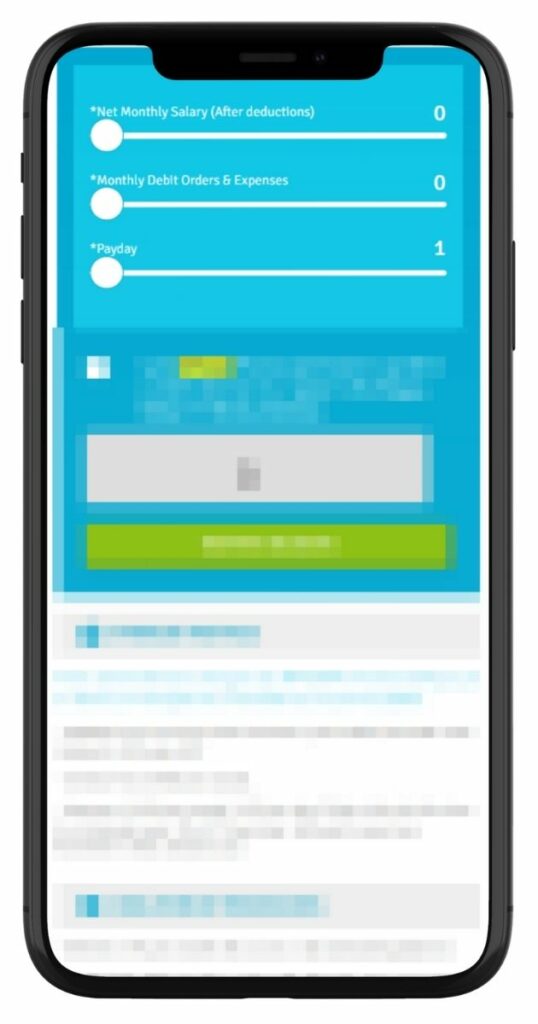

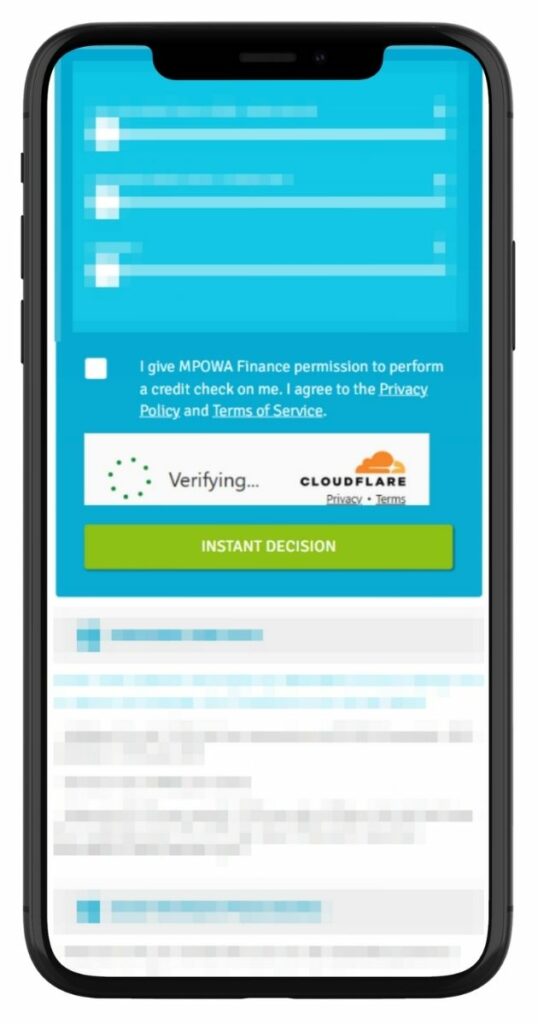

Step 4. Input your salary, expenses, and payday, then complete the CAPTCHA.

Step 5. Agree to the credit check and click “INSTANT DECISION” to apply.

Step 6. Upload the necessary documents directly through the website. This typically includes your ID, proof of income, and recent bank statements.

Step 7. Once your application is processed, they will present you with a loan offer. This offer includes the loan amount, interest rate, and repayment terms.

Step 8. If you agree to the terms, you’ll need to accept the offer. They may require a final verification call or additional documentation at this stage.

Step 9. Upon acceptance and completion of any final checks, the loan amount is deposited into your bank account, often within the same day.

Eligibility Check

MPOWA Finance provides an online tool on their website where potential borrowers can quickly check their eligibility for a loan. This tool usually asks for basic information like income level, employment status, and existing financial commitments. It’s a preliminary check that gives an indication of whether you’re likely to qualify for a loan, without having to go through the full application process.

This pre-check is particularly useful as it saves time and effort. It gives applicants a clear idea of their chances of approval before they proceed with the more detailed application process. However, it’s important to note that this is just an initial assessment. The final loan approval and terms are determined after a thorough review of the full application and supporting documents.

Security and Privacy at MPOWA

This lender employs robust encryption technologies to safeguard data transmitted between the borrower’s device and their servers. This encryption acts like a secure tunnel, ensuring that sensitive information such as bank details, personal identification numbers, and login credentials are not accessible to unauthorised parties.

Their commitment to privacy is reflected in their policies and practices:

- Transparent Privacy Policy: MPOWA’s privacy policy, based on the Protection of Personal Information Act and available on their website, details how customer data is collected, used, and protected. This transparency helps customers understand their data rights and the company’s obligations.

- Limited Data Sharing: The company asserts that it does not share customer data with third parties without consent, except as required by law or necessary for the provision of their services. For instance, credit reference agencies might be consulted as part of the loan approval process, but such interactions are governed by strict confidentiality agreements.

- Data Usage: The information collected by MPOWA Finance is primarily used for processing loan applications, managing accounts, and improving their services. They also take steps to ensure that the data is accurate and up-to-date, enhancing the overall security and reliability of their processes.

- Customer Control and Access: Customers have rights regarding their personal information, including the right to access, correct, or delete their data.

How Much Money Can I Request from MPOWA?

MPOWA Finance offers short-term loans ranging from R500 to R7 000, typically repayable on your next payday.

First-time borrowers may qualify for amounts between R500 and R2 500, and after successfully repaying three loans, you can apply for higher amounts up to the maximum limit.

The approved loan amount depends on factors such as your net salary, employment duration, and credit history.

Personalised Loan Offers

MPOWA Finance takes a personalised approach to loan offers. Instead of a one-size-fits-all solution, they consider several factors specific to the individual applicant. This includes your income level, credit history, and current financial commitments. Based on this information, this lender tailors their loan offer to suit your unique financial situation, ensuring that the loan is manageable and aligned with your repayment capability. This customisation helps in making sure that borrowers are not overburdened by their loans.

Receiving Your Money from MPOWA

The time it takes to receive money from MPOWA Finance after a loan application is surprisingly swift and is one of the key advantages of their service. On average, once a loan is approved, the funds are typically deposited into your bank account the same day. This rapid processing is a significant relief for those who need urgent financial assistance.

However, several factors can affect this withdrawal speed. The time of day when you complete your application plays a role; early applications within business hours are more likely to be processed the same day. Additionally, the accuracy and completeness of the information and documentation you provide can impact the processing time. Delays often occur if they need to request additional information or if there are errors in your application.

Repaying a Loan from MPOWA

Repaying a loan from MPOWA Finance is straightforward. The full loan amount, including any applicable fees, is typically due on your next payday, as selected during the application process. Repayment is collected automatically via a debit order, so it’s important to ensure that sufficient funds are available in your bank account on the agreed date. If you wish to settle your loan early, you can contact Mpowafin.co.za to request an updated balance. Once your loan is fully repaid, you’re eligible to apply for another loan, possibly at a higher amount based on your repayment history.

Fees and Penalties

Failure to repay on time may result in additional charges, including a default fee, daily interest on the outstanding amount, and potential legal recovery costs. These penalties can negatively affect your credit score and future borrowing ability. Always ensure timely repayment to avoid extra fees and maintain a positive credit standing.

MPOWA Finance Loan – Overview in Detail

| Name | MPOWA Finance |

|---|---|

| Financial | Privately Operated |

| Product | Short-Term Unsecured Loans |

| Minimum Age | 18 years |

| Minimum Amount | R500 |

| Maximum Amount | R7 000 (up to R8 000 for returning customers) |

| Minimum Term | 30 days |

| Maximum Term | 45 days |

| APR | 36% – 54% |

| Monthly Interest Rate | 4.5% (first loan), 3% (subsequent loans in same calendar year) |

| Early Settlement | Allowed; interest calculated daily |

| Repayment Flexibility | Fixed term; DebiCheck debit order |

| NCR Accredited | Yes (NCRCP6666) |

| Our Opinion | ✅ Fast approval and payout ✅ Fully online process ⚠️ Higher interest than banks |

| User Opinion | ✅ Fast, convenient loans ⚠️ Some customer service issues ⚠️ High cost of borrowing |

Online Reviews of MPOWA

The online reviews of MPOWA Finance offer a mixed bag of feedback, reflecting a range of customer experiences. Many borrowers praise the quick and easy application process, highlighting the convenience of getting a loan approved and disbursed in a short time. The straightforward, no-fuss approach to lending is frequently mentioned as a positive aspect.

Very user friendly system to apply, fast payout and the customer service is great. Impressed.

Excellent service. They are there when you need them the most. Everything done online. No scam. Thanks and keep up the good work.

However, some reviews point out the higher interest rates and fees compared to traditional banks. Customers who have faced issues with repayment or have had to deal with penalties and additional charges also share less favourable experiences. It’s noted in several reviews that while MPOWA is an excellent option for quick, short-term loans, the cost of borrowing might be higher, and the short repayment terms can be challenging for some.

I will not recommend MPOWA finance to anyone.

I paid my account, yet I’m still being debited. When I called to ask their consultant why I was double-charged, they told me it wasn’t their problem. I kindly asked for a refund, but they told me to wait 48 hours for the system to update. and I still haven’t received my refund.

Another common theme in the reviews is the customer service experience. Many customers report positive interactions, stating that MPOWA’s staff are helpful and informative. On the other hand, some have experienced difficulties, particularly when facing financial challenges or needing to negotiate repayment terms.

Customer Service at MPOWA Finance

If you have specific questions or need detailed information about MPOWA’s loan products, repayment terms, or your loan application status, it’s best to contact them directly. Their customer service team is equipped to provide tailored information, ensuring that your queries are resolved accurately and efficiently.

Contact Channels

Phone number:

Office: 0861 228 228

Mobile (SMS/WhatsApp): 083 736 0165

Hours of operation:

Monday to Friday: 7:00 AM – 4:00 PM; Payments processed by 5:00 PM

Last Saturday of Each Month: 8:30 AM – 11:30 AM; Payments processed by 12:00 PM

Postal address:

PostNet Suite 462, Private Bag X9, Benmore, 2010

Alternatives to MPOWA

For those looking for alternatives to MPOWA Finance or wishing to compare different loan offers, there are several other credit comparison portals and financial service providers in South Africa. These platforms allow you to compare various loan products, interest rates, and terms from different lenders, helping you make an informed decision.

Comparison Table

| Lender | Loan Type | Minimum Loan Amount | Maximum Loan Amount | Interest Rate | Repayment Terms | Additional Fees |

|---|---|---|---|---|---|---|

| MPOWA Finance | Payday Loans | R500 | R5 000 | 0.17% per day (5% or 3% per month) | Short-term, typically until next payday | R165 origination fee (up to R1000), 10% for loans above R1000, R60 monthly service fee |

| Finchoice | Short-term Loans | R500 | R40 000 | From 5% | 1 – 24 months | Not specified |

| Absa Personal Loans | Personal Loans | R250 | R350 000 | Varies, detailed rates not provided | 12 to 84 months (2 months for existing Absa customers) | Service and initiation fees |

| African Bank | Personal Loans | Not specified | R250 000 | 15% to 27.75% APR | 7 to 72 months | Insurance rates from 5.04% to 5.4% |

| Capitec Personal Loans | Personal Loans | Not specified | R250 000 | 12.9% to 24.5% | Up to 84 months | Not specified |

| EC Online Loans | Payday Loans | R1 000 | R100 000 | APR 10.71%, Fixed nominal rate 84% p.a. | Not specified | Not specified |

This table provides a quick overview of the different loan options available from these lenders, including the types of loans offered, loan amount ranges, interest rates, repayment terms, and any additional fees. Each lender has its unique offerings and terms, so it’s important for borrowers to consider their individual needs and circumstances when choosing a loan.

History and Background of MPOWA

MPOWA Finance has quickly become a prominent name in the South African short-term loan market. Founded with the vision of providing quick and accessible financial solutions to individuals facing immediate cash flow challenges, this lender has consistently delivered on its promise, making it a preferred choice for many.

Mission

The company’s mission revolves around offering transparent, straightforward, and efficient loan services. They aim to bridge the gap between traditional banking processes, which can often be lengthy and cumbersome, and the urgent financial needs of everyday individuals. By leveraging technology and a customer-centric approach, they have streamlined the loan application and approval process, ensuring that funds reach borrowers in record time.

Vision

MPOWA’s vision is to be a leading financial service provider in South Africa, recognised for its integrity, innovation, and commitment to customer satisfaction. They envision a future where financial solutions are easily accessible to all, regardless of their financial history or background.

Pros and Cons of MPOWA Finance

Pros of MPOWA Finance

- Quick Processing: MPOWA’s online application process is swift, often resulting in same-day loan approvals and fund disbursements.

- Flexible Credit Checks: Unlike traditional banks, MPOWA is more accommodating of individuals with less-than-perfect credit histories.

- Transparent Terms: All fees, interest rates, and repayment terms are clearly outlined, ensuring borrowers are well-informed.

Cons of MPOWA Finance

- Higher Interest Rates: Due to the short-term nature of their loans, MPOWA’s interest rates can be higher than those of traditional banks.

- Limited Loan Types: MPOWA primarily offers short-term personal loans, which might not cater to those looking for long-term financial solutions or larger loan amounts.

- Strict Repayment Terms: Given the short-term nature of the loans, borrowers have limited flexibility in terms of repayment schedules.

Conclusion

Given its focus on speed, accessibility, and customer service, MPOWA Finance can be highly rated for its niche in providing quick, short-term loans. However, the rating might be lower for those seeking more affordable interest rates and flexible repayment options. Overall, MPOWA is a strong choice for specific short-term financial needs but may not be the best fit for every financial situation.

Individuals considering MPOWA Finance for their financial needs should carefully weigh the advantages and disadvantages discussed earlier to determine if this lender’s offerings align with their specific requirements and preferences.

Frequently Asked Questions about MPOWA

Interest rates at MPOWA are generally higher than traditional banks, reflecting the short-term nature and higher risk of their unsecured loans.

Yes, MPOWA considers applicants with less-than-perfect credit scores, though this may influence the terms of your loan.

Funds are typically disbursed on the same day as loan approval, especially if the application is completed early in the day.

Yes, late repayments can incur additional fees and negatively impact your credit score.

This depends on the specific terms of your loan agreement. It’s advisable to contact MPOWA directly for information regarding early repayment.