Navigating the world of short-term loans can be daunting, but our comprehensive review of Sunshine Loans [Sunshineloans.co.za] aims to provide clear and concise information to help you make an informed decision. In this review, we will delve into various aspects of this lender, such as the types of loans they offer, the application process, interest rates, customer service, and their approach to responsible lending. Our goal is to present a balanced view, highlighting both the strengths and areas where they could improve, allowing you to assess whether their services align with your financial needs and circumstances.

Sunshine Loans offers short-term personal loans ranging from R500 to R4 000, with repayment terms aligned with the borrower’s next payday or within a maximum period of 49 days. The application process is fast and simple, featuring an easy online application, instant eligibility checks, and quick disbursement for immediate financial relief.

Sunshine Loans: Quick Overview

Loan Amount: R500 – R4 000

Loan Term: 4 to 49 days

Interest Rate: Rates vary based on loan amount and repayment term; calculated upfront

Fees: Transparent fee structure disclosed during application; no hidden charges

Loan Types: Short-term loans, including payday loans, emergency loans, and cash advances

About Arcadia Finance

Streamline your loan acquisition with Arcadia Finance. Apply at no cost and choose from a range of offers provided by up to 19 different lenders. Each lender is credible and operates under the guidelines of the National Credit Regulator, ensuring ethical and reliable financial practices in South Africa.

Sunshine Loans Lender Full Review

Experiences with Sunshine Loans

Navigating through the financial landscape of loans and borrowing can often feel like a daunting task. However, Sunshine Loans aims to simplify this process, providing a user experience that is straightforward and hassle-free. Borrowers who have interacted with Sunshineloans.co.za often highlight the simplicity of the application process and the speed at which they receive their funds. The company’s online platform is designed to be user-friendly, allowing for a smooth navigation process where information is readily available and easily accessible.

The focus of this lender is on short-term lending solutions means that their services are tailored to meet immediate or emergency financial needs. This specialisation in service offering ensures that borrowers receive a product that is well-suited to meet sudden or unexpected financial obligations, providing a sense of relief and financial support when it is most needed.

Who can apply for a Sunshine Loans loan?

Criteria for potential borrowers

- Applicants must be over 18 years old.

- Must be residents of South Africa.

- Must be employed and receiving a regular income.

Differences from Other Loan Providers

Sunshine Loans differentiates itself from other loan providers through its focus on simplicity, speed, and accessibility. Unlike some lenders who may require extensive documentation and a lengthy approval process, this lender prioritises a swift and straightforward application process. This approach is particularly beneficial for individuals who are facing emergency financial situations where time is of the essence.

Another point of differentiation is the company’s commitment to responsible lending. While the objective is to provide financial support, this lender also places a significant emphasis on ensuring that borrowers are not placed in a position of financial vulnerability due to taking out a loan. This balanced approach reflects a level of care and consideration for the financial well-being of the borrowers, ensuring that the loan serves as a support rather than a financial burden.

Selecting the right loan provider is crucial to managing your finances effectively. Whether you’re looking for lower interest rates, better customer service, or more flexible repayment options, our guide on the best loan providers in South Africa will help you navigate your options.

What Makes the Sunshine Loans Unique?

Sunshine Loans brings to the table a variety of short-term loan offerings, each designed to meet specific immediate financial needs. What sets Sunshine Loans apart is their commitment to simplicity and speed in the loan application and approval process. Borrowers can expect a hassle-free online application, quick decision-making, and fast disbursement of funds, ensuring that urgent financial needs are met promptly.

Types of Loans Offered by Sunshine Loans

Payday Loans

Payday loans are one of the solutions Sunshine Loans offers to address short-term financial needs. These loans are ideal for bridging the gap between paydays, providing immediate access to funds for unexpected expenses. They are typically small in amount and are repaid on the borrower’s next payday.

Emergency Loans

For urgent situations such as medical expenses, Sunshine Loans provides emergency loans. These loans ensure that essential financial needs are met promptly, offering a fast and reliable way to manage unforeseen emergencies without delay.

Cash Advances & Quick Cash Loans

To further support customers facing time-sensitive financial challenges, Sunshine Loans offers cash advances and quick cash loans. These loan options are designed for speed and convenience, making them a go-to choice when quick access to cash is necessary.

Requirements for a Sunshine Loans Loan

When considering a loan with Sunshine Loans, it’s essential to be prepared with the necessary documents and information. Having the right documentation on hand can expedite the application process. Typically, they require borrowers to provide proof of identity, proof of income, and recent bank statements. This ensures that the company can assess your ability to repay the loan and determine the most suitable loan amount and terms for your situation.

Who Is Sunshine Loans Best For?

Sunshine Loans is best suited for South African borrowers who:

- Need small, short-term loans to manage urgent or unexpected expenses

- Are employed with a steady income and can afford short repayment terms

- Prefer a fast, fully online application and approval process

- Require quick access to funds without lengthy paperwork or documentation

- Are looking for flexible repayment options aligned with their pay cycle

Is Sunshine Loans a Safe and Good Option?

Sunshine Loans is a registered South African credit provider specialising in short-term unsecured loans. Through a fully online process, borrowers can access loan amounts from R500 to R4 000, with repayment terms typically linked to the borrower’s next payday or up to 49 days.

Applications are quick and straightforward, with approvals often completed within one business day and funds disbursed shortly thereafter. They offer a transparent fee structure, with all costs clearly outlined upfront and no penalties for early settlement.

Ideal for South Africans needing urgent financial assistance, their loans provide a practical and reliable solution for managing unexpected expenses or short-term cash flow needs, while maintaining a strong commitment to responsible lending.

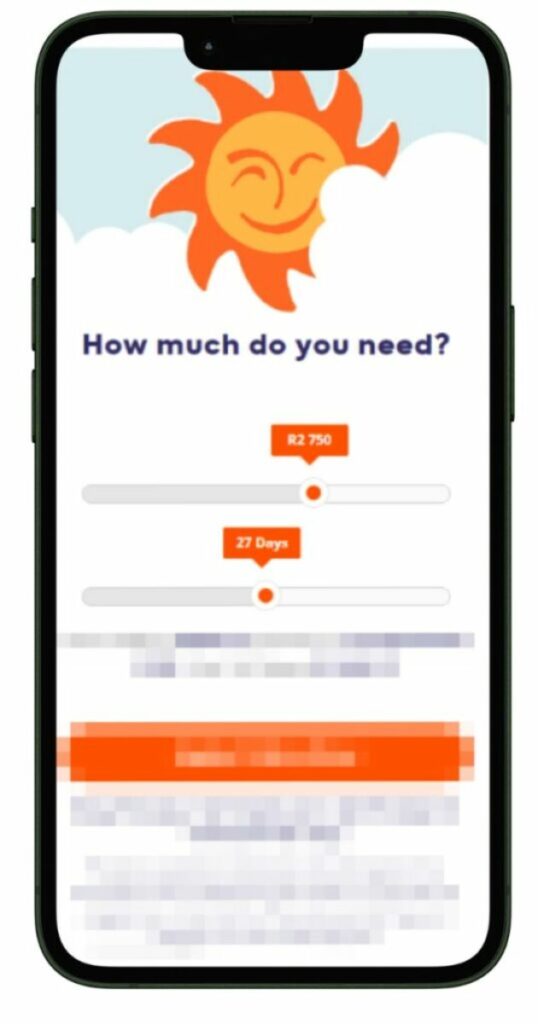

Simulation of a Loan at Sunshine Loans

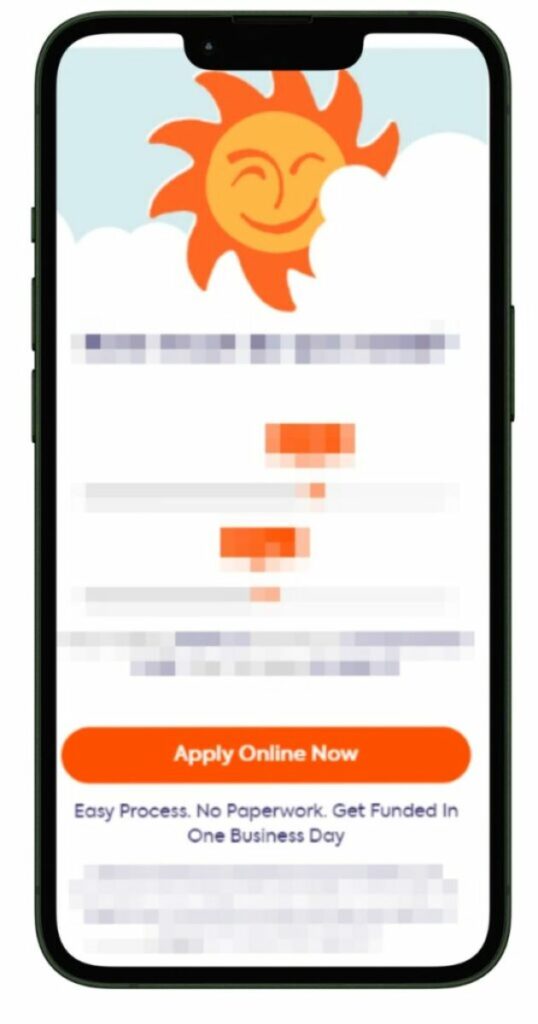

Step 1: Start by navigating to the official Sunshineloans.co.za

Step 2: Select the amount you need and the repayment period using the sliders.

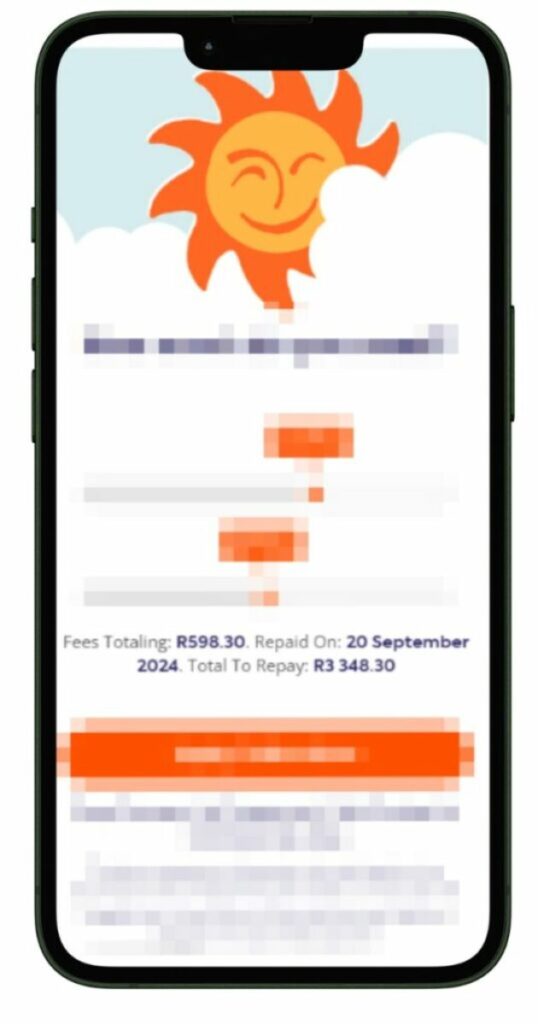

Step 3: Review the loan fees, repayment date, and total amount to repay.

Step 4: Click “Apply Online Now” to proceed with your application.

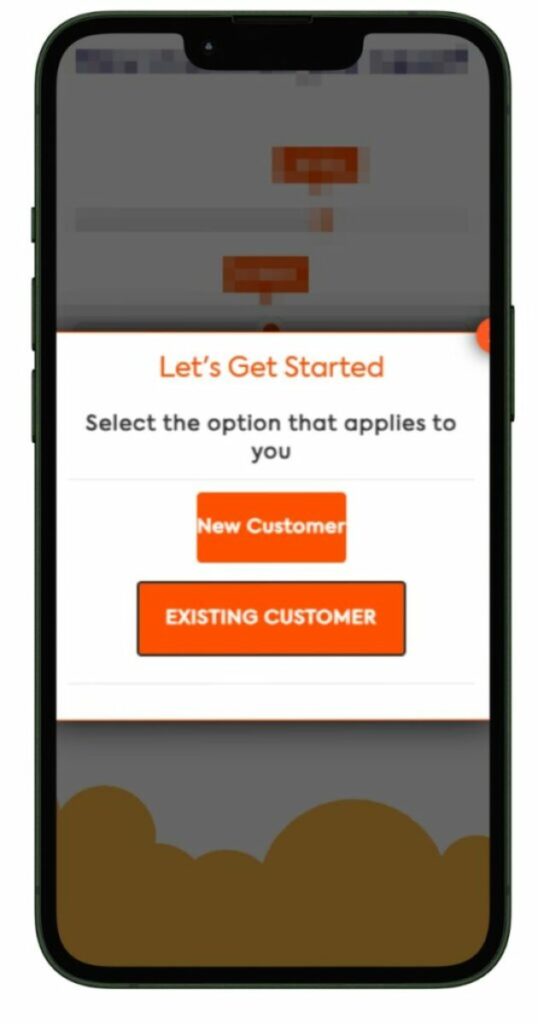

Step 5: Choose whether you’re a new or existing customer.

Step 6: For new customers, fill out the loan application form.

Step 7: If you’re an existing customer, log in with your email and password to continue.

Step 8: Before submitting your application, carefully review all the information you’ve provided.

Step 9: Wait for approval.

Step 10: Upon approval, the loan amount will be transferred to your specified bank account

Eligibility Check

Before applying for a loan, Sunshine Loans offers an online eligibility checker tool. This tool allows you to input basic details such as income and desired loan amount to get a preliminary idea of your eligibility. Use this tool to gauge your likelihood of loan approval before proceeding with the full application.

Security and Privacy

Sunshine Loans prioritises the security and privacy of your personal and financial information. They employ advanced encryption technologies to protect data transmitted through their website. Additionally, comprehensive privacy policies are in place to outline how customer data is collected, used, and protected. This lender aims to build trust by being transparent about their data handling practices, ensuring a secure and reliable service for customers.

Remember to refer to the specific terms and conditions for detailed information on the application process, eligibility criteria, and loan terms.

How Much Money Can I Request from Sunshine Loans?

When applying for a loan with Sunshine Loans, the amount of money you can request varies based on the type of loan product you choose and your financial circumstances. The minimum loan amount is typically R500, while the maximum can go up to R4 000. this lender assesses each application individually, considering factors such as income level and repayment ability, to determine the most suitable loan amount and terms for each borrower.

Sunshine Loans also offers personalised loan offers, tailoring the loan terms to meet the specific needs and financial situation of each applicant. This personalised approach ensures that borrowers receive loan offers that are aligned with their repayment capabilities, promoting responsible borrowing and lending.

Sunshine Loans – Overview in Detail

| Name | Sunshine Loans |

|---|---|

| Financial | Registered Credit Provider |

| Product | Short-term unsecured loans, including payday loans and cash advances |

| Minimum age | 18 years |

| Minimum amount | R500 |

| Maximum amount | R4 000 |

| Minimum term | 4 days |

| Maximum term | 49 days |

| APR | Rates vary; they are calculated upfront and depend on the individual’s credit and repayment history |

| Monthly Interest Rate | Interest rates are applied based on the loan amount and duration |

| Early Settlement | Allowed without additional charges |

| Repayment Flexibility | Repayment coincides with the borrower’s payday; early repayment options available |

| NCR Accredited | Yes |

| Our Opinion | ✔️ Quick application and approval process ✔️ Offers flexibility in loan terms ✔️ Suitable for urgent financial needs due to fast disbursement |

| User Opinion | ✔️ Convenient for managing sudden expenses ❌ High-interest rates compared to long-term loans ✔️ Helpful for those with less-than-perfect credit history |

How Long Does It Take to Receive My Loan Payout from Sunshine Loans?

One of the standout features of Sunshine Loans is the speed at which they process loan applications and disburse funds. On average, the approval process is swift, often completed within one business day. Once approved, the funds are typically transferred to the borrower’s bank account promptly, ensuring that urgent financial needs are met without unnecessary delays. However, the actual time it takes to receive the money can vary based on factors such as the applicant’s bank and the timing of the application.

How Do I Repay My Loan from Sunshine Loans?

Repaying a loan from Sunshine Loans is designed to be as straightforward as possible. Repayments are usually aligned with the borrower’s pay cycle, and the amounts are directly debited from the borrower’s bank account. This automated repayment process simplifies the repayment experience, reducing the risk of missed payments.

It’s also crucial to be aware of potential fees and penalties associated with the loan. While Sunshine Loans strives for transparency in their fee structure, borrowers should ensure they fully understand any additional costs that may apply, such as late payment fees, to avoid unexpected charges during the repayment process.

Online Reviews of Sunshine Loans

Online reviews serve as a valuable resource in assessing a lender like Sunshine Loans. Customers’ experiences and feedback offer insights into the company’s reliability, quality of customer service, and overall loan offerings. While reviews can differ based on individual experiences, they often illuminate common trends and areas where the lender excels or could improve.

When evaluating Sunshine Loans, it’s recommended to explore various review platforms to gain a comprehensive perspective on what past and present customers convey about their experiences. Consider aspects such as the ease of the application process, swiftness of fund disbursement, clarity of terms, and responsiveness of customer service as highlighted in the reviews.

I took a loan from Sunshine, I was paid within the same day. They were paid back without a glitch, no extra or hidden costs. Everything ran smoothly.

Nothing bad to say about this company. They are always reliable! the only loan company I can use! Always available for email or phone communication when there is an issue.

Having made my application and had it accepted, I have been waiting for the debit mandate for 4 days. No one answers call or email. The contact details provided seem to be fake as you’ll never get a response via email & phone number doesn’t work.

Most unprofessional service ever. They don’t care about their customers and aren’t willing to work with their customers on payment arrangements.

Customer Service

Sunshine Loans endeavours to offer comprehensive support and assistance throughout the loan process. If you have additional questions or require clarification on any aspect of the loan, Sunshine Loans provides multiple avenues for communication. Their customer service team is available to address queries, offer guidance, and assist with the application process.

Contact Channels

Phone number:

Office: +2710 496 2073

Hours of operation:

Monday to Friday: 8:00 AM – 5:00 PM

Postal address:

25 Quantum Street Technopark, Stellenbosch 7600, Western Cape, South Africa

Alternatives to Sunshine Loans

While Sunshine Loans provides a variety of short-term loan products tailored to address various financial needs, it’s worth noting that there are other credit comparison portals available that may be worth considering. These platforms offer borrowers a range of loan options, enabling them to compare and select the most suitable option for their circumstances.

Comparison Table

| Criteria | Sunshine Loans | BlinkFinance | Wonga | Lime24 | MyMulah |

|---|---|---|---|---|---|

| Loan Range | R500 – R4 000 | R500 – R8 000 | R500 – R4 000 | R300 – R5 400 | R100 – R5 000 |

| Approval Time | Within one business day | Within one business day | Within hours | Within one business day | Typically disbursed on the same day if the loan is approved before 3 pm. |

| Repayment Terms | Aligned with pay cycle | 61-65 days | Up to 6 months | Up to 35 days | Up to 90 days |

| Online Application | Yes | Yes | Yes | Yes | Yes |

| Fees & Charges | Transparent fee structure | Varies based on loan amount and term | Fixed interest rate | Transparent fee structure | Interest rate starting from 5%, with a fixed interest rate for the length of the loan |

| More Info | BlinkFinance Review | Wonga Review | Lime24 Review | MyMulah Review |

History and Background of Sunshine Loans

Sunshine Loans has positioned itself as a prominent player in the short-term lending market, concentrating on delivering swift and straightforward loan solutions to individuals facing immediate financial requirements. The company was founded with a mission to streamline the borrowing process, ensuring prompt accessibility to funds for those in urgent need. Sunshine Loans operates with a vision to uphold responsible lending practices, issuing loans in a manner that aligns with borrowers’ repayment capabilities, thereby promoting financial health and sustainability.

Pros and Cons of Sunshine Loans

Pros of Sunshine Loans

- Quick Approval and Disbursement: Sunshine Loans boasts a rapid application and approval process, often disbursing funds within one business day.

- Online Convenience: The entire loan application process can be completed online, providing a convenient option for borrowers.

- Transparent Fees: Sunshine Loans maintains transparency in its fee structure, aiding borrowers in understanding the associated costs.

- Personalised Loan Offers: Loans are tailored to individual financial circumstances, encouraging responsible borrowing.

Cons of Sunshine Loans

- Limited Loan Amounts: With loans capped at R4 000, the amount might not be sufficient for some borrowers.

- Short Repayment Terms: The emphasis on short-term loans means that repayment periods might be brief, potentially posing challenges for some borrowers.

- Availability: As an online platform, those without internet access or who are not tech-savvy may find it challenging to access services.

Conclusion

Sunshine Loans emerges as a viable option for short-term borrowing, embodying a combination of efficiency, transparency, and customer-centric approaches in its services. Their commitment to simplifying the borrowing landscape, coupled with upholding responsible lending practices, underscores their credibility as a short-term loan provider in the financial market.

Frequently Asked Questions

Sunshine Loans specialises in short-term loans, providing various products like payday loans, emergency loans, cash advances, and quick cash loans. Each loan type is crafted to address specific immediate financial needs, ensuring borrowers can find a suitable solution that aligns with their circumstances.

Sunshine Loans prioritises speed in their loan processing. Typically, loan applications are approved within one business day, and funds are disbursed promptly. In many cases, the funds reach the borrower’s bank account on the same day of approval.

To be eligible for a loan from Sunshine Loans, applicants must be over 18 years old, residents of South Africa, and employed with a regular income stream. Additionally, applicants need to provide necessary documents such as proof of identity and recent bank statements.

Repayments at Sunshine Loans are automated for convenience. The repayment amounts are directly debited from the borrower’s bank account, aligning with their pay cycle. Borrowers should also be aware of potential fees and penalties, such as those associated with late payments.

Sunshine Loans stands out for its quick approval and disbursement process, transparent fees, and a range of short-term loan products. However, it’s important to note that the loan amounts are capped at R4 000, and the focus is primarily on short-term lending solutions. Comparing these features with other lenders can help borrowers choose a loan that best meets their needs and repayment capabilities.