Credit is a familiar term, but what does it mean? In plain language, it refers to the ability to borrow money or obtain goods and services with the understanding that you’ll pay for them later. Credit is essential to achieving financial objectives like buying a house, launching a business, or pursuing higher education.

This article provides a comprehensive overview of credit, including its different types, how it works, advantages and disadvantages, and how to use it responsibly. By the end of this article, readers will have a better understanding of credit and how it can impact their finances and every day lives.

Different Types of Credit

Credit is not a one-size-fits-all solution. It comes in various forms, each with its unique features and benefits. Here are the most common types of credit you can consider:

Revolving credit:

This credit allows you to borrow up to a certain limit and make payments over time. The credit limit is usually based on factors such as income, credit score, and other relevant criteria. Credit cards and lines of credit are examples of revolving credit.

Installment credit:

Installment credit lets you borrow a fixed amount of money and repay it in equal monthly installments over a set period. The interest rate is fixed, and the loan term can range from a few months to several years. Examples of installment credit include car loans, student loans, and personal loans.

Secured credit:

Secured credit requires you to pledge collateral, such as a car or house, to obtain the credit. This means that if you default on payments, the lender can seize the collateral to recover the debt. Secured credit examples include home equity loans and secured credit cards.

Unsecured credit:

Unsecured credit doesn’t require collateral, and lenders rely on your creditworthiness to decide if you qualify for the credit. Interest rates on unsecured credit are generally higher than secured credit. Examples of unsecured credit include personal loans, credit cards, and student loans.

It’s crucial to understand the different types of credit before choosing which one to use. Understanding the terms and conditions of the credit is also essential, such as interest rates, fees, and repayment terms. By being informed about your options, you can make better decisions about which credit product best suits your needs and use credit to your advantage.

» Read more: The Pros and Cons of Secured Loans vs Unsecured Loans

How Credit Works

Credit not only involves borrowing money, but also building and maintaining a good credit history. Understanding how credit works involves the following key components:

Credit score and credit report:

Your creditworthiness is represented by a numerical value called a credit score, which is determined by your credit history. Your credit report provides a detailed record of your credit history, including your credit accounts, payment history, and any negative information.

Credit applications and approval process:

When you apply for credit, the lender will assess your credit score and credit report to determine your eligibility for credit and the interest rate at which you will be offered credit. Other factors such as your income, employment history, and debt-to-income ratio may also be considered.

Interest rates and fees:

The interest rate is the cost of borrowing money, expressed as a percentage of the amount borrowed. In addition to interest rates, lenders may charge fees, such as annual fees, balance transfer fees, and late payment fees. It’s important to understand how interest rates and fees work and how they can impact the total cost of borrowing.

To use credit effectively, it’s important to build and maintain a good credit history, understand the credit application process, and the terms and conditions of the credit, including interest rates and fees. By doing so, you can access credit when you need it and use it to achieve your financial goals.

» Read more: Everything You Need to Know About Good Credit Score

Benefits of Credit

Credit can offer several advantages, when dealing with life challenge. Below you will find a few of the main benefits of having access to and using credit:

- Ability to make larger purchases: One of the most significant advantages of credit is the ability to make larger purchases than you could with cash or a debit card. For example, you can buy a car or a home with a loan and pay it off over time.

- Convenience and flexibility: Credit is also more convenient and flexible than cash. You can use credit to make purchases online, over the phone, or in-person. Credit also provides flexibility in terms of repayment, allowing you to make payments over time rather than paying the full amount upfront.

- Establishing credit history: Another advantage of credit is that using it responsibly can help you establish a positive credit history. A good credit history is crucial for future borrowing and can lead to lower interest rates, higher credit limits, and better terms on future loans.

- Rewards and perks: Many credit cards offer rewards and perks, such as cash back, travel rewards, and points for purchases. These rewards can add up over time and provide significant benefits if used wisely.

- Emergencies: Credit can also be helpful in emergencies, such as unexpected medical expenses or car repairs. Having access to credit can provide peace of mind and help you cover unexpected expenses.

It’s important to note that while credit can offer several advantages, it’s essential to use it responsibly. Misusing credit can lead to high-interest rates, fees, and debt, which can negatively impact your financial health. By making timely payments and managing credit wisely, you can access the benefits of credit while avoiding its drawbacks.

» Read more: The Benefits of Consolidating Debts

Drawbacks of Credit

Although credit can be beneficial when used responsibly, it also has its disadvantages. Below are some of the primary drawbacks of using credit:

- High interest rates and fees: Credit often comes with high interest rates and fees, particularly if you have a low credit score. This can make borrowing more expensive over time and lead to substantial debt if payments are not made on time.

- Risk of debt and credit damage: If you use credit irresponsibly or make late payments, you run the risk of accumulating debt and damaging your credit score. This can make it harder to access credit in the future and result in higher interest rates on future loans.

- Temptation to overspend: Credit can make it easy to overspend and accumulate debt, particularly if you have a high credit limit. It’s important to use credit only for necessary purchases and to make timely and full payments to avoid accumulating debt.

It is essential to understand the potential drawbacks of credit when deciding whether to use credit and how to use it responsibly. By being aware of the risks and taking steps to manage credit effectively, you can use credit to your advantage and avoid its pitfalls.

About Arcadia Finance

Simplify your loan journey with Arcadia Finance for increased efficiency. Fill out a free application and receive offers from 19 lenders. Trust in our dedication to partnering exclusively with reputable lenders compliant with the regulations of the National Credit Regulator of South Africa.

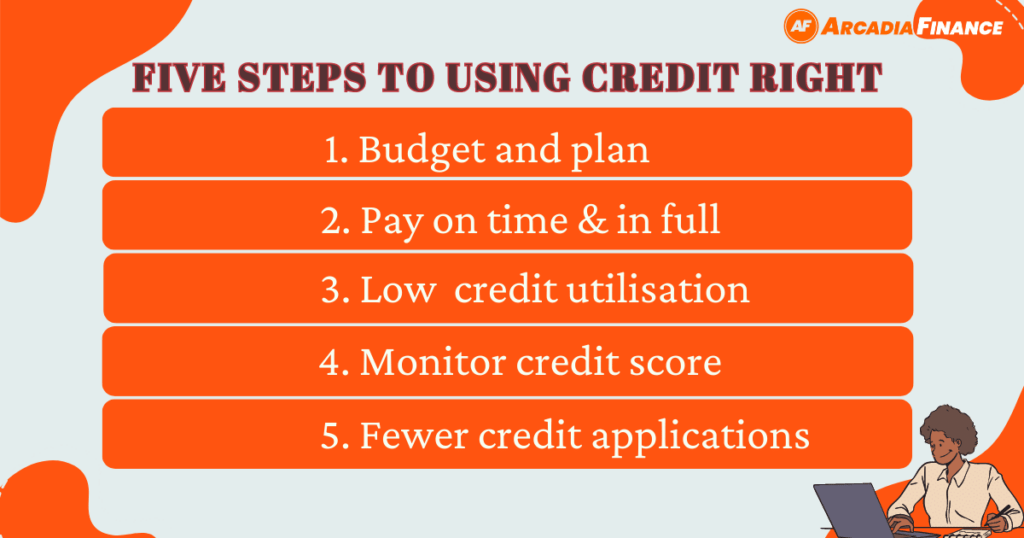

How to Use Credit Responsibly

Credit can be a useful tool when used responsibly. However, using credit irresponsibly can lead to significant debt and damage to your credit score. Here are five easy steps to help you use credit responsibly and avoid the pitfalls of debt and damaged credit:

- Budgeting and planning: Before using credit, create a budget and plan for how you will repay the debt. Only borrow what you can afford to repay, and avoid using credit for unnecessary purchases.

- Making payments on time and in full: Paying your credit accounts on time and in full can help you avoid late fees and interest charges and maintain a good credit score.

- Keeping credit utilization low: Maintaining a low credit utilization, which is the amount of credit you use compared to your credit limit, can help you avoid debt and preserve a good credit score.

- Monitoring your credit report: Regularly checking your credit report can help you detect errors and potential fraud, and take steps to correct them.

- Avoiding too many credit applications: Too many credit applications can lower your credit score, so only apply for credit when necessary.

By following these tips, you can use credit responsibly and avoid the problems that come from high debt and damaged credit. If you are struggling with debt or credit issues, it’s crucial to seek professional help.

Conclusion

Ultimately, credit can be a valuable tool for achieving our financial goals and improving our quality of life. However, it is essential to use credit responsibly and understand the potential risks and drawbacks. This involves creating a budget, making payments on time and in full, keeping credit utilization low, and monitoring our credit score.

By understanding the different types of credit, how they work, and their advantages and disadvantages, we can make informed decisions and use credit to our advantage.

FAQ

Yes, you can apply for credit even if you have a low credit score. However, you may be offered higher interest rates and may have a lower credit limit. It’s important to use credit responsibly and make timely payments to improve your credit score over time.

The best way to use credit cards to build credit is to make small purchases and pay the balance in full and on time each month. This demonstrates responsible credit use and can help improve your credit score over time.

Yes, late payments can have a negative impact on your credit score. It’s important to make payments on time to avoid late fees and negative marks on your credit report.

If you default on a loan or credit card payment, it can have serious consequences, including damage to your credit score, collection calls and letters, and even legal action. It’s important to contact your lender or creditor and work out a payment plan if you are struggling to make payments.