When it comes to managing our finances, finding the right loan can make all the difference. It’s not just about gaining access to funds; it’s about discovering a solution that aligns with our lifestyle and budget. That’s why we’ll be delving into Absa Personal Loans. Absa [Absa.co.za], a renowned name in South African banking, provides personal loans that offer flexibility and competitive rates. But what does this truly mean for you and me? Whether you’re seeking to consolidate debt, finance a significant purchase, or simply require a financial buffer, understanding the offerings can guide you in making an informed decision.

Absa offers personal loans ranging from R250 to R350,000, with flexible repayment terms between 12 and 84 months. If you are seeking a reliable and versatile loan option to cover anything from smaller expenses to larger financial goals, read on to find out more about Absa’s services and whether their offerings are the right fit for your needs.

Absa: Quick Overview

Loan Amount: R250 – R350 000

Loan Term: 12 to 84 months

Interest Rate: Personalised rates, typically from prime + 3% to prime + 17.5% per annum

Fees: Initiation fee based on loan size (up to a maximum of R1,207.50 + VAT); Monthly service fee of R69 + VAT

Loan Types: Personal loans, revolving loans, express loans, instant loans, home improvement loans

About Arcadia Finance

Arcadia Finance eases the loan application process. Apply for free and receive offers from up to 19 unique lenders. We’re aligned with established lenders in South Africa, all regulated by the National Credit Regulator, for a reliable and safe borrowing experience.

Absa Full Review

When it comes to personal loans, individual experiences may vary, but there are some common threads that define the Absa loan experience. Absa’s approach is centred around providing a loan tailored to your specific needs. What distinguishes them is their flexibility in loan amounts and repayment terms. You can borrow up to R350 000, a substantial amount, and you have the option to repay it over a period of up to 84 months. This flexibility means whether you’re renovating your home, funding education, or handling unforeseen expenses, there’s likely a plan that suits your needs.

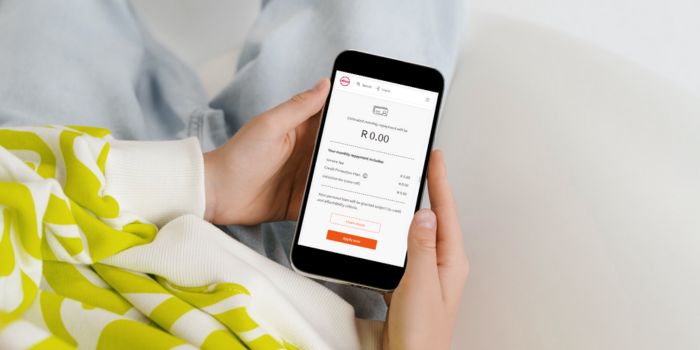

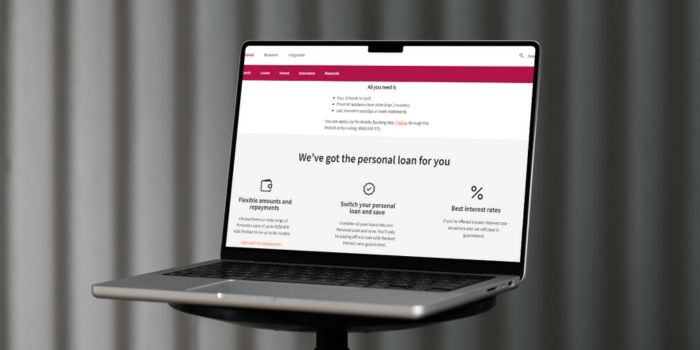

Another crucial aspect of the experience is the application process. Absa has streamlined it, offering options to apply online, through their app, or in person at a branch. This variety of choices accommodates different preferences, whether you’re tech-savvy or prefer a face-to-face interaction. The response time is also noteworthy and appreciated by many users. Once you’ve submitted all the necessary documents, the approval process is typically swift, allowing you to access funds without a prolonged wait.

ABSA may dominate the national lending space, but regional institutions offer something different. Dive into our Ithala Bank Review to see how this provincial lender is helping South Africans access fair, community-centred credit.

Types of Loans Offered by Absa

Absa Bank provides a diverse range of loan products, each designed to address different financial needs and goals. Understanding the specifics of each loan type can assist you in determining which one is most suitable for your situation. Here’s a breakdown of the main types of loans available from Absa:

Personal Loan

Absa’s Personal Loan is suited for a wide range of needs, whether you are managing unexpected expenses or planning significant purchases. You can borrow up to R350 000, with flexible repayment periods ranging from 12 to 84 months. A key feature is Absa’s price guarantee, where they commit to beating any lower interest rate you might find elsewhere. This makes it a strong option for borrowers seeking a balance of affordability and flexibility.

Express Loan

The Express Loan is intended for smaller, short-term financial needs. Loan amounts range from R1 500 to R8 000, and repayment terms vary between 1 and 6 months. It offers a fixed interest rate, ensuring that your repayments remain consistent throughout the loan term. In addition to addressing immediate cash requirements, it also offers an opportunity to build a positive credit record if repayments are made on time.

Instant Loan

Absa’s Instant Loan is ideal for customers who require fast, easily accessible funding. Loan amounts start from as little as R350 and go up to R8 000, with repayment required within a maximum of 35 days. This loan is available 24/7 through Absa ATMs, Cellphone Banking, and Online Banking, allowing you to access the funds you need almost immediately after approval, without the delays of traditional loan processing.

Home Improvement Loan

The Home Improvement Loan is designed specifically for those who want to renovate or upgrade their property. It offers financing of up to R350 000, with repayment periods of up to 84 months. Whether you are planning minor updates or major renovations, this loan provides a structured solution to manage the costs, with flexible repayment options that can be tailored to fit the size and scale of your project.

Who Are Absa Loans Best Suited For?

Absa loans are ideal for individuals who:

- Need loan amounts from R250 up to R350 000 for personal, home, education, or debt consolidation needs.

- Have a stable income and can provide proof of employment or regular earnings.

- Prefer flexible repayment terms ranging from 12 to 84 months.

- Want convenient application options, including online, mobile, and branch services.

- Value borrowing from a trusted bank, with competitive rates and optional Credit Protection Plan cover.

Is Absa a Safe and Good Option?

Absa Bank is a registered financial services provider regulated by the National Credit Regulator (NCRCP7), ensuring that it operates as a legitimate and trustworthy institution in South Africa. The bank offers a wide range of lending solutions, including personal loans, home loans, vehicle finance, and revolving credit facilities. Personal loan amounts range from R250 up to R350 000, with flexible repayment terms spanning from 12 to 84 months. Borrowers can apply easily online, through the Absa mobile app, telephonically, or by visiting one of the many Absa branches nationwide. Applicants will need basic documentation such as a valid South African ID, proof of income, proof of residence, and recent bank statements.

Absa maintains a focus on transparent and responsible lending, providing clear information regarding interest rates, service fees, and repayment conditions upfront. All loan applications are subject to affordability assessments to ensure that credit is granted responsibly. Once approved, funds are typically disbursed promptly into the borrower’s account, allowing for quick access to financial assistance. With its strong reputation, diverse loan offerings, and emphasis on customer service and security, Absa is a suitable choice for individuals seeking reliable and flexible financing solutions.

Requirements for an Absa Loan

Applying for a loan with Absa is a straightforward process, but it does require you to have specific documents and information on hand. This ensures that Absa can accurately assess your financial situation and determine your eligibility for a loan. Here’s what you need to prepare:

General Requirements

- Age: You must be at least 18 years old.

- Income: A steady, verifiable income is crucial, demonstrating your ability to repay the loan.

- Credit Score: A good credit history signals responsible borrowing and influences the interest rate offered.

- Residency: You need to be a resident in South Africa with a valid ID.

- Bank Account: A South African bank account is necessary for loan disbursement and repayments.

Specific Documents Needed

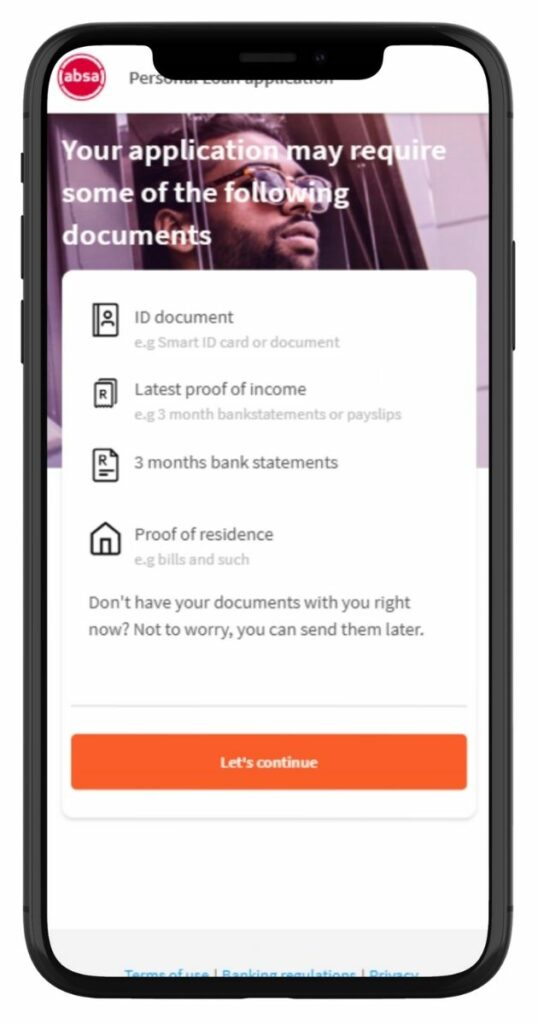

- Proof of Identity: A valid South African ID book or Smart ID card.

- Proof of Residence: Recent utility bill, lease agreement, or a similar document showing your current address (not older than 3 months).

- Bank Statements: Statements from the last three months to assess your financial behaviour and regular expenses.

- Proof of Income

- For salaried individuals: Recent payslips (usually the last three months).

- For self-employed individuals: Recent bank statements (usually the last three to six months) and other documents proving a steady income.

Step-by-Step Guide to Applying for a Loan with Absa

Applying for a loan with Absa can be a smooth process if you follow these steps:

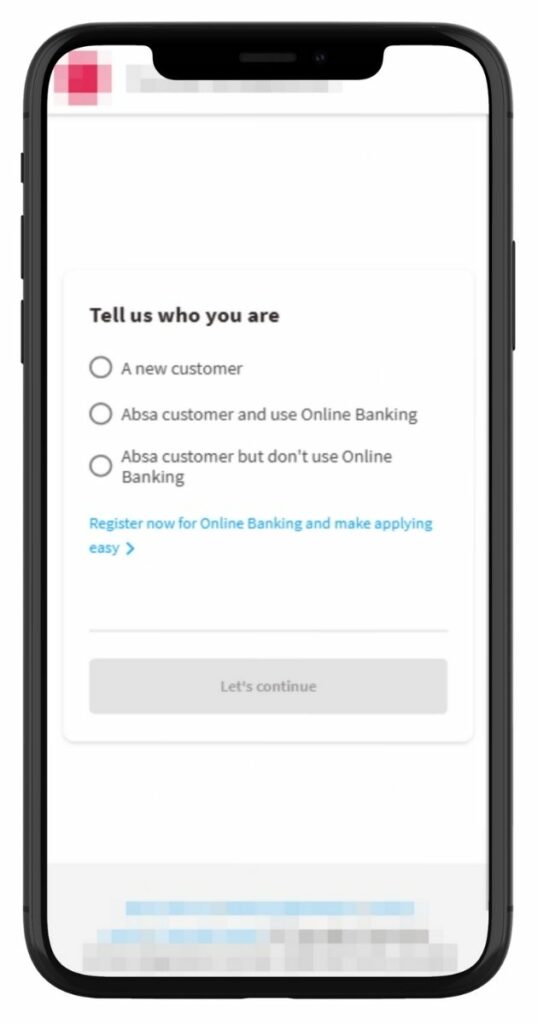

Step 1. Log in to Absa Online Banking or the Absa Banking App.

Step 2. Tap “Apply now” to start your loan application.

Step 3. Select your customer type and tap “Let’s continue”.

Step 4. Prepare required documents and tap “Let’s continue”.

Step 5. Select the type of loan you want (e.g., personal loan).

Step 6. Fill in your personal and financial details.

Step 7. Upload required documents (e.g., ID, proof of income).

Step 8. Review loan terms and conditions.

Step 9. Submit your application for processing.

How Much Money Can I Request from Absa?

Minimum Amount: Absa’s personal loans start from a relatively modest sum, potentially as low as a R250. This caters to smaller, short-term financial needs that borrowers may have.

Maximum Amount: Absa offers loans up to a substantial R350 000. This maximum limit is notably generous and accommodates significant expenses such as home renovations, higher education costs, or the consolidation of large debts.

How Long Does It Take to Receive My Loan Payout from Absa?

Once you’ve applied for a loan with Absa and received approval, the speed at which you get the money can vary. Here’s what you can typically expect:

Average Processing Times

Immediate to a Few Days: For many personal loans, especially if you’re an existing Absa customer and apply online or via the app, the processing can be incredibly swift, sometimes almost immediate. In other cases, it might take a few business days.

Complex Loans: For more substantial or complex loans, like home loans or certain business loans, the processing time might be longer due to the additional documentation and verification required.

Factors Affecting Withdrawal Speed

Several factors can influence how quickly you receive your loan funds from Absa:

- Application Accuracy: Ensuring that your application is complete and accurate can speed up the process. Missing or incorrect information can lead to delays.

- Document Submission: Promptly submitting all required documents can expedite the approval process.

- Loan Type: Some loan types, like personal loans, are typically processed faster than more complex loans such as home loans.

- Credit Checks and Assessments: The time it takes to perform credit checks and assess your financial situation can vary, impacting how quickly the loan is approved.

- Approval Process: The internal approval process at Absa, including the final review and signing off on the loan, can affect the disbursement speed.

Being aware of these factors and ensuring that you provide accurate information and submit required documents promptly can contribute to a smoother and faster loan disbursement process with Absa.

Absa – Overview in Detail

| Name | Absa Bank Limited |

|---|---|

| Financial | Public Company (Listed on Johannesburg Stock Exchange) |

| Product | Personal Loans (secured and unsecured), Home Loans, Vehicle Loans, Revolving Loans |

| Minimum Age | 18 years |

| Minimum Amount | R250 |

| Maximum Amount | R350 000 (for Personal Loans) |

| Minimum Term | 12 months (1 year) |

| Maximum Term | 84 months (7 years) |

| APR | Variable – typically from prime + 3% to prime + 17.5% per annum |

| Monthly Interest Rate | Approx. 0.25% to 1.46% (depending on profile and loan type) |

| Early Settlement | Allowed (may involve an early termination fee) |

| Repayment Flexibility | Fixed monthly repayments via debit order; borrower selects term |

| NCR Accredited | Yes (NCRCP7) |

| Our Opinion | ✅ Ideal for a wide range of borrowing needs ✅ Comprehensive product range ⚠️ Early settlement fees might apply |

| User Opinion | ✅ Quick and user-friendly application ✅ Solid customer support ⚠️ Processing times can vary |

How Do I Repay My Loan from Absa?

Repaying your loan from Absa is designed to be straightforward and flexible, with various options to suit different financial situations. Understanding these options, repayment plans, and associated fees or penalties is crucial for effective loan management. Here’s what you need to know:

- Direct Debit Orders: The most common and convenient method, with automatic deductions from your bank account on a specified date each month.

- Electronic Funds Transfer (EFT): Payments can be made via EFT from your bank account, providing more control over payment timings but requiring manual transfers.

- Absa Branches or ATMs: Payments can be made at Absa branches or ATMs, useful for cash transactions or cheque deposits.

- Online Banking: Easily transfer funds to your loan account through Absa’s online banking platform, offering convenience and real-time monitoring of balances and repayments.

Possible Fees and Penalties

Absa may charge late payment fees for missed repayments and early settlement fees if you pay off your loan ahead of schedule. While early repayment could reduce future interest, it may come with costs. Additional charges like initiation fees, monthly service fees, and insurance premiums, especially under a Credit Protection Plan, may also apply.

Pros and Cons of Absa Loans

Pros of Absa

- Flexible Loan Options: Absa offers a variety of loan products, including personal loans up to R350,000 with repayment terms ranging from 12 to 84 months, catering to diverse financial needs.

- Competitive Interest Rates: They provide personalised interest rates and even offer a rate-beat guarantee if you find a lower rate elsewhere, ensuring cost-effective borrowing.

- Convenient Application Process: Applications can be submitted online, via the Absa app, over the phone, or in person at branches, providing flexibility and convenience.

- Credit Protection Plan: Absa offers a Credit Protection Plan that covers you in events like death, disability, or loss of income, adding a layer of financial security.

- Reputable Institution: As one of South Africa’s major banks, Absa has a strong reputation for reliability and customer service.

Cons of Absa

- Interest Rates for Lower Credit Scores: Borrowers with less favourable credit histories may be offered higher interest rates, increasing the cost of borrowing.

- Mandatory Credit Insurance: Absa requires credit life insurance for all personal loans, which adds to the overall cost of the loan.

- Potential Fees: There are initiation fees (up to 10% of the loan amount) and monthly service fees (R69), which can add to the total repayment amount.

- Early Settlement Charges: While early repayment is allowed, it may involve early termination fees, so it’s important to understand these costs upfront.

- Application Denial Impact: If your loan application is not approved, the process could still negatively impact your credit score, affecting your future creditworthiness.

Online Reviews of Absa

What Customers Say About Absa

When considering a loan or any financial product from Absa, it’s valuable to explore the opinions of current and past customers through online reviews. Here’s a summary of common themes and sentiments found in customer reviews:

I always get the best service, including banking tips from them. They try by all means to get resolutions, and their turn-around time is not bad at all. Thank you.”

Great service … You really know how to do service recovery after a customer has been inconvenienced.

“If I can give a zero star for Absa bank I would, I still have not received my money with their stupid investigation.

They are dishonest and deny any wrong doing when presented with facts. My advice is do not bank with them. The private suite is of no worth.

Customer Service

If you have any questions or concerns regarding your loan or any other services offered by Absa, their customer service team is ready to assist you. Absa prides itself on providing top-notch customer support, ensuring that all queries are addressed promptly and efficiently. Whether you have a question about your loan application, repayment terms, or any other matter, Absa’s dedicated team is there to help.

Contact Channels

Phone number:

Office: +27 (0) 8600 08600

Hours of operation:

Monday to Sunday: 08:00 – 17:00

Postal address:

7th Floor, Absa Towers West

15 Troye Street

Johannesburg, Gauteng, 2001

South Africa

Alternatives to Absa

While Absa is a prominent financial institution in South Africa, there are other credit portals and banks that offer similar services. It’s always a good idea to compare offers and terms from different providers to ensure you’re getting the best deal.

Comparison Table

| Lender | Loan Amount Range | Loan Terms | Interest Rates |

|---|---|---|---|

| Absa Loan | R250 to R350 000 | 12 to 84 months | Prime + 17.5% p.a. |

| Sanlam Personal Loans | R5 000 to R300 000 | 12 to 72 months | Fixed rate for full term |

| Nedbank Personal Loans | R2 000 to R300 000 | Flexible | Personalised based on history |

| Hippo Personal Loans | R1 000 to R350 000 | 7 to 72 months | Typically 27.25% p.a. |

| Old Mutual | Up to R250 000 | 3 to 72 months | Varies |

| RCS Loans | R5 000 to R300 000 | 12 to 60 months | 15% |

| 1Life Loan | Up to R150 000 | 12 to 60 months | Maximum of 29.25% (varies based on risk profile) |

History and Background of Absa

Absa Group Limited is indeed one of South Africa’s major financial services organisations with a long history of serving a diverse range of customers. Although specific mission and vision statements are not explicitly provided on the page, the company’s commitment to delivering high-quality financial solutions is evident through its services and initiatives. Their purpose is “Empowering Africa’s tomorrow, together… one story at a time”.

Absa’s dedication to innovation, customer service, and community involvement suggests a broader aim to be a leading force in the banking industry in South Africa. Companies often express their mission and vision through various channels, including official statements, corporate reports, or dedicated sections on their websites.

For the most accurate and up-to-date information on Absa’s mission and vision, it’s recommended to refer to the company’s official publications, reports, or directly contact their corporate communications or investor relations department.

Absa Group Limited emerges as a prominent and competitive financial institution in South Africa, providing an extensive array of products and services to address diverse financial needs. The company’s emphasis on customer service, complemented by a robust digital presence, positions it as a compelling choice within the banking sector. Prospective customers looking for a comprehensive and customer-centric banking experience may find Absa to be a noteworthy option in the South African financial landscape.

Conclusion

Absa stands out as a prominent financial institution in South Africa, offering a wide range of products and services that cater to various financial needs. Its commitment to customer service, combined with a strong digital presence, makes it a competitive choice in the banking sector.

Frequently Asked Questions

Absa offers a variety of loan products, including personal loans, home loans, car loans, and student loans. Each loan type is designed to meet different financial needs and comes with its own set of terms and conditions.

You can apply for a loan from Absa online through their website or mobile app, by visiting a branch, or over the phone. The application process involves providing personal and financial information and submitting any required documentation.

Interest rates for Absa loans vary depending on the type of loan, the amount borrowed, the repayment term, and the applicant’s creditworthiness. Absa offers competitive rates, but it’s advisable to check the current rates directly with the bank or on their website.

Yes, you can repay your Absa loan early. However, it’s important to check if there are any early repayment fees or penalties that might apply.

Absa uses advanced security measures, including data encryption and secure banking practices, to protect your personal and financial information. They also comply with relevant data protection regulations.