In today’s fast-paced world, financial flexibility is not just a luxury; it’s a necessity. Whether you’re planning a family vacation, renovating your home, or facing unforeseen expenses, having access to quick and reliable financial solutions can have a real impact. Enter RCS, a leading consumer finance business in South Africa. With a range of products designed to cater to the unique needs of South Africans, RCS has positioned itself as a trusted partner in the journey towards financial freedom.

Experiences with RCS Loan

Navigating the financial landscape can be daunting, but with RCS, many have found a reliable partner. Those who have used RCS loans often highlight the company’s transparent processes, customer-centric approach, and ease of application. The feedback consistently points to RCS’s commitment to providing solutions tailored to individual needs, making the loan experience smooth and hassle-free.

Who can apply for an RCS Loan?

If you’re wondering whether you’re eligible for an RCS loan, the answer is quite inclusive. RCS caters to a broad spectrum of South Africans. Whether you’re a working professional, a business owner, or someone looking to consolidate debts, RCS has a range of products designed to fit diverse financial profiles. However, like all responsible lenders, RCS does have certain criteria to ensure the financial well-being of its borrowers.

Criteria for Potential Borrowers

To qualify for an RCS loan, applicants must meet specific criteria. Firstly, applicants need to be 18 years or older. A consistent source of income is essential, ensuring that the borrower can manage repayments. RCS also looks at credit history, but this doesn’t mean those with less-than-perfect credit scores are automatically excluded. The company evaluates the overall financial health and repayment capacity of the applicant. Additionally, providing accurate documentation, like proof of income and identity, is crucial for the application process.

Differences from Other Loan Providers

What sets RCS apart from other loan providers? It’s a combination of factors. RCS’s deep understanding of the South African financial landscape allows it to offer products that resonate with the local populace. Their approach is not just transactional; it’s relational. They aim to build long-term relationships with their customers, guiding them at every step of their financial journey. RCS’s transparent processes mean there are no hidden charges or unpleasant surprises. Their commitment to customer education ensures that borrowers are well-informed and make decisions that align with their financial goals. In a market filled with numerous loan providers, RCS stands out for its integrity, commitment, and customer-first approach.

About Arcadia Finance

Streamline your loan search with Arcadia Finance. Our no-fee application grants you access to offers from up to 10 distinct lenders. We work in tandem with reputable, NCR-accredited lenders in South Africa, providing a trustworthy and secure lending journey.

RCS Loan

In the vast financial landscape of South Africa, RCS has carved a niche for itself with its distinctive loan offerings. But what exactly makes the RCS loan stand out from the crowd?

What Makes the RCS Loan Unique?

RCS loans are not just about borrowing money; they’re about building financial solutions that resonate with individual needs. RCS understands that every borrower is unique, and so are their financial requirements. This understanding is reflected in their tailored loan products, transparent terms, and a commitment to ensuring that the borrower is at the center of every transaction. Their deep-rooted presence in the South African market gives them insights that few can match, allowing them to design products that truly cater to the local populace.

Advantages of the RCS Loan Comparison

When you compare RCS loans with other offerings in the market, several advantages come to the fore. Firstly, RCS’s transparent processes ensure that borrowers are always in the know, with no hidden charges or terms. Their customer-centric approach means that assistance is just a call away, with a team ready to guide borrowers at every step. The flexibility of RCS loans, both in terms of repayment and loan amounts, ensures that borrowers can find a solution that fits their specific needs. The speed of approval and disbursement with RCS is noteworthy, ensuring that funds are available when borrowers need them the most.

Types of Loans Offered by RCS

RCS’s loan portfolio is diverse, catering to a wide range of financial needs.

Description of Different Loan Products Available

- RCS Personal Loans: These are versatile loans that can be used for a variety of purposes, from funding a vacation to consolidating debts. They are designed for individuals who need quick access to funds without the constraints of specifying a purpose.

- RCS Home Loans: Tailored for those looking to buy or renovate a home, these loans come with competitive interest rates and terms that make homeownership a reality for many.

- RCS Auto Loans: For those dreaming of buying a new car or upgrading their existing one, RCS auto loans offer the perfect solution. With flexible repayment terms and a quick approval process, getting behind the wheel of your dream car is easier than ever.

Suitable Purposes for Each Loan Type

- RCS Personal Loans: Ideal for unforeseen expenses, travel, education, or even medical emergencies. Their flexibility means they can be used wherever and whenever funds are needed.

- RCS Home Loans: Perfect for buying a new home, renovating an existing one, or even refinancing a current mortgage. They bring homeownership dreams to life.

- RCS Auto Loans: Designed for new car purchases or upgrades, they ensure that driving your dream car doesn’t remain just a dream.

Requirements for an RCS Loan

When considering a loan from RCS, it’s essential to be prepared with the requirements to ensure a smooth application process. RCS, like all responsible lenders, has specific criteria to ensure the financial well-being of its borrowers and to maintain the integrity of its lending process.

Documents and Information Needed

To apply for an RCS loan, applicants must provide the following:

- Proof of Identity: A valid South African ID or a passport for foreign nationals residing in South Africa is essential. This helps RCS verify the identity of the applicant and prevent fraudulent activities.

- Proof of Income: This can be in the form of recent payslips or bank statements. For self-employed individuals, financial statements or other relevant documents showcasing consistent income might be required. This helps RCS assess the repayment capacity of the borrower.

- Proof of Residence: A recent utility bill, rental agreement, or any official document that clearly shows the applicant’s current address is required. This ensures that RCS has the correct contact details for the borrower.

- Banking Details: Applicants need to provide their bank account details where the loan amount will be disbursed upon approval. This also allows RCS to set up a debit order for repayments if the loan is approved.

- Credit History: While applicants don’t need to provide this, RCS will conduct a credit check to understand the applicant’s creditworthiness. A good credit history can enhance the chances of loan approval and might even fetch better interest rates.

- Details of Current Financial Commitments: Information about any existing loans, credit card debts, or other financial obligations helps RCS get a comprehensive view of the applicant’s financial health.

Simulation of a Loan at RCS

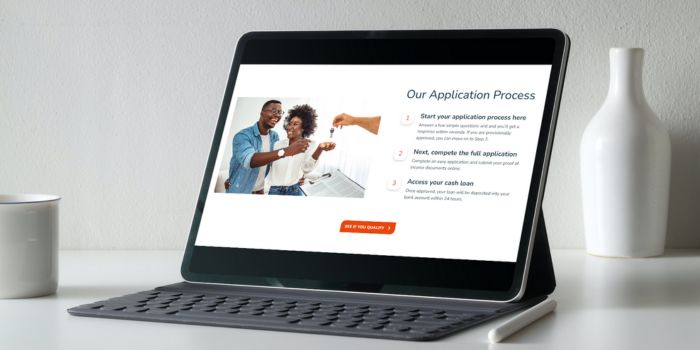

Navigating the loan application process can sometimes feel overwhelming, but RCS, is designed to be user-friendly and straightforward. Here’s a step-by-step guide to help you understand how to apply for a loan with RCS.

Step-by-Step Guide to Applying for a Loan with RCS

- Visit the RCS Website: Start by heading to the official RCS website. Here, you’ll find detailed information about the various loan products they offer.

- Choose the Desired Loan Type: RCS offers a range of loan products, from personal loans to home loans. Select the one that best fits your needs.

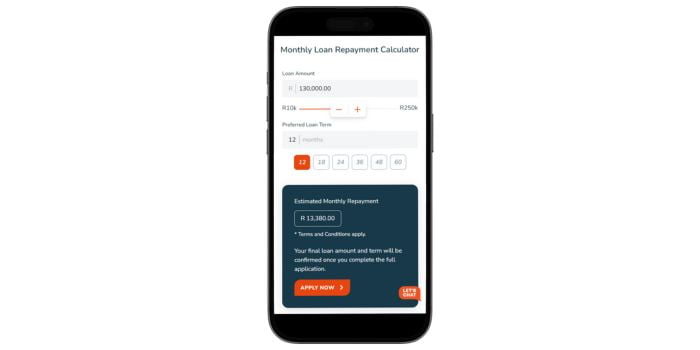

- Enter Loan Details: Once you’ve chosen the loan type, you’ll be prompted to enter details like the desired loan amount and the repayment term. This will give you an estimate of your monthly repayments.

- Fill Out the Application Form: The online application form will ask for personal details, employment information, and financial commitments. Ensure you fill out every section accurately to avoid any delays.

- Submit Necessary Documents: Upload the required documents, such as proof of identity, proof of income, and proof of residence, as mentioned in the requirements section.

- Wait for Approval: After applying, RCS will review your details and conduct a credit check. This process can be swift, and you might receive a response in a short time.

- Loan Disbursement: Once approved, the loan amount will be disbursed to the bank account you provided during the application process.

Eligibility Check

Before diving into the application process, it’s wise to check if you meet RCS’s eligibility criteria. This can save time and increase the chances of your loan application being approved.

Tools or Methods Offered by RCS to Pre-Check Eligibility

RCS understands the importance of time and the need for borrowers to know their chances of loan approval. To assist with this, RCS offers an online eligibility checker on their website. By entering basic details like income, existing financial commitments, and desired loan amount, potential borrowers can get a preliminary idea of their eligibility. This tool provides an instant response, giving users a clear picture before they proceed with the full application. Remember, while this tool offers a quick check, the final approval will be based on a comprehensive review of your application and credit history.

Security and Privacy at RCS

In the digital age, the security and privacy of personal and financial information are paramount. RCS, being a leading financial institution, is acutely aware of this responsibility and has implemented robust measures to ensure that its customers’ data remains protected.

How RCS Ensures the Security of Personal and Financial Information

RCS employs state-of-the-art encryption technologies to safeguard the data transmitted between the user’s device and RCS’s servers. This ensures that any information you provide, be it personal details or financial data, is encrypted and secure from potential eavesdroppers.

Additionally, RCS’s IT infrastructure is fortified with advanced firewalls and intrusion detection systems. These tools monitor and defend the network against any unauthorized access or potential cyber threats. Regular security audits and assessments are conducted to identify and rectify any vulnerabilities, ensuring that the systems remain impervious to breaches.

RCS has stringent internal protocols in place. Employees undergo regular training on data security and are bound by confidentiality agreements. Access to sensitive data is restricted, and only authorized personnel can view or process such information.

Privacy Policies and Data Handling Practices

RCS’s commitment to privacy is evident in its comprehensive privacy policy. This policy outlines how RCS collects, uses, and protects your personal information. It emphasizes that RCS only gathers data necessary for the provision of its services and ensures that this data is processed in compliance with South Africa’s data protection regulations.

RCS is transparent about its data handling practices. The company informs its customers about the purpose of data collection and ensures that personal information is not shared with third parties without explicit consent. Exceptions might include scenarios where data sharing is mandated by law or is essential for providing RCS’s services.

RCS provides its customers with the right to access, modify, or delete their personal information. If you ever wish to review or change your data, RCS has a dedicated team to assist with such requests, ensuring that your data rights are always upheld.

How Much Money Can I Request from RCS?

When considering a loan from RCS, it’s essential to know the range of loan amounts available. RCS offers a variety of loan products, each with its minimum and maximum borrowing limits. These limits are designed to cater to a wide range of financial needs, ensuring that whether you have a small expense or a significant financial undertaking, RCS has got you covered.

Minimum and Maximum Amounts

The minimum loan amount you can request from RCS typically starts at a modest sum, making it accessible for those who need just a little financial boost. On the other hand, the maximum amount is set at a higher threshold, catering to those with more substantial financial requirements. It’s worth noting that the exact amount you qualify for will depend on various factors, including your creditworthiness, income, and existing financial commitments.

Receive Offers

RCS prides itself on offering personalized loan solutions. Instead of a one-size-fits-all approach, RCS evaluates each application’s merits and tailors loan offers to suit individual needs.

How RCS Creates Personalized Loan Offers

RCS uses a combination of advanced algorithms and manual assessments to create personalized loan offers. By analyzing the information provided in the application, along with credit history and other relevant data, RCS determines the loan amount, interest rate, and repayment terms that best fit the applicant’s financial profile.

How Long Does It Take to Receive My Money from RCS?

One of the standout features of RCS is its swift processing times. Once your loan application is approved, the disbursement of funds is usually quick.

Average Processing Times

On average, after approval, it can take just a few business days for the loan amount to be credited to your bank account. However, this timeline can vary based on several factors.

Factors Affecting Withdrawal Speed

Several factors can influence the speed at which you receive your funds from RCS. These include the accuracy of the information provided, the time it takes for verification, bank processing times, and the volume of applications RCS is handling at any given time.

How Do I Repay My Loan from RCS?

Repaying your loan is a straightforward process with RCS. They offer multiple repayment options to ensure convenience for their borrowers.

Repayment Options and Plans

RCS typically sets up a monthly debit order, automatically deducting the loan installment from your bank account. This ensures timely repayments and reduces the hassle for borrowers. Additionally, RCS offers flexible repayment terms, allowing borrowers to choose a tenure that aligns with their financial situation.

Possible Fees and Penalties

While RCS is transparent about its loan terms, it’s essential to know any potential fees and penalties. Late payments or missed installments might incur additional charges. It’s always a good practice to review the loan agreement in detail and stay informed about any fees or penalties associated with the loan. If ever in doubt, RCS’s customer service is readily available to clarify any queries or concerns.

Online Reviews of RCS

In the age of digital communication, online reviews play a pivotal role in shaping the reputation of a company. They offer potential customers insights into the experiences of those who have already used of a company’s services or products. For RCS, a leading financial institution in South Africa, online reviews paint a comprehensive picture of its offerings and customer service.

What Customers Say About RCS

Customers often highlight RCS’s commitment to providing tailored financial solutions. Many appreciate the transparent processes and the absence of hidden charges, which makes the loan application and repayment journey predictable and hassle-free.

The speed of approval and disbursement is another aspect that garners positive feedback. Customers value the promptness with which RCS processes applications, ensuring that funds are available when needed the most.

RCS’s customer service also receives commendation. The responsive and knowledgeable team is often mentioned in reviews, with customers appreciating the guidance and assistance they receive throughout their financial journey with RCS.

However, like all companies, RCS also has areas where some customers feel there’s room for improvement. A few reviews might point out specific challenges faced during the application process or wish for even more flexible repayment options.

Customer Service

Navigating the financial landscape can sometimes raise questions or concerns. It’s crucial to have a reliable customer service team to turn to for guidance and clarification.

Do You Have Further Questions for RCS?

If you have additional queries or need further information about RCS and its offerings, their dedicated customer service team is ready to assist. They are trained to provide detailed insights into RCS’s products, help with the application process, and address any concerns you might have.

Alternatives to RCS

While RCS is a prominent player in the South African financial market, there are other credit providers that potential borrowers might consider:

- Sanlam Loans: A prominent financial services group in South Africa, offering a range of personal loan products.

- Direct Axis: Another leading financial services provider in South Africa, Direct Axis specializes in personal loans and debt consolidation.

Comparison Table: A Side-by-Side Comparison of RCS with Top Competitors

| Lender | Loan Amount Range | Interest Rate | Repayment Period |

|---|---|---|---|

| RCS Loans | R5,000 to R300,000 | 15% | 12 to 60 months |

| Sanlam Loans | R5,000 to R300,000 | 15% to 29.25% per annum | 12 months to 6 years |

| Direct Axis | Up to R300,000 | Maximum of 29.25% per annum | 24 to 72 months |

| Finchoice | R500 to R40,000 | From 5% | 1 – 24 months |

| Old Mutual Loan | Up to R250,000 | Varies | 3 – 72 months |

This table shows a basic comparison of the loan amounts, interest rates, and repayment periods for each lender. The interest rates for Sanlam Loans, and Direct Axis are variable and depend on the borrower’s personal risk profile. It’s important to note that these details might vary and it’s recommended to consult each lender’s website or contact them directly for the most current information.

History and Background of RCS

RCS, a leading consumer finance business in South Africa, has a rich history that spans several years. Established with the vision to provide South Africans with innovative financial solutions, RCS has grown exponentially, carving a niche for itself in the competitive financial landscape.

Brief History and Establishment of the Company

RCS was founded to bridge the gap between traditional banking and the evolving needs of consumers. Over the years, the company has expanded its footprint, not just in South Africa but also in neighboring countries like Namibia and Botswana. Their association with leading retailers and brands has further solidified their position as a trusted financial partner for many.

Company’s Mission and Vision

RCS’s mission is to empower individuals by providing them with tailored financial solutions that enhance their quality of life. Their vision is to be at the forefront of financial innovation, continuously evolving to meet the changing needs of their customers.

Pros and Cons

Advantages of Choosing RCS:

- Tailored Financial Products: RCS offers a range of products designed to cater to individual needs, ensuring that customers get solutions that resonate with their financial goals.

- Transparent Processes: RCS is known for its clear and transparent processes, ensuring that customers are always in the know and face no hidden charges.

- Quick Approval and Disbursement: RCS’s streamlined processes ensure that loan applications are processed swiftly, and funds are disbursed on time.

Disadvantages of Choosing RCS:

- Limited Physical Presence: While RCS has a strong online presence, they have limited physical branches, which might be a concern for those who prefer in-person interactions.

- Competitive Market: With many financial institutions offering similar products, some might find RCS’s offerings comparable to other providers in the market.

Conclusion

RCS has established itself as a reliable and trusted financial partner for many South Africans. Their commitment to innovation, customer-centric approach, and transparent processes make them a preferred choice for many. While they face competition in the market and have areas where they can further enhance their offerings, their overall dedication to empowering individuals financially is commendable.

Overall Rating of RCS

Considering the comprehensive offerings, customer feedback, and commitment to excellence, RCS can be rated as a top-tier financial institution in South Africa. Their continuous efforts to evolve and cater to the changing needs of their customers further solidify their position in the market.

Frequently Asked Questions about RCS

RCS is a leading consumer finance business in South Africa, offering a range of financial products tailored to the unique needs of individuals.

RCS provides various loan products, including personal loans, home loans, and auto loans, among others.

You can apply for an RCS loan online through their official website. The application process is user-friendly, requiring you to fill out a form and submit the necessary documents.

Yes, RCS employs state-of-the-art encryption technologies and robust security measures to ensure the protection of your data.

RCS is known for its swift approval process. Typically, once all required documents are submitted, you can expect a response within a few business days.