When it comes to personal loans, there’s a sea of options available. One name that often pops up in South Africa is Old Mutual. But what makes their loan offerings stand out? In this review, we’ll dive deep into the specifics of Old Mutual Personal Loans, shedding light on its features, terms, and what potential borrowers can expect.

Experiences with Old Mutual Loan

Navigating the financial landscape can be daunting, but with Old Mutual, many borrowers have found a reliable partner. Over the years, Old Mutual has built a reputation for its transparent loan processes, clear communication, and commitment to customer satisfaction. Feedback from numerous customers highlights the ease of application, prompt response times, and the helpfulness of the Old Mutual team. While experiences can vary, the overarching sentiment is one of trust and reliability when it comes to Old Mutual’s loan services.

Who Can Apply for an Old Mutual Loan?

Old Mutual aims to cater to a broad spectrum of individuals. Whether you’re a salaried employee, a self-employed professional, or someone with varied income sources, Old Mutual has provisions to accommodate diverse financial profiles. However, like all responsible lenders, they have certain criteria to ensure the creditworthiness of applicants. It’s not just about offering loans; it’s about ensuring that borrowers can comfortably repay them without straining their finances.

Criteria for Potential Borrowers

While Old Mutual is inclusive, there are basic criteria that potential borrowers must meet:

- Age: Applicants must be 18 years or older.

- Income: A consistent source of income is essential. This can be through employment, business, or other verifiable means.

- Credit History: Old Mutual will conduct a credit check. While a perfect credit score isn’t mandatory, a decent credit history can improve the chances of approval and potentially secure better terms.

- Documentation: Proof of identity, income, and residence are typically required. This can be in the form of ID documents, payslips, bank statements, and utility bills.

Differences from Other Loan Providers

Old Mutual stands out in a crowded market, and here’s how:

- Flexibility: With loan terms ranging from 3 to 72 months and amounts up to R250,000, Old Mutual offers a range that caters to both short-term and long-term needs.

- Transparency: No hidden fees or surprise charges. Everything is laid out clearly from the onset.

- Multiple Application Avenues: Whether you prefer online methods, a callback request, or visiting a branch, Old Mutual accommodates all.

- Reputation: With years in the financial sector, Old Mutual’s legacy is one of trust and reliability. This isn’t just about numbers but about building lasting relationships with customers.

About Arcadia FInance

Arcadia Finance streamlines loan acquisition by connecting you with a variety of banks and financial institutions. Simply complete a complimentary application to receive offers from as many as 10 distinct lenders. Our partnerships are exclusively with reputable, licensed lenders, all regulated by the National Credit Regulator (NCR) in South Africa.

Requirements for an Old Mutual Loan

When considering a loan application, Old Mutual, like most financial institutions, has specific requirements to ensure the creditworthiness and authenticity of the applicant. These requirements are in place to protect both the lender and the borrower, ensuring that loans are granted to individuals who have the means to repay them.

Documents and Information Needed

For an Old Mutual loan application to be processed, applicants need to provide certain documents and information. Firstly, proof of identity is paramount. This can be in the form of a valid South African ID document or passport. It’s essential to ensure that the document is current and has a clear photograph.

Next, proof of income is crucial. This demonstrates to Old Mutual that the applicant has a consistent source of funds to repay the loan. Typically, this would be the latest payslips if the applicant is employed. For self-employed individuals or those with varied income sources, bank statements showcasing consistent income over the past few months would be required.

Proof of residence is another vital piece of information. This could be any official document that has both the applicant’s name and residential address. Utility bills, such as water or electricity bills, or even a lease agreement, can serve this purpose. The address on this document must match the one provided in the loan application.

Lastly, Old Mutual would require details about the applicant’s current financial obligations. This includes any other loans or credit facilities the applicant might have. This information helps Old Mutual assess the applicant’s overall financial health and ensures that they won’t be overburdened with debt.

Simulation of a Loan at Old Mutual

Navigating the loan application process can sometimes feel like a maze. However, with Old Mutual, the process is streamlined and user-friendly. Let’s walk through a step-by-step guide to applying for a loan with Old Mutual.

Step-by-Step Guide to Applying for a Loan with Old Mutual

- Start Online: Begin by visiting the Old Mutual website. They have a dedicated section for personal loans where you can find all the necessary information and start your application.

- Choose Your Loan Type: Old Mutual offers various loan products, so you’ll need to select the one that best fits your needs, be it a personal loan, home loan, or auto loan.

- Enter Loan Details: Input the desired loan amount and the preferred repayment term. This will give you an estimate of your monthly repayments.

- Fill Out the Application Form: The online form will ask for personal details, employment information, and financial obligations. Ensure that all the information provided is accurate to avoid any hiccups in the process.

- Submit Necessary Documents: As previously mentioned, you’ll need to provide proof of identity, income, and residence. These can usually be uploaded directly through the online portal.

- Wait for Approval: Once you’ve submitted your application and documents, Old Mutual will review the information. They might also conduct a credit check to assess your creditworthiness.

- Receive Feedback: Old Mutual will get back to you with their decision. If approved, they will provide the loan agreement with all the terms and conditions.

- Sign and Accept: If you’re satisfied with the terms, you can sign the agreement. Once this is done, the loan amount will be disbursed to your bank account.

Eligibility Check

Before diving into the full application process, it’s wise to check if you meet Old Mutual’s eligibility criteria. This can save time and ensure that you’re on the right track.

Tools or Methods Offered by Old Mutual to Pre-Check Eligibility

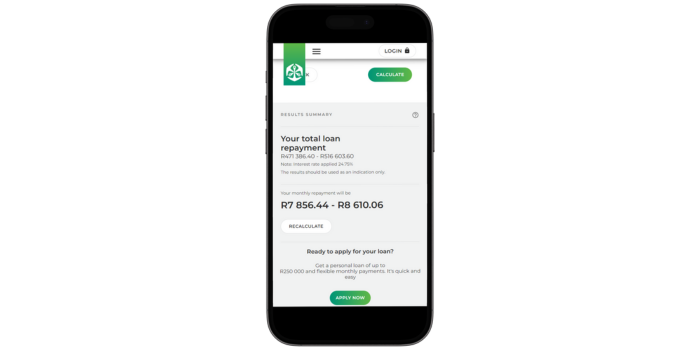

Old Mutual understands the importance of time and the need for clarity when considering a loan. To assist potential borrowers, they offer an online loan calculator. This tool allows users to input the desired loan amount and term to get an estimate of monthly repayments. While this doesn’t guarantee approval, it gives a clear picture of what to expect.

Additionally, Old Mutual’s website provides detailed information on the basic criteria for loan approval. By reviewing this information, applicants can gauge their eligibility before starting the application process.

Security and Privacy at Old Mutual

In today’s digital age, the security of personal and financial information is paramount. Old Mutual recognizes the importance of this and has implemented robust measures to ensure that their customers’ data remains protected.

How Old Mutual Ensures the Security of Personal and Financial Information

Old Mutual employs state-of-the-art encryption technologies to safeguard the data transmitted between the user’s device and their servers. This means that any information you provide, be it personal details or financial specifics, is encrypted during transmission, making it extremely difficult for unauthorized parties to intercept or decipher.

Old Mutual’s digital platforms are fortified with advanced firewalls and intrusion detection systems. These tools continuously monitor and defend against potential threats, ensuring that the platforms remain secure and uncompromised.

Beyond the digital realm, Old Mutual also places a strong emphasis on physical security. Any hard copies of documents or data are stored in secure facilities with restricted access. Only authorized personnel can access these areas, ensuring that your data remains confidential.

Privacy Policies and Data Handling Practices

Old Mutual is committed to upholding the highest standards of data privacy. Their privacy policy is comprehensive and designed to inform customers about how their data is collected, used, and protected.

Firstly, Old Mutual only collects information that is necessary for the provision of their services. This could be for processing loan applications, communicating with customers, or ensuring compliance with regulatory requirements.

The data collected is used solely for the purposes stated and is not sold or shared with third parties for marketing purposes. Old Mutual might share information with regulatory bodies if required by law, but this is done with the utmost care and in compliance with legal provisions.

Old Mutual also believes in giving customers control over their data. As a customer, you have the right to access, modify, or even delete your data. Their privacy policy provides clear guidelines on how customers can exercise these rights.

In terms of data retention, Old Mutual only keeps customer data for as long as it’s necessary. Once the data has served its purpose and is no longer required, it’s securely deleted or anonymized.

How Much Money Can I Request from Old Mutual?

When considering a loan from Old Mutual, it’s essential to know the range of loan amounts they offer. Old Mutual provides a flexible range, ensuring they cater to a variety of financial needs. The minimum and maximum amounts vary based on the type of loan and the borrower’s financial profile. Typically, for personal loans, Old Mutual offers amounts up to R250,000. However, the exact amount you can request will depend on your creditworthiness, income, and other financial factors.

Receive Offers

Old Mutual prides itself on creating personalized loan offers for its customers. They understand that everyone’s financial situation is unique, and a one-size-fits-all approach doesn’t always work. To create these tailored offers, Old Mutual evaluates various factors, including your credit score, monthly income, existing financial obligations, and the purpose of the loan. By assessing this information, they can determine the loan amount, interest rate, and repayment term that best suits your needs.

How Long Does It Take to Receive My Money from Old Mutual?

The anticipation of receiving loan funds can be high, especially if you have pressing financial needs. With Old Mutual, the average processing times are relatively swift. Once your application is approved, it typically takes a few business days for the funds to be disbursed into your bank account. However, it’s worth noting that this is an average timeframe, and the actual duration can vary.

Factors Affecting Withdrawal Speed

Several factors can influence the speed at which you receive your loan funds from Old Mutual. The completeness and accuracy of the information and documents you provide play a significant role. If there are discrepancies or missing details, it might require additional verification, leading to delays. Additionally, the mode of disbursement you choose and the processing times of your bank can also impact the speed of fund receipt.

How Do I Repay My Loan from Old Mutual?

Repaying your loan is a crucial aspect of the borrowing process. Old Mutual offers various repayment options to ensure convenience for its customers. You can opt for direct debits from your bank account, ensuring that the repayment amount is automatically deducted on the due date. Alternatively, you can make manual payments through bank transfers or at Old Mutual branches.

Possible Fees and Penalties

While Old Mutual is transparent about its fee structure, it’s essential to be aware of potential fees and penalties. There’s usually a once-off initiation fee and a monthly admin fee. If a repayment is missed or delayed, additional interest might accrue, and there could be late payment fees. It’s always advisable to read the loan agreement carefully and understand all associated charges to avoid any surprises.

Online Reviews of Old Mutual

In the age of digital communication, online reviews have become a valuable resource for potential customers looking to understand the experiences of others. Old Mutual, with its longstanding presence in the financial sector, has garnered a plethora of reviews from its customers. Let’s delve into what they have to say.

What Customers Say About Old Mutual

Many customers appreciate Old Mutual for its transparency and clear communication. They often highlight the ease of understanding the terms and conditions of their loans, with no hidden fees or unexpected charges. This transparency builds trust, a crucial factor when dealing with financial matters.

Customer service is another area where Old Mutual shines, according to online reviews. Many customers mention the helpfulness and professionalism of the Old Mutual team. Whether it’s answering queries, guiding through the application process, or addressing concerns, the Old Mutual staff often receive praise for their dedication and patience.

The speed of processing is a recurring theme in many reviews. Customers appreciate the swift response times, from the initial application to the disbursement of funds. In situations where financial needs are pressing, this efficiency is particularly valued.

However, like any company, Old Mutual has its share of critiques. Some customers have pointed out issues with the online portal, while others wished for more flexible repayment options. It’s essential to remember that individual experiences can vary, and what might be a concern for one person might not be for another.

Alternatives to Old Mutual

While Old Mutual is a prominent player in the financial sector, there are several other credit comparison portals and institutions that potential borrowers might consider. Let’s explore some of these alternatives and see how they stack up against Old Mutual.

Comparison table of Old Mutual Loan with Top Competitors

| Lender | Loan Amounts (R) | Loan Terms (Months) | Annual Interest Rate (%) | Initiation Fee (R) | Monthly Service Fee (R) |

| Old Mutual Loan | Up to R250,000 | 3 – 72 | Varied | Not specified | Not specified |

| Nedbank Personal Loan | R2,000 – R300,000 | 6 – 72 | 11.25 – 28.75 | Not specified | Not specified |

| Standard Bank Personal Loan | R3,000 – R300,000 | 12 – 72 | 7.75 – 25.75 | R1,207 | R69 |

| Capitec Bank | R1,000 – R250,000 | 7 – 84 | 13.25 – 28.75 | R1,207 | R69 |

| RCS Loans | R5,000 – R300,000 | 12-60 | 15% |

This table provides a quick overview of the key features of each loan option. Keep in mind that specific details like the actual interest rate you may receive can vary based on your individual credit profile and other factors. The information for Old Mutual Loan is based on general data as specific rates and fees weren’t provided in the article.

History and Background of Old Mutual

Founded in 1845 in Cape Town, South Africa, Old Mutual has a rich history that spans over a century. Initially established as a mutual insurance company, it has since evolved into a diversified financial services group, offering a range of products from insurance to personal loans. Over the years, Old Mutual has expanded its footprint, not only within South Africa but also in other parts of the world, making it a global name in the financial sector.

Company’s Mission and Vision: Old Mutual’s mission is to empower its customers to achieve their financial goals, ensuring a brighter future for them and their families. Their vision is to be their customers’ most trusted financial partner, always delivering exceptional value and service.

Pros and Cons

Advantages of Choosing Old Mutual:

- Legacy and Trust: With over a century in the business, Old Mutual has built a reputation for reliability and trustworthiness.

- Diverse Offerings: From insurance to loans, Old Mutual offers a comprehensive range of financial products, catering to varied needs.

- Customer-Centric Approach: Old Mutual places its customers at the heart of its operations, ensuring tailored solutions and excellent service.

Disadvantages of Choosing Old Mutual:

- Size and Complexity: Being a large institution, some customers feel that Old Mutual can sometimes be bureaucratic and slow in its processes.

- Online Platform Issues: While they have made strides in digital offerings, some users have pointed out glitches and inefficiencies in their online platforms.

Conclusion

Old Mutual, with its rich history and commitment to customer empowerment, remains a formidable player in the financial sector. While they offer numerous advantages, like any institution, they have areas for improvement. However, their dedication to value and service makes them a preferred choice for many.

Overall Rating of Old Mutual: 4.5/5 – Based on their legacy, diverse offerings, and customer-centric approach, with minor points deducted for occasional bureaucratic delays and online platform issues.

Frequently Asked Questions about Old Mutual

Old Mutual specializes in a range of financial services, including insurance, personal loans, savings, and investment solutions.

Old Mutual was established in 1845, making it one of the oldest and most established financial institutions in South Africa.

While Old Mutual originated in South Africa, it has expanded its operations and now serves customers in various parts of the world.

You can apply for a loan with Old Mutual through their online portal, by visiting one of their branches, or by requesting a callback through their website.

Old Mutual employs state-of-the-art encryption technologies and advanced firewalls to safeguard customer data. They also adhere to strict data protection regulations to ensure confidentiality.