BlinkFinance [BlinkFinance.co.za] is a registered South African credit provider that specialises in short term, same day loans of up to R8 000. The lender positions itself as a quick and convenient option for individuals who need fast access to cash, offering an entirely paperless application process and rapid payouts directly to your bank account once approved. In this review, we explore their products, fees, eligibility requirements, and how it compares to other lenders in the local market, helping you decide whether it is the right fit for your financial needs.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by BlinkFinance and is based solely on our research.

BlinkFinance offers short-term loans ranging from R1 000 up to R8 000, with repayment terms between 61 and 65 days. If you’re in need of a fast and reliable lending solution to cover urgent expenses, such as medical bills, car repairs, or bridging the gap until payday, read on to find out whether BlinkFinance’s services meet your financial requirements.

BlinkFinance Loan: Quick Overview

Loan Amount: R1 000 – R8 000

Loan Term: 61 to 65 days

Interest Rate: Up to 30% APR

Fees: R69 monthly service fee for missed payments; 5% monthly penalty interest on overdue balances; Optional R57 (“immediate payout”) fee for faster disbursement

Loan Types: Short-term payday loans tailored for urgent needs

BlinkFinance Full Review

Experiences with BlinkFinance Loan

People who have used BlinkFinance often say the site is easy to use, the approval is quick, and the terms are clear. Getting a loan fast is not just something they advertise, it’s what actually happens for many customers. Because the whole process is digital and paperless, you don’t have to deal with piles of forms, which makes applying simple and stress free.

Who Can Apply for a BlinkFinance Loan?

BlinkFinance caters to a broad audience. Whether you’re a working professional, a business owner, or someone facing a sudden financial crunch, this lender is open to serving your needs. However, it’s essential to note that while the platform is accessible to many, there are specific criteria that applicants must meet. This ensures both the lender’s and borrower’s security and satisfaction in the loan process.

Criteria for Potential Borrowers

To be eligible for a their loan, applicants must meet certain foundational criteria:

- South African residency with a valid South African ID number (used to run a credit check)

- Proof of stable income, such as payslips or bank statements, to show you can repay the loan

- Basic personal details, including contact information, physical and postal address

- Employer details to assist with verification and streamline the approval process

Differences from Other Loan Providers

What sets BlinkFinance apart from the myriad of loan providers out there? For starters, their commitment to a paperless credit solution stands out. BlinkFinance is ahead of the curve, offering a seamless online loan application process. Their same-day loan approval and transfer feature mean that borrowers don’t have to wait in prolonged anticipation. This speed and efficiency are especially crucial for those in urgent need of funds. Another distinguishing factor is their transparent fee structure. With them, what you see is what you get. There are no hidden charges or last-minute surprises. Lastly, their accreditation with the National Credit Act underscores their commitment to ethical lending practices, ensuring that borrowers are always treated fairly and with respect.

About Arcadia Finance

Streamline your loan acquisition process with Arcadia Finance. Complete a free application and discover options from up to 19 distinct lenders. All our partner lenders are credible and governed by the National Credit Regulator, guaranteeing adherence to standards and trustworthiness in South Africa’s financial sector.

BlinkFinance Loan

Their approach to lending goes beyond merely providing funds; it focuses on delivering a customised experience that resonates with the needs of the modern borrower.

What Makes the BlinkFinance Loan Unique?

BlinkFinance has established itself as a unique player with its instant loan offerings. In an era where time is of the essence, they ensure not only the approval but also the transfer of loan proceeds within the same day. This immediacy proves to be a game-changer for individuals facing urgent financial requirements. Their commitment to a paperless process highlights their dedication to leveraging technology for efficiency. Borrowers can bid farewell to the tedious paperwork traditionally associated with loan applications. Additionally, their adherence to the National Credit Act underscores their commitment to ethical lending practices, assuring clients that they are always in secure hands.

Types of Loans Offered by BlinkFinance

BlinkFinance focuses on providing short term credit solutions that are designed to help borrowers cover urgent financial needs. The lender specialises in small, fast loans with a simple application process and quick turnaround times. The main types of loans include:

Payday Loans

BlinkFinance offers payday loans of up to R8 000, intended to bridge the gap until your next salary. These loans are typically repaid in a single instalment or over a very short period, making them suitable for unexpected expenses such as medical bills, car repairs, or emergencies.

Same Day Loans

A key feature of this lender is its promise of same day payouts. Once your application is approved, funds are transferred directly into your bank account within 24 hours. This makes it a practical option for individuals who need immediate access to cash without lengthy approval processes.

Requirements for a BlinkFinance Loan

Applying for a loan with BlinkFinance is quick and straightforward, but there are a few key requirements you need to meet. These checks help make sure you can manage the loan and that the process runs smoothly.

What You’ll Need to Apply

- Accurate Information: Even though BlinkFinance is digital-first and offers a paperless process, the information you provide must be correct and up to date. This helps speed up approval and ensures the payout happens without delays.

- Valid South African ID: You must have a valid South African ID number. This lender uses this to run a credit check and see how you’ve managed debt in the past.

- Proof of Income: You’ll need to show that you have a steady source of income. This could be recent payslips, bank statements, or similar documents. This step reassures them that you’ll be able to repay the loan on time.

- Basic Personal Details: You’ll be asked for contact information, your physical and postal address, and details about your current employer. These details help confirm your application and make it easier to stay in touch during the loan period.

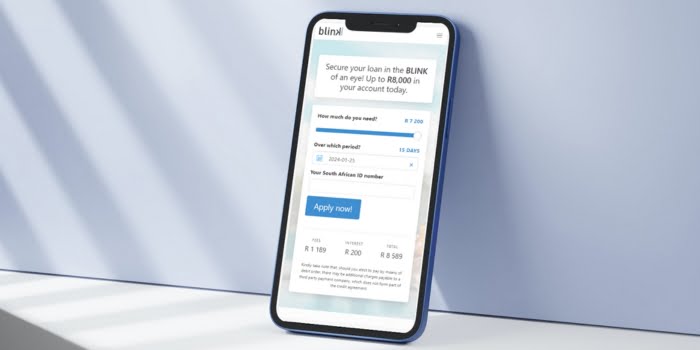

Step-by-step Guide to Applying for a Loan with BlinkFinance

Step 1. Go to Blinkfinance.co.za

Step 2. Select how much money you need using the slider.

Step 3. Choose your repayment period and confirm the dates.

Step 4. Enter your South African ID number and personal details.

Step 5. Submit your application by clicking “Apply now.”

Step 6. Upload supporting documents such as payslips or bank statements for income verification.

Step 7. Wait for credit check and approval. BlinkFinance will review your details and assess your eligibility.

Step 8. Receive funds directly in your bank account if approved, usually within 24 hours.

Eligibility Check

BlinkFinance makes it easy to see if you qualify before committing to a full loan application.

How Their Tools Work:

- Loan Calculator: On BlinkFinance.co.za, you can enter your preferred loan amount and repayment date to see the estimated total cost, including fees and interest.

- ID Number Verification: By entering your South African ID, BlinkFinance runs an initial credit and identity check. This helps them assess your likelihood of approval.

These steps give you quick feedback, so you know whether moving forward is worthwhile. While the calculator and ID check offer a good indication, full approval also depends on factors like income, expenses, and employment stability.

Security and Privacy

BlinkFinance prioritises security and privacy by using advanced encryption to protect all transmitted data, from ID numbers to bank details, while secure firewalls and regular audits safeguard its systems against cyber threats. Its fully digital, paperless approach reduces risks linked to physical documents, ensuring sensitive information stays protected. In line with the National Credit Act, this lender follows strict data-handling standards, outlined in a transparent privacy policy that explains how data is collected, used, and safeguarded. Personal information is applied only for legitimate purposes such as loan approval and disbursement, never shared without consent, and clients retain the right to access, correct, or delete their data through clear support channels.

Who Are BlinkFinance Loans Best Suited For?

- Borrowers needing R1 000 to R8 000 for urgent short-term expenses.

- South African residents aged 18+ with a valid ID and regular income.

- Those who can provide proof of income and basic personal details.

- Applicants who prefer a fast, fully online application process.

- Individuals seeking short-term repayment terms of 61 to 65 days.

Is BlinkFinance a Safe and Good Option?

BlinkFinance is a registered credit provider in South Africa, authorised by the National Credit Regulator (NCRCP12599). It focuses on providing short-term payday loans through an entirely online and paperless process. Loan amounts range from R1 000 to R8 000, with repayment terms between 61 and 65 days. The application process is completed online via their website, where borrowers can select their loan amount, enter their South African ID number, and upload required documentation such as proof of income, address, and employment.

BlinkFinance promotes responsible lending with a transparent fee structure and clearly defined repayment terms. All applications undergo a credit check and affordability assessment. If approved, funds are usually disbursed within 24 hours, often on the same day. With its focus on speed, convenience, and compliance with the National Credit Act, this lender offers a practical solution for South Africans needing fast, short-term financial assistance.

How Much Money Can I Request from BlinkFinance?

When considering a loan from BlinkFinance, it’s crucial to understand the range of amounts you can request. The company offers loans that address various financial needs. The minimum amount you can request is typically determined by your financial capability and creditworthiness. On the higher end, this lender allows borrowers to request up to R8 000.

Loan Amount Range

- Minimum Amount: The minimum amount you can request is subject to your financial capability and creditworthiness.

- Maximum Amount: BlinkFinance allows borrowers to request up to R8 000.

Receive Offers

BlinkFinance prides itself on providing tailored loan solutions to its clients. Instead of a one-size-fits-all approach, they analyse individual financial profiles to create personalised loan offers.

The process commences with the information you furnish during the application. Details such as your income, expenses, and credit history play a pivotal role. Their advanced algorithms then analyse this data to determine the loan amount, interest rate, and repayment terms that align with your financial situation. This personalised approach ensures that the loan offer you receive is not only competitive but also sustainable for your financial health.

How Long Does It Take to Receive My Loan Payout from BlinkFinance?

One of the standout features of this lender is its commitment to swift processing times. On average, once your loan is approved, the funds are transferred directly into your account within 24 hours. This quick turnaround is especially beneficial for those in urgent need of funds.

Factors Affecting Withdrawal Speed

While BlinkFinance aims for rapid disbursements, certain factors can affect withdrawal speed. The accuracy of the information provided, the time of approval, and bank processing times can influence the exact time it takes for the funds to reflect in your account. It’s always advisable to ensure that all provided details are accurate and to apply during regular business hours to expedite the process.

BlinkFinance: Overview in Detail

| Name | BlinkFinance Loan |

|---|---|

| Financial Institution | BlinkFinance (NCR‑registered credit provider, NCRCP12599) |

| Product | Short‑term, same‑day online payday loans |

| Minimum Age | 18 years |

| Minimum Loan Amount | From R1,000 |

| Maximum Loan Amount | Up to R8 000 |

| Repayment Term | Flexible between 61–65 days |

| APR (Annual Percentage Rate) | Maximum 30% APR |

| Repayment Mechanism | Automatic debit order timed to payday |

| Early Settlement | Allowed at any time; borrower pays outstanding principal, interest, and fees |

| Fees / Penalties | – R69 monthly admin fee for missed payments – 5% monthly penalty interest – Debt collection after two missed payments |

| NCR Accredited | Yes (Regulated under the National Credit Act) |

| Our Opinion | ✅ Fast, paperless application with same‑day payout ✅ Transparent interest and fees ⚠️ Loan limited to R8 000 and short term |

| User Opinion | ✅ Quick fund disbursement praised ⚠️ Penalties and credit score impact noted |

How Do I Repay My Loan from BlinkFinance?

BlinkFinance makes loan repayment straightforward by using debit orders. Once your loan is approved, a debit order is set up on the bank account you provided during the application. Each time you receive your salary, the agreed instalment is automatically deducted, ensuring repayments are made on time without the need for manual transfers.

You must ensure that enough funds are available in your account on the repayment date. If a debit order fails, the lender may charge penalty fees and interest on late payments. Missed or delayed instalments can also negatively affect your credit record, making it more difficult or expensive to qualify for future loans.

Repayment terms usually range from 61 to 65 days, depending on your agreement. If you anticipate financial difficulties, the company advises contacting them immediately. They may be able to discuss alternative arrangements to help you avoid unnecessary costs and keep your account in good standing.

Online Reviews of BlinkFinance

BlinkFinance, like many other companies, has its share of online feedback.

What Customers Say About BlinkFinance

Great service seamless and paperless application. They kept me up to date with the status of my application and it was approved swiftly.

Awesome and transparent with outstanding service,what more can I say,u’ll only know if u apply.

Takes forever. Too much paperwork.

Just simply useless,they must shut it down.I applied for a loan after debicheck and contract signing, they declined without even informing me, I had to call them.

Customer Service

If you have additional questions or need clarification on any aspect of BlinkFinance’s offerings, don’t hesitate to reach out to their customer service team. They are equipped to provide detailed explanations and guide you through any uncertainties you might have. Remember, it’s always better to ask and be clear than to make assumptions, especially when dealing with financial matters.

Phone number:

Office: 012 534 3863

Hours of operation:

Online applications are accepted 24/7.

Postal address:

Unit 15, Kingfisher Building, Hazeldean Office Park, Silverlakes Road, Tyger Valley, Pretoria, 0084

Alternatives to BlinkFinance

While BlinkFinance offers a range of financial solutions tailored to meet various needs, it’s always a good idea to explore alternatives. The financial market is vast, and several other credit comparison portals might suit your specific requirements.

Comparison Table

| Lender | Loan Range | Interest Rate | Repayment Period |

|---|---|---|---|

| BlinkFinance | R1 000 – R8 000 | Varies | 61-65 days |

| Wonga | Up to R4 000 | Varies | Up to 6 months |

| ExpressFinance | Up to R3 000 | Varies | Until next payday |

| Sunshine Loans | R500 – R4 000 | Varies | Aligned with pay cycle |

History and Background of BlinkFinance

BlinkFinance emerged in the financial landscape as a response to the growing need for swift and reliable online lending solutions. Established in the heart of South Africa, the company quickly gained traction by offering digital, paperless credit solutions to individuals facing sudden financial challenges. Over the years, this company has grown not just in terms of its customer base but also in its commitment to ethical lending practices, as evidenced by its accreditation with the National Credit Act.

Company’s Mission and Vision

This lender’s mission is clear: to provide fast, transparent, and reliable loan solutions to those in need. They believe in leveraging technology to make the loan application process as seamless and hassle-free as possible. Their vision is to be at the forefront of online lending, setting industry standards in terms of speed, transparency, and customer satisfaction.

Pros and Cons

Advantages of Choosing BlinkFinance

- Swift Processing: Known for its same-day loan approval and transfer, ensuring that borrowers get access to funds when they need them the most.

- Transparent Fee Structure: There are no hidden charges. Borrowers can easily understand the cost implications of their loans.

- Digital-First Approach: The paperless credit solution offered by this lender ensures a smooth and efficient loan application process.

Disadvantages of Choosing BlinkFinance

- Limited Loan Amount: The maximum loan amount offered is R8 000, which might not cater to those needing larger sums.

- Short Repayment Period: With repayment periods ranging from 61 to 65 days, some borrowers might find it challenging to repay the loan in such a short timeframe.

Conclusion

BlinkFinance has undoubtedly made its mark in the online lending space with its swift processing times and transparent fee structure. The advantages of same-day loan approval, a clear fee structure, and a digital-first approach contribute to its appeal. However, potential borrowers should also be aware of the limitations, such as the capped loan amounts and relatively short repayment periods.

Frequently Asked Questions

BlinkFinance is an online lending platform based in South Africa that specialises in offering swift and transparent loan solutions to individuals in need. They focus on providing digital, paperless credit solutions with an emphasis on speed and customer satisfaction.

You can request loan amounts ranging from a minimum of R1 000 to a maximum of R8 000, depending on your financial capability and creditworthiness.

BlinkFinance is known for its rapid processing times. On average, once your loan is approved, the funds are transferred directly into your account within 24 hours.

No, BlinkFinance prides itself on its transparent fee structure. All costs associated with the loan are clearly outlined during the application process, ensuring no hidden charges or surprises.

All repayments are done via debit order. This automated process ensures timely repayments and reduces the hassle for borrowers. Before the debit order is executed, borrowers receive a notification for transparency.