In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s for a personal project, a new car, or to consolidate existing debts, finding the right loan can be a daunting task. Enter MoneyLoans.co.za, a platform designed to simplify this process for South Africans. This review will delve into the offerings of MoneyLoans, shedding light on its services, benefits, and how it stands out in the crowded loan marketplace. By the end, you’ll have a clear understanding of whether MoneyLoans is the right fit for your financial needs.

Experiences with MoneyLoans Loan

Navigating the financial landscape can be challenging, especially when seeking a loan that aligns with one’s needs. Many individuals have turned to MoneyLoans in their quest for financial solutions, and the feedback has been overwhelmingly positive. Users often highlight the platform’s user-friendly interface, the variety of loan options available, and the swift response times.

Who can apply for a MoneyLoans loan?

MoneyLoans is inclusive and caters to a broad audience. Whether you have an excellent credit history, are just starting out with no credit footprint, or have faced financial hiccups in the past, MoneyLoans offers solutions tailored to various financial backgrounds. The platform is designed to assist both individuals in urgent need of short-term financial boosts and those seeking more substantial, long-term financial assistance.

Criteria for Potential Borrowers

To ensure the safety and security of both lenders and borrowers, MoneyLoans has set specific criteria that potential borrowers must meet. Firstly, applicants must be over the age of 18, as this is the legal age to enter into a contractual agreement in South Africa. Additionally, applicants should be permanent employees, providing recent payslips and bank statements that show transactions over the past 90 days. This is to ensure that the borrower has a steady income and can manage the loan repayments. A copy of a valid South African ID and proof of residence are required during the application process.

Differences from Other Loan Providers

What sets MoneyLoans apart from other loan providers is its commitment to transparency and user empowerment. Instead of navigating the loan process alone, users are provided with tools and resources to make informed decisions. The platform’s loan comparison feature is particularly noteworthy, allowing users to evaluate various loan options side by side. MoneyLoans places a strong emphasis on educating its users, ensuring they understand the terms and implications of their chosen loan. This holistic approach, combined with their vast network of lenders, positions MoneyLoans as a preferred choice for many seeking financial solutions in South Africa.

About Arcadia Finance

Simplify your process of obtaining a loan with Arcadia Finance. Complete a free application form and discover options from up to 19 distinct lenders. All our lending partners are trustworthy and governed by the National Credit Regulator, guaranteeing adherence to regulations and dependability in the South African financial context.

MoneyLoans Loan

In the expansive realm of financial lending, MoneyLoans has carved out a niche for itself, offering a distinctive approach to loans that caters to the diverse needs of its users.

What makes the MoneyLoans loan unique?

MoneyLoans isn’t just another loan provider; it’s a platform that bridges the gap between borrowers and a variety of lenders. What truly sets MoneyLoans apart is its commitment to user empowerment. Instead of presenting a one-size-fits-all solution, MoneyLoans offers tools, resources, and information that enable users to make informed decisions tailored to their specific financial situations. This user-centric approach ensures that individuals aren’t just taking a loan but are choosing a financial solution that aligns with their needs and capabilities.

Advantages of the MoneyLoans loan comparison

One of the standout features of MoneyLoans is its loan comparison tool. In a market flooded with options, making an informed choice can be overwhelming. MoneyLoans simplifies this process by allowing users to compare various loan options side by side. This not only saves time but also ensures that users can evaluate interest rates, repayment terms, and other crucial factors in one place. By providing a clear and transparent comparison, MoneyLoans ensures that users can select the most cost-effective and suitable loan for their needs.

Types of Loans Offered by MoneyLoans

MoneyLoans understands that financial needs vary from person to person. As such, they offer a diverse range of loan products to cater to these varied requirements.

Personal Loans: These are versatile loans that can be used for a variety of purposes, from funding a dream vacation to covering unexpected expenses. With flexible repayment terms and competitive interest rates, personal loans from MoneyLoans are a popular choice for many.

Home Loans: For those looking to purchase a new home or refinance an existing mortgage, MoneyLoans offers home loans with competitive rates. These loans are tailored to help individuals achieve their dream of homeownership.

Auto Loans: Buying a car is a significant investment, and MoneyLoans is here to make it easier. Their auto loans are designed to help individuals finance their vehicle purchase, ensuring they can drive away with their dream car without breaking the bank.

Requirements for a MoneyLoans Loan

When considering a loan application, MoneyLoans aims to ensure the safety and security of both its lenders and borrowers. To achieve this, they have set specific criteria and requirements that potential borrowers must meet. These requirements not only help in assessing the borrower’s ability to repay the loan but also ensure a transparent and smooth loan process.

Documents and Information Needed

- A valid copy of a South African ID, which confirms the applicant’s identity and ensures they are of legal age to enter into a contractual agreement.

- Most recent payslips, which serve as proof of a steady income. This helps MoneyLoans determine the applicant’s ability to manage loan repayments and assess their financial stability.

- Bank statements showing transactions over the past 90 days. These statements give a clearer picture of the applicant’s financial behavior, spending patterns, and overall financial health.

- Proof of residence, which can be a utility bill or any official document showing the applicant’s current address. This is crucial for verification purposes and to ensure that the applicant has a stable residence.

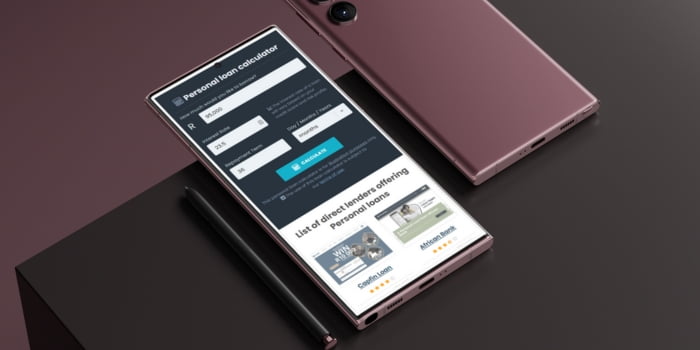

Simulation of a Loan at MoneyLoans

Navigating the process of applying for a loan can seem daunting, but with MoneyLoans, the journey is streamlined and user-friendly. Here’s a step-by-step guide to help you understand how to simulate and apply for a loan with MoneyLoans.

Step-by-Step Guide to Applying for a Loan with MoneyLoans

- Visit the MoneyLoans Website: Start by accessing the official MoneyLoans website. This platform is designed to be intuitive, making it easy for users to find the information and tools they need.

- Choose the Desired Loan Type: MoneyLoans offers various loan products, from personal loans to auto loans. Select the one that aligns with your financial needs.

- Enter Loan Details: Input the desired loan amount and preferred repayment term. This will help MoneyLoans provide a simulation of your potential loan, including estimated monthly repayments and interest rates.

- Provide Personal Information: Fill in your personal details, such as name, contact information, and employment status. This information is crucial for MoneyLoans to assess your application.

- Submit Financial Documents: Upload the necessary financial documents, including recent payslips, bank statements, and a copy of your South African ID. These documents allow MoneyLoans to evaluate your financial stability and determine your loan eligibility.

- Review Loan Offers: Once your information is processed, MoneyLoans will present you with various loan offers from different lenders. Review these offers carefully, considering factors like interest rates, repayment terms, and any additional fees.

- Select and Confirm: After reviewing the offers, choose the one that best suits your needs. Confirm your selection, and MoneyLoans will guide you through the final steps of the loan agreement.

- Wait for Approval: Once your application is submitted, MoneyLoans will review it in conjunction with the chosen lender. Approval times can vary, but MoneyLoans aims to provide swift responses to all applications.

- Receive Funds: Upon approval, the loan amount will be disbursed to your provided bank account. Ensure that all bank details provided during the application process are accurate to avoid any delays.

Eligibility Check

MoneyLoans understands the importance of time and the need to avoid unnecessary hard inquiries on one’s credit report. To assist with this, they offer tools and methods for users to pre-check their eligibility before formally applying.

Tools or Methods Offered by MoneyLoans to Pre-Check Eligibility

Online Eligibility Checker: MoneyLoans provides an online tool where users can input basic information, such as income, employment status, and desired loan amount. This tool then gives a preliminary assessment of the user’s eligibility for the selected loan product.

Loan Simulation: By simulating a loan on the MoneyLoans platform, users can get an idea of the loan terms they might be eligible for, based on the provided details and desired loan amount.

Customer Support: For those who prefer a more personalized touch, MoneyLoans offers customer support where potential borrowers can discuss their financial situation and get a preliminary assessment of their loan eligibility.

Security and Privacy at MoneyLoans

In the digital age, the security and privacy of personal and financial information are paramount. MoneyLoans recognizes this importance and has implemented robust measures to ensure that users can trust the platform with their data.

How MoneyLoans Ensures the Security of Personal and Financial Information

MoneyLoans employs a multi-layered approach to data security. Firstly, the platform uses advanced encryption technologies to protect data transmissions between the user’s device and MoneyLoans servers. This ensures that any information shared, be it personal details or financial documents, is encrypted and safeguarded from potential eavesdroppers or malicious actors.

In addition to encryption, MoneyLoans has firewalls and intrusion detection systems in place. These tools monitor and analyze traffic to the platform, looking for any unusual or suspicious activity. If any such activity is detected, the system takes immediate action to block or neutralize the threat.

MoneyLoans is committed to regularly updating and patching its systems. By staying updated with the latest security advancements and potential vulnerabilities, MoneyLoans ensures that its platform remains fortified against evolving cyber threats.

Privacy Policies and Data Handling Practices

MoneyLoans is not only dedicated to securing data but also to handling it with the utmost respect and transparency. Their privacy policy outlines the types of information they collect, how it’s used, and with whom it might be shared.

When users provide their personal and financial information, MoneyLoans uses it primarily to process loan applications and provide services. The platform does not sell or rent user data to third parties for marketing purposes. Any sharing of data is done with the user’s consent and is typically limited to lenders within the MoneyLoans network, necessary for processing loan applications.

MoneyLoans provides users with control over their data. Users can access, modify, or even request the deletion of their data from the MoneyLoans system. This commitment to user empowerment ensures that individuals have a say in how their information is used.

In terms of data retention, MoneyLoans retains user data solely for the duration required to deliver services or adhere to legal requirements. Once data is no longer necessary, it’s securely deleted from the system.

How much money can I request from MoneyLoans?

MoneyLoans offers a range of loan options from different providers, each with their own minimum and maximum loan amounts, processing times, and repayment options.

Possible Fees and Penalties

Specific details about fees and penalties are not always listed upfront. However, it’s crucial to read the terms and conditions of each loan offer to understand any potential fees or penalties for late payments or defaults.

Each lender on MoneyLoans.co.za has its own set of criteria, rates, and terms. Therefore, it’s advisable to use their loan calculators and read their terms and conditions carefully to understand the full scope of the loan offer, including the total cost and any additional charges.

Online Reviews of MoneyLoans

Navigating the world of online loans can be tricky, and potential borrowers often turn to online reviews to gauge the credibility and performance of loan providers. MoneyLoans, like many other platforms, has its share of online feedback. Here’s a glimpse into what customers are saying about MoneyLoans.

What Customers Say About MoneyLoans

On the website Sitejabber, MoneyLoans has received a range of reviews. Some users have expressed dissatisfaction, mentioning issues related to communication. For instance, a user named Ericka B. mentioned receiving frequent calls and expressed skepticism about the platform’s intentions. Another user, violet g., labeled the company as untrustworthy and advised potential users to stay away. Racheal j. also had a negative experience, referring to the platform as a scam.

While these reviews provide a snapshot of some users’ experiences, it’s essential to approach online reviews with a balanced perspective. Every individual’s experience can vary, and while some might face challenges, others might have a smooth and positive experience with the platform.

For a more comprehensive understanding, potential borrowers should also consider other sources of reviews, such as Trustpilot, where additional feedback about MoneyLoans can be found. It’s also beneficial to read the company’s responses to reviews, if available, as it can provide insight into how the company handles feedback and addresses concerns.

Customer Service at MoneyLoans

MoneyLoans prides itself on offering top-notch customer service to address any queries or concerns users might have. If you’re navigating the loan application process, need clarity on repayment terms, or just want to learn more about the platform’s offerings, MoneyLoans’ dedicated customer service team is ready to help.

Do You Have Further Questions for MoneyLoans?

If you have additional questions or need further information about MoneyLoans, it’s recommended to reach out to their customer service directly. They typically offer multiple channels of communication, including email, phone, and live chat on their website. Engaging with their team can provide personalized answers tailored to your specific situation.

Alternatives to MoneyLoans

While MoneyLoans offers a comprehensive platform for loan comparisons, there are other credit comparison portals available. Some of these platforms might include:

- LoanFinder: A platform that also caters to South Africans, offering a range of loan products and financial solutions.

- JustMoney: Another popular portal that provides insights into various financial products, including loans, insurance, and banking services.

- Fincheck: A comparison site that not only offers loan comparisons but also provides users with tools to check their credit score and financial health.

These platforms, along with MoneyLoans, contribute to providing users with a variety of options for comparing and selecting financial products that best suit their needs. It’s advisable for users to explore multiple portals and review their features, user feedback, and the range of products offered before making informed decisions about their financial choices.

MoneyLoans vs. Top Competitors

| Criteria | MoneyLoans | LoanFinder | SupaSmartLoans | BESTloans |

|---|---|---|---|---|

| User Interface | Easy-to-navigate platform with intuitive tools | User-friendly with a range of solutions | Modern design with added tools for credit checks | Easy to use with a variety of options available |

| Loan Types Offered | Personal, Home, Auto, and more | Personal, Debt Consolidation, and more | Personal, Home, Auto, and Credit Checks | Personal, Payday, Home, Auto |

| Customer Support | Email, Phone, Live Chat | Email, Phone | Email, Phone, Live Chat | Email, Phone |

| Additional Features | Loan simulation, Eligibility check | Debt counseling, Financial advice | Credit score checks, Financial insights | Eligibility checker, loan simulator |

| More Info | SupaSmartLoans Review | BESTloans Review |

Comparison Table of Direct Lenders in South Africa

| Lender | Maximum Loan Amount | Interest Rate | Repayment Period |

|---|---|---|---|

| BlinkFinance | R8,000 | Varies | 61-65 days |

| Sunshine Loans | R4,000 | Varies | Aligned with pay cycle |

| Unifi Credit | R50,000 | 28% p.a. | Up to 36 months |

| Capitec Bank | R250,000 | 12.9% p.a. | Up to 84 months |

| African Bank | R250,000 | 15% p.a. | Up to 60 months |

| Nedbank | R300,000 | 10% p.a. | Up to 60 months |

| BetterBond | Up to R50,000,000 | Start at around 11.5% | 1 to 30 years |

History and Background of MoneyLoans

While the specific origins and establishment details of MoneyLoans are not immediately available from the provided content, the history of lending itself is deeply rooted in human civilization. Lending practices have evolved over thousands of years, from the agricultural communities of Mesopotamia around 2000 BCE, where seeds and animals were loaned, to the establishment of the first central bank in England in 1690 AD. Over time, lending mechanisms have adapted to the changing needs of societies, but the core principle remains the same: transferring wealth to those who can utilize it with the trust of repayment.

Company’s Mission and Vision

MoneyLoans, like many lending platforms, likely has a mission and vision centered around providing financial solutions tailored to individual needs, empowering users with tools and resources, and ensuring a transparent and trustworthy lending process. Their commitment to user empowerment and education suggests a vision of creating a more informed and financially literate user base.

While specific details about MoneyLoans’ history are not provided, the broader context of the historical evolution of lending and the general principles guiding modern lending institutions can help frame the company’s mission and vision within the broader narrative of financial services. If more specific details are required, it would be advisable to refer to the official documentation or contact the company directly for accurate information.

Pros and Cons of Choosing MoneyLoans

Advantages

- User Empowerment: MoneyLoans provides tools and resources that enable users to make informed decisions tailored to their specific financial situations.

- Transparency: The platform offers a clear and transparent loan comparison tool, ensuring users can evaluate various loan options side by side.

- Diverse Loan Offerings: MoneyLoans caters to a wide range of financial needs, offering various loan products from personal loans to auto loans.

Disadvantages

- Online Feedback: Some online reviews suggest issues related to communication and trustworthiness, indicating potential areas of improvement for MoneyLoans.

- Limited Information: Without comprehensive details about the company’s history, establishment, and specific services, potential users might feel hesitant to engage with the platform.

Conclusion

MoneyLoans, as a platform, offers a user-centric approach to lending, emphasizing transparency, empowerment, and education. While they have garnered positive feedback for their services, like all platforms, they have areas to improve upon. It’s essential for potential users to conduct thorough research, consider both the pros and cons, and make an informed decision based on their specific needs.

Frequently Asked Questions

Qualifying for a loan typically involves assessing your financial stability, employment status, and credit history. Factors such as your job duration, marital status, and potential collateral might also play a role.

The amount you can borrow often depends on the type of loan you’re applying for, your financial health, and the collateral you can provide. It’s essential to determine how much you need and ensure you can manage the repayments.

While specific processes can vary, most loan applications involve submitting personal and financial information, providing necessary documents, reviewing loan offers, and awaiting approval.

Some lending platforms might have application fees that are deducted from the approved loan amount. It’s crucial to be aware of any such fees and factor them into your loan decision.

Repayment periods can vary based on the loan type and terms agreed upon. It’s essential to understand the duration and terms to manage your finances effectively.