FairBanker [Fairbanker.co.za] is a reputable loan comparison service in South Africa, providing a variety of loan products to help individuals and businesses address their financial needs. Whether you’re consolidating debt, funding large purchases, or supporting business ventures, FairBanker offers competitive interest rates and flexible loan terms. Their application process is designed to be simple and straightforward, making it easy for borrowers to access funds quickly and efficiently. With a focus on transparency and customer satisfaction, this lender aims to provide accessible financial solutions tailored to diverse financial situations.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by FairBanker and is based solely on our research.

FairBanker offers personal loans starting from as little as R100 up to R350 000, with repayment terms ranging from 61 days to 72 months. If you’re looking for a dependable and flexible financing solution, whether to manage short-term needs or fund more significant financial plans. Keep reading to see how FairBanker’s services could match your requirements.

FairBanker: Quick Overview

Loan Amount: R100 – R350 000

Loan Term: 61 days to 72 months

Interest Rate: Personalised rates based on credit profile; typically between 15% and 28% APR

Fees: Transparent cost structure; fees vary depending on the lender selected through FairBanker

Loan Types: Personal loans, payday loans, small online loans, short-term loans, quick loans, easy loans, debt consolidation loans, cash loans, loans for bad credit, loans without credit check

FairBanker Full Review

What Makes FairBanker Loans Unique?

FairBanker stands out in the South African lending market due to its flexible loan options and user-friendly processes that are designed to meet diverse financial needs. If you need a personal loan for unexpected expenses or business capital, FairBanker offers customised solutions tailored to your specific goals. Their transparent approach to loan terms and fees ensures that borrowers are fully informed before committing, making this broker a reliable choice for those who value clarity and control over their financial decisions.

A unique aspect of this company is its focus on accessibility and convenience. Through their easy-to-use online application platform, borrowers can apply for loans from anywhere, eliminating the need for lengthy paperwork and in-person visits. The process is designed to be fast and efficient, with quick approvals and competitive interest rates that are often more affordable than those offered by traditional banks. These features make them a great choice for individuals or businesses in need of fast, flexible financial solutions without sacrificing service quality.

About Arcadia Finance

Get the loan you need, stress-free, with Arcadia Finance. Explore options from 19 accredited lenders, fully aligned with South Africa’s National Credit Regulator. No application fees, no hassle; just straightforward, trustworthy financial solutions.

Types of Loans Offered by FairBanker

FairBanker offers a range of loan products designed to meet the diverse needs of South Africans. Here’s an overview of the types of loans available and their potential uses:

Personal Loans

Personal loans are ideal for individuals seeking to cover a variety of expenses, such as medical bills, education costs, or consolidating existing debt. With flexible repayment terms and manageable instalments, these loans offer financial relief and support for personal goals.

Payday Loans

Designed for short-term financial needs, payday loans offer quick access to smaller amounts, typically up to R8 000, to be repaid by the next payday.

Small Online Loans

These loans, ranging from R500 to R10 000, are ideal for minor unexpected expenses, with a straightforward online application process and rapid approval.

Short-Term Loans

For temporary financial gaps, short-term loans provide flexible repayment options over a few months, balancing quick access to funds with manageable repayment schedules.

Quick Loans

Quick loans prioritise speed, offering fast processing and disbursement, often within the same day, for urgent financial requirements.

Consolidation Loan

These loans allow borrowers to combine multiple debts into a single loan, potentially reducing overall interest rates and simplifying monthly repayments.

Loans for Bad Credit

FairBanker offers loan for individuals with poor credit histories, focusing on current income and affordability rather than past credit performance.

Loans Without Credit Check

These loans assess eligibility based on income and financial stability, bypassing traditional credit checks, though they may come with higher interest rates due to increased risk.

Requirements for a FairBanker Loan

To apply for a FairBanker loan, you must meet the following eligibility criteria and provide the necessary documentation:

Eligibility Criteria:

- Age: Applicants must be at least 18 years old.

- Employment: Proof of stable employment or a regular income source is required.

- South African Residency: Applicants must be South African citizens or hold valid residency permits.

- Credit History: While credit checks are standard, FairBanker considers applications from individuals with varying credit profiles.

Documents Required:

- A valid South African ID.

- Proof of address (e.g., utility bill) that is no older than three months.

- Recent payslips or proof of income (usually for the last three months).

- Bank statements covering the last three months.

These requirements help FairBanker assess your financial capability and ensure that the loan offered is suitable for your needs.

Simulation of a Loan at FairBanker

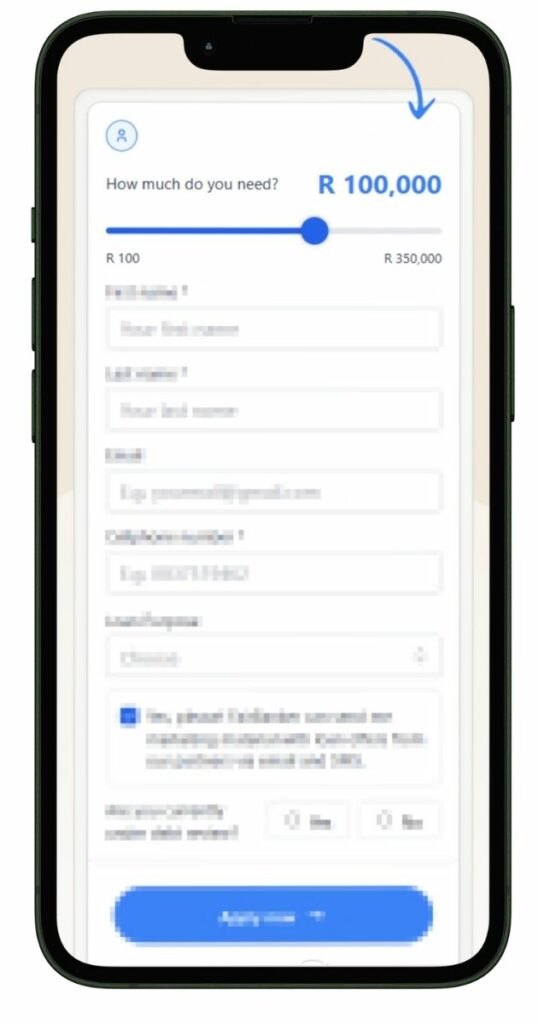

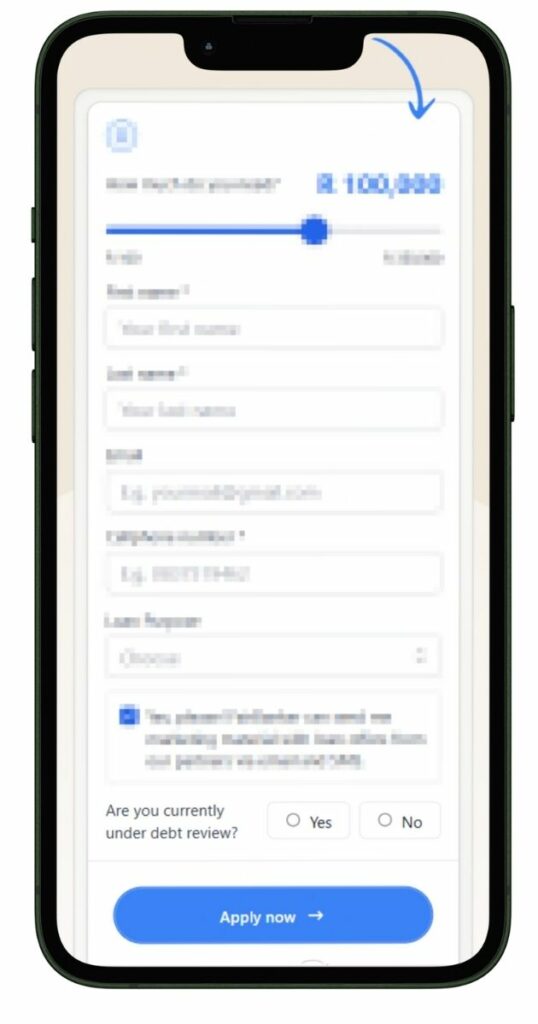

Follow this step-by-step guide:

Step 1. Visit Fairbanker.co.za

Step 2. Use the slider to select the desired loan amount.

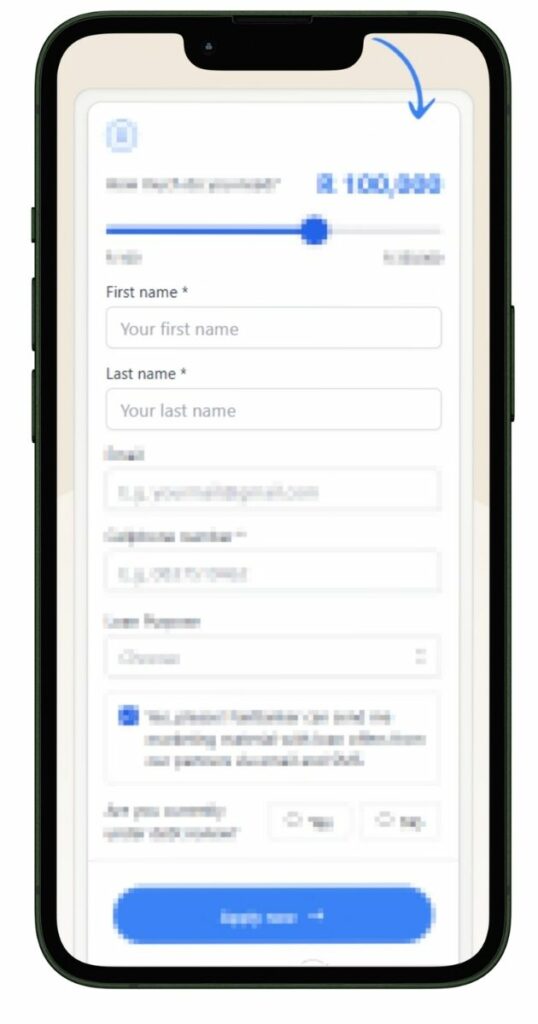

Step 3. Fill in your first name and last name in the respective fields.

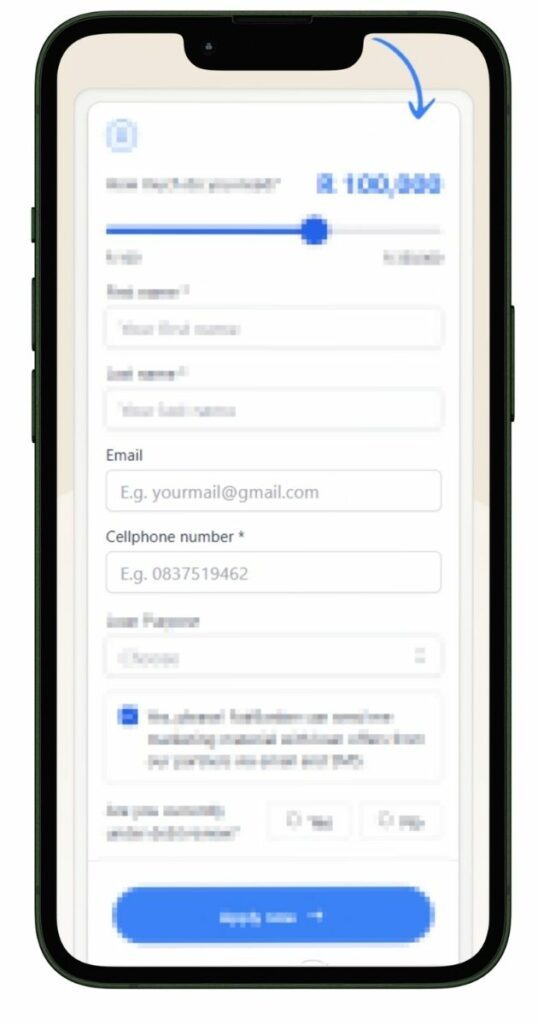

Step 4. Enter your email address and cellphone number accurately.

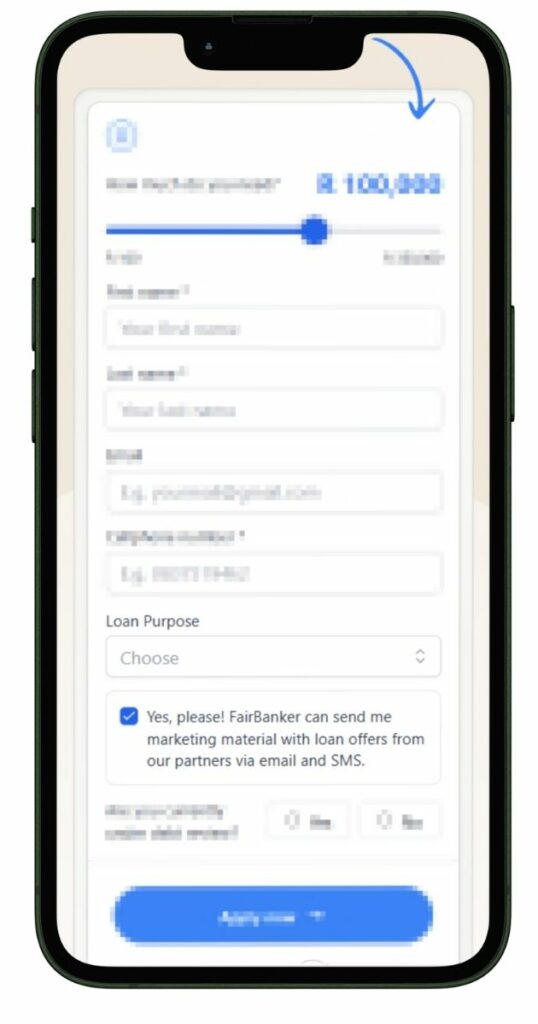

Step 5. Choose the purpose of your loan from the dropdown menu.

Step 6. Confirm if you’re under debt review and click “Apply Now” to submit the application.

Step 7. Wait for approval

Step 8. Receive your funds, typically within a few business days if your application is approved.

Eligibility Check

FairBanker’s loan enquiry form also serves as an online eligibility checker that allows potential borrowers to quickly assess if they meet the basic requirements for a loan. By filling out a short form on their website with details about your income, expenses, and employment status, you can receive an instant indication of your eligibility. This tool helps streamline the process by giving you an early understanding of whether you qualify before committing to a full application, saving you time and making the experience more efficient and user-friendly.

Who Are FairBanker Loans Best Suited For?

FairBanker loans are ideal for South Africans who:

- Need loan amounts from R100 to R350 000 for personal or business use.

- Earn a regular income and can provide basic financial documents.

- Want flexible repayment terms from 61 days to 72 months.

- Prefer a fast, fully online application process.

- Value comparing multiple NCR-registered loan offers in one place.

Is FairBanker a Safe and Good Option?

FairBanker is a trusted credit intermediary in South Africa, working only with NCR-accredited lenders. It offers access to a wide range of loan products, including personal, payday, and short-term loans, with amounts ranging from R100 to R350,000 and repayment terms of 61 days to 72 months. Applications are completed entirely online, and applicants must submit a valid South African ID, proof of income, proof of residence, and recent bank statements.

The platform promotes responsible lending by ensuring all loan terms, fees, and interest rates are disclosed upfront. Affordability checks are conducted before any loan is approved. Once accepted, funds are typically paid out within 24 to 48 hours. With its fast, transparent process and broad lender network, FairBanker is a reliable choice for borrowers seeking flexible financing.

How Much Money Can I Request from FairBanker?

FairBanker offers flexible loan options ranging from a minimum of R100 to a maximum of R350 000, based on the borrower’s credit profile and financial needs. The exact loan amount you qualify for depends on factors like your income, expenses, and creditworthiness. Whether you need a small amount for an emergency or a larger sum for a significant expense, FairBanker’s loan range accommodates various needs.

Receive Offers

Once you complete your application, the lender analyses the information provided such as income, credit history, and loan requirements to present you with personalised loan offers. These offers include details on the loan amount, interest rate, and repayment terms, allowing you to select the one that best aligns with your financial situation.

How Long Does It Take to Receive My Loan Payout from FairBanker?

Fairbanker.co.za is known for its efficient processing times. After your loan application is approved, funds are typically disbursed within 24 to 48 hours. However, this timeline can be affected by how quickly your documentation is submitted and verified. Delays may also occur during weekends or public holidays. Ensuring that all your documents are accurate and complete can help expedite the process.

How Do I Repay My Loan from FairBanker?

FairBanker provides several repayment options to make loan repayment simple and manageable. Monthly instalments are typically automatically deducted from your bank account on the agreed date. Alternatively, you can opt for manual payments if preferred.

It’s important to be aware of fees and penalties associated with your loan. Late payments may incur additional charges, and early settlement might attract an early repayment fee. Carefully reviewing the terms of your loan agreement ensures that you avoid unnecessary costs and manage your loan repayment effectively.

FairBanker – Overview in Detail

| Name | FairBanker |

|---|---|

| Financial | Privately Owned Credit Intermediary |

| Product | Personal Loans, Business Loans, Vehicle Loans, Home Loans |

| Minimum Age | 18 years |

| Minimum Amount | R100 |

| Maximum Amount | R350 000 |

| Minimum Term | 61 days |

| Maximum Term | 72 months |

| APR | 15% – 28% |

| Monthly Interest Rate | Variable based on loan type and borrower profile |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Tailored to meet specific borrower’s needs |

| NCR Accredited | Yes |

| Our Opinion | ✅ Quick and straightforward application process] ✅ Flexible loan options tailored to individual financial needs ⚠️ Limited to the maximum amount which may not suffice for all users |

| User Opinion | ✅ Generally positive reviews for customer service and efficiency ⚠️ Some complaints about interest rates for certain loan types |

Pros and Cons of Fairbanker

Pros of Fairbanker

- Flexible Loan Options: Provides a wide variety of loan types, including personal, business, home, and vehicle loans, allowing borrowers to meet different financial needs.

- Transparent Terms: The loan terms and fees are clearly outlined, ensuring that borrowers understand the full scope of their financial commitment before proceeding.

- Convenient Online Application: The application process is fully online, making it accessible and simple for users to apply from anywhere without needing to visit a physical branch.

- Quick Processing Times: Loan approvals and disbursement of funds are typically completed within 24 to 48 hours, allowing borrowers to access funds quickly.

- Eligibility for a Range of Borrowers: Accommodates applicants with various credit profiles, offering a chance for those who might not qualify with traditional banks to secure financing.

Cons of Fairbanker

- Potential Fees: Late payment fees or early settlement charges may apply, adding extra costs to the loan depending on the terms and repayment schedule.

- Limited Branch Access: Since FairBanker primarily operates online, individuals who prefer face-to-face interaction or in-person assistance may find this less convenient.

- Loan Amount Restrictions: The maximum loan amount is capped at R350 000, which may not meet the financial needs of those requiring larger loans.

- Interest Rates May Vary: Depending on the borrower’s creditworthiness, interest rates could be higher than those offered by traditional banks, particularly for those with lower credit scores.

Customer Service

If you have further questions or need assistance with your FairBanker loan application, their dedicated customer service team is available to help. You can contact them through Fairbanker.co.za, by email, or by phone for any clarifications or support regarding your loan application, terms, or repayment plans. FairBanker is committed to providing prompt and helpful responses, ensuring that your concerns are addressed efficiently and thoroughly.

Contact Channels

Phone number:

Office: 087 654 4868

Cell: 079 159 4389

Hours of operation:

Monday to Friday: 08:00 – 17:00 Saturday to Sunday: By appointment only

Postal address:

Office 2, DGE Building, 90 Sovereign Drive, Route 21 Corporate Park, Irene, South Africa

Online Reviews of FairBanker

Customer feedback is essential in evaluating the reliability of any lender, and FairBanker is no exception. Online reviews often highlight the company’s efficient application process and quick disbursement of funds, making it a preferred choice for borrowers in need of fast financial solutions. Many customers praise them for their user-friendly online platform, which streamlines the loan application process and offers personalised loan options.

However, like any financial institution, FairBanker has received some mixed reviews. While most clients appreciate the transparency in loan terms, a few have expressed concerns over delayed responses, particularly during peak application periods. Despite these occasional challenges, this broker generally receives positive ratings for offering flexible loan options and maintaining a customer-centric approach.

Alternatives to FairBanker

If FairBanker doesn’t meet your specific needs, there are several other credit comparison portals and lenders to consider. These alternatives provide competitive offers, varying loan amounts, and repayment options that might better suit your financial situation.

Comparison Table

| Feature | FairBanker | Wonga | Capitec Bank | Lime Loans | African Bank |

| Loan Amount Range | R100 – R350 000 | R500 – R8 000 | R1 000 – R250 000 | R500 – R5 000 | R2 000 – R350 000 |

| Application Process | Fully Online | Fully Online | Online/ In-branch | Fully Online | Online/ In-branch |

| Processing Time | 24 – 48 Hours | Same Day | 1 – 3 Business Days | Same Day | 1 – 2 Business Days |

| Interest Rates | Competitive | Higher for Short-Term | Affordable | Higher for Emergencies | Competitive |

| More Info | Wonga Review | Capitec Review | Lime Review | African Bank Review |

History and Background of FairBanker

FairBanker was established with the mission of providing accessible and transparent financial solutions to South Africans. Since its founding, the company has expanded to become a trusted name in the lending industry, offering a wide range of loan products that cater to both individual and business needs. By embracing technology, this broker has modernised the borrowing process, making applications simpler and enhancing the overall customer experience.

The company’s mission is to empower South Africans by offering reliable and adaptable financial support tailored to their unique circumstances. They are committed to providing competitive loan options while ensuring transparency and fairness in all its transactions. Its vision is to be a leading financial partner for individuals and businesses, fostering financial stability and growth across South Africa.

Conclusion

FairBanker stands out as a reliable and customer-focused lending intermediary in South Africa, offering a variety of loan options with competitive interest rates and a straightforward application process. While some customers have noted occasional delays during peak periods, the overall experience remains positive, with many highlighting the company’s transparency and efficiency. Whether you’re seeking a small loan for urgent expenses or a larger sum for long-term goals, this company offers a trustworthy and convenient solution tailored to meet the needs of borrowers.

Frequently Asked Questions

FairBanker provides a variety of loan options, including personal loans, business loans, home loans, vehicle loans, and emergency loans, catering to a wide range of financial needs.

You can apply for a loan online through their website by filling out an application form, uploading the required documents, and submitting your request for review.

Applicants need to provide a valid South African ID, proof of address (no older than three months), recent payslips or proof of income, and bank statements from the last three months.

Once your loan is approved and all documentation is verified, funds are typically disbursed within 24 to 48 hours.

Yes, you can make early repayments. However, depending on the terms of your loan, an early settlement fee may apply.