For those who are unfamiliar with Finance27 [Finance27.co.za], it’s an accredited and regulated credit provider. They offer simplistic, fast, and easy means to approach loans, especially using their online platform. Additionally, they provide financial advice and planning through a qualified team of experts.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by Finance27 and is based solely on our research.

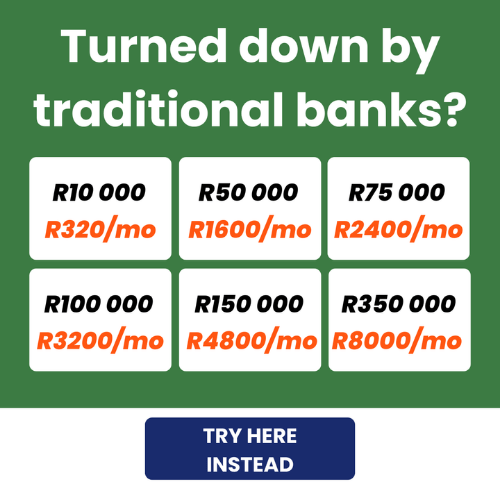

At a glance, Finance27 offers borrowers between R800 and R6 000, with repayment periods ranging from 61 to 65 days. If you’re considering this lender, read on to discover essential details to determine if they’re the right choice for your financial needs.

Finance 27: Quick Overview

- Loan Amount: R800 to R6 000

- Loan Term: 61 to 65 days

- Interest Rate: Maximum annual percentage rate (APR) of 38%

- Fees:

- Initiation Fee: Varies based on loan amount

- Service Fee: Applicable monthly

- Credit Protection Fee: Not specified

- Loan Types: Short-term personal loans

About Arcadia Finance

Get hassle-free financing with Arcadia Finance. With no application fees, you can choose from 19 trusted lenders, all fully compliant with South Africa’s National Credit Regulator. Enjoy a fast, secure, and transparent loan process designed to meet your financial needs.

Finance27 Full Lender Review

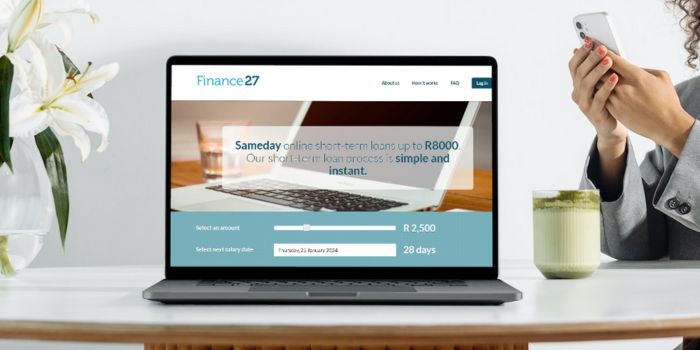

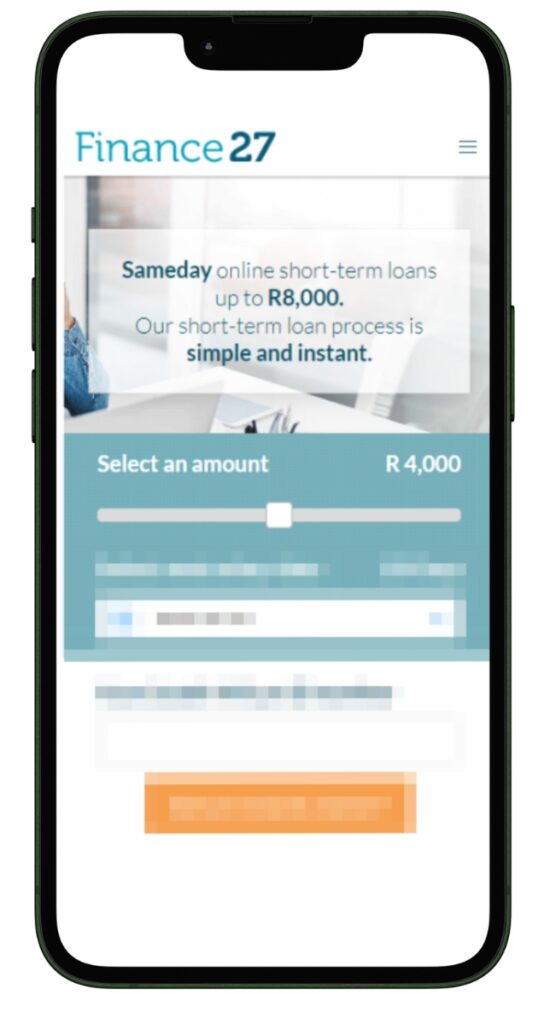

Finance27 offers a very innovative online platform for their loan applicants. Those who qualify can expect a loan offer within less than 5 minutes. The loan offers are available 24/7 on their online platform. Their service is seamless and efficient for attaining your loan from the comfort of your home. You can expect to receive your cash amounts somewhat instantly following an agreement of their terms of service.

Respectfully, the repayment structure is just as doable and simplistic, offering smaller repayment plans for payday or short-term loans with a maximum percentage interest rate not exceeding 38% with repayment plans of up to 65 days.

Finance27.co.za offers a range of short-term loans, each designed to cater to specific financial emergencies or urgent cash flow needs. Here are more detailed descriptions of the types of loans they provide:

1. Short-Term Personal Loans

These loans are ideal for individuals who require immediate financial assistance and can repay the amount within a short period.

- Loan Amount: R800 to R6 000

- Repayment Term: 61 to 65 days

- Interest Rate: Up to 38% APR

2. Payday Loans

Payday loans are tailored for those who need a small cash advance before their next salary payment. These loans help cover urgent expenses and are typically repaid in full when the borrower receives their next wage.

- Fast approval and payout

- Short repayment period aligned with payday

- No long-term financial commitment

3. Emergency Loans

For unexpected costs such as medical bills, urgent home repairs, or sudden travel expenses, this lender offers emergency loans that provide quick access to cash with minimal paperwork.

- Quick application and processing

- Flexible short-term repayment

- Designed for urgent financial needs

Can I Only Find Payday Loans at Finance27?

Finance27 provides instant loans, short-term loans, to simplistic payday loans. They offer a quick and convenient solution to those short-term financial goals. It’s safe to say that this company offers mainly short-term financial solutions. Their instant payday loans are from as little as R800 to R6 000.

These short-term loans are designed to serve various purposes, including covering unexpected expenses, managing cash flow gaps, or addressing other short-term financial needs. The focus on short-term lending ensures that Finance27’s services are tailored to meet immediate financial challenges, providing a reliable and efficient solution for borrowers.

Who is Finance27 Best For?

- Salaried employees needing a payday advance – Ideal for those who need extra funds before their next salary payment.

- People facing financial emergencies – Quick access to cash for unexpected expenses like medical bills or car repairs.

- Borrowers needing a small, short-term loan – Loan amounts range from R800 to R6 000 with a repayment period of 61 to 65 days.

- Individuals looking for fast approval – Simple online application with same-day payouts.

- South Africans with a regular income – Applicants must have a stable income and an active bank account.

Who Should Avoid Finance27 Loans?

- People looking for long-term financing – The loan terms (61 to 65 days) are short, so this is not a good option for large expenses that require extended repayment periods.

- Individuals who may struggle with repayment – If you are uncertain about repaying the loan within the given period, borrowing could lead to financial strain.

- Applicants with irregular income – Since repayments are scheduled, individuals without a stable income might find it difficult to meet the payment deadlines.

Is Finance27 a Safe and Good Option?

Finance27 is a safe and reliable option for borrowers who need quick, short-term financial assistance. The company operates within South African lending regulations, ensuring transparent fees and secure transactions. Their fast online application process and same-day payouts make them a convenient choice for emergencies or payday advances. Payments are processed through DebiCheck debit orders, adding an extra layer of security and control for borrowers.

However, their loans come with a short repayment period (61 to 65 days) and higher interest rates typical of short-term lending. This makes them unsuitable for long-term financial needs or individuals who may struggle with repayments. Borrowers should ensure they can meet the repayment terms before applying to avoid financial difficulties.

What Makes the Finance27 Loan Unique?

Finance27’s loan offerings are distinguished by their simplicity and accessibility. The company has customized its services to ensure that the loan application process is as straightforward as possible. The online platform is designed for ease of use, allowing applicants to quickly complete the application process, making it particularly suitable for those in urgent need of financial assistance.

Another unique aspect of their loans is the same-day approval and disbursement. This feature is crucial for applicants who require immediate access to funds, ensuring that their financial needs are met promptly. The company’s focus on timely service enhances the overall customer experience, providing a reliable solution in times of financial urgency.

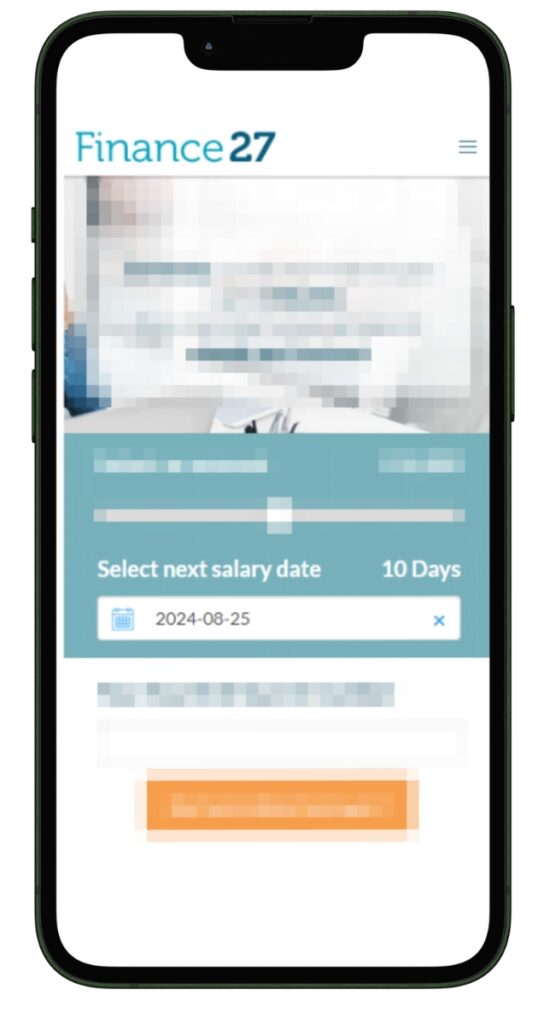

Does Finance27 Let me Use an Online Loan Calculator?

Their online calculator can project loan costs very efficiently. With loans from as little as R800 to a maximum of R6 000. As well as calculating costs between paychecks dates. This can easily be located on their home page.

How Can Finance27 Loan Interest Rate Change Loan Payments?

Those with ideal credit scores are typically offered lower interest rates and deals with any loan. However, short-term loans are synonymous with having higher interest rates. Through Finace27, you can expect offers that are highly competitive rates against other lenders.

Special Requirements of the Finance27 Loan Application?

The are no special requirements when it comes to your loan application. This lender will ask that you provide these:

Borrower Requirements:

- Must be 18+ years old

- Reside in South Africa with a valid ID

- Provide proof of income

- Have an active checking account

Optional:

- Bank account

- Credit or debit card

Step-by-step Guide to Applying for a Loan with Finance27

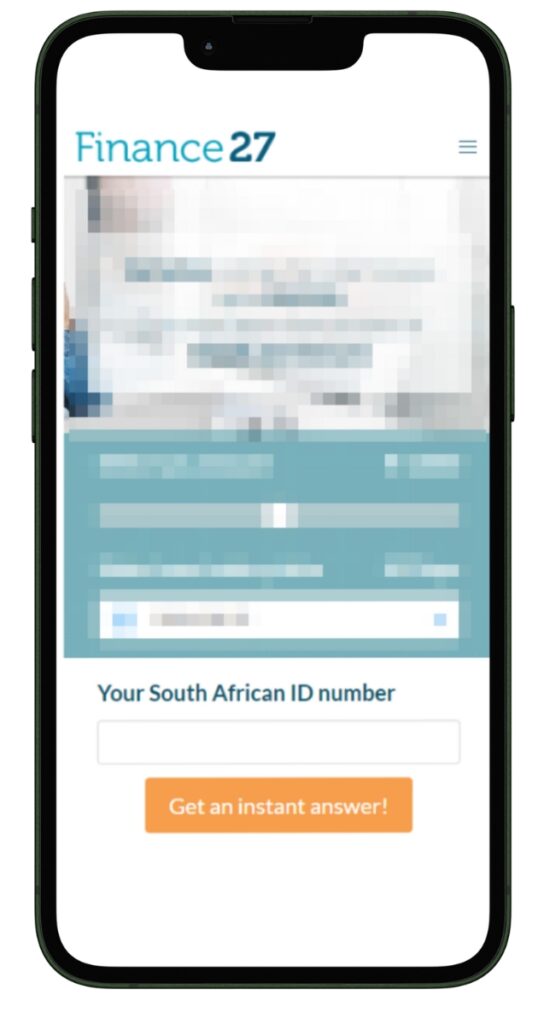

Step 1. Visit the Finance27 Website: Start by navigating Finance27.co.za.

Step 2. Select Loan Amount

Step 3. Select Your Next Salary Date

Step 4. Enter South African ID Number

Step 5. Register or log in when asked

Step 5. Review and Agree to Terms: Before finalizing the application, review the terms, interest rates, and fees associated with the loan. Once you understand and agree, proceed to the next step.

Step 6. Submit Application: Once all details are filled in, submit the application.

Step 7. Wait for Approval: Finance27 will review the application, and if approved, funds will be disbursed on the same day.

Eligibility Check

To assist potential borrowers in understanding their eligibility before applying, this company offers a loan simulation tool on its website. Users can input their details to get an approximate idea of the loan amount they might be eligible for, along with the associated terms. This pre-check ensures that applicants have a clear understanding of what to expect, reducing uncertainties and enhancing the overall application experience.

For a comprehensive comparison of Finance27’s offerings with other similar services, you might want to check out our detailed Boodle Loan Review.

Security and Privacy

In the digital age, the security of personal and financial information is paramount. Finance27 demonstrates a strong commitment to safeguarding customer data, ensuring that the information provided during the loan application process is handled with utmost confidentiality and security.

How Finance27 Ensures Security

This company employs robust security measures to protect customer data from unauthorized access or disclosure. The online platform is secured using advanced encryption technologies, crucial for safeguarding the information transmitted during the loan application process. This focus on security is designed to provide applicants with peace of mind, knowing that their personal and financial information is well-protected.

Privacy Policies and Data Handling Practices

Finance27’s privacy policies comply with legal and regulatory standards, ensuring that data handling practices uphold the principles of confidentiality and integrity. The company is transparent about its data practices, providing clear information on how personal and financial data is collected, used, and stored.

The commitment to privacy also extends to information sharing. Finance27 exercises caution and discretion, ensuring that customer information is not disclosed to unauthorized parties. This approach underscores their dedication to maintaining a secure and trustworthy environment, where customers can engage with confidence in the integrity of the loan application process.

How Much Money Can I Request from Finance27?

When applying for a loan with Finance27, there are various options available in terms of the loan amount. The company offers loans starting from a minimum of R800, which can be ideal for covering small, unexpected expenses or financial shortfalls. On the other end of the spectrum, this company provides loans up to a maximum of R6 000. This range allows for flexibility, enabling borrowers to choose a loan amount that aligns with their specific financial needs and repayment capabilities.

This lender also focuses on creating personalized loan offers. The offers received are tailored based on the individual’s financial situation and repayment ability, ensuring that the loan terms are realistic and manageable for the borrower.

How Long Does it Take to Receive My Money from Finance27?

One of the standout features of this lender is the speed at which they process and disburse loans. The company specializes in same-day online short-term loans, meaning that applicants can receive the funds they need promptly, often on the same day of application. However, various factors can influence the withdrawal speed, such as the time of application and the verification process.

How Do I Repay My Loan from Finance27?

Repaying a loan to this lender is designed to be as convenient as possible. Various repayment options are available, allowing borrowers to choose a method that suits them best. The company offers a clear outline of the repayment terms, ensuring that borrowers are well-informed about their obligations.

It’s also essential to be aware of the fees and penalties associated with loan repayment. This company charges a service fee and interest for non-payment, and continuous failure to repay could lead to additional costs and a decrease in credit rating. Thus, understanding the potential fees and penalties associated with repayment is crucial for managing the loan effectively and avoiding unnecessary costs.

Finance27 – Loan Overview

| Name | Finance27 |

|---|---|

| Financial | Registered Credit Provider |

| Product | Quick Loans |

| Minimum age | >18 years |

| Minimum amount | R800 |

| Maximum amount | R6 000 |

| Minimum term | 7 days |

| Maximum term | 65 days |

| APR | Up to 38% |

| Monthly Interest Rate | 5% |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Flexible repayment options |

| NCR Accredited | Yes |

| Our Opinion | ✅ Simple, fast application process ✅ Instant cash loan disbursement on approval ⚠️ Limited to small amounts suitable for short-term needs only |

| User Opinion | ✅ Quick approval and disbursement ⚠️ High-interest rates for short-term loans |

Those Who Have Done a Review of Finance27, Are They Positive?

Online reviews provide valuable insights into customer experiences and satisfaction levels with Finance27. Generally, customer feedback revolves around the ease of the application process and the speed of loan disbursement. Borrowers appreciate the straightforward online platform and the prompt service, especially beneficial for those in urgent need of financial assistance.

However, as with any service, experiences may vary, and it’s advisable to consider a range of reviews to gain a comprehensive understanding of what to expect when choosing Finance27 as a lending partner.

I’m happy with the service I received, they were fast, simple and efficient.

They were extremely helpful and friendly. Even when I didn’t understand some things they answered patiently.

I have only made 1 loan application, was paid out and boom was debited twice the same installment.

I keep getting unclear responses if they do answer the phone. Very bad service i would not recommend

What are Finance27’s Contact Details?

Currently, their contact details are as follows 012 941 1572. Contact via email for inquiries at the following address info@finance27.co.za. They are currently in the process of integrating into the social media platform Whatsapp.

Phone number:

Office: 012 941 1572

Hours of operation:

Monday to Friday: 08:00 – 15:00

Saturday to Sunday: Closed

Postal address:

Unit 13, Kingfisher Building, Hazeldean Office Park, Silverlakes Rd, Tyger Valley, Pretoria, 0084, South Africa

Customer Service

This lender places a strong emphasis on customer support, ensuring that applicants and borrowers have access to necessary assistance and information throughout the loan process. If you have further questions or require clarification on any aspect of the loan, Finance27’s customer service team is available to help.

Contacting customer service is a practical approach to resolving queries, gaining additional information, or seeking clarification on specific aspects of the loan process. The team’s expertise can be instrumental in guiding borrowers, ensuring they have a clear understanding of the loan terms, repayment obligations, and any other relevant details. Access to this support enhances the overall customer experience, providing a reliable resource for assistance and guidance.

Alternatives to Finance27

While Finance27 offers a range of benefits for those seeking short-term loans, there are other credit comparison portals available that might cater to different needs or preferences. These platforms provide various loan offers, interest rates, and terms, allowing borrowers to explore multiple options before making a decision.

Other credit comparison portals include platforms like Wonga, Lime24, and LittleLoans. Each of these platforms has its unique selling points, from flexible repayment terms to different loan amounts and durations. It’s always a good idea for potential borrowers to explore these alternatives to ensure they’re getting the best deal that suits their individual circumstances.

Comparison Table

| Criteria | Finance27 | Wonga | Lime24 | LittleLoans |

|---|---|---|---|---|

| Maximum Loan Amount | R6 000 | R4 000 | R5 400 | R8 000 |

| Repayment Duration | 61 to 65 days | Up to 6 months | 35 days | 1 to 36 months |

| Interest Rate | Maximum 38% APR | Varies based on loan | Competitive rates | Varies based on loan |

| Same-day Approval | Yes | Yes | Yes | No |

| Fees for Non-payment | R69 service fee + 5% interest | Varies | Varies | Varies |

| More Info | Wonga Review | Lime24 Review | LittleLoans Review |

Pros and Cons of Finance27

Pros of Finance27

- Quick and Convenient: Finance27 specializes in same-day online short-term loans, ensuring prompt access to funds when needed.

- Transparent Terms: The company provides clear information regarding interest rates, fees, and repayment terms, fostering informed decision-making.

- Flexible Loan Amounts: Offering loan amounts ranging from R800 to R6 000, Finance27 provides flexibility to meet various financial needs.

Cons of Finance27

- Limited Loan Types: Finance27 primarily focuses on short-term loans, which may not be suitable for individuals seeking long-term financial solutions or larger loan amounts.

- Fees and Penalties: Non-payment or late payment of loans incurs fees and penalties, potentially increasing the overall cost of borrowing if not managed carefully.

Conclusion

Finance27 offers quick, short-term loans with flexible repayment options, supported by a user-friendly online platform that operates 24/7. Their service is NCR registered, ensuring a straightforward application process. While customer reviews are mixed, with positive feedback from those approved and critical reviews from those denied, this lender remains a viable option for individuals needing immediate financial assistance, even considering applicants with bad credit based on their repayment ability.

Frequently Asked Questions

You can borrow up to R6 000. The company offers a range of loan amounts to cater to various needs, ensuring that you can select an amount that aligns with your financial requirements and repayment capabilities.

Finance27 specializes in same-day online short-term loans. In many cases, you can receive the funds on the same day that your application is approved, ensuring quick access to the financial assistance you need.

Their loans come with repayment periods ranging from 61 to 65 days. The company offers various repayment options, including debit orders, to provide flexibility and convenience in managing loan repayments.

Yes, this lender charges a service fee and additional interest for late repayments or non-payment of loans. Continuous failure to meet repayment obligations could also lead to a decrease in your credit rating and additional costs.

Finance27 is committed to protecting the privacy and security of your personal information. The company adheres to legal and regulatory guidelines to ensure that your data is handled with utmost confidentiality and security.