Boodle [Boodle.co.za] offers instant loans as a registered lender through the NCR. Upon review, comments vary on Boodle as specific individuals have reviewed them positively for their customer service and instant cash payday loans. Additionally, Boodle’s online platform is simple and easy to use. The online site can verify your credit rating and deem if you qualify for a potential loan.

Boodle offers short-term loans ranging from R100 to R8 000, with repayment terms spanning from 2 days up to 6 months. New customers can borrow up to R3 000, with the potential to increase this limit to R8 000 by maintaining a good repayment history

Boodle: Quick Overview

- Loan Amount: R100 – R8 000

- Loan Term: 2 days to 6 months

- Interest Rate: 0.17% per day (approximately 5% per month)

- Fees:

- Initiation Fee: R165 plus 10% of the loan amount exceeding R1 000, capped at 15% of the loan value, plus 15% VAT

- Service Fee: R60 per month plus 15% VAT

- Loan Types: Short-term personal loans

About Arcadia Finance

Opt for Arcadia Finance for a straightforward loan securing process. We connect you with a plethora of banks and lenders once you fill out a free application. Look forward to offers from up to 19 varied lenders. All our lender associates are licensed by the National Credit Regulator (NCR) in South Africa, ensuring trustworthiness.

Boodle Full Lender Review

For those who are unfamiliar with Boodle, they are an instant loan company that offers loans within 10 minutes upon approval. This lender offers instant, short-term loan solutions such as payday loans. They have friendly and helpful customer service. A new customer can request a loan valued up to R3 000 with a repayment term of 2 to 32 days. This credit provider offers more significant amounts to clients who have fulfilled their previous payment obligations through them on loans they have taken out.

What Types of Loan Products Does Boodle Offer?

Boodle specialises in short-term personal loans designed to provide quick financial relief for unexpected expenses. Their loan products are flexible, easy to access, and tailored to suit different borrowing needs. Here’s a closer look at what they offer:

1. Short-Term Personal Loans

Boodle offers small, short-term loans ranging from R100 to R8 000, with repayment terms of 2 days to 6 months. These loans are ideal for covering emergency expenses, small purchases, or short-term cash flow gaps.

2. First-Time Borrower Loans

New customers can apply for loans up to R3 000. With responsible borrowing and timely repayments, they may qualify for higher loan amounts in the future, up to R8 000.

3. Flexible Repayment Options

Borrowers can choose their repayment period, from as little as 2 days to as long as 6 months, depending on their financial situation. This flexibility allows customers to spread their repayments over a timeframe that suits their budget.

Boodle loans smile ranking system

Once you are a preferred lender through their unique smile rating system, they award a smile to add to your smile rank once a previous loan is repaid. Each smile increases your rating, enabling you to qualify for loans of up to R8 000.

Who is Boodle Best For?

Boodle is ideal for individuals who need quick, short-term financial assistance with minimal hassle. Their flexible loan options cater to various needs, making them a great choice for the following types of borrowers:

- Emergency Expenses – Ideal for unexpected costs like medical bills or car repairs.

- Salaried & Self-Employed Individuals – Helps bridge short-term cash flow gaps.

- First-Time Borrowers – A great way to build credit, with an initial loan limit of up to R3 000.

- Flexible Repayment Seekers – Choose a repayment period from 2 days to 6 months.

- Fast & Easy Loan Applicants – 100% online process with instant approvals and quick payouts.

Boodle’s 100% online application, instant approval process, and quick payouts make it ideal for individuals who want a hassle-free borrowing experience without visiting a bank or filling out complex paperwork.

Who Might Not Benefit from Boodle?

While Boodle is an excellent choice for short-term borrowing, it may not be suitable for those who:

- Need a large loan amount exceeding R8 000.

- Require long-term financing for major purchases or investments.

- Have difficulty repaying loans within the short repayment periods.

Boodle is best for responsible borrowers who need quick, small loans and can repay them within the agreed timeframe without financial strain.

Is Boodle a Safe and Good Option?

Yes, Boodle is a legitimate and safe lender in South Africa. They are registered with the National Credit Regulator (NCR), ensuring compliance with responsible lending practices. Their website uses secure encryption technology to protect customer data, and all loan terms, fees, and interest rates are transparently displayed before finalising a loan. This means borrowers can make informed decisions without worrying about hidden charges or unfair lending practices.

Boodle is also a good option for short-term borrowing, especially for those who need quick and hassle-free access to funds. Their fully online process, instant loan approval, and flexible repayment terms make them a convenient choice for emergencies or small financial gaps. However, like any short-term loan provider, borrowers should ensure they can repay their loan on time to avoid additional costs. When used responsibly, Boodle offers a reliable and efficient way to manage unexpected expenses.

Special Requirements of the Boodle Loan Application?

The requirements for a loan are relatively straightforward. You will need to have a South Africa Identity Document. Borrowers will need to be over the age of 18 years old. Own a South African bank account as well as have access to the internet. Lastly, you will need to earn a regular monthly income.

Step-by-Step Guide to Applying for a Loan with Boodle

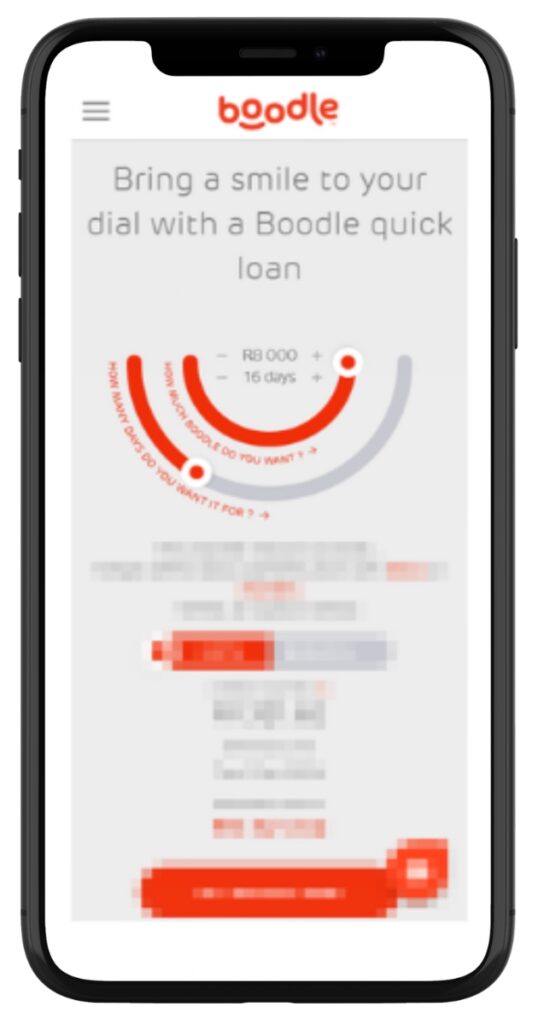

Step 1. Visit boodle.co.za

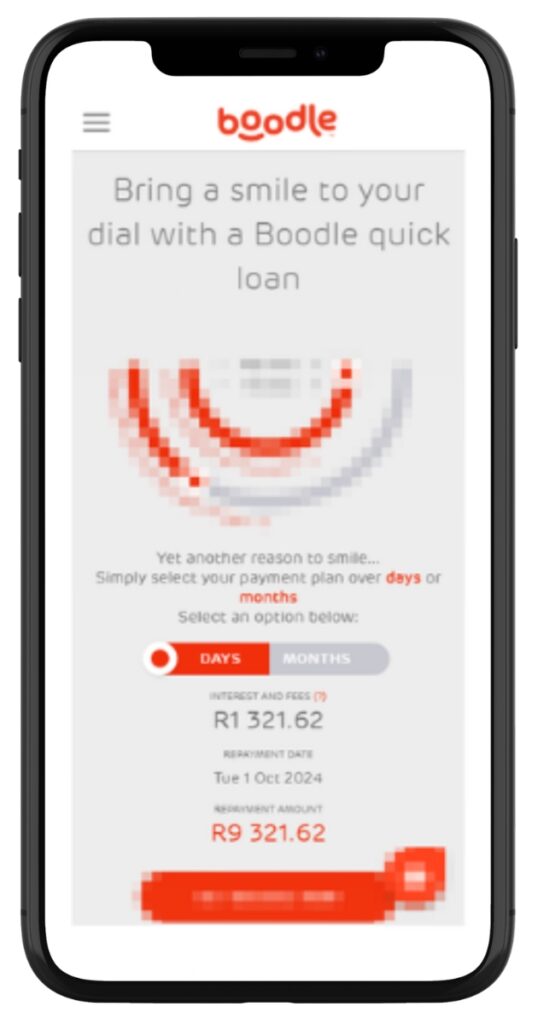

Step 2. Select loan amount and duration.

Step 3. View payment plan (days or months).

Step 4. Click “Get Boodle Now”

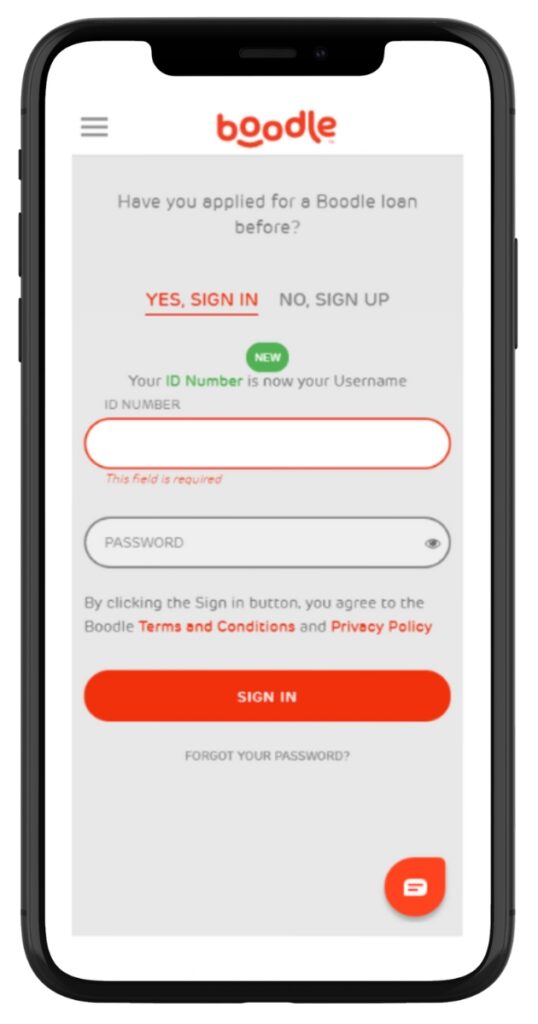

Step 5. Sign in or sign up.

Step 6. Upload the necessary documents, such as your ID, proof of income, and bank statements.

Step 7. Wait for them to review your application. This process is usually quick.

Step 8. If approved, you’ll receive a loan agreement. Read it carefully before accepting.

Step 9. Once you accept the terms, they will deposit the money into your bank account.

Security and Privacy at Boodle

Boodle understands this concern and has implemented several measures to ensure the safety and confidentiality of its customer’s data.

Ensuring the Security of Information

Secure Website: Their website uses SSL (Secure Socket Layer) encryption, which is a standard security technology for establishing an encrypted link between a web server and a browser. This ensures that all data passed between the web server and browsers remain private and integral.

Data Protection Protocols: They employ robust data protection protocols to safeguard your personal and financial information from unauthorized access or breaches. This includes using secure servers and implementing network security measures.

Compliance with Regulations: As a registered credit provider in South Africa, this lender is required to comply with relevant national regulations, including the National Credit Act and the Protection of Personal Information Act (POPIA). These laws mandate strict standards for the handling and protection of personal information.

Regular Audits and Updates: To keep up with evolving threats, this credit provider regularly updates its security systems and undergoes audits to ensure that all security measures are effective and up-to-date.

How Much Money Can I Request from Boodle?

Boodle’s loans start from a modest sum, which can be as low as a few hundred Rands. This is ideal for those who need just a small amount to tide over an immediate financial need. The maximum amount you can borrow is typically around R8 000. However, this limit can depend on several factors, including your creditworthiness and repayment history with them (if applicable).

Boodle doesn’t just set a flat maximum for every borrower. Instead, they create personalized loan offers based on various factors related to each individual applicant.

How Boodle Creates Personalized Loan Offers

Assessment of Financial Health: This company looks at your overall financial situation, including your income, expenses, and credit history. This assessment helps them determine how much you can comfortably borrow without risking financial strain.

Boodle Smilerank®: Their unique Smilerank® system also plays a role in determining your loan offer. This system rewards borrowers for responsible borrowing and repayment behaviors, potentially influencing the amount you’re eligible to borrow.

Previous Interactions: If you’ve borrowed from them before and have a good repayment history, you might be eligible for a higher amount compared to a first-time borrower.

Do Boodle Let Me Use an Online Loan Calculator?

On Boodle.co.za’s official page, you can view their online calculator, which offers and showcases all the fees associated with your potential loan. Their online calculator is very transparent with all its fees and associated costs. With Boodle, you can expect a service fee of R 60.00, including VAT, with an initiation fee of R165.00, and 10% of the amount lent, including VAT. The interest charge is daily, with an interest rate of 0.74%.

How Long Does It Take to Receive My Money from Boodle?

One of the key advantages of Boodle.co.za is the speed at which they process loans. Once you’ve submitted your application, they typically review it within minutes. This is subject to the submission of all required documents and information.

After approval, the loan amount is usually disbursed quickly. Most borrowers can expect to see the funds in their account within the same day of approval.

How Do I Repay My Loan from Boodle?

Repaying your loan is designed to be as straightforward and hassle-free as the application process. Understanding your repayment options, along with any potential fees and penalties, is crucial for managing your loan responsibly and avoiding any financial hiccups.

Repayment Options and Plans

- Direct Debit: The most common way to repay a loan from this credit provider is through a direct debit (also known as a debit order) from your bank account. This lender will automatically deduct the repayment amount on the due date as per the agreement you accept when taking out the loan. This method ensures that your repayment is made on time without requiring any manual intervention from your side.

- Manual Electronic Transfer: If you prefer, you can also make repayments via electronic funds transfer (EFT). In this case, you’ll need to manually transfer the repayment amount to Boodle’s bank account. It’s important to remember the due date and include your loan reference number in the transfer to avoid any confusion.

- Payment Reminder: They typically send out reminders before your repayment is due. This can help you ensure that you have sufficient funds in your account if you’re using direct debit or remind you to make the transfer if you’re paying manually.

Possible Fees and Penalties

Late Payment Fees: If you miss a repayment, you may be charged a late payment fee. The amount and terms of these fees should be clearly outlined in your loan agreement. Late payments can also affect your credit score and your ability to borrow in the future, not just from Boodle but from other lenders as well.

Additional Interest: Apart from late fees, delayed repayments can accrue additional interest. This means the longer you take to repay, the more you might end up paying in total.

Early Repayment: Typically allows you to repay your loan early without any penalties. This can be a good strategy to reduce the amount of interest you pay overall. It’s always a good idea to check the specific terms regarding early repayment in your loan agreement.

Non-Payment Implications: If you’re unable to repay your loan, it’s crucial to communicate with the lender as soon as possible. Ignoring the problem can lead to increased fees, legal action, and a negative impact on your credit score. They may offer a restructuring of your repayment plan in some cases, but this will depend on your specific circumstances and their policies.

Boodle.co.za offers straightforward repayment options to ensure you can settle your loan without any hassle. Being aware of the repayment date, ensuring you have sufficient funds for a direct debit, and understanding the implications of late or non-payment are key to managing your loan effectively. If you ever find yourself struggling to make a repayment, it’s better to contact Boodle directly to discuss your options rather than missing a payment.

Related post: Letsatsi Finance Loan Review

Boodle – Loan Overview

| Category | Detail |

|---|---|

| Name | Boodle |

| Financial Status | Registered with the National Credit Regulator |

| Product | Short-term, unsecured payday loans |

| Minimum Age | 18 years |

| Minimum Amount | R100 |

| Maximum Amount | R8 000 |

| Minimum Term | 2 days |

| Maximum Term | 32 days |

| APR | 60% |

| Monthly Interest Rate | Approx. 0.17% to 0.35% per day |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Limited; aligned with payday loan terms |

| NCR Accredited | Yes |

| Our Opinion | ✅ Efficient and quick approval process ✅ Flexible loan terms based on client value ⚠️ Limited to short-term needs only, not suitable for long-term financial planning |

| User Opinion | ✅ Convenient access to funds ⚠️ High-interest rates for short-term loans ⚠️ Limited repayment flexibility |

Are the reviews of Boodle Positive?

Boodle loan reviews are mixed from individuals who have not been approved or were declined. Others are annoyed with the constant spam of new potential loan offers. Others claim that their services are outstanding and friendly. They themselves makes a fair amount of effort to remedy dissatisfied customers.

I would really like to recommend Boodle to anyone who really need a Payday Loan or short Term Loan . I have been doing Business with them for more than 4 yrs now and I’m very happy with their Services.

Boodle helped my even barried my love ones and pay for school fees. Thanks you are the best 💕💕💕

Why is that every month i have to review this company on hello peter for poor service? no replies on emails and no calls, communication takes forever.

What a mess! I set my loan amount to R1000, but they changed this to R8000 which is insane. On the dashboard, the loan amount shows R1000 but when I have to upload documents it says R8000.

What are Boodle’s Contact Details?

Those seeking to reach out via e-mail or a contact form can do so through support@boodle.co.za or on their official page, where you can leave comments or questions. Those needing a direct and more human approach can call them directly at 0861 266 353.

The Loan Company Contact Channels

Phone number:

Office: 0861 266 353

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: By appointment only

Postal address:

19 Ameshoff Street, Braamfontein, Johannesburg, 2001

Alternatives to Boodle

It’s always wise to consider other options in the market:

Comparison Table

| Feature/Company | Boodle | Wonga | Lime24 | FinChoice |

|---|---|---|---|---|

| Maximum Loan Amount | R8 000 | R8 000 | R8 000 | Varies |

| Loan Term | Up to 1 month | Up to 6 months | Up to 37 days | Up to 24 months |

| Application Process | Online, quick | Online, quick | Online, quick | Online, may require additional documentation |

| Customer Service | Responsive, multiple channels | Good, mainly online | Efficient, online focus | Comprehensive, includes telephonic support |

| Unique Features | Boodle Smilerank® | Flexible repayment options | Fast processing | Offers larger, longer-term loans |

| More Info | Wonga Review | Lime24 Review | FinChoice Review |

Pros and Cons of Choosing Boodle

When considering this lender for a short-term loan, it’s crucial to weigh both the advantages and disadvantages. This balanced perspective can assist you in making an informed decision based on your personal financial needs and circumstances.

Pros of Boodle

- Quick and Easy Application Process: Online application is straightforward and can be completed in just a few minutes, which is particularly beneficial for those who need funds urgently.

- Fast Loan Disbursement: Once approved, this lender typically disburses loans quickly, often within the same day, making it ideal for urgent financial needs.

- Transparent Fees and Charges: Known for its transparency regarding fees and interest rates. All costs are clearly outlined before you accept the loan, minimizing surprises later.

- Flexible Loan Amounts: With loan amounts ranging from a few hundred to around R8 000, they offer flexibility depending on your specific needs.

- Innovative Features: Features like the Smilerank® system encourage and reward responsible borrowing and repayment behaviors.

- Responsive Customer Service: Generally receives positive reviews for its customer service, with various channels available for support and queries.

Cons of Boodle

- Higher Interest Rates for Short-term Loans: As with many short-term loans, the interest rates can be higher compared to traditional, longer-term loans from banks, potentially resulting in a relatively steep overall repayment amount.

- Limited Loan Amounts: While the flexibility of loan amounts is a plus, the maximum limit of R8 000 might not be sufficient for those who need a larger sum.

- Short Repayment Periods: This credit provider’s loans are typically required to be repaid within a month, which might not be feasible for everyone, especially if you’re looking for a loan with a longer repayment term.

- Not Suitable for Long-term Financial Solutions: Given their nature, their loans are best for short-term financial gaps and might not be suitable for long-term financial planning or larger financial obligations like home loans or extensive debt consolidation.

- Eligibility Criteria: Some individuals might find their eligibility criteria restrictive, especially if they have a poor credit history or irregular income.

Conclusion

Upon review, Boodle is a company registered and compliant with the NCR. There are mixed reviews from previous clients on the Internet regarding this lender. In all instances, they reach out to positive and negative reviews urging dissatisfied clients to provide additional information to find an adequate solution. The costs involved with their loans, such as payday loans, are relatively high. However, those needing immediate funds in case of an emergency can find a financial solution quickly. As with all loans, you will need to ensure you make your repayments timely, especially as the loan will need to be repaid within 32 days or risk damaging your credit rating.

Frequently Asked Questions

They are known for their quick processing times. Once your application is submitted and approved, you can typically expect to receive the funds in your account within the same day, although this can vary based on individual circumstances and application times.

To apply for a loan, you must be over 18 years old, a South African citizen or legal resident, have a regular income, a valid bank account, and contact details (email and phone). Your creditworthiness will also be assessed as part of the application process.

This lender prides itself on transparency. All fees and charges associated with your loan will be clearly outlined during the application process. There are no hidden fees, but it’s important to understand the total cost of your loan, including interest rates and any potential late payment fees.

Yes, they allow for early repayment of loans. Repaying a loan early can sometimes reduce the total interest you pay. It’s advisable to check your loan agreement for any specific terms related to early repayment.

The amount you can borrow from them is based on several factors, including your financial health, income, expenses, and credit history. This lender’s unique Smilerank® system may also influence your eligible loan amount, especially if you have a history of borrowing and repaying on time with Boodle.