When it comes to financing your education in South Africa, the multitude of options can be overwhelming. Standard Bank, one of the country’s leading financial institutions, offers a student loan and other types of loan that has garnered attention for their features and benefits. This review aims to shed light on the specifics of the Standard Bank loan, whether you’re a student just embarking on your academic journey or nearing graduation, understanding the financial tools at your disposal can make a significant difference.

Experiences with Standard Bank Loan

Many individuals seeking financial assistance for various needs have turned to Standard Bank for their loan requirements. The experiences of these borrowers often highlight the bank’s commitment to providing transparent, efficient, and customer-centric services. From the ease of application to the clarity in terms and conditions, Standard Bank has consistently demonstrated its dedication to ensuring a smooth borrowing experience for its clients.

Who Can Apply for a Standard Bank Loan?

Standard Bank offers a range of loan products tailored to meet the diverse needs of its clientele. Whether you’re a student looking to finance your education, a homeowner seeking to renovate, or an entrepreneur aiming to boost your business, Standard Bank has provisions for various demographics. Both residents of South Africa and qualified foreign nationals can explore the bank’s loan offerings, provided they meet the bank’s stipulated criteria.

Criteria for Potential Borrowers

To be eligible for a loan from Standard Bank, potential borrowers must meet certain criteria. This typically includes proof of a steady income, a good credit history, and documentation supporting the borrower’s financial stability. Additionally, the bank may require collateral for certain types of loans. Applicants need to familiarise themselves with the specific requirements of the loan they’re interested in, as criteria might vary based on the loan type.

Differences from Other Loan Providers

What sets Standard Bank apart from other loan providers is its holistic approach to lending. The bank not only offers competitive interest rates but also provides borrowers with resources and tools to manage their finances effectively. Their digital platforms, for instance, offer a seamless application and monitoring process, reducing the need for physical visits to the bank. Standard Bank’s customer service is often lauded for its responsiveness and expertise, ensuring that borrowers have a reliable point of contact throughout their loan journey. In comparison to other providers, Standard Bank’s blend of technology, service, and competitive offerings positions it as a preferred choice for many borrowers.

About Arcadia Finance

Arcadia Finance makes securing loans from diverse banks and lenders effortless. Fill in a free application to explore loan options from up to 19 unique lenders. Our network includes only trusted, NCR-licensed lenders in South Africa.

Standard Bank Loan

When navigating the financial landscape, Standard Bank emerges as a beacon for many seeking reliable loan solutions. Their offerings are not just about providing monetary assistance but also about ensuring that borrowers have a comprehensive understanding and a smooth experience throughout their loan journey.

What Makes the Standard Bank Loan Unique?

Standard Bank’s loan products stand out due to their customer-centric approach. The bank has invested in understanding the diverse needs of its clientele, leading to the development of loan products that cater to specific requirements. Their digital platforms offer a seamless application process, and their commitment to transparency ensures that borrowers are always in the know. The bank’s emphasis on financial education empowers borrowers to make informed decisions, setting Standard Bank apart from many other financial institutions.

Advantages of the Standard Bank Loan Comparison

Comparing Standard Bank’s loan offerings with those of other institutions reveals several advantages. Firstly, their interest rates are competitive, ensuring that borrowers get value for their money. Additionally, the flexibility in repayment terms allows borrowers to choose a plan that aligns with their financial situation. The bank’s robust online platform also facilitates easy tracking and management of the loan, reducing the hassle for borrowers. Lastly, the bank’s reputation for integrity and customer service ensures that borrowers have a trusted partner in their financial journey.

Types of Loans Offered by Standard Bank

Standard Bank offers a diverse range of loan products tailored to meet the specific needs of its customers.

Home Loan

This loan is designed for individuals looking to purchase, renovate, or refinance a home. With competitive interest rates and flexible repayment terms, Standard Bank’s home loan is a popular choice for many homeowners. Ideal for purchasing a new home, renovating an existing property, or refinancing a current mortgage.

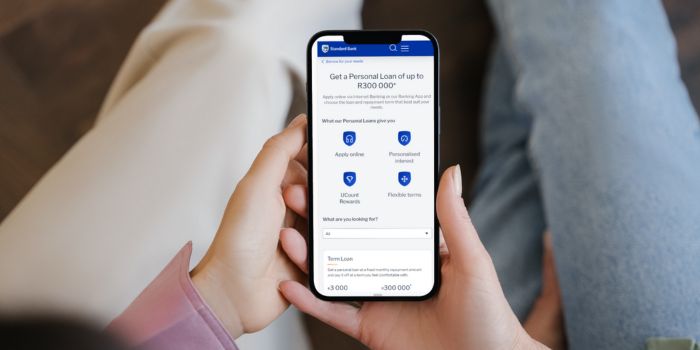

Personal Loan

For those unexpected expenses or to consolidate debt, Standard Bank’s personal loan offers a solution. With quick approval times and a straightforward application process, it’s a convenient option for many. Suitable for managing unexpected expenses, consolidating debt, funding vacations, or even pursuing personal projects.

Auto Loan

For individuals looking to purchase a new or used vehicle, Standard Bank provides auto loans with competitive rates. The bank also offers resources to help borrowers understand the total cost of ownership, ensuring they make an informed decision. Designed for those looking to buy a new or used vehicle, be it a car, truck, or SUV.

Requirements for a Standard Bank Loan

Securing a loan from Standard Bank necessitates a thorough understanding of the requirements set forth by the bank. These prerequisites ensure that both the bank and the borrower have a clear understanding of the terms and conditions, leading to a transparent and efficient loan process.

Documents and Information Needed

To apply for a loan with Standard Bank, prospective borrowers need to provide a range of documents and information. Here’s a breakdown of what’s typically required:

- Proof of Identity: A valid South African ID or passport for foreign nationals.

- Proof of Income: Recent payslips or bank statements showcasing a steady income source. For self-employed individuals, financial statements or other relevant documents might be required.

- Proof of Residence: A utility bill or any official document showing the applicant’s current residential address.

- Credit History: While the bank will typically conduct its own credit check, having a clear understanding of one’s credit score can be beneficial during the application process.

- Employment Details: Information about the borrower’s current employer, including contact details and duration of employment.

- Loan Purpose: A clear description of why the loan is being sought, be it for home renovation, purchasing a vehicle, or any other purpose.

- Collateral Information: For certain types of loans, details about the collateral being offered, such as property deeds or vehicle registration details, might be required.

Simulation of a Loan at Standard Bank

Navigating the loan application process can be overwhelming, particularly for first-time borrowers. To simplify the journey, here’s a step-by-step guide to applying for a loan with Standard Bank.

Step-by-Step Guide to Applying for a Loan with Standard Bank

- Research and Selection: Begin by exploring the various loan products offered by Standard Bank. Based on your needs, whether it’s a home loan, personal loan, or auto loan, select the one that aligns with your requirements.

- Online Application: Visit the official Standard Bank website. Navigate to the loans section and select the desired loan product. Click on the ‘Apply Now’ or a similar button to initiate the online application process.

- Fill in Personal Details: Provide all the necessary personal information, including your name, contact details, and South African ID number or passport details for foreign nationals.

- Employment and Financial Information: Enter details about your current employment, monthly income, and any other relevant financial information.

- Loan Details: Specify the amount you wish to borrow and the desired loan term. Also, provide information about the purpose of the loan.

- Document Upload: Upload all the required documents, such as proof of identity, proof of income, and proof of residence.

- Review and Submit: Prior to submission, thoroughly check all the details you have entered for correctness. When you are content that everything is accurate, proceed to submit the application.

- Wait for Approval: After submission, Standard Bank will review the application, conduct a credit check, and verify the provided documents. This process might take a few days.

- Loan Offer: Once approved, Standard Bank will present a loan offer detailing the loan amount, interest rate, and repayment terms. Review this offer carefully.

- Acceptance and Disbursement: If you agree with the terms, accept the offer. Upon acceptance, Standard Bank will disburse the loan amount to the specified account or directly to the relevant parties, based on the loan type.

Eligibility Check

Standard Bank recognizes the value of time and the importance for borrowers to assess their likelihood of loan approval in advance. Here are the tools and methods offered by Standard Bank to pre-check eligibility:

Tools or Methods Offered by Standard Bank to Pre-Check Eligibility

Online Loan Calculator: Standard Bank provides an online loan calculator tool. By entering details such as the desired loan amount, term, and monthly income, prospective borrowers can obtain an estimate of their eligibility and potential monthly repayments.

Instant Online Quote: For certain loan products, Standard Bank offers an instant online quote feature. This allows applicants to receive a preliminary idea of the loan amount they might be eligible for, based on the provided details.

It’s important to note that while these tools offer a preliminary assessment, the final loan approval is subject to a detailed review by Standard Bank, which includes a comprehensive credit check and document verification.

Security and Privacy at Standard Bank

In the digital age, safeguarding the security and privacy of personal and financial information is crucial. As a leading financial institution, Standard Bank places significant emphasis on ensuring that its customers’ data remains protected and confidential.

How Standard Bank Ensures the Security of Personal and Financial Information

Standard Bank employs a multi-layered approach to safeguard the information entrusted to them by their customers.

Advanced Encryption: All data transmitted between the customer’s device and Standard Bank’s servers is encrypted using advanced encryption techniques. This ensures that even if data is intercepted, it remains unreadable to unauthorized parties.

Two-Factor Authentication: To access sensitive financial information or conduct transactions, Standard Bank often requires two-factor authentication. This adds an extra layer of security, ensuring that even if login details are compromised, unauthorized access is prevented.

Regular Security Audits: Standard Bank conducts regular security audits of its systems and infrastructure. This helps in identifying and rectifying potential vulnerabilities, ensuring that the bank’s digital platforms remain secure.

Anti-Fraud Systems: The bank has in place sophisticated anti-fraud systems that monitor transactions in real-time. Any suspicious activity is flagged, and the customer is alerted immediately.

Secure Data Centers: All customer data is stored in secure data centers with state-of-the-art security measures. Access to these centers is restricted to authorized personnel only.

Privacy Policies and Data Handling Practices

Standard Bank is committed to upholding the privacy of its customers. Their approach to data privacy is governed by strict policies and practices.

Data Collection: Standard Bank only collects data that is necessary for providing its services. This includes personal identification information, financial data, and transaction history.

Data Usage: The bank uses the collected data primarily to offer tailored financial products, process transactions, and provide customer support. They do not sell or rent customer data to third parties.

Data Retention: Standard Bank retains customer data only for as long as it’s necessary. Once the data is no longer needed, it’s securely deleted from their systems.

Data Sharing: While Standard Bank does not sell customer data, they might share it with trusted third-party partners for specific purposes, such as credit checks. However, all third-party partners are bound by strict confidentiality agreements.

Customer Rights: Standard Bank’s customers have the right to access, modify, or delete their personal data. The bank’s privacy policy provides detailed information on how customers can exercise these rights.

How Much Money Can I Request from Standard Bank?

When considering a loan from Standard Bank, it’s crucial to comprehend the range of loan amounts available. While the exact amount you can request depends on the type of loan and your financial profile, Standard Bank offers both minimum and maximum thresholds to cater to a wide range of needs.

Minimum and Maximum Amounts

Standard Bank’s loan products come with varying minimum and maximum amounts. For instance, personal loans might start from a few thousand Rands and can go up to several hundred thousand Rands. However, specific amounts for home loans or auto loans might have different thresholds based on the property’s value or the vehicle’s cost.

Receive Offers

Standard Bank prides itself on understanding its customers’ unique financial situations.

How Standard Bank Creates Personalized Loan Offers

The bank employs a combination of factors to create personalized loan offers. This includes your credit history, current financial situation, employment status, and the purpose of the loan. By analyzing these factors, Standard Bank can tailor a loan offer that aligns with your needs and repayment capacity.

How Long Does It Take to Receive My Money from Standard Bank?

Once you’ve applied for a loan and received approval, the next question is often about the disbursement speed.

Average Processing Times

On average, after approval, Standard Bank may take a few business days to disburse the loan amount. However, this timeline can vary based on the loan type and any additional verifications or checks the bank might need to conduct.

Factors Affecting Withdrawal Speed

Several factors can influence the speed at which you receive your loan amount from Standard Bank. This includes the completeness and accuracy of the information provided, the bank’s internal processing times, and any external factors like public holidays.

How Do I Repay My Loan from Standard Bank?

Repaying your loan is a crucial aspect of the borrowing process. Standard Bank offers multiple avenues to ensure that the repayment process is as seamless as possible.

Repayment Options and Plans

Standard Bank provides various repayment options, including direct debit orders, electronic transfers, or even in-branch payments. Customers can choose a repayment plan that aligns with their monthly income, be it on a monthly, bi-weekly, or even weekly basis.

Possible Fees and Penalties

While Standard Bank strives to maintain transparency in its fee structure, it’s essential to be aware of any potential fees or penalties. This can include early repayment fees, late payment penalties, or any administrative charges. It’s always a good idea to review the loan agreement in detail to understand any additional costs that might be associated with the loan.

Online Reviews of Standard Bank

When considering a financial institution, especially for something as significant as a loan, it’s crucial to understand what other customers have experienced. Online reviews provide a window into the real-world interactions and experiences of past and current customers. Here’s a summary of what some customers have said about Standard Bank:

What Customers Say About Standard Bank

Standard Bank, like many large institutions, has a mix of positive and negative reviews. On Trustpilot, a popular review platform, the bank has received a rating of 1.6 out of 5 based on 148 reviews. Here are some of the sentiments expressed by customers:

Negative Feedback: Some customers have expressed dissatisfaction with specific services offered by Standard Bank. For instance, one customer mentioned being charged a significant amount for an overdraft service, while another highlighted challenges with the bank’s estate department, stating it took an extended period to finalize matters. Issues with the bank’s mobile app and call center services were also pointed out.

Positive Feedback: On the brighter side, there were customers who had positive experiences with the bank. One reviewer praised the staff for being friendly and helpful, stating that the bank’s branches in Empangeni exceeded their expectations in terms of service. Another customer appreciated the assistance they received from a specific staff member at the Kingsmead branch in Durban, highlighting their professionalism.

Mixed Feedback: Some reviews were mixed, pointing out both the good and the bad. For instance, a customer mentioned their disappointment with Standard Bank’s service plan but also acknowledged the excellent service they received from a particular staff member.

Customer Service

When it comes to banking and financial services, customer service plays a pivotal role in ensuring that clients have a seamless and positive experience. Standard Bank, being one of the leading banks in South Africa, has invested in its customer service to cater to the diverse needs of its clientele.

Do You Have Further Questions for Standard Bank?

If you have additional queries or concerns regarding Standard Bank’s services, there are multiple avenues to reach out. You can contact their helpline, visit a local branch, or even use their online chat feature on their official website. Standard Bank’s customer service team is trained to assist with a wide range of issues, from account inquiries to loan applications.

Alternatives to Standard Bank

While Standard Bank offers a comprehensive range of financial products, it’s always a good idea to explore other options to ensure you’re getting the best deal. South Africa has several other reputable banks and financial institutions that might cater to your specific needs.

Other Credit Comparison Portals and Their Offers

There are various credit comparison portals available that allow users to compare loan offers, interest rates, and other financial products from different banks and institutions. These platforms provide a holistic view of the market, helping customers make informed decisions.

By exploring alternative options and utilizing credit comparison tools, you can assess a variety of offerings and choose the one that best suits your financial requirements.

Comparison Table

| Feature | Standard Bank | Absa Bank | Nedbank | FNB | Square Finance |

|---|---|---|---|---|---|

| Interest Rate | Prime + 1.5% | Prime + 2% | Prime + 1% | Prime + 1.75% | Starting from 5% |

| Loan Amount Range | R10,000 – R300,000 | R5,000 – R150,000 | R20,000 – R200,000 | R15,000 – R180,000 | Up to R3,000,000 |

| Repayment Period | Up to 15 years | Up to 10 years | Up to 20 years | Up to 12 years | Up to 10 years |

| Eligibility Criteria | SA Citizen or permanent resident, proof of admission | SA Citizen, proof of admission, surety required | SA Citizen, under 30, proof of admission | SA Citizen, proof of admission, creditworthy surety | SA Citizen, proof of admission, creditworthy surety |

| Application Process | Online/In-person | Online/In-person | Online/In-person | Online/In-person | Online/In-person |

| Approval Time | 2 weeks | 1 week | 3-5 business days | 1-2 weeks | Varies |

| Additional Benefits | Study device discount, textbook allowance | Competitive interest rates for top academic performers | Rewards program, flexible interest rate options | No collateral required for full-time students | Fast financing directly from the lender |

| More Info | Absa Review | Nedbank Review | FNB Review | Square Finance Review |

History and Background of Standard Bank

Standard Bank, officially known as The Standard Bank of South Africa Limited, is one of South Africa’s largest and most established financial institutions. Founded in 1862 in Port Elizabeth, South Africa, by a group of businessmen led by John Paterson, the bank was initially established to finance the booming wool export businesses. Over the years, Standard Bank expanded its operations across the African continent and beyond, establishing a strong presence in various global markets.

Company’s Mission and Vision

Mission: Standard Bank’s mission is to drive sustainable and inclusive economic growth across Africa. By providing financial products and services that cater to the unique needs of its diverse clientele, the bank aims to uplift communities and contribute to the continent’s prosperity.

Vision: Standard Bank envisions itself as a leading African financial institution, recognized globally for its commitment to innovation, customer-centricity, and sustainable growth. The bank aspires to be at the forefront of driving Africa’s growth, connecting its customers to opportunities, and helping them realize their dreams.

Pros and Cons

Pros

Extensive Network: Standard Bank boasts a wide-reaching network with branches and operations spanning multiple countries, providing services to both local and international clients.

Diverse Financial Products: The bank offers a comprehensive range of financial products and services, catering to various needs from personal banking to corporate finance.

Innovative Digital Solutions: Standard Bank has made significant investments in digital banking solutions, enhancing accessibility and convenience for its customers through innovative online platforms.

Cons

Customer Service Variability: While many customers report positive experiences, there are instances of inconsistencies in customer service across different branches, indicating variability in service quality.

Fees and Charges: Some customers express concern about the bank’s fees and charges, especially for certain services, stating that they perceive them to be on the higher side compared to competitors.

Online Platform Glitches: Occasional reports of glitches and downtimes on the bank’s online platforms have been noted, causing inconvenience to users and highlighting potential areas for improvement in digital service reliability.

Conclusion

Standard Bank, with its rich history and commitment to Africa’s growth, stands as a key player in the continent’s financial landscape. The bank offers numerous advantages, including a comprehensive range of financial services and an extensive network that caters to both local and international clients.

However, potential customers should also take into account the reported cons. Variability in customer service quality across branches, concerns about fees and charges, and occasional glitches in online platforms have been noted. As with any financial decision, it is advisable for individuals to carefully weigh both the pros and cons, consider their specific needs, and conduct thorough research before making a decision on banking services.

FAQs

Standard Bank is headquartered in Johannesburg, South Africa.

You can open an account with Standard Bank by visiting any of their branches, or you can initiate the process online through their official website.

Yes, Standard Bank offers a comprehensive digital banking platform, allowing customers to manage their accounts, make transactions, and access various services online.

Standard Bank offers a range of loan products, including personal loans, home loans, auto loans, and business loans, among others.

You can contact Standard Bank’s customer service through their helpline, available on their official website, or by visiting a local branch.