Sanlam [Sanlamonline.co.za], a well-established financial services provider, offers a range of personal loan products tailored to meet the diverse needs of South African consumers. We take a closer look at their loan offerings, examining their features, interest rates, eligibility criteria and overall value for money. Whether you are looking to consolidate debt, finance a major purchase or cover unexpected expenses, understanding what this company brings to the table can help you make an informed borrowing decision.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by Sanlam and is based solely on our research.

Sanlam provides personal loan solutions that are customised according to your financial circumstances, with loan amounts determined by your income, credit profile, and affordability. Loan options range from R5 000 to R350 000, with fixed interest rates and repayment terms between 12 and 84 months. There are no penalties for early settlement, offering added repayment flexibility. Sanlam performs a full affordability assessment to ensure the loan offer aligns with your financial needs and ability to repay.

Sanlam Personal Loan: Quick Overview

Loan Amount: R5 000 – R350 000

Loan Term: 12 to 84 months (1 to 7 years)

Interest Rate: Fixed rates ranging from 16% to 28.5% per annum, determined by credit profile

Fees: Initiation fee up to R1,207.50; monthly service fee of R69

Loan Types: Unsecured personal loans suitable for various purposes such as home improvements, education expenses, or consolidating existing debts

Sanlam Lender Full Review

Many individuals who have opted for a Sanlam loan have found the experience to be straightforward and customer-centric. Sanlam’s approach to lending is rooted in understanding the unique needs of each borrower. From the initial application process to the final repayment, the company ensures that borrowers are well-informed and supported. The transparency in terms and conditions, coupled with responsive customer service, has made Sanlam a preferred choice for many seeking financial assistance.

What Makes the Sanlam Loan Unique?

This company’s personal loan offering is distinguished by its combination of flexibility, transparency, and customer-focused benefits. Borrowers can access amounts ranging from R5 000 up to R350 000, with repayment terms spanning 12 to 84 months. The fixed interest rate structure ensures predictable monthly repayments, aiding in effective budgeting. A notable feature is the Wealth Bonus®, which allows clients to earn up to 10% of their loan amount back as a reward for consistent, on-time repayments .

The application process is streamlined through an online platform, providing quick access to funds upon approval. They also offers tools to help clients manage their credit profiles and repayment plans effectively. This approach reflects Sanlam’s commitment to responsible lending and supporting clients in achieving their financial goals.

About Arcadia Finance

Streamline your loan procurement with Arcadia Finance, where we connect you to a selection of banks and lenders. Simply fill out a no-charge application to get loan proposals from up to 19 varied lenders. We partner with reputable lenders, all regulated by South Africa’s National Credit Regulator.

Types of Loans Offered by Sanlam

Sanlam Personal Loans

These unsecured loans offer up to R350 000 with flexible repayment terms ranging from 12 months to 7 years. Interest rates vary between 16% and 28.5% per annum, compounded monthly, making them suitable for a wide range of personal financial needs such as debt consolidation, education or large purchases.

Capfin Loans

Offered in partnership with Capfin, these loans range from R1 000 to R50 000 and are repayable over 6 to 24 months. They are designed for quick, short-term financial support with a straightforward application process.

Home Loans

Through a collaboration with ooba, Sanlam helps clients access home loans by assisting with prequalification and offering tools to compare multiple quotes. This service is aimed at helping clients find competitive interest rates and terms when purchasing property.

Each loan type is designed with specific purposes in mind, providing clients with options that align with their individual financial situations.

Requirements for a Sanlam Loan

To apply for a their personal loan, you will need to provide the following documents:

- A copy of your green barcoded ID book or Smart ID card

- Your last 3 months’ consecutive payslips or bank statements

- A recent document confirming your residential address

Who Can Apply for a Sanlam Loan?

Sanlam welcomes a broad spectrum of applicants, including salaried employees, self-employed individuals and those with varied income sources, offering loan products tailored to different financial profiles. To qualify, applicants must be South African residents of legal age with a steady income, and their credit history will be assessed to gauge financial reliability, though each application is considered on its own merits. Unlike many lenders that rely solely on credit scores, this company adopts a more holistic approach, taking into account the applicant’s overall financial situation, goals and needs. This ensures that the loan product aligns with the borrower’s capacity and circumstances. this company also stands out for its transparency, with all fees disclosed upfront, and for its user-friendly digital platform, which allows borrowers to manage their loans easily and efficiently online.

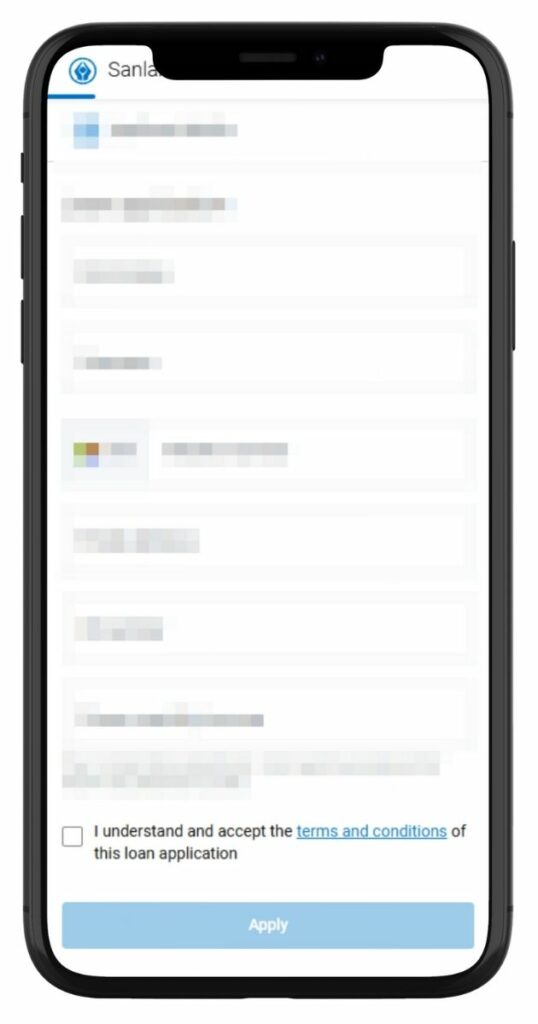

Step-by-Step Loan Application Process at Sanlam

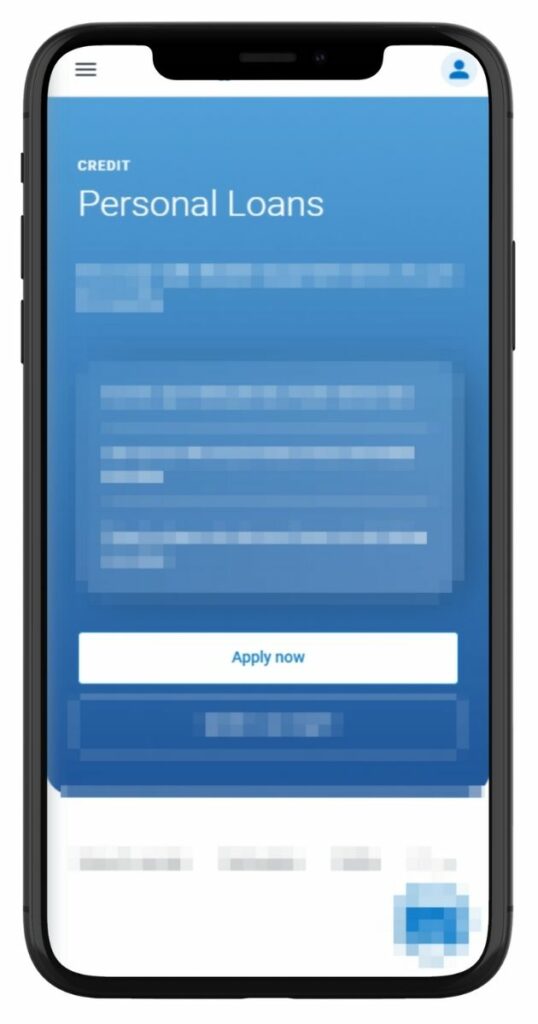

Step 1. Visit Sanlamonline.co.za and hover to over Credit and then click Personal Loans.

Step 2. Tap “Apply now” on the Personal Loans screen to start your application.

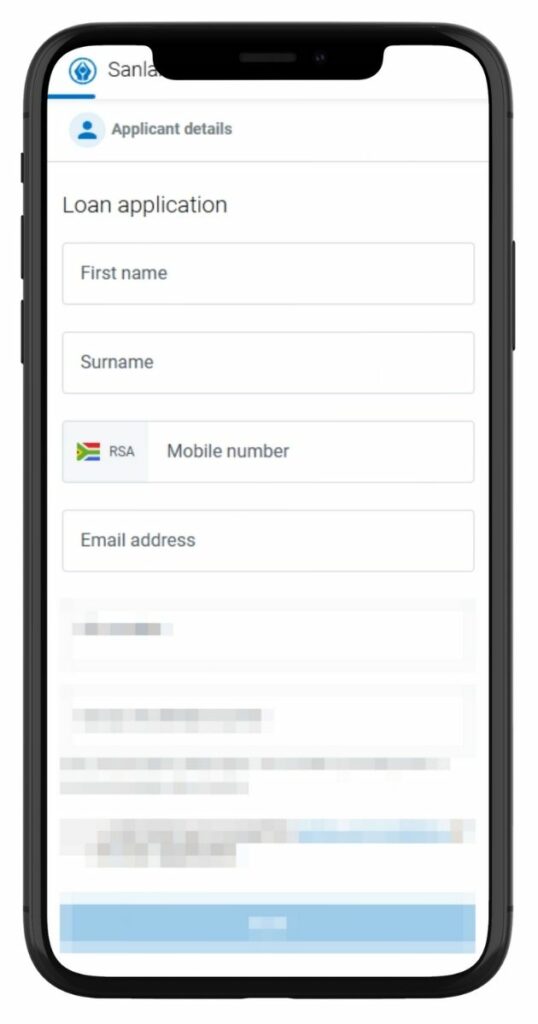

Step 3. Fill in your personal details including name, mobile number, and email address.

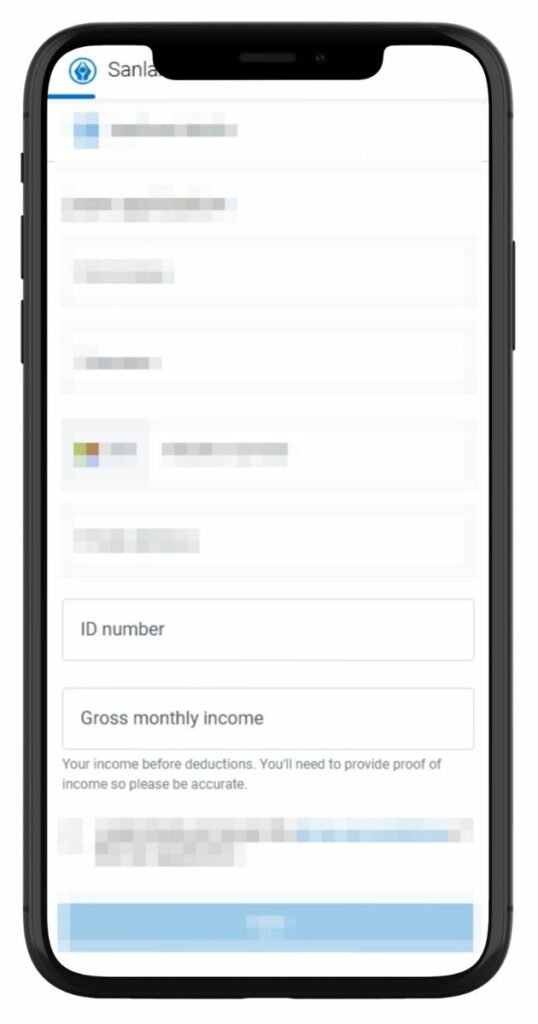

Step 4. Enter your ID number and gross monthly income accurately.

Step 5. Accept the terms and tap “Apply” to submit your loan application.

Step 6. Upload the required documents.

Step 7. Submit your application.

Step 8. Wait for approval and receive your funds upon acceptance.

Eligibility Check

Sanlam offers tools to help you pre-check your loan eligibility:

- Sanlam Credit Solutions Dashboard: This platform allows you to manage your credit profile, check your credit score, and understand factors affecting your creditworthiness.

- Credit Coach: Their AI-powered Credit Coach provides personalised coaching on credit management, helping you understand your credit score and improve your loan eligibility.

Security and Privacy at Sanlam

Sanlam employs a multi-layered approach to data security. The company uses advanced encryption techniques to ensure that any information transmitted between you and their servers is secure and cannot be intercepted by unauthorised parties. This encryption is especially crucial when dealing with sensitive financial transactions or when sharing personal details.

In addition to encryption, they have robust firewalls in place to protect against potential cyber threats. These firewalls are continuously updated to guard against new and emerging threats, ensuring that the company’s systems remain impervious to unauthorised access.

They also employ regular security audits and assessments. These evaluations, conducted by internal teams and third-party experts, ensure that the company’s security measures are always up to date and can effectively counter any potential vulnerabilities.

This company has stringent protocols in place for internal data access. Employees can only access data that’s relevant to their specific roles, and there are strict controls and monitoring in place to prevent any unauthorised or malicious access.

Who Is Sanlam Best For?

It is ideal for South Africans who:

- Need personal loans for home upgrades, education, or debt consolidation

- Have a steady income and want fixed-rate repayments

- Prefer dealing with a trusted, long-standing financial provider

- Want flexible loan amounts (R5 000 to R350 000) and terms (up to 84 months)

- Value tools like credit score tracking and Wealth Bonus® rewards

Is Sanlam a Safe and Good Option?

Sanlam is one of South Africa’s most reputable financial institutions, with over a century of experience in providing financial services. Registered with the National Credit Regulator (NCRCP272), Sanlam offers unsecured personal loans ranging from R5 000 to R350 000, with fixed interest rates and repayment terms of up to 84 months. The application process is straightforward and accessible online, and clients can benefit from additional tools like the Sanlam Credit Dashboard and Credit Coach to help manage their financial profile.

This company’s loans are structured with transparency and affordability in mind, offering fixed repayments and no penalties for early settlement. Borrowers are clearly informed of all associated fees upfront, including initiation and monthly service charges. While not aimed at the short-term or microloan segment, Sanlam’s offerings are well-suited to those seeking reliable medium-to-large loan amounts backed by a well-regarded and long-established financial provider.

How Much Money Can I Request from Sanlam?

Sanlam offers personal loans ranging from R5 000 to R350 000, with repayment terms between 12 and 84 months. The specific amount you can borrow is determined by your credit profile, income, and financial obligations. This flexibility allows you to tailor the loan to your individual needs.

It prides itself on creating loan offers tailored to individual needs. Instead of a one-size-fits-all approach, Sanlam evaluates each application on its merits.

Sanlam takes into account various factors when crafting a loan offer. This includes your credit score, monthly income, existing financial obligations, and the purpose of the loan. By analysing this data, they can determine the loan amount you’re eligible for, the interest rate applicable, and the best repayment terms for your situation.

How Long Does It Take to Receive My Loan Payout from Sanlam?

Once your loan application is approved, Sanlam strives to ensure that the funds reach your account as soon as possible.

Average Processing Times

On average, after loan approval, it might take anywhere from 24 to 72 hours for the funds to reflect in your account. This duration can vary based on the type of loan, the amount, and inter-bank processing times.

Factors Affecting Withdrawal Speed

Several factors can influence the speed at which you receive your loan amount. These include the accuracy of the information provided, the time taken for verification, bank processing times, and any potential discrepancies that might arise during the verification process.

Sanlam Personal Loan – Overview in Detail

| Name | Sanlam Personal Loan |

|---|---|

| Financial Institution | Sanlam (Registered Credit Provider NCRCP272) |

| Product | Unsecured personal loan with fixed interest and Wealth Bonus® |

| Minimum Age | 18 years |

| Loan Amount Range | R5 000 – R350 000 |

| Repayment Term | 12 to 84 months |

| APR (Annual Percentage Rate) | 16% – 28.5% (fixed) |

| Monthly Interest Rate | Fixed, based on individual credit profile |

| Early Settlement | Allowed at any time without penalties |

| Repayment Flexibility | Fixed monthly instalments via debit order |

| NCR Accredited | Yes |

| Our Opinion | ✅ Trusted brand with long-standing reputation ✅ Wealth Bonus® benefit up to 10% ✅ Predictable repayments ⚠️ Higher interest than some banks ⚠️ Customer service mixed reviews |

| User Opinion | ✅ Simple online application ✅ Fixed instalments help with budgeting ⚠️ Delays in payout reported ⚠️ Customer service concerns |

How Do I Repay My Loan from Sanlam?

Repaying your loan to Sanlam is designed to be as hassle-free as possible, with multiple options available to suit different preferences.

Repayment Options and Plans

Sanlam offers various repayment methods, including direct bank transfers, electronic fund transfers, and debit orders. You can choose a repayment plan that aligns with your financial cycle, be it monthly, bi-monthly, or even quarterly. This company also provides the flexibility to adjust your repayment terms if your financial situation changes.

Possible Fees and Penalties

If a repayment is missed or delayed, Sanlam might charge a late payment fee. Additionally, if you choose to settle your loan earlier than the agreed-upon term, there might be an early settlement fee. It’s always advisable to read the loan agreement thoroughly and clarify any doubts to avoid unexpected charges.

Pros and Cons of Sanlam

Pros of Choosing Sanlam

- Diverse Portfolio: Provides a broad spectrum of financial products to meet various needs.

- Long-standing Reputation: With a history spanning over a century, this company has earned a reputation for reliability and trustworthiness.

- Global Presence: Has extended its operations beyond South Africa, offering international clients access to its services.

- Innovative Solutions: Consistently updates its product offerings, ensuring they remain relevant and competitive.

Cons of Choosing Sanlam

- Customer Service Concerns: Some clients have voiced dissatisfaction with this company’s customer service.

- Complex Product Terms: A few customers find that some of their financial products come with intricate terms and conditions that can be challenging to navigate.

- Competitive Market: With numerous financial institutions providing similar services, this company faces stiff competition, potentially influencing its product pricing and features.

Customer Service at Sanlam

Whether you’re a current client or considering Sanlam’s services, the company provides multiple channels to address queries, concerns, or feedback.

Contact Channels

Phone number:

General Enquiries: 0860 223 390

WhatsApp Self-Service: 0860 726 526

Hours of operation:

Monday to Friday: 08:00 – 17:00

Closed: Weekends and Public Holidays

Postal address:

Sanlam Head Office, Private Bag X8, Tyger Valley 7536, Western Cape, South Africa

Online Reviews of Sanlam

Sanlam’s customer feedback presents a mixed picture. Common complaints include delayed payouts, unresponsive customer service, and high charges. Some customers have also reported poor service, especially concerning retirement plan queries, with responses taking weeks.

Conversely, employee reviews are more favourable, suggesting a positive internal work environment. This disparity indicates that while this company may be a good employer, there are areas for improvement in customer-facing services.

Thanks to Sanlam for a successful intervention and having my matter resolved as efficiently as possible. I used the word efficiently to this rightful review because that’s what should happen to servicing departments to maintain their competitive advantage.

Thanks to Sanlam, I feel more confident about my financial future. Their online platform is user-friendly and makes managing my finances convenient. When I had a concern about my policy, the representative went above and beyond to ensure I was satisfied.

“ would like to express my concern regarding the turnaround time and communication surrounding my personal loan application. I submitted my application on Tuesday last week, and since then, the process has been slow, inconsistent, and lacking in transparency.

I’ve been struggling with Sanlam since April. The communication seriously sucks.

Alternatives to Sanlam

While this company is a prominent financial institution, there are other credit comparison portals and financial service providers in the market. These alternatives offer a range of products, and it’s beneficial to explore them to make an informed decision.

Comparison Table with Top Competitors

| Lender | Minimum Loan Amount | Maximum Loan Amount | Interest Rates | Repayment Terms |

|---|---|---|---|---|

| Sanlam Loans | R5 000 | R350 000 | 8.5% – 24.5% (15% – 25% PA) | 24 months – 84 months |

| ABSA Personal | R250 | R350 000 | Competitive rates | 12 months – 84 months |

| African Bank | R2 000 | R250 000 | 12% on loans up to R50 000 | 7 months – 72 months |

| Standard Bank | R3 000 | R300 000 | 24.75% PA | 12 months – 84 months |

| The Loan Company | R5 000 | R500 000 | From 36% | Up to 90 days |

History and Background of Sanlam

Sanlam, founded in 1918, boasts a storied history that extends beyond a century. Initially established as a life insurance company in Cape Town, South Africa, Sanlam has experienced significant growth over the years. The company has expanded its services and broadened its footprint, not only within South Africa but also on an international scale.

Sanlam’s origins trace back to its founding as a subsidiary of Santam, a general insurance company. Initially conceived to offer life insurance products to the wider South African community, this company emerged as an independent entity over the years. It gradually diversified its product range, extending beyond life insurance to encompass a comprehensive array of financial services, ranging from personal loans to investment solutions.

Company’s Mission and Vision

At the core of this company’s mission is its commitment to empower its clients through robust financial solutions. The company strives to generate value for its stakeholders and play a crucial role in enhancing the financial well-being of its clients. Sanlam envisions itself as a leader in client-centric wealth creation, protection, and management, not only in South Africa but also in selected international markets.

Conclusion

With a wealth of experience and a steadfast dedication to client empowerment, Sanlam continues to hold a prominent position in the financial sector. Despite the numerous advantages it offers, prospective clients should exercise caution, considering the challenges alongside the benefits. Conducting thorough research and seeking insights from existing clients can provide a comprehensive understanding of what this company brings to the table. Making informed decisions is crucial in navigating the dynamic landscape of financial services offered by the company.

Frequently Asked Questions

It was founded in 1918 in Cape Town, South Africa, initially as a life insurance company.

They provide a diverse range of financial products, including life insurance, personal loans, investment solutions, retirement planning, and wealth management services, among others.

No, while it originated in South Africa, it has expanded its operations to various international markets, offering its services to clients globally.

You can apply for a loan through their official website or by visiting one of their branches. They also offer an online loan calculator to help you estimate your potential monthly repayments.

Sanlam emphasises a client-centric approach, aiming to provide tailored financial solutions to its customers. They offer multiple channels for customer support, including phone, email, and in-person consultations at their branches.