Southern Finance has become a noteworthy name in the financial landscape of South Africa, offering a glimmer of hope for individuals facing unexpected expenses. In the era of digital accessibility, Southern Finance pledges a smooth online loan experience. However, a closer examination is essential to evaluate its performance under scrutiny. This review seeks to provide insight into the offerings of Southern Finance, aiming to guide potential borrowers through the intricacies of their loan process.

Experiences with Southern Finance Loan

In the complex world of finance, finding a reliable partner for loans can be daunting. Southern Finance has emerged as a trusted ally for many borrowers who appreciate the platform’s understanding of their needs. Customer experiences highlight the simplicity of the application process, swift approval timelines, and transparent terms offered by Southern Finance.

The digital platform is a key feature, eliminating the need for extensive paperwork or enduring long queues. Borrowers can conveniently apply for a loan from the comfort of their homes, receiving timely approval. The expeditious disbursement of funds, particularly with the same-day payment option, has proven to be a crucial lifeline for those urgently in need of financial assistance.

Who Can Apply for a Southern Finance Loan?

Southern Finance caters to a diverse range of borrowers across South Africa. Whether facing a sudden medical emergency, a student in need of tuition funds, or someone dealing with unexpected expenses, Southern Finance aims to assist. The platform is designed for residents of South Africa holding a valid South African ID number. However, responsible lending and borrowing are ensured through specific criteria.

Criteria for Potential Borrowers

- Valid South African ID: Applicants must possess a valid South African ID for identity verification.

- Stable Income: A stable source of income is required to demonstrate the borrower’s ability to repay the loan.

- Credit Check: Southern Finance conducts a credit check as a standard procedure to assess creditworthiness and associated risks. While a good credit score enhances approval chances, other factors are also considered for a comprehensive evaluation.

Differences from Other Loan Providers

Southern Finance stands out from other loan providers in several ways. Their digital-first approach simplifies the borrowing experience, contrasting with traditional lenders’ physical visits and paperwork requirements. Transparency is paramount, evident in the clear breakdown of interest rates, fees, and total repayment amounts. Accreditation by the NCR underscores credibility and adherence to industry standards. The option of same-day payments, albeit for a fee, is a distinctive feature. Southern Finance’s customer-centric approach, reflected in responsive customer service and clear communication, makes it a preferred choice for many borrowers in South Africa.

About Arcadia Finance

Simplify the process of obtaining a loan with Arcadia Finance. Submit an application free of charge and discover options from up to 10 distinct lenders. All our lending partners are esteemed and governed by the National Credit Regulator, guaranteeing adherence and dependability in South Africa’s financial realm.

Southern Finance Loan

In the expansive realm of financial lending, Southern Finance stands out as a unique entity. Through its tailored offerings and customer-centric approach, it has successfully carved a niche for itself in the South African loan market.

What Makes the Southern Finance Loan Unique?

Southern Finance’s distinctiveness lies in its digital-first approach. In an era where time is a critical factor, Southern Finance ensures that borrowers are spared the hassle of navigating through tedious paperwork or enduring long queues. The entire loan application process, from initiation to completion, is seamlessly conducted online, offering unparalleled convenience for users. The company’s commitment to transparency is evident at every stage, providing borrowers with a comprehensive breakdown of interest rates, fees, and total repayment amounts, eliminating any hidden surprises. The availability of same-day payments further distinguishes Southern Finance, catering to individuals in urgent need of funds.

Advantages of Southern Finance Loan Comparison

When it comes to loan comparison, Southern Finance offers clear advantages. One of the primary benefits is the company’s transparent and upfront communication regarding loan terms, leaving no room for ambiguity. Borrowers have a clear understanding of what they are committing to. The swift approval process, combined with the option of same-day payments, ensures prompt disbursement of funds. The company’s accreditation by the NCR (National Credit Regulator) adds an extra layer of trust, demonstrating its commitment to upholding industry standards. Southern Finance, with its unique features, provides a compelling option for borrowers in South Africa.

Types of Loans Offered by Southern Finance

Southern Finance, known for its diverse offerings, caters to a broad spectrum of financial needs. While the specifics of each loan type may vary, the company’s primary focus centers on providing short-term loans.

Different Loan Products Available

Southern Finance’s flagship offering is its online short-term loan. These loans are crafted for individuals in need of quick funds to navigate through unexpected expenses. The flexibility in loan amounts, ranging from as little as R500 to up to R8000, ensures that borrowers can select an amount that aligns precisely with their financial requirements.

Suitable Purposes

The short-term loans provided by Southern Finance exhibit versatility, making them suitable for a myriad of purposes. Whether it’s covering medical emergencies, addressing unexpected home repairs, or managing tuition fees, these loans offer the necessary financial cushion. The expeditious disbursement of funds, particularly with the same-day payment option, makes these loans ideal for urgent requirements.

However, it’s crucial for borrowers to exercise responsibility in their financial decisions. Before taking out a loan, individuals should carefully assess their ability to repay within the stipulated time frame. While Southern Finance’s short-term loans offer a convenient solution for immediate financial needs, prudent borrowing practices ensure a positive borrowing experience for all users.

Requirements for a Southern Finance Loan

When considering a loan from Southern Finance, thorough preparation and understanding of the company’s requirements are crucial. These prerequisites not only facilitate a seamless application process but also align with Southern Finance’s commitment to responsible lending.

Documents and Information Needed

Valid South African ID: A valid South African ID is a fundamental requirement to initiate the loan application process. This document is vital for verifying the borrower’s identity and confirming legal residency in South Africa.

Proof of Stable Income: Applicants must provide proof of a stable source of income, which can be demonstrated through recent payslips or bank statements. This serves a dual purpose by indicating the borrower’s capacity to repay the loan and assisting Southern Finance in determining a safe loan amount.

Banking Details: Accurate and up-to-date banking details are essential since Southern Finance operates primarily online and facilitates direct bank transfers for loan disbursements. Additionally, the company sets up a debit order on the borrower’s bank account for seamless loan repayments.

Permission for Credit Check: During the application process, Southern Finance seeks permission from applicants to conduct a credit check through relevant credit bureaus. This check aids the company in assessing the creditworthiness of the borrower. While a positive credit score can enhance approval chances, Southern Finance takes a holistic approach, considering various factors for a comprehensive evaluation of the applicant’s financial standing.

By fulfilling these requirements, applicants not only contribute to a smoother loan application process but also collaborate with Southern Finance in upholding responsible lending practices.

Simulation of a Loan at Southern Finance

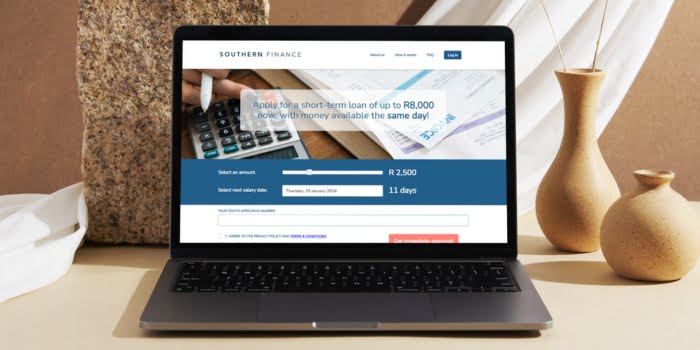

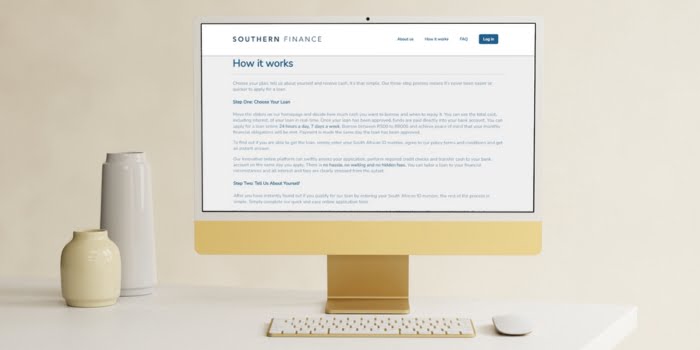

Navigating the world of loans can be complex, but Southern Finance strives to make the process as straightforward and user-friendly as possible. If you’re considering a loan with Southern Finance, here’s a step-by-step guide to help you understand the application process:

- Visit the Southern Finance Website: Begin by accessing the official Southern Finance website. Here, you’ll find comprehensive information about their loan offerings.

- Choose Your Loan Amount: On the homepage, locate a slider or input field allowing you to select your desired loan amount, typically ranging from R500 to R8,000.

- Select Repayment Date: Choose the date when you plan to repay the loan. This date is usually aligned with your salary payment to ensure you have sufficient funds available for repayment.

- Enter Personal Details: Provide your South African ID number and other requested personal details. This information is crucial for identity verification and the loan processing procedure.

- Agree to Terms: Before proceeding, agree to Southern Finance’s privacy policy and terms & conditions. Additionally, you’ll be granting permission for Southern Finance to conduct a credit check, a standard procedure to assess your creditworthiness.

- Submit Application: Once all details are filled in, submit your application. Southern Finance will then review your application and perform necessary checks.

- Wait for Approval: If you meet the criteria and everything goes smoothly, you’ll receive an approval notification. The approval process is swift, minimizing your wait time.

- Receive Funds: Upon approval, the loan amount will be transferred to your bank account. Opting for the immediate same-day payment option may incur a small fee, but you’ll receive the funds on the same day.

This step-by-step guide aims to simplify the loan application process with Southern Finance, ensuring that potential borrowers understand each stage and can navigate through the procedure with ease.

Eligibility Check

Before delving into the loan application, it’s prudent to ascertain your eligibility. Southern Finance places a high value on transparency and provides tools and methods for pre-checking eligibility.

Tools and Methods Offered for Pre-Checking Eligibility

The Southern Finance website presents explicit guidelines on who qualifies for a loan. Key criteria include possessing a valid South African ID and maintaining a stable source of income. While the website provides insights into the fundamental eligibility criteria, the definitive determination of eligibility occurs after a credit check and a comprehensive assessment of the applicant’s financial standing. It is advisable to thoroughly review the terms and conditions, as well as the frequently asked questions (FAQs) on the Southern Finance website, to gain a clearer understanding of the eligibility requirements.

Security and Privacy at Southern Finance

In today’s digital age, the security and privacy of personal and financial information are of utmost importance. Southern Finance acknowledges the significance of safeguarding its customers’ data and has implemented robust measures to ensure that every piece of information shared with them remains confidential and protected.

How Southern Finance Ensures the Security of Personal and Financial Information

Southern Finance employs state-of-the-art encryption technologies to safeguard the data transmitted between the borrower and the company’s servers. This ensures that any information shared, whether personal details or financial transactions, is encrypted and remains inaccessible to unauthorized individuals or entities.

In addition to encryption, Southern Finance has firewalls and other advanced security protocols in place to prevent unauthorized access to their systems. Regular security audits and assessments are conducted to identify potential vulnerabilities and proactively address them. This continuous monitoring and updating of security measures ensure that the company stays ahead of potential threats.

Southern Finance is committed to training its staff on the importance of data security. Employees receive regular updates on best practices and protocols to handle customer information with the utmost care and discretion.

Privacy Policies and Data Handling Practices

Southern Finance’s commitment to privacy is evident in its comprehensive privacy policy. The policy outlines how the company collects, uses, and protects customer information. It emphasizes that customer data is never sold or shared with third parties for marketing purposes. The only instances where data might be shared are for essential business operations or if mandated by law.

The company also provides clarity on the use of cookies and other tracking technologies on its website. These tools are primarily used to enhance the user experience and understand user behavior, ensuring a seamless online journey for customers.

Southern Finance respects the rights of its customers to access, modify, or delete their personal data. Customers can reach out to the company’s support team if they have any concerns or requests related to their data.

How Much Money Can I Request from Southern Finance?

When considering a loan from Southern Finance, it’s crucial to be aware of the range of loan amounts available. Southern Finance offers flexibility in this regard. Borrowers can request amounts as low as R500, making it accessible for those who need just a small financial boost. On the higher end, Southern Finance provides loans of up to R8,000, catering to those with more substantial financial needs.

How Southern Finance Creates Personalized Loan Offers

Southern Finance takes pride in understanding the unique financial needs of each borrower. Rather than adopting a one-size-fits-all approach, the company utilizes a combination of financial data, credit history, and the information provided by the borrower during the application process to craft personalized loan offers. This tailored approach ensures that borrowers receive loan terms that align with their financial situation and repayment capabilities.

How Long Does It Take to Receive My Money from Southern Finance?

One of the standout features of Southern Finance is its rapid processing times. Upon approval of a loan application, funds are typically deposited into the borrower’s bank account within 24 hours. For individuals in urgent need, Southern Finance provides an immediate same-day payment option, albeit for a small fee.

Factors Affecting Withdrawal Speed

While Southern Finance aims for prompt fund disbursement, several factors can influence withdrawal speed. These include the accuracy of the bank details provided by the borrower, bank processing times, and any potential system outages. It’s always advisable for borrowers to ensure they provide precise banking information to avoid any delays.

How Do I Repay My Loan from Southern Finance?

Repaying a loan from Southern Finance is designed to be hassle-free. Once the loan is approved and disbursed, Southern Finance sets up a debit order on the borrower’s bank account. This means that when the repayment is due, typically aligned with the borrower’s salary date, the repayment amount is automatically deducted from the bank account. This automated process ensures timely repayments and reduces the chances of missed payments.

Possible Fees and Penalties

While Southern Finance is transparent about its interest rates and fees, borrowers should be aware of potential additional charges. If a borrower chooses to repay via debit order, there might be extra charges payable to third-party payment companies. Additionally, non-payment of the loan can result in an R69 service fee and an added 5% interest monthly. If repayments are missed for two consecutive months, the account may be handed over to an external debt collection company. It’s crucial for borrowers to stay informed about their repayment dates and ensure they have sufficient funds in their bank accounts to avoid any additional fees or penalties.

Online Reviews of Southern Finance

In the era of digital communication, online reviews play a crucial role in shaping the reputation of a company. Southern Finance, with its online presence and digital loan offerings, is no exception. Potential borrowers often turn to online reviews to gauge the experiences of previous customers and determine if Southern Finance is the right fit for their financial needs.

What Customers Say About Southern Finance

Customers’ feedback about Southern Finance paints a picture of a company that is committed to providing a seamless and transparent loan experience. Many reviewers highlight the ease of the online application process, noting that it’s straightforward and user-friendly. The swift approval times and prompt disbursement of funds are also frequently mentioned, with customers appreciating the company’s efficiency, especially when they’re in urgent need of financial assistance.

Transparency is a recurring theme in many reviews. Borrowers value the clear communication from Southern Finance regarding loan terms, interest rates, and repayment schedules. The absence of hidden fees and the upfront nature of all charges have earned Southern Finance the trust of many of its customers.

Customer service is another area where Southern Finance seems to shine. Reviewers often mention the responsive and helpful nature of the company’s support team. Whether it’s answering queries, addressing concerns, or providing guidance during the application process, the Southern Finance team is commended for its professionalism and dedication.

However, like any company, Southern Finance has its share of constructive feedback. Some customers have pointed out areas where they believe the company could improve, such as offering more flexible repayment options or providing a broader range of loan amounts.

Customer Service

Southern Finance places a high emphasis on customer service. They understand that the financial world can be complex, and having a dedicated team to guide borrowers through the process is invaluable. Whether it’s answering queries about loan terms, assisting with the application process, or addressing any concerns, the Southern Finance team is always ready to help.

Do You Have Further Questions for Southern Finance?

If you have additional questions or need clarification on any aspect of Southern Finance’s offerings, it’s recommended to reach out directly to their customer service team. They can provide detailed insights, offer guidance, and ensure that you have all the information you need to make an informed decision.

Alternatives to Southern Finance

While Southern Finance offers a range of financial solutions, it’s always a good idea to explore alternatives and compare offerings. There are several other credit comparison portals and lenders in the market, each with its unique set of offerings.

Comparison Table

| Lender | Maximum Loan Amount | Interest Rate | Repayment Period | Special Features |

|---|---|---|---|---|

| Southern Finance | R8,000 | Varies | 61 to 65 days | Same-day payment option, NCR accredited |

| Koodo | Up to R5,000 | Maximum APR 38% | 61 to 65 days | Registered with NCR, quick online application |

| Sunshine Loans | R4,000 | Interest and fees calculated upfront | Minimum 4 days, maximum 49 days | Regulated by NCR, one loan at a time policy, fast processing |

| MiPayDayLoans | R4000 | Varies | Up to 31 days | fast processing |

History and Background of Southern Finance

Southern Finance has, over the years, established itself as a prominent entity in the South African financial landscape. Founded with the goal of bridging the gap between traditional lending and the evolving needs of modern borrowers, Southern Finance has consistently adapted to the changing financial environment. The company’s digital-first approach, coupled with its unwavering commitment to transparency and customer service, has positioned it as a preferred choice for many seeking financial solutions in South Africa.

The company’s mission is straightforward: to provide accessible and transparent financial solutions to individuals, regardless of their financial standing. Southern Finance believes in empowering its customers, ensuring they have the tools and knowledge to make well-informed financial decisions. The vision of Southern Finance is to be a leader in the digital lending space, continually innovating and adapting to meet the evolving needs of its customers.

Pros and Cons of Southern Finance

Advantages of Choosing Southern Finance

- Digital-First Approach: The online platform ensures a seamless borrowing experience, eliminating the need for physical visits or cumbersome paperwork.

- Transparency: Southern Finance is upfront about its terms, interest rates, and fees, ensuring borrowers are well-informed.

- Swift Processing: The company’s efficient processing ensures quick loan approvals and fund disbursements.

- Customer-Centric: Southern Finance places a high emphasis on customer service, ensuring borrowers have a smooth and hassle-free experience.

Disadvantages of Choosing Southern Finance

- Loan Amount Limitations: The maximum loan amount of R8,000 might not cater to those seeking larger financial solutions.

- Short Repayment Period: The repayment period of 61 to 65 days might be limiting for some borrowers.

- Fees for Same-Day Payments: While the same-day payment option is convenient, it comes with an additional fee.

This overview provides a balanced perspective on the advantages and disadvantages of choosing Southern Finance, allowing potential borrowers to make informed decisions based on their specific needs and preferences. If you have any specific modifications or additional information you’d like me to include, please let me know.

Conclusion

Southern Finance, driven by its commitment to transparency, customer service, and digital innovation, has solidified its position as a reliable lender in the South African market. Despite its notable advantages, akin to any financial institution, there are areas where it could enhance its services. The company’s strengths, particularly its digital platform and customer-centric approach, outweigh its limitations. Nonetheless, potential borrowers should conduct a thorough assessment of their individual needs and circumstances before making a decision.

Frequently Asked Questions about Southern Finance

Southern Finance is a digital lending platform based in South Africa that offers short-term loans to individuals. The company emphasizes transparency, swift processing, and customer-centric services.

You can borrow amounts ranging from as low as R500 to up to R8,000, depending on your financial needs and creditworthiness.

The application process is entirely online. Visit the Southern Finance website, select your desired loan amount and repayment date, provide the necessary personal and financial details, and submit your application.

Southern Finance is known for its swift approval process. Once you submit your application and all necessary documents, you can expect a response within a short time frame, often within 24 hours.

Yes, while Southern Finance offers an immediate same-day payment option for those in urgent need of funds, this service comes with a small fee.