Navigating the online lending landscape in South Africa can be quite overwhelming, given the multitude of choices and sometimes perplexing terms and conditions. EC Online Loans [Ecloans.co.za] positions itself as a viable solution by providing a variety of loan services customized to suit different financial requirements and situations. Founded in 2005, this company has been dedicated to simplifying the loan application procedure, making it as efficient and swift as possible, utilizing online and mobile platforms to enhance the overall customer experience.

EC Loans – Loan Overview

| Name | EC Loans |

| Financial | Privately Owned & Registered Credit Provider |

| Product | Personal & Quick Loans |

| Minimum age | 18 years |

| Minimum amount | R1 000 |

| Maximum amount | R120 000 |

| Minimum term | 12 months |

| Maximum term | 84 months |

| APR | Up to 28% |

| Monthly Interest Rate | Typically starts from 28% |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Tailored to meet specific requirements |

| NCR Accredited | Yes |

| Our Opinion | ✅ Fast personal loans ✅ Competitive interest rates ✅ Affordable repayment terms |

| User Opinion | ✅ Quick and easy approval ❌ High interest rates for short-term loans ✅ No penalty for early settlement |

What Makes EC Loans Unique?

EC Loans stands out in the South African lending market by offering a variety of loan products that cater to specific financial needs. Unlike some lenders with limited loan options, EC Loans provides a flexible range including personal loans, emergency loans, debt consolidation loans, and vehicle financing. This versatility allows customers to choose loans that best suit their circumstances, whether they are looking for quick cash to handle unexpected costs or a structured debt consolidation plan to manage existing obligations. With a straightforward online application process, EC Loans aims to make the borrowing experience convenient and accessible to South Africans across different income levels and credit profiles.

Additionally, EC Loans places a strong emphasis on transparent rates and manageable repayment options, helping borrowers to feel secure and informed when choosing a loan. Their commitment to clear terms with no hidden fees enhances trust, making it easier for customers to plan their finances confidently. EC Loans also provides tailored customer support, offering guidance at each stage of the process, from application to repayment, ensuring that borrowers have the resources they need to make sound financial decisions. This approach contributes to EC Loans’ reputation as a trustworthy and adaptable lender in South Africa.

About Arcadia Finance

Arcadia Finance facilitates the process of securing loans from a range of banks and lenders. Fill out a free application and get loan offers from up to 19 different lenders. We collaborate with well-established, trustworthy lenders who are licensed by the National Credit Regulator (NCR) in South Africa.

Experiences with EC Online Loans

Many individuals have discovered that the loan application process with this lender is remarkably user-friendly and uncomplicated. The company’s online platform is specifically crafted to enable convenient access to loan services, empowering prospective borrowers to request loans from the convenience of their homes or workplaces. The feedback from past clients illustrates a lender that is dedicated to delivering fast and convenient loan solutions, personalized to address the distinctive financial requirements of every borrower.

Who can apply for an EC Online Loans?

Eligibility Requirements for Potential Borrowers

EC Online Loans has established specific criteria that prospective borrowers must meet to qualify for their loan services. Firstly, applicants must be South African residents, aligning their services with the local market. Additionally, applicants should be employed and receive a regular monthly income, which is a standard prerequisite to ascertain the borrower’s repayment capacity. The primary focus is to make sure that loans are accessible to individuals with the financial capability to effectively manage and repay them within the stipulated terms and conditions.

Distinguishing Features from Other Loan Providers

EC Online Loans sets itself apart from other loan providers with its adaptable and accommodating loan offerings. In contrast to certain lenders who may concentrate solely on credit scores, this lender provides services such as Blacklisted Loans, tailored for individuals who may have encountered financial challenges in the past. This approach broadens the pool of eligible applicants, ensuring that more people have access to financial support when required. The company also places a strong emphasis on transparency and clarity within their processes, ensuring that borrowers are well-informed and confident in their borrowing decisions. This customer-centric approach is a defining characteristic that distinguishes this company from many other lenders in the market.

EC Online Loans Loan

Ecloans.co.za has established itself as a specialist in providing customized loan solutions that address a wide range of financial needs. Their approach goes beyond merely offering financial assistance; it also emphasizes ensuring that borrowers have a clear comprehension of the terms and conditions. This dedication to transparency ensures that there are no concealed surprises in the future. Additionally, their online platform is designed for user-friendliness, making it accessible even to those who aren’t particularly tech-savvy, enabling them to navigate and apply for loans without any complications.

Advantages of Using the EC Online Loans Loan Comparison Tool

Comparing loan options is a wise decision for any prospective borrower, and with this lender, this process is made even more advantageous. Their platform permits users to compare various loan products side by side, enabling borrowers to make well-informed decisions based on their individual requirements and financial situation. This comparison tool not only saves time but also ensures that borrowers secure the best possible deal tailored to their unique circumstances.

Types of Loans Provided by EC Online Loans

Personal Loans

Ecloans.co.za offers a diverse range of loan products to address various financial needs. Their Personal Loans are versatile, offering financial solutions for unexpected expenses like medical emergencies or home repairs, as well as planned expenditures such as holidays. These loans provide the flexibility needed to effectively manage a wide array of financial demands.

Blacklisted Loans

In addition to Personal Loans, they extend support to individuals who have experienced financial challenges in the past through their Blacklisted Loans. This product reflects the company’s commitment to providing financial assistance regardless of previous financial setbacks, ensuring that individuals are not permanently hindered by past financial missteps.

Business Loans

For those with entrepreneurial ambitions, this lender provides Business Loans, a product designed to fuel business growth. These loans can be utilized for various business needs, including expansion, inventory purchase, or managing operational expenses, supporting businesses in their journey towards growth and sustainability.

Payday Loans

Lastly, this company offers the Payday Loans option, a short-term financial solution designed to assist individuals in bridging the gap between paychecks. This offering is particularly beneficial for managing unforeseen expenses that require immediate financial attention, ensuring that individuals can maintain financial stability even between pay periods.

Requirements for an EC Online Loans Loan

When applying for a loan with them, it is essential to prepare specific documents and information to streamline the application process. Applicants are expected to submit personal identification documents, which are vital for verification purposes. Typically, this includes:

- Valid South African ID or passport

- Proof of residence

- Recent payslips or bank statements to confirm income stability

These documents play a pivotal role in determining the applicant’s eligibility and repayment capacity, guaranteeing that the loan is customized to suit the applicant’s financial circumstances.

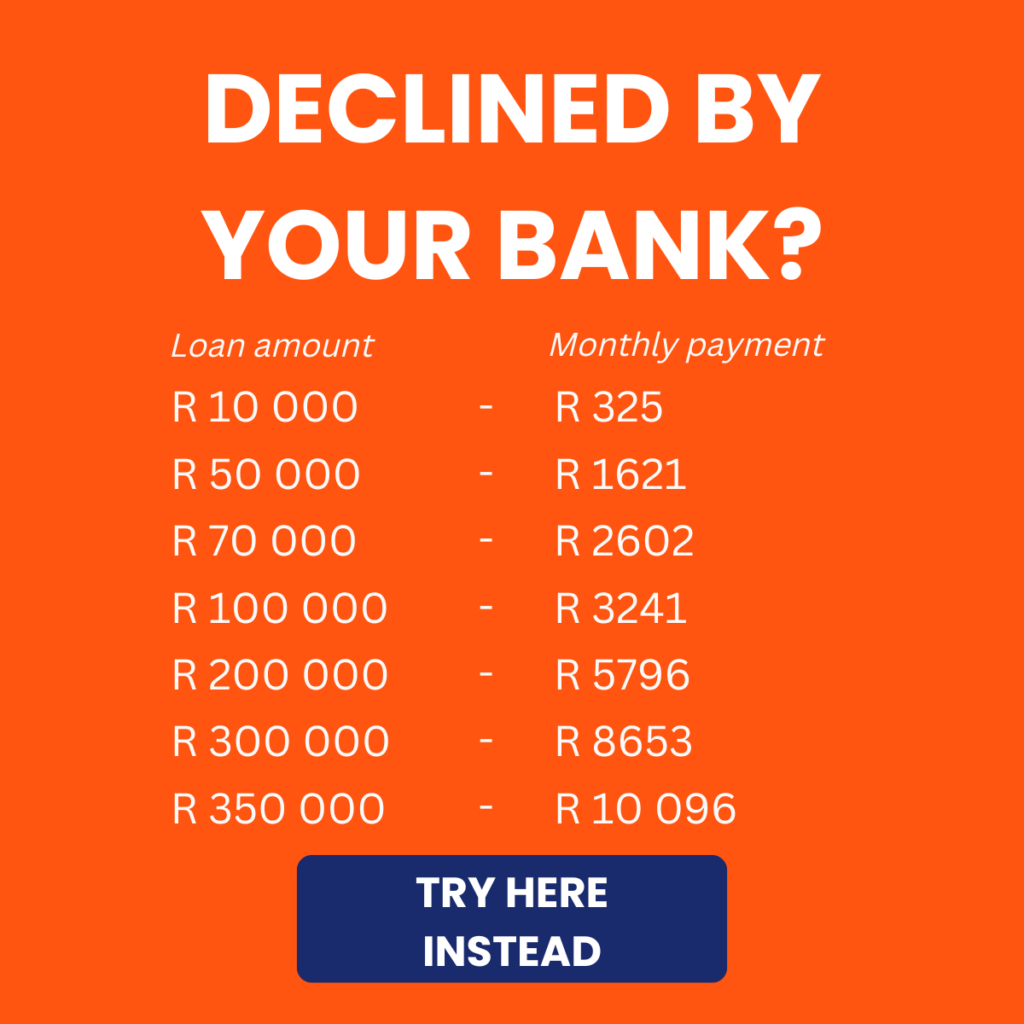

Simulation of a Loan at EC Online Loans

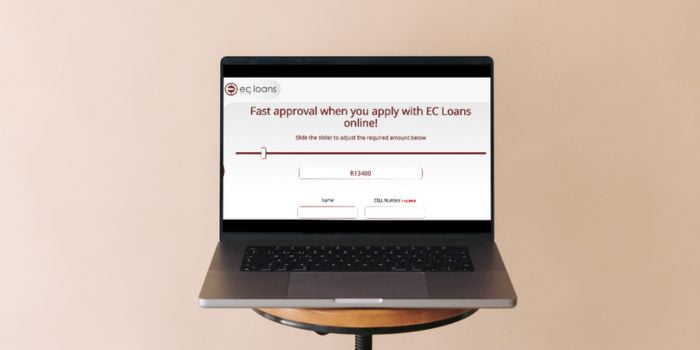

Step 1. Go to Ecloans.co.za

Step 2. Use the slider to select the desired loan amount.

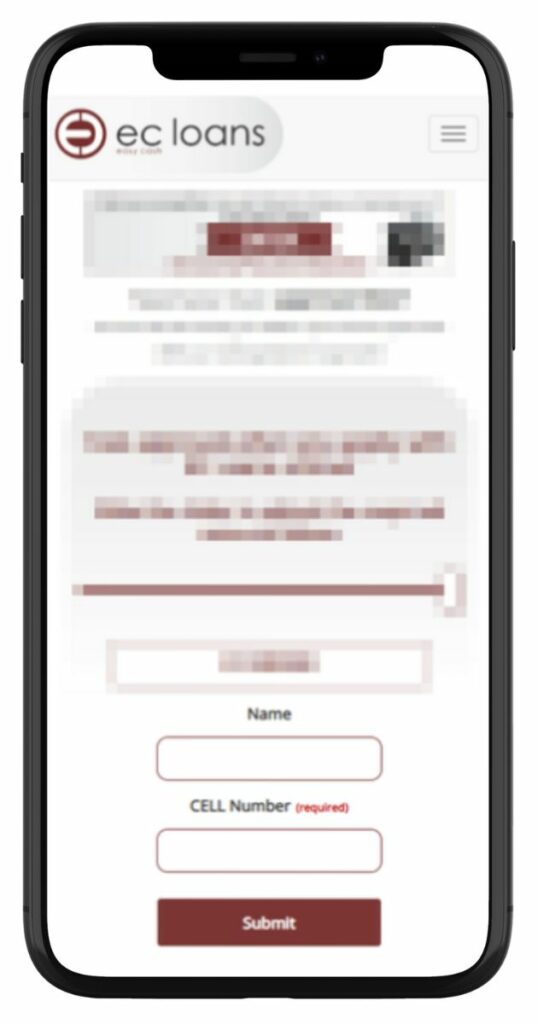

Step 3. Fill in your name and cell number and click submit.

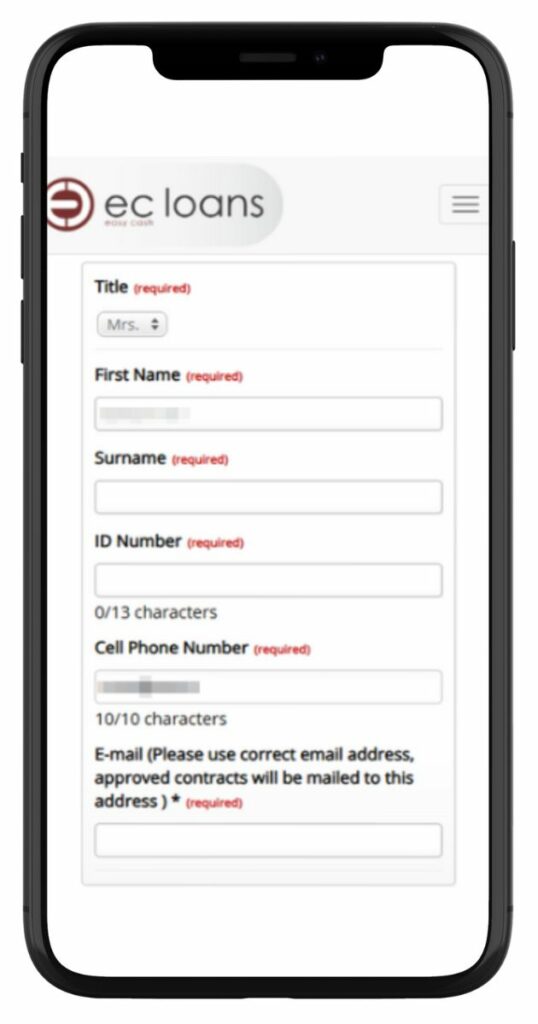

Step 4. Complete the form with your title, full name, surname, ID number, and cell phone number.

Step 5. Specify your company name and salary payment date for income verification.

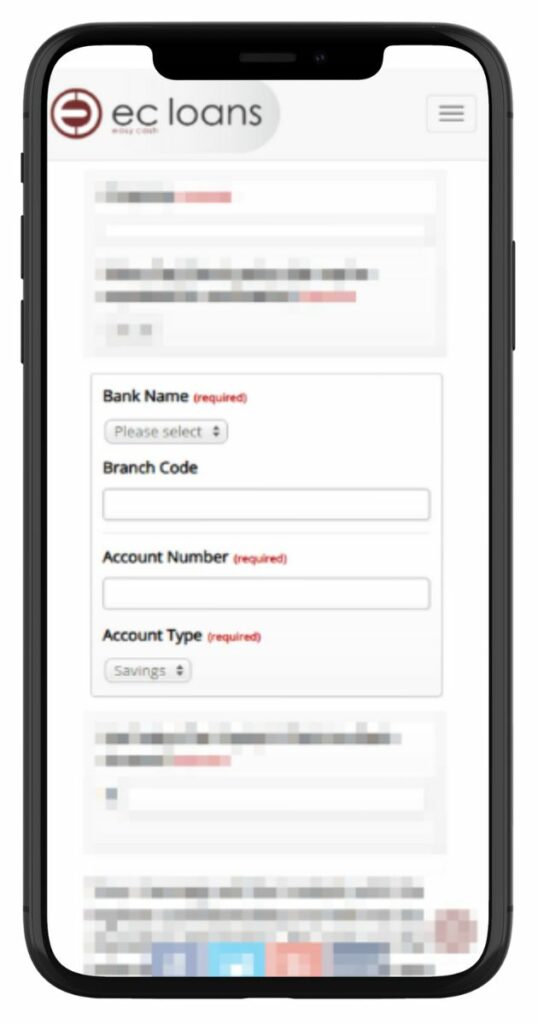

Step 6. Fill in your bank name, branch code, account number, and account type.

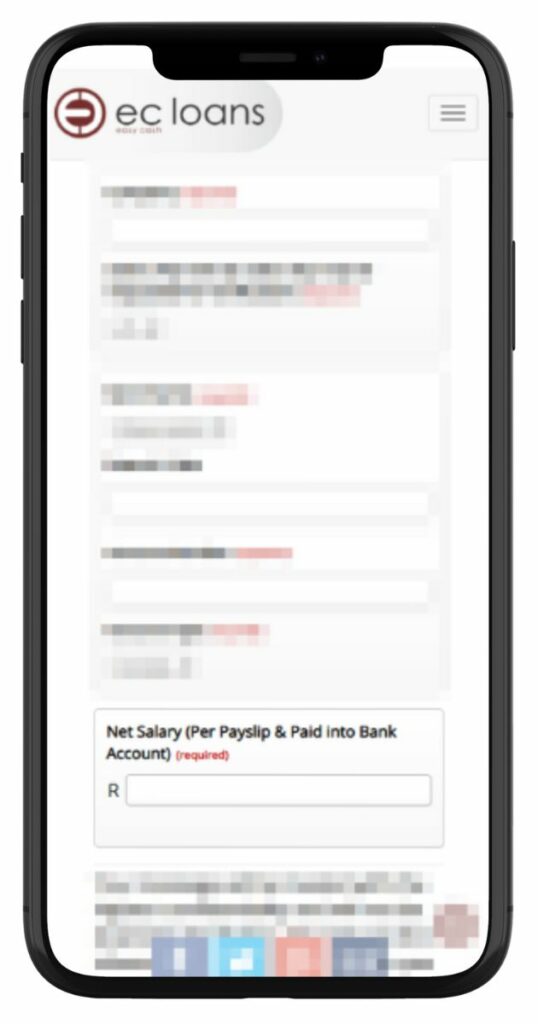

Step 7. Enter your net salary amount and confirm additional financial details as required.

Step 8. Carefully read and acknowledge the terms and conditions before finalizing your application.

Step 9. Click the “Submit” button to send your completed loan application for review.

Eligibility Check

EC Online Loans offers tools that allow potential borrowers to pre-check their eligibility for a loan. These tools are accessible on their website, providing a convenient way for applicants to assess their suitability for a loan before proceeding with the full application. By utilising these tools, applicants can gain insights into their likelihood of loan approval, enabling them to make informed decisions regarding their loan application. This preliminary step is instrumental in guiding applicants, ensuring that they embark on the application process with clarity and confidence.

Security and Privacy

In the realm of online loans, the security and privacy of personal and financial information are of utmost importance. This lender takes significant measures to ensure that the data shared by applicants and borrowers is protected with the utmost diligence. Robust security protocols are in place to safeguard sensitive information from unauthorized access or potential breaches, guaranteeing the integrity of the data is preserved at all times.

The company’s privacy policies are meticulously crafted to uphold the confidentiality of the information entrusted by the borrowers. EC Online Loans is dedicated to managing data with a high degree of responsibility and care, ensuring that personal and financial details are utilized exclusively for their intended purposes and are not misused or mishandled. Transparent data handling practices are a fundamental aspect of their operations, ensuring that borrowers are well-informed about how their information is utilized and safeguarded.

This lender places a premium on the security and privacy of its customers’ information, instilling confidence in borrowers that their data is in safe hands. This commitment to security and privacy is a testament to the company’s dedication to maintaining trust and reliability in their interactions with borrowers, ensuring that the loan application process is conducted with integrity and a profound respect for the privacy of the applicants.

How much money can I request from EC Online Loans?

When considering a loan from EC Online Loans, applicants have the flexibility to request various amounts based on their individual needs and financial circumstances. The company offers loans ranging from R1 000 – R120 000, ensuring that a wide range of financial needs can be addressed. The minimum amount that one can apply for is typically quite accessible, making it convenient for meeting smaller, short-term financial requirements.

This company also provides personalized loan offers, tailoring the loan terms to suit the applicant’s financial situation and repayment capacity. This personalized approach ensures that borrowers receive offers that align with their financial realities, promoting responsible borrowing and lending practices.

How long does it take to receive my money from EC Online Loans?

The time it takes for applicants to receive their funds from EC Online Loans can vary based on several factors, including the verification of documents and the approval process. However, they strive to ensure that the processing times are as swift and efficient as possible, enabling borrowers to access their funds promptly when they require them most.

How do I repay my loan from EC Online Loans?

Repaying a loan is facilitated through various repayment options, providing borrowers with the flexibility to select a repayment plan that aligns with their financial circumstances. Borrowers should be mindful of the agreed-upon repayment terms, including the repayment schedule and any applicable fees or penalties. EC Online Loans values transparency, ensuring that borrowers are fully informed of any potential fees or penalties associated with their loan repayment, promoting a clear and straightforward repayment process.

Online Reviews of EC Online Loans

Online reviews provide valuable insights into the experiences of previous customers with EC Online Loans. These reviews typically cover various aspects of the customer journey, ranging from the simplicity of the application process to the responsiveness of customer service. Customers commonly express their satisfaction with the uncomplicated and efficient loan application process provided by EC Online Loans, underscoring the company’s dedication to customer convenience and overall satisfaction.

Customer Service

Customer service plays a crucial role in the borrowing experience, and EC Online Loans is dedicated to offering support and guidance throughout the loan process. In case of questions or uncertainties, they have a team ready to assist and provide the necessary clarifications. Their customer service is focused on ensuring that borrowers have all the information and support required to navigate the loan process with confidence and ease. Whether it’s a question regarding loan eligibility, repayment terms, or any other aspect of the borrowing process, EC Online Loans is well-prepared to offer prompt and informative responses, thereby enhancing the overall customer experience.

EC Loans Contact Channels

Phone number:

Office: 021 200 6010

Cell: 087 943 2500

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: Closed

Postal address:

11 Long St, Cape Town City Centre, Cape Town, Western Cape, 8000, South Africa

Alternatives to EC Online Loans

While Ecloans.co.za offers a comprehensive range of loan services tailored to various financial needs, there are other credit comparison portals available in the market. These platforms provide potential borrowers with alternative options, ensuring that they can make an informed decision based on a broader perspective. These platforms, like EC Online Loans, aim to simplify the loan application process, providing users with a range of options to choose from based on their individual financial situations.

Comparison Table

| Feature/Company | EC Online Loans | FNB | Capitec Bank Loans | Boodle Loans | ABSA |

|---|---|---|---|---|---|

| Loan Amounts | Up to R100 000 | Up to R150 000 | Up to R230 000 | Up to R8 000 (for returning clients) | R3 000 to R350 000 |

| Interest Rates | APR 10.71%, Fixed nominal rate 84% p.a. | Personalised | 15.5% – 33.2% | Not specified | Competitive |

| Repayment Terms | Not specified | Up to 60 months | 24 months (Example) | Not specified | 12 to 72 months |

| Loan Type | Payday loan | General personal loans | Unsecured personal loans | Payday/short-term loans | General personal loans |

| Special Features | One-time service fee approx. 2% of loan amount | Payment break every January, no early penalties | Free retrenchment and death cover, quick process | Over 90% applications processed within 5 minutes | Immediate fund access, easy approval for extra funds |

| Application Process | Online | Online | Online (20-minute process) | Online (10-minute process) | Online (quicker for existing customers) |

| More info | FNB Review | Capitec Review | Boodle Loan Review | Absa Review |

History and Background of EC Online Loans

Since its inception in 2005, EC Online Loans has played a significant role in the financial landscape. Over the years, it has earned a reputation for delivering customized loan solutions to address diverse financial needs. The company was founded with the vision of simplifying the loan application process, making it more accessible and user-friendly. EC Online Loans has consistently pursued a mission to provide transparent, fair, and responsible lending services, with a strong commitment to ensuring that customers are well-informed and supported throughout their loan application and repayment journey.

Pros and Cons

Choosing EC Online Loans does indeed come with its own set of advantages and disadvantages that potential borrowers should consider:

Pros

- Diverse Loan Types: EC Online Loans offers a wide range of loan types, catering to various personal and business-related financial needs.

- Transparency: The company places a strong emphasis on transparency, ensuring that borrowers are well-informed about the terms and conditions of their loans, which promotes responsible borrowing.

- User-Friendly Online Application: The online application process at EC Online Loans is designed to be straightforward and user-friendly, making it easy for potential borrowers to apply for loans.

Cons

- Maximum Loan Amount: EC Online Loans may not meet the needs of individuals seeking larger financial support, such as for home purchases, as their maximum loan amount may be limited.

- Eligibility Criteria: The eligibility criteria set by EC Online Loans, including the requirement for a consistent monthly income, may restrict the accessibility of their loans, making them available to a narrower group of borrowers.

Conclusion

EC Online Loans is a robust and reliable lending platform that offers a diverse range of loan products to address various financial needs. The company excels in its commitment to transparency, customer-centric approaches, and a wide array of loan options, including Personal Loans, Blacklisted Loans, Business Loans, and Payday Loans.

When assessing EC Online Loans as a whole, it emerges as a commendable option for those seeking financial assistance tailored to their individual needs and circumstances. The thoughtful design of their services, combined with a strong focus on customer satisfaction and responsible lending practices, positions EC Online Loans as a lender that should be considered by potential borrowers navigating the South African loan market.

Frequently Asked Questions

EC Online Loans offers a variety of loans, including Personal Loans, Blacklisted Loans, Business Loans, and Payday Loans. Each loan type is designed to meet different financial needs, ensuring that borrowers have access to a loan that suits their specific circumstances.

The disbursement of funds from EC Online Loans is typically efficient. After the approval of your application, the funds are usually transferred promptly, ensuring that borrowers can access their money when they need it most.

EC Online Loans offers loans up to R150,000. However, the approved loan amount will depend on various factors such as your credit score, income, and repayment capacity.

Yes, EC Online Loans offers Blacklisted Loans, which are tailored for individuals who may have a low credit score or have faced past financial challenges. This ensures that a wider range of borrowers has access to financial support when necessary.

EC Online Loans provides tools on their website that allow potential borrowers to pre-check their eligibility. These tools offer insights into the likelihood of loan approval, helping applicants make informed decisions before proceeding with the full application.