Capitec Bank [Capitecbank.co.za] has become a popular choice among South Africans looking for accessible and flexible credit options. A Capitec Bank Loan is designed to cater to a range of financial needs, whether you’re planning a major purchase, covering emergency expenses or consolidating debt. With competitive interest rates, tailored repayment terms and a straightforward application process, Capitec aims to make borrowing simple and transparent.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by Capitec Bank and is based solely on our research.

Capitec Bank offers personal loans with repayment terms ranging from 12 to 84 months, tailored to suit your individual financial needs. The loan amount and interest rate are determined based on your credit profile and affordability, ensuring that the offer you receive is both fair and manageable. If you’re seeking a trustworthy lending option with a fast and user-friendly application process, read on to find out whether a Capitec Bank Personal Loan is the right choice for your financial situation.

Capitec Bank Personal Loans: Quick Overview

Loan Amount: From R1 000 up to R500 000, based on your credit profile and affordability

Loan Term: Flexible repayment terms ranging from 12 to 84 months

Interest Rate: Personalised interest rate starting from 13%, calculated according to your creditworthiness (in compliance with the National Credit Act)

Fees: Once-off initiation fee and a monthly service fee apply, determined by your individual profile

Loan Types: Fixed-term unsecured personal loans, with additional credit solutions such as a revolving access facility for ongoing financial needs

Capitec Bank Personal Loans Full Review

Capitec Bank’s loan offerings distinguish themselves through their simplicity and customer-focused features. The bank has carefully designed its loan products to cater to the diverse needs of its customers, ensuring that each loan effectively serves a specific purpose.

What sets Capitec Bank loans apart is their transparent fee structure, competitive interest rates, and the flexibility they offer in terms of repayment. The bank’s approach is aimed at making loans more accessible and manageable, aligning with customers’ financial situations and aspirations.

About Arcadia Finance

At Arcadia Finance, we simplify your loan process. Submit one free application and get connected with varied lenders. Our partnerships are with established, NCR-authorised lenders in South Africa, guaranteeing a trustworthy loan experience.

Types of Loans Offered by Capitec Bank

Personal Loan

Unsecured personal loans up to R500 000 with repayment terms between 12 and 84 months, suitable for consolidating debt, funding home improvements, or covering significant personal expenses.

Home Loan

In partnership with SA Home Loans, Capitec provides home loans for properties valued up to R5 million, with repayment terms up to 30 years, ideal for purchasing or switching home loans.

Vehicle Loan

Unsecured loans up to R500 000 for purchasing vehicles, with terms up to 84 months. The loan is not tied to the vehicle, allowing ownership from day one.

Education Loan

Loans up to R500 000 to cover tuition and educational expenses at any South African-registered institution, with the option to pay the institution directly.

Business Term Loan

Tailored loans for businesses to finance capital expenditure, expansion, or other operational needs, with repayment terms up to 60 months.

Credit Card

Offers a personalised credit limit with interest rates ranging from 13.00% to 28.50%, suitable for everyday purchases and managing cash flow

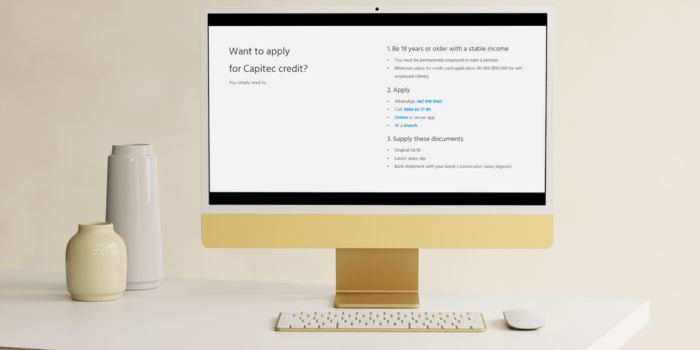

Requirements for a Capitec Bank Loan

Applying for a loan with Capitec Bank in South Africa requires a specific set of documents and information to ensure a smooth and efficient application process. The bank needs these details to evaluate your eligibility, creditworthiness, and to customise a loan that aligns with your financial capacity and needs.

First and foremost, you need to provide personal identification documents. A valid South African ID or passport is crucial for identity verification. This is a fundamental requirement to ensure the security and integrity of the financial transaction.

Secondly, proof of residence is a necessity. This can take the form of a utility bill or an official document that confirms your residential address. This is vital for correspondence and further verification procedures.

Additionally, proof of income is indispensable. This can be recent payslips or bank statements that illustrate your financial inflow. This information is essential for the bank to assess your ability to repay and to determine the loan amount and terms that can be offered to you.

Lastly, details concerning your employment and employer are also required. This includes your employer’s contact information and the length of your employment. Such information enables the bank to gain a more comprehensive understanding of your financial stability and reliability as a borrower. All financial figures and currency will be converted to Rands to align with South African currency standards.

Capitec isn’t the only player in the digital banking space. Our Discovery Bank Review explores how this tech-savvy bank stacks up on innovation, flexibility, and customer benefits.

Step-by-Step Guide to Applying for a Loan with Capitec Bank

To apply for a loan with Capitec Bank in South Africa, follow these steps:

- Begin by visiting the official Capitec Bank website or a physical branch. Online platforms offer convenience, allowing you to initiate the process from the comfort of your home.

- Select personal, credit and then the type of loan that aligns with your financial needs. Capitec offers various loan products, each designed to cater to different financial situations.

- Enter the required personal and financial information. This includes your income details, employment information, and the loan amount you wish to apply for.

- Choose your preferred loan term. This is the duration over which you intend to repay the loan. Different terms come with varying interest rates and monthly repayment amounts.

Eligibility Check

Capitec Bank provides tools and methods to pre-assess your eligibility for a loan. This initial step offers an indication of whether you qualify for a loan and the potential loan amount and terms you might receive.

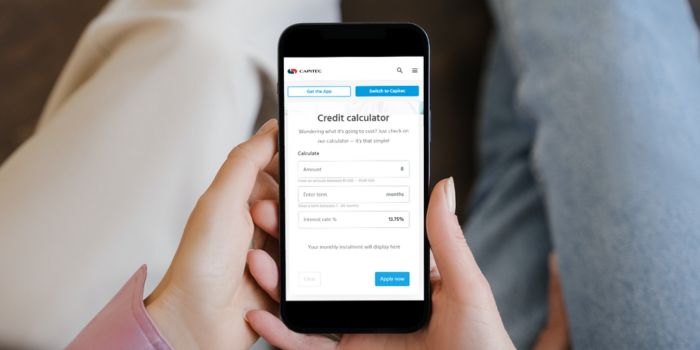

One such tool is the online loan calculator available on the Capitec Bank website. This tool enables you to input various details like the desired loan amount and repayment term, providing an estimated overview of the interest rates and monthly repayment amounts.

You can also consult with Capitec Bank representatives who can provide a preliminary assessment based on the information you provide. They will guide you on your eligibility and suggest suitable loan options.

Security and Privacy

Capitec Bank employs cutting-edge technology and rigorous security protocols to fortify the defense against potential threats and vulnerabilities. The bank’s systems are meticulously designed to fend off unauthorised access, guaranteeing that your personal and financial details remain shielded from malicious intent. Encryption technologies and secure sockets layer (SSL) protocols play a vital role in protecting the data transmitted between clients and the bank, strengthening the security framework.

Who Are Capitec Bank Personal Loans Best Suited For?

Capitec Bank Personal Loans are ideal for South Africans who:

- Need funds for emergencies, home upgrades, or education

- Have stable, verifiable monthly income

- Prefer a fast, online application via app or website

- Want to customise loan amount, term, and repayments

- Need flexible terms up to 84 months, with no early settlement fees

Is Capitec Bank a Safe and Good Option for Personal Loans?

Capitec Bank’s personal loans are fully compliant with the National Credit Act and regulated by the National Credit Regulator (NCR), positioning the bank as a trusted and legitimate lender in South Africa. These unsecured loans are designed to suit a wide range of personal financial needs, with flexible repayment terms ranging from 12 to 84 months. Capitec provides a simple and streamlined application process, which can be completed online, via the Capitec app, or at a physical branch. To apply, customers typically need to provide a valid South African ID, proof of income, recent bank statements, and employment details.

Capitec Bank emphasises responsible lending, with all applications assessed for affordability to ensure that borrowers are not overextended. Interest rates are personalised and based on the applicant’s credit profile, in line with the provisions of the National Credit Act. Once approved, funds are often disbursed on the same day, making Capitec a convenient choice for individuals in need of quick access to funds. With its strong reputation, competitive loan terms, and customer-focused service, Capitec Bank remains a dependable and accessible option for personal borrowing in South Africa.

How Much Money Can I Request from Capitec Bank?

You can apply for a personal loan of up to R500 000, with flexible repayment terms ranging from 12 to 84 months. Interest rates are personalised and start from 13% per annum, depending on your creditworthiness and affordability.

To determine the loan amount you may qualify for, Capitec takes into account factors such as your income, expenses and credit history. You can use their online credit calculator or mobile app to get an estimate and submit your application.

How Long Does It Take to Receive a Loan Approval and Payout from Capitec Bank?

Obtaining a loan is often linked to immediate or urgent financial needs. Consequently, the speed at which a bank processes your loan application and disburses the funds is crucial. Capitec Bank is well aware of this urgency, and their systems are designed to ensure efficient loan processing times.

The average processing times at Capitec Bank are competitive, reflecting their commitment to customer satisfaction and responsiveness. Several factors can influence the withdrawal speed, such as the accuracy of the information provided, the completeness of the application, and the type of loan requested.

It’s essential to make sure that all the necessary documentation is in order and accurately presented to facilitate a smooth and swift processing time. Capitec Bank’s focus is on ensuring that the funds reach your account promptly once the application is approved, allowing you to address your financial needs without undue delays.

Capitec Bank – Overview in Detail

| Name | Capitec Bank Personal Loan |

|---|---|

| Financial Institution | Capitec Bank |

| Product | Unsecured Personal Loan |

| Minimum Age | 18 years |

| Minimum Loan Amount | Subject to affordability assessment |

| Maximum Loan Amount | Up to R500 000 |

| Repayment Term | 12 to 84 months |

| Interest Rate | Personalised, starting from 13% per annum |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Fixed monthly repayments; restructuring available in cases of financial difficulty |

| NCR Accredited | Yes |

| Our Opinion | ✅ Competitive personalised interest rates ✅ Flexible repayment terms ✅ Fast approval and payout ⚠️ Rate depends on credit profile |

| User Opinion | ✅ Simple application process ✅ Quick fund access ⚠️ Interest rate can vary significantly based on credit score |

How Do I Repay My Loan from Capitec Bank?

You can repay your loan from Capitec Bank through convenient monthly debit order deductions directly from your bank account. This ensures that payments are made automatically on the agreed date, helping you avoid missed instalments and maintain a good credit record. The repayment amount and period are based on your personalised loan agreement, which takes into account your income, expenses, and credit profile. You can also view your repayment schedule, track your balance, and manage your loan via the Capitec banking app or online banking platform. Early repayments are allowed, and settling your loan ahead of schedule could save you money on interest.

Pros and Cons of Capitec Bank Loans

Selecting Capitec Bank as your loan provider involves weighing the advantages and disadvantages to make an informed decision.

Pros of Capitec Bank Loans

- Simplified Banking Solutions: Capitec Bank is well-regarded for offering straightforward and uncomplicated loan services, making it an attractive choice for those who prefer an easy and transparent banking experience.

- Customer Empowerment: The bank’s focus on customer empowerment is evident in its flexible loan options, competitive interest rates, and transparent fee structure. This empowers customers to make informed financial decisions.

- User-Friendly Application Process: Customers often find the bank’s loan application process user-friendly and less intimidating, enhancing the overall experience.

- Responsive Customer Service: Capitec Bank is known for its responsive customer service team, which facilitates a smoother banking experience and provides support when needed.

Cons of Capitec Bank Loans

- Limited Loan Variety: Capitec Bank’s loan offerings might not be as diverse as those of some other established banks. This limitation can reduce options for potential borrowers who may require more specialised loan products.

- Loan Amounts and Terms: While the bank aims for simplicity and affordability, some customers may find that the available loan amounts, terms, or interest rates do not fully align with their specific financial needs or expectations.

- Physical Presence: Capitec Bank’s physical branch network may not be as extensive as that of traditional banks. This limited physical presence can impact accessibility for some customers, particularly in areas with fewer branches.

Online Reviews of Capitec Bank

When sifting through the plethora of online reviews, one encounters a wide spectrum of customer experiences with Capitec Bank. These reviews provide valuable insights for potential borrowers. Customers predominantly express satisfaction, often highlighting the bank’s simplicity and customer-centric approach as its standout qualities.

The bank’s loan offerings seem to resonate well with many, where the ease of application and clarity in terms and conditions are particularly praised. Customers appreciate the transparency, feeling empowered with the necessary information to navigate their loan repayment journey. However, as with any service, there are also instances of dissatisfaction, with customers facing challenges, often related to customer service responsiveness and loan approval times.

Truly impressed by the customer service from Capitec. Would recommend to anyone who is looking to open a new account.

Thank you for assisting me with my banking needs and explaining to me how to better save money. It helped me alot your service was great.

I took up a personal loan with Capitec of which as per the agreement the repayment was for 84 months. But we are currently on the 88th month hopefully this month will be the 89th. Despite the fact that they have all the data yet every time it is all about speculation that I probably defaulted. There are still thousands that they claim I have to pay to adhere to the agreement loan.

I’m still not impressed and I can’t get a solid explanation as to why I’m paying for such high interests and I’m thinking of changing banks as I feel I’m being exploited.

Customer Service

Beginning a loan application journey often raises questions and uncertainties. Capitec Bank provides several ways to seek clarification and assistance. Their customer service is organized to address and resolve customer inquiries, ensuring that you feel supported throughout your journey.

If you have lingering questions or require guidance, reaching out to their customer service is a viable option. They offer multiple communication channels, guaranteeing that help is easily accessible. The objective is to create a supportive environment where customers feel valued and heard, facilitating a smoother and more informed loan application and repayment process. Whether you prefer contacting them by phone, email, or visiting a branch, Capitec Bank is committed to assisting you every step of the way.

Contact Channels

Phone number:

Office: 0860 10 20 43

Hours of operation:

Monday to Friday: 06:30–19:00

Saturday: 08:00–12:00

Postal address:

Capitec Bank Limited, P.O. Box 12451, Die Boord, Stellenbosch 7613, South Africa

Alternatives to Capitec Bank

Numerous other institutions and credit portals offer a range of loan products tailored to diverse needs. These portals provide a consolidated view of various loan offers, helping customers choose the most suitable option.

Comparison Table

| Feature/Parameter | Capitec Bank | Nedbank | Standard Bank | FNB | Dial Direct | Peerfin |

|---|---|---|---|---|---|---|

| Interest Rate | Competitive rates based on individual credit profiles | Customised rates for amount and term | Customised rates for different loan products | Tailored rates based on creditworthiness | From as low as 15% | Fixed at 27% |

| Loan Tenure | Up to 84 months | Up to 72 months | Up to 72 months | Up to 60 months | Up to 60 months | 12 to 72 months |

| Max Loan Amount | Up to R250 000 | Up to R300 000 | Up to R300 000 | Up to R200 000 | Up to R150 000 | Up to R50 000 |

| Online Application | Available | Available | Available | Available | Available | Available |

| Repayment Options | Flexible, with early repayment options | Fixed monthly instalments | Varied options including fixed and flexible repayments | Monthly fixed instalments | Flexible, fixed monthly repayments | Flexible terms |

| Customer Service | Highly responsive with multiple channels | Dedicated helpline and email support | 24/7 helpline and branch support | Multiple channels including live chat | Personal consultant callback service available | Contact via email or phone; responsive service |

| More info | Here | Here | Here | Here | Here |

History and Background of Capitec Bank

Capitec Bank has established a prominent presence in the South African banking sector since its inception in 2001. Starting as a humble institution, the bank has grown into a formidable entity, celebrated for its customer-centric services and innovative banking solutions. Capitec Bank’s journey has been characterised by an unwavering commitment to simplifying banking and increasing the accessibility of financial services to the wider South African population.

The bank’s mission resonates with the core principles of customer empowerment and financial inclusivity. Its goal is to provide simplified and affordable banking options that cater to the diverse needs of its clientele. Capitec Bank’s vision is centred on the ambition to become a leading bank that transcends traditional banking norms, cultivating a banking experience that is both rewarding and uncomplicated for its customers. Their philosophy is encapsulated in the ongoing pursuit of solutions that are both innovative and customer-centric, ensuring that their services adapt in sync with evolving customer needs and market dynamics.

Conclusion

Capitec Bank has demonstrated a clear commitment to customer-centric solutions, streamlining the banking process to align with the requirements and preferences of a diverse clientele.

Capitec Bank is characterised by a combination of simplicity, customer focus, and competitive loan offerings. Given these attributes, Capitec Bank receives a commendably high overall rating in the context of loans. They stand out as a reliable choice for potential borrowers looking for a balance of affordability, simplicity, and supportive customer service in their loan experiences.

Frequently Asked Questions

Capitec Bank primarily offers personal loans with flexible repayment terms and competitive interest rates. They also collaborate with SA Home Loans to provide home loans to their customers, ensuring access to comprehensive financial solutions for various needs, including education, home improvements, or emergency expenses.

Applying for a loan at Capitec Bank is a straightforward process. You can apply online via the Capitec Bank website or mobile app, or you can visit a Capitec Bank branch in person. You’ll need to provide specific documents such as your ID, latest payslip, and a stamped bank statement showing your last three salary deposits.

Interest rates at Capitec Bank are personalised based on the individual’s credit profile and the loan amount. The rates are competitive and transparent, ensuring customers receive a fair and affordable repayment plan. You can estimate the interest rates applicable to your loan by using the loan calculator available on the Capitec Bank website.

Loan approval times at Capitec Bank are generally swift. Once you have submitted all the required documents and completed the application process, you could receive approval and access to the funds on the same day. However, the actual time may vary based on individual circumstances and the completeness of the application and documents provided.

Yes, Capitec Bank allows customers to repay their loans earlier than the agreed term without incurring additional penalties. Early repayment can reduce the total interest paid over the life of the loan, making it a financially prudent option if you find yourself able to settle the loan ahead of schedule.