Financial flexibility is not just a luxury; it’s a necessity. Whether you’re planning a family vacation, renovating your home, or facing unforeseen expenses, having access to quick and reliable financial solutions can have a real impact. Enter RCS [Rcs.co.za], a leading consumer finance business in South Africa. With a range of products designed to cater to the unique needs of South Africans, RCS has positioned itself as a trusted partner in the journey towards financial freedom.

This review was written by the Arcadia Finance editorial team.

It is not sponsored by RCS and is based solely on our research.

RCS offers unsecured personal loans ranging from R2 000 to R300 000, with flexible repayment terms between 12 and 60 months. If you’re seeking a reliable loan option designed for a wide range of financial needs, whether for home improvements, education, or unexpected expenses, read on to learn more about RCS and whether their services align with your financial goals.

RCS Loans: Quick Overview

Loan Amount: R2 000 – R300 000

Loan Term: 12 to 60 months

Interest Rate: From 15% to 28.75% (fixed, based on credit profile)

Fees: Initiation fee up to R1 207.50 (incl. VAT); Monthly service fee of R69

Loan Types: Unsecured personal loans for purposes such as debt consolidation, home improvements, medical expenses, and education

About Arcadia Finance

Streamline your loan search with Arcadia Finance. Our no-fee application grants you access to offers from up to 19 distinct lenders. We work in tandem with reputable, NCR-accredited lenders in South Africa, providing a trustworthy and secure lending journey.

RCS Full Review

Experiences with RCS Loan

Navigating the financial landscape can be daunting, but with RCS, many have found a reliable partner. Those who have used RCS loans often highlight the company’s transparent processes, customer-centric approach, and ease of application. The feedback consistently points to RCS’s commitment to providing solutions tailored to individual needs, making the loan experience smooth and hassle-free.

Who Can Apply for an RCS Loan?

If you’re wondering whether you’re eligible for an RCS loan, the answer is quite inclusive. This lender caters to a broad spectrum of South Africans. Whether you’re a working professional, a business owner, or someone looking to consolidate debts, this lender has a range of products designed to fit diverse financial profiles. However, like all responsible lenders, RCS does have certain criteria to ensure the financial well-being of its borrowers.

Differences from Other Loan Providers

What sets RCS apart from other loan providers? It’s a combination of factors. Their deep understanding of the South African financial landscape allows it to offer products that resonate with the local populace. Their approach is not just transactional; it’s relational. They aim to build long-term relationships with their customers, guiding them at every step of their financial journey. RCS’s transparent processes mean there are no hidden charges or unpleasant surprises. Their commitment to customer education ensures that borrowers are well-informed and make decisions that align with their financial goals. In a market filled with numerous loan providers, this one stands out for its integrity, commitment, and customer-first approach.

RCS Loan

RCS is not just about borrowing money; they’re about building financial solutions that resonate with individual needs. This company understands that every borrower is unique, and so are their financial requirements. This understanding is reflected in their tailored loan products, transparent terms, and a commitment to ensuring that the borrower is at the centre of every transaction. Their deep-rooted presence in the South African market gives them insights that few can match, allowing them to design products that truly cater to the local populace.

Types of Loans Offered by RCS

RCS offers unsecured personal loans ranging from R2 000 to R300 000, with repayment periods between 12 and 60 months. These loans are versatile and can be utilised for various purposes, including home renovations, educational expenses, medical emergencies, or consolidating existing debts. The absence of collateral requirements and the swift online application process make these loans accessible to a broad spectrum of borrowers.

Requirements for an RCS Loan

To apply for a personal loan with them in South Africa, you must meet the following criteria:

- Age: 18 years or older.

- Identification: Possess a valid South African ID or driver’s licence.

- Bank Account: Have an active South African bank account.

- Employment and Income: Be employed with a minimum monthly income of R3 000.

- Proof of Income: Provide documentation verifying your income.

Required Documents

- Valid South African ID or driver’s licence.

- Latest payslip or recent bank statements.

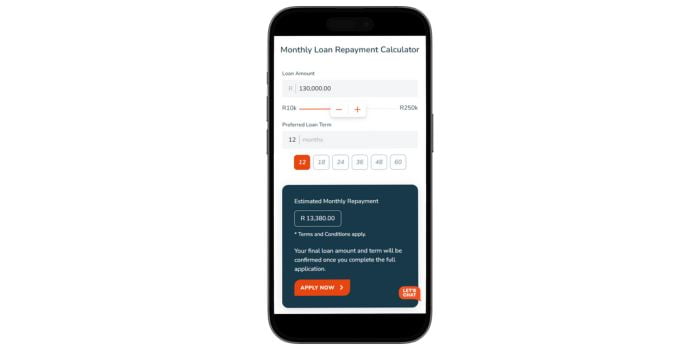

Simulation of a Loan at RCS

Applying for an RCS loan is straightforward. Here’s a simple step-by-step guide:

Step 1. Visit Rcs.co.za

Step 2. Tap “See If You Qualify” to begin your RCS personal loan application.

Step 3. Enter your first name, last name, and continue filling in required details.

Step 4. Provide your ID number, email address, and mobile number.

Step 5. Fill in your employment and income details including total income.

Step 6. Accept the terms, give consent, and tap “Start Quick Check” to submit.

Step 7. Choose your desired loan amount and repayment term.

Step 8. Upload your proof of income and identification documents.

Step 9. If approved, the loan amount will be deposited into your bank account within 24 hours.

Eligibility Check

Before applying, this lender provides tools that allow potential applicants to assess whether they meet the basic requirements for a loan. One option is the online eligibility checker, which lets users input key details such as their income, current financial obligations, and the loan amount they wish to apply for. Based on this information, the tool offers a preliminary indication of whether the applicant may qualify.

In addition, individuals are encouraged to review their credit reports from recognised South African credit bureaus such as TransUnion, Compuscan, Experian, or XDS. This step helps borrowers understand their creditworthiness and whether their profile aligns with RCS’s lending criteria.

Who Are RCS Loans Best Suited For?

RCS loans are ideal for South Africans who:

- Need larger loan amounts from R2 000 to R300 000 for personal expenses like home upgrades or debt consolidation

- Earn at least R3 000 per month and can provide a valid ID and proof of income

- Prefer repayment terms of 12 to 60 months with fixed monthly instalments

- Want a quick, fully online application process with fast approval and payout

- Seek a reputable NCR-registered lender with clear fees and optional insurance

Is RCS a Safe and Good Option?

RCS is a registered credit provider in South Africa, authorised by the National Credit Regulator (NCRCP 38), making it a legitimate and trustworthy option for consumers seeking personal finance solutions. The company offers unsecured personal loans ranging from R2 000 to R300 000, with flexible repayment terms between 12 and 60 months. Applications can be completed entirely online, allowing borrowers to apply from the comfort of their homes using basic documents such as a valid South African ID, proof of income, and bank statements.

This lender is committed to responsible lending and provides clear, transparent information about loan costs, interest rates, and repayment obligations upfront. Every application is subject to an affordability assessment to ensure responsible borrowing. Once approved, funds are typically disbursed within 24 to 48 hours. With its streamlined application process, competitive interest rates, and customer-focused service, they are a reliable choice for South Africans in need of medium- to large-sized personal loans.

How Much Money Can I Request from RCS?

The minimum loan amount you can request typically starts at R2 000, making it accessible for those who need just a little financial boost. On the other hand, the maximum amount is set at a higher threshold R300 000, catering to those with more substantial financial requirements. It’s worth noting that the exact amount you qualify for will depend on various factors, including your creditworthiness, income, and existing financial commitments.

Receive Offers

RCS prides itself on offering personalised loan solutions. Instead of a one-size-fits-all approach, this lender evaluates each application’s merits and tailors loan offers to suit individual needs.

How RCS Creates Personalised Loan Offers

RCS uses a combination of advanced algorithms and manual assessments to create personalised loan offers. By analysing the information provided in the application, along with credit history and other relevant data, they determine the loan amount, interest rate, and repayment terms that best fit the applicant’s financial profile.

How Long Does It Take to Receive My Loan Payout from RCS?

On average, after approval, it can take just a few business days for the loan amount to be credited to your bank account.

Several factors can influence the speed at which you receive your funds from RCS. These include the accuracy of the information provided, the time it takes for verification, bank processing times, and the volume of applications this company is handling at any given time.

RCS – Overview in Detail

| Name | RCS Group |

|---|---|

| Financial | Privately Owned |

| Product | Unsecured Personal Loans |

| Minimum Age | 18 years |

| Minimum Amount | R2 000 |

| Maximum Amount | R300 000 |

| Minimum Term | 12 months |

| Maximum Term | 60 months |

| APR | 15% – 28.75% |

| Monthly Interest Rate | Fixed rate, determined individually |

| Early Settlement | Permitted; contact RCS for settlement amount |

| Repayment Flexibility | Fixed terms with mandatory debit order payments |

| NCR Accredited | Yes (NCRCP 38) |

| Our Opinion | ✅ Suitable for medium to large financial needs ✅ Transparent fee structure and fixed interest rates ✅ Quick online application and approval process ⚠️ Mandatory debit order repayments |

| User Opinion | ✅ Efficient and user-friendly online application ✅ Prompt fund disbursement upon approval ⚠️ Fixed repayment terms may not suit all borrowers |

How Do I Repay My Loan from RCS?

Repaying your loan is a straightforward process with RCS. They offer multiple repayment options to ensure convenience for their borrowers.

Repayment Options and Plans

RCS typically sets up a monthly debit order, automatically deducting the loan instalment from your bank account. This ensures timely repayments and reduces the hassle for borrowers. Additionally, they offer flexible repayment terms, allowing borrowers to choose a tenure that aligns with their financial situation.

Possible Fees and Penalties

While this lender is transparent about its loan terms, it’s essential to know about any potential fees and penalties. Late payments or missed instalments might incur additional charges. It’s always a good practice to review the loan agreement in detail and stay informed about any fees or penalties associated with the loan. If ever in doubt, their customer service is readily available to clarify any queries or concerns.

Online Reviews of RCS

Customers often highlight RCS’s commitment to providing tailored financial solutions. Many appreciate the transparent processes and the absence of hidden charges, which makes the loan application and repayment journey predictable and hassle-free.

The speed of approval and disbursement is another aspect that garners positive feedback. Customers value the promptness with which RCS processes applications, ensuring that funds are available when needed the most.

RCS’s customer service also receives commendation. The responsive and knowledgeable team is often mentioned in reviews, with customers appreciating the guidance and assistance they receive throughout their financial journey with RCS.

Quick, efficient, effective and super friendly. Great service!

My experience with the RCS has been amazingly satisfying so far and the customer service and care is absolutely excellent, the way everything is brought to understanding to you as a customer is clear and straight forward provided with all the calculation.

However, like all companies, RCS also has areas where some customers feel there’s room for improvement. A few reviews might point out specific challenges faced during the application process or wish for even more flexible repayment options.

My experience with RCS as a whole has been terrible… Overall would not recommend, the entire process is time and money wasting.

Terrible Customer service from this company. No soft skills. No empathy. No passion for their jobs and zero regards for the company’s brand image.

Pros and Cons of Choosing RCS

Advantages of Choosing RCS

- Tailored Financial Products: RCS offers a range of products designed to cater to individual needs, ensuring that customers get solutions that resonate with their financial goals.

- Transparent Processes: RCS is known for its clear and transparent processes, ensuring that customers are always in the know and face no hidden charges.

- Quick Approval and Disbursement: RCS’s streamlined processes ensure that loan applications are processed swiftly, and funds are disbursed on time.

Disadvantages of Choosing RCS

- Limited Physical Presence: While RCS has a strong online presence, they have limited physical branches, which might be a concern for those who prefer in-person interactions.

- Competitive Market: With many financial institutions offering similar products, some might find RCS’s offerings comparable to other providers in the market.

Customer Service

Navigating the financial landscape can sometimes raise questions or concerns. It’s crucial to have a reliable customer service team to turn to for guidance and clarification.

Contact Channels

Phone number:

Customer Service: 0861 729 727

Loan Enquiries: 021 597 4000

Hours of operation:

Monday to Friday: 8:00 AM – 10:00 PM

Saturday: 8:00 AM – 9:00 PM

Sunday: 9:00 AM – 7:00 PM

Postal address:

Mutualpark, Jan Smuts Drive, Pinelands, Cape Town 7405, South Africa

Do You Have Further Questions for RCS?

If you have additional queries or need further information about RCS and its offerings, their dedicated customer service team is ready to assist. They are trained to provide detailed insights into RCS’s products, help with the application process, and address any concerns you might have.

Alternatives to RCS

While RCS is a prominent player in the South African financial market, there are other credit providers that potential borrowers might consider:

Comparison Table: A Side-by-Side Comparison of RCS with Top Competitors

| Lender | Loan Amount Range | Interest Rate | Repayment Period |

|---|---|---|---|

| RCS Loans | R5 000 to R300 000 | 15% to 28.75% per annum | 12 to 60 months |

| Sanlam Loans | R5 000 to R300 000 | 15% to 29.25% per annum | 12 months to 6 years |

| Direct Axis | Up to R300 000 | Maximum of 29.25% per annum | 24 to 72 months |

| Finchoice | R500 to R40 000 | From 5% | 1 – 24 months |

| Old Mutual Loan | Up to R250 000 | Varies | 3 – 72 months |

This table shows a basic comparison of the loan amounts, interest rates, and repayment periods for each lender. The interest rates for Sanlam Loans, and Direct Axis are variable and depend on the borrower’s personal risk profile. It’s important to note that these details might vary and it’s recommended to consult each lender’s website or contact them directly for the most current information.

History and Background of RCS

RCS, a leading consumer finance business in South Africa, has a rich history that spans several years. Established with the vision to provide South Africans with innovative financial solutions, RCS has grown exponentially, carving a niche for itself in the competitive financial landscape.

RCS was founded to bridge the gap between traditional banking and the evolving needs of consumers. Over the years, the company has expanded its footprint, not just in South Africa but also in neighbouring countries like Namibia and Botswana. Their association with leading retailers and brands has further solidified their position as a trusted financial partner for many.

Company’s Mission and Vision

RCS’s mission is to empower individuals by providing them with tailored financial solutions that enhance their quality of life. Their vision is to be at the forefront of financial innovation, continuously evolving to meet the changing needs of their customers.

Conclusion

RCS has established itself as a reliable and trusted financial partner for many South Africans. Their commitment to innovation, customer-centric approach, and transparent processes make them a preferred choice for many. While they face competition in the market and have areas where they can further enhance their offerings, their overall dedication to empowering individuals financially is commendable.

Frequently Asked Questions

RCS is a leading consumer finance business in South Africa, offering a range of financial products tailored to the unique needs of individuals.

RCS provides various loan products, including personal loans, home loans, and auto loans, among others.

You can apply for an RCS loan online through their official website. The application process is user-friendly, requiring you to fill out a form and submit the necessary documents.

Yes, RCS employs state-of-the-art encryption technologies and robust security measures to ensure the protection of your data.

RCS is known for its swift approval process. Typically, once all required documents are submitted, you can expect a response within a few business days.