Letsatsi Finance [Letsatsifinance.co.za] is an authorized financial credit and service provider. They are registered and regulated by the NCR (National Credit Regulator). With over 20 years of experience and over 50 branches across South Africa. This lender offers several affordable loans to its customers, from short to long-term financial solutions, and has become a preferred choice for those seeking financial assistance. What distinguishes them from the multitude of other lenders in the market? Is it their flexible terms, their customer service approach, or the simplicity of their application process?

Letsatsi Finance offers personal loans ranging from R500 to R100 000, with repayment terms varying from 1 month to 36 months, depending on the loan type. If this sounds like a good deal, keep reading to find out everything you need to know about this lender and whether they’re the right option for you.

Letsatsi Finance: Quick overview

Loan amount: R500 – R100 000

Loan term: 1 to 36 months

Interest rate: Regulated by NCR, includes service fees and insurance

Fees:

- Initiation Fee: R86

- Service Fee: R69 per month

- Credit Protection Insurance: R6.33 per month

Loan types: Short term loans, long term loans, debt consolidation loans, funeral cover, financial assistance

About Arcadia Finance

Arcadia Finance eases the process of obtaining loans from various banks and financial bodies. Complete a free application to access offers from up to 19 distinct lenders. We ensure all our lending partners are credible and regulated by the National Credit Regulator in South Africa.

Letsatsi Finance Full Review

This company has several loan options available to its clients, which range fairly wide for any financial solution you may need.

Can I Only find Payday Loans at Letsatsi?

Letsatsi Finance offers more than just payday loans but varying short and long-term financial solutions.

Short Single-month Loans

Letatis Finance offers small to medium loan amounts from R500 to R7 000 for those emergency costs. This is a hassle-free solution to aid with the ups and downs of unexpected expenses. For such a loan, the repayment terms are that the amount is repaid within a month. Ideally, this is to bridge the gap between your next paycheck. A loan will require two months’ worth of payslips, three recent bank statements and your South African ID.

Short-term Loan

This short-term loan option is more flexible than their short-term single-month loan. The repayment terms typically range between 2 to 6 months. The loan amounts range between R500 to R7 000 with the required documents such as a South African ID, two months of payslips, and three months’ worth of bank statements.

Long-term Loan

This lender’s long-term loan options are 9 to 36 months. The amounts offered are over R500 to R50 000; this type of loan is ideal for those who wish to finance a new vehicle, fund their tertiary studies, have unexpected emergencies, or have funeral costs. Typically, long-term loans require a more thorough assessment, such as a credit check, before qualifying. Additionally, this lender only requires two months’ current payslips and three months’ worth of your latest bank statements.

Debt Consolidation Loans

Those whore are seeking to consolidate their debt into a singular repayment plan can do so through Letsatsi, where they will assist in combining your smaller loan accounts into a single monthly repayment. This is a great financial tool for those looking to reduce the time spent paying or managing multiple accounts.

Additionally, this may lead to a reduction in fees associated with several individual accounts. A loan as such can further be used for those struggling to honour all of their repayments. As with fewer accounts needing repaid, this may improve your credit record as the repayments may be more affordable. Loan repayments range from 9 to 36 months to a value of R100 000. They will only require two months’ current payslips and three months’ worth of your latest bank statements.

Funeral Cover

Apart from their loan options, a Funeral cover plan for you or loved ones for as little as R92 per month.

Financial Assistance

Lastly, this lender offers guidance and assistance to those under debt review or seeking additional advice for their financial situation.

How do I Know if Letsatsi Loan is Legit?

As with any lending company, they must be registered through the NCR(National Credit Regulator). Due to this, Letsatsi Finance is registered under the governing body and is regarded as a legitimate lender.

Who Is Letsatsi Finance Best For?

Letsatsi Finance is best for borrowers who:

- Need Small, Short-Term Loans

- Require Larger, Long-Term Personal Loans

- Are Looking for Debt Consolidation Options

- Prefer a Simple Application Process

- Want Access to In-Person Support

Is Letsatsi Finance a Safe and Good Option?

Letsatsi Finance is a registered South African lender regulated by the National Credit Regulator (NCR), offering personal, payday, and debt consolidation loans. Loan amounts range from R500 to R100 000, with repayment terms between 1 and 36 months. The application process is straightforward, requiring proof of income, bank statements, and a valid South African ID.

With a focus on affordability, this company provides structured loan options with transparent terms. Approvals are subject to affordability assessments and credit checks, but the lender aims for quick processing times, making it a practical choice for borrowers seeking regulated financial assistance.

What are the Requirements of the Letsatsi Loan Application?

To apply for a loan you will need the following:

Applicants must be South African citizens between the ages of 21 to 60 and earn a salary exceeding R3500 per month for over six months.

Loan applications require the following four documents:

- Three of your latest bank statements

- Your South African ID

- Proof of residency

- Two of your most recent payslips

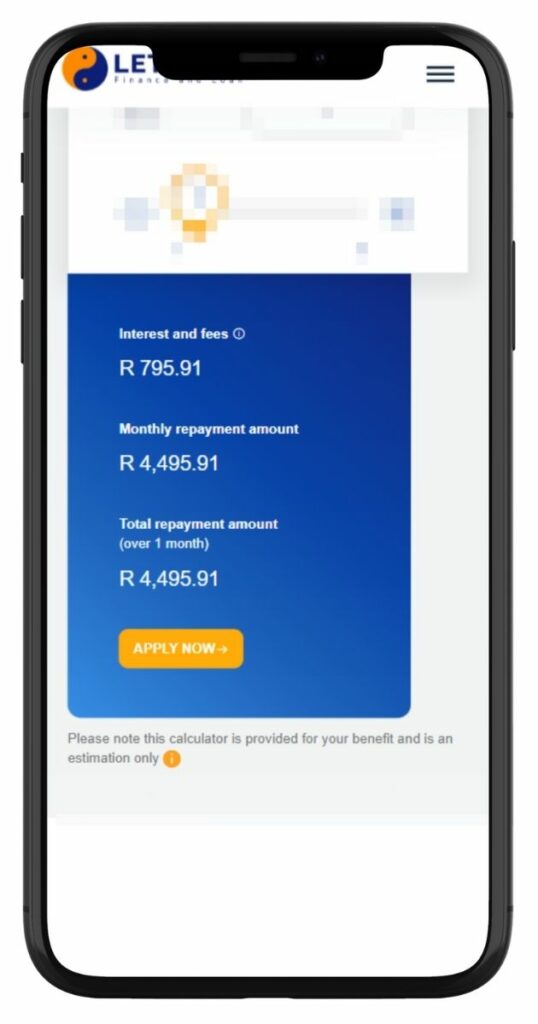

Simulation of a Loan Application at Letsatsi Finance

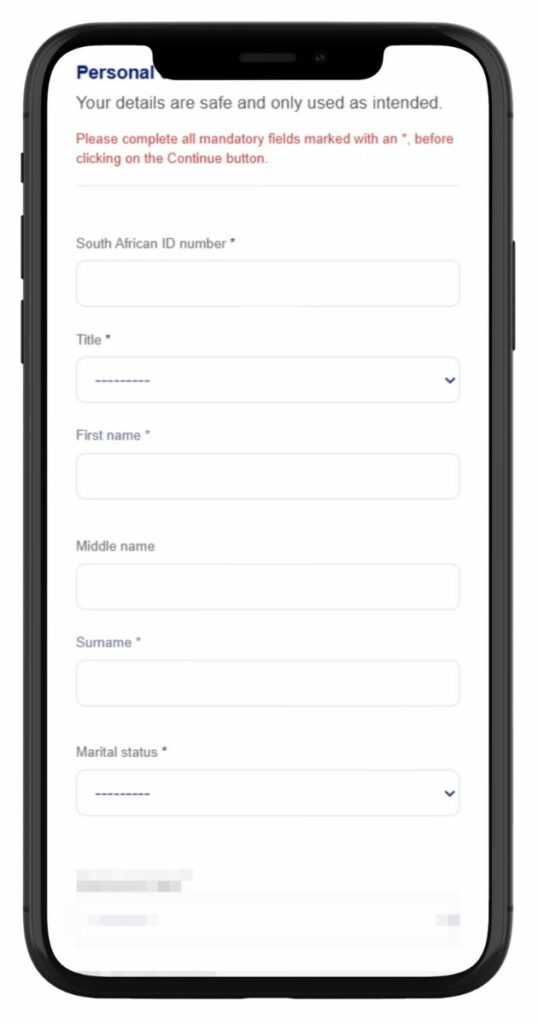

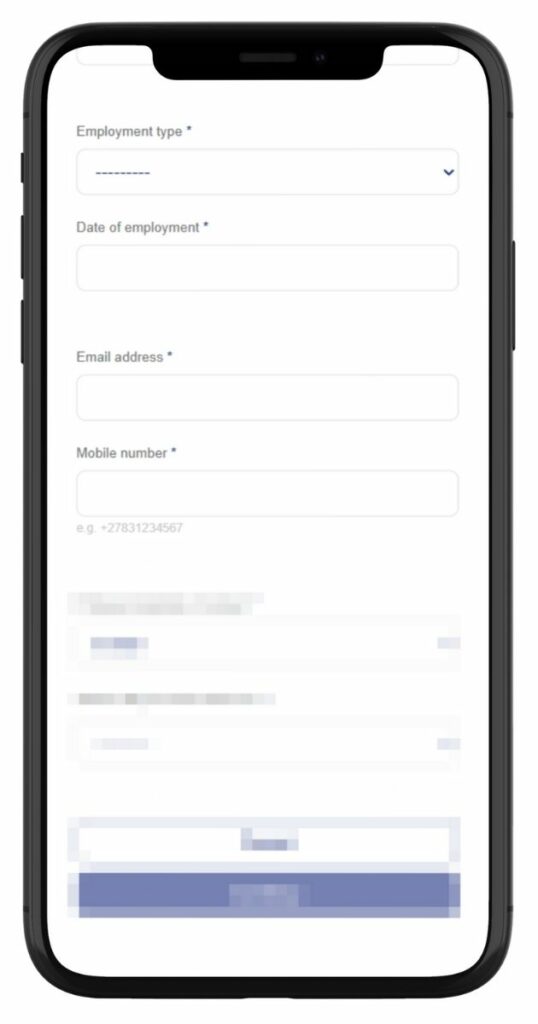

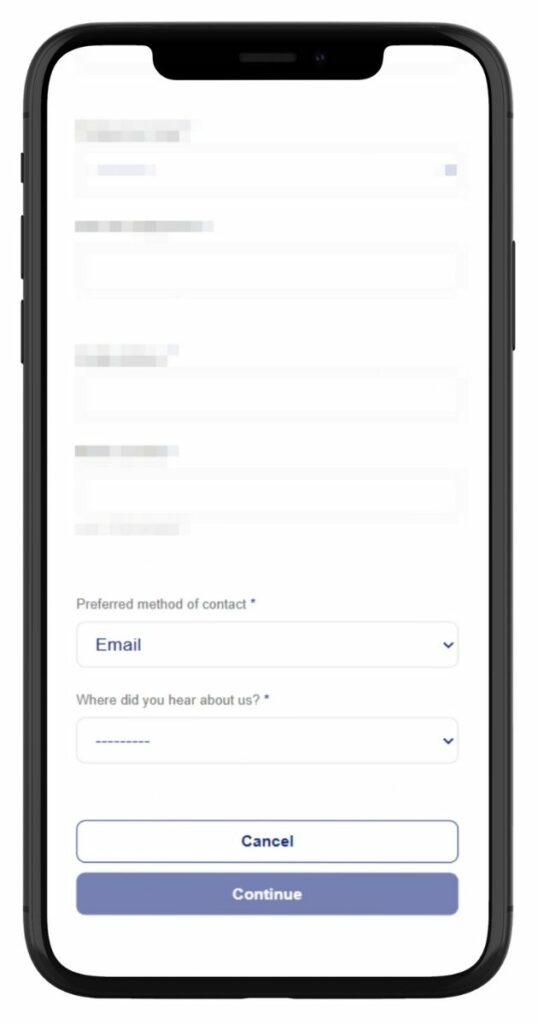

Before diving into the application process, it’s beneficial to understand what the journey looks like. Here’s a step-by-step guide to applying for a loan with them:

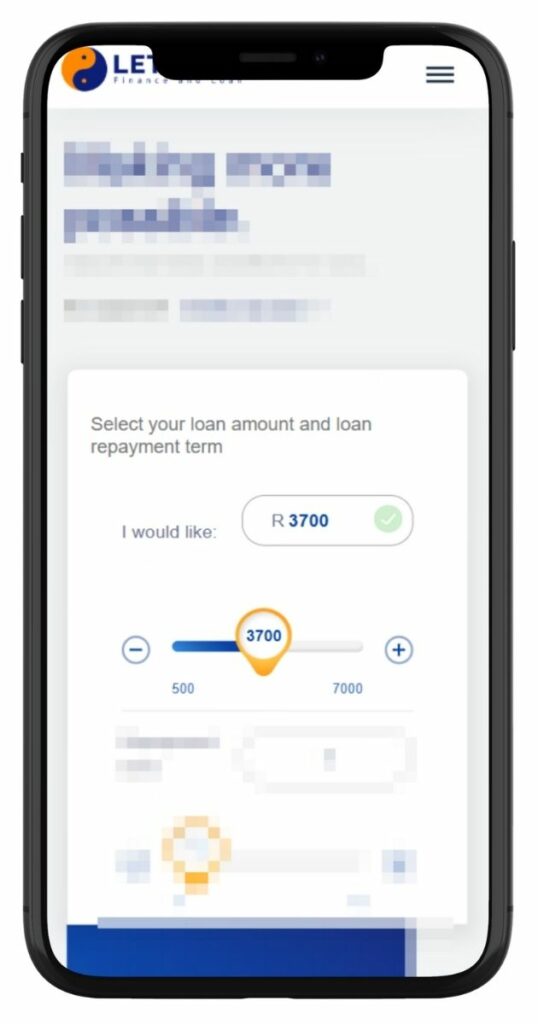

Step 1. Start by visiting the official letsatsifinance.co.za.

Step 2. Use the slider to choose the loan amount you need.

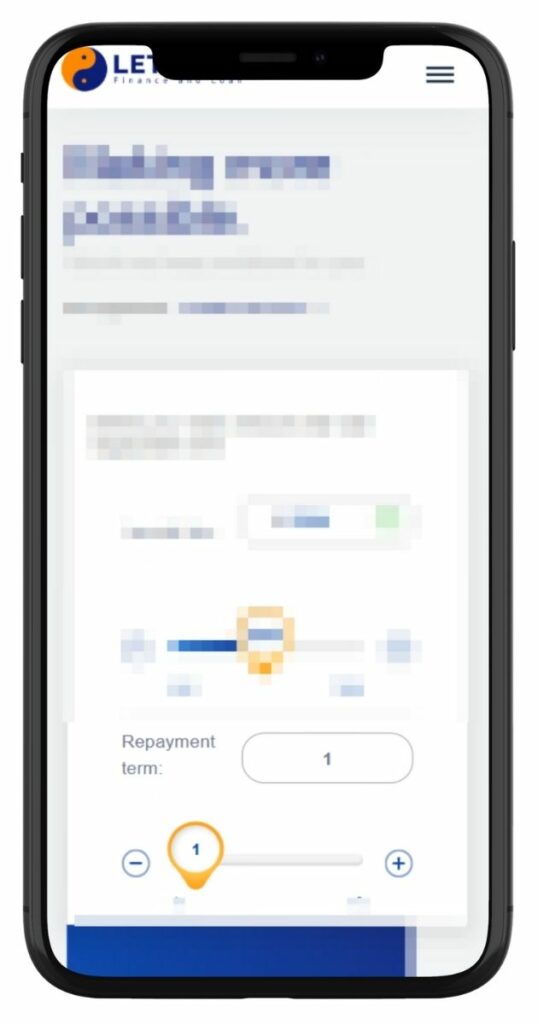

Step 3. Adjust the slider to select the repayment duration.

Step 4. View interest, fees, and total repayment details. Click “Apply Now”.

Step 5. Enter your South African ID, name, and marital status.

Step 6. Input employment type, date of employment, email, and mobile number.

Step 7. Select a preferred contact method and finalize the application.

Step 8. Upload the required documents.

Step 9. Once the application is submitted, their team will review it. This process can take anywhere from a few hours to a couple of days.

Step 10. Upon approval, the loan amount will be transferred to the provided bank account.

Step 11. Based on the agreed terms, monthly repayments will commence, either through direct debits or as per the chosen repayment method.

Eligibility Check

Before diving into the application, it’s always wise to gauge one’s eligibility. This not only saves time but also ensures a higher chance of loan approval.

This company understands the importance of this preliminary step and offers tools and methods for potential borrowers to check their eligibility. One of the most prominent tools is the online eligibility checker on their website. By inputting basic information such as income, existing financial commitments, and the desired loan amount, applicants can get a preliminary idea of their loan eligibility. This tool uses the provided data to simulate loan terms, giving pote

Security and Privacy at Letsatsi Finance

Data breaches and cyber threats are on the rise, and the security and privacy of personal and financial information have become paramount. This lender recognises the importance of this and has implemented robust measures to ensure that its clients’ data remains protected at all times.

Digital Infrastructure

The company’s security measures are its state-of-the-art digital infrastructure. The company employs advanced encryption techniques to ensure that data transmitted between the client and the company’s servers remains secure. This encryption ensures that even if data were intercepted, it would be indecipherable to unauthorized parties.

Regular Audits

To stay ahead of potential threats, they conducts regular security audits. These audits assess the company’s digital and physical infrastructure, identifying potential vulnerabilities and rectifying them before they can be exploited.

Two-Factor Authentication

For added security, they implemented two-factor authentication for its online services. This means that besides the regular password, users are required to verify their identity through an additional method, such as a one-time code sent to their mobile phones.

Employee Training

Recognizing that human error can often be a weak link in security chains, This company invests in regular training for its employees. This ensures that they are aware of the latest security protocols and are equipped to handle sensitive data responsibly.

How Much Money Can I Request from Letsatsi?

Letsatsi Finance offers a broad range of loan amounts to cater to various financial needs. Borrowers can apply for short-term loans ranging from R500 to R7 000, ideal for covering emergency expenses or smaller financial obligations. For more substantial needs, such as debt consolidation or major purchases, they also provide long-term loans from over R500 up to R100 000. This flexibility ensures that they can accommodate different financial situations and requirements.

How Letsatsi Creates Personalised Loan Offers

The process begins with a thorough assessment of the applicant’s financial profile. This includes examining their income, credit history, existing financial commitments, and the purpose of the loan. Based on this comprehensive analysis, this lender crafts a loan offer that aligns with the borrower’s capacity to repay and their specific requirements. This personalised approach ensures that borrowers aren’t saddled with loans they can’t manage, and at the same time, they receive an amount that genuinely caters to their needs.

How can Letsatsi Finance’s Loan Interest Rate Change Loan Payments?

Their interest rate is regulated according to the NCR. There is a standard monthly service fee applied to your loan account. Credit protection insurance is additionally charged every month regarding your loan repayments.

Do Letsatsi Loans Let me Use an Online Loan Calculator?

This lender’s online calculator will enable users to input an amount, request a loan, and choose a repayment term. Their online calculator will estimate and project the associated cost of the loan. The calculator will enable users to calculate their monthly instalment costs. The projected repayments would allow users to find an adequate financial solution within their budget. This is the ideal way to go about sourcing a loan.

Letsatsi Finance – Overview in Detail

| Name | Letsatsi Finance |

|---|---|

| Financial Institution | Letsatsi Finance, registered with the National Credit Regulator (NCR) |

| Product | Personal loans, including short-term and long-term financial solutions |

| Minimum Age | 21 years |

| Minimum Loan Amount | R500 |

| Maximum Loan Amount | R100 000 |

| Minimum Term | 1 month |

| Maximum Term | 36 months |

| APR (Annual Percentage Rate) | Regulated by the National Credit Regulator (NCR) |

| Monthly Interest Rate | Varies based on applicant profile, subject to NCR regulations |

| Fees | – Initiation Fee: R86 – Service Fee: R69 per month – Credit Protection Insurance: R6.33 per month |

| Early Settlement | Full loan balance can be repaid at any time without penalties |

| Repayment Flexibility | Monthly repayments required, with debit order and manual payment options |

| NCR Accredited | Yes |

| Our Opinion | ✅ Offers a wide range of loan amounts with flexible repayment terms ✅ Debt consolidation option available for better financial management ⚠️ Fees and credit protection insurance increase overall repayment cost ⚠️ Customer reviews indicate potential service delays |

| User Opinion | ✅ Useful for short-term and emergency financial needs ⚠️ Mixed customer feedback on approval times and service quality |

How Long Does It Take to Receive My Money from Letsatsi Finance?

On average, once a loan is approved, this lender processes and transfers the funds within a short timeframe. Many clients have reported receiving their money within 24 to 48 hours post-approval. However, it’s worth noting that this can vary based on individual circumstances and the specifics of the loan.

Factors Affecting Withdrawal Speed

Several factors can influence the speed at which funds are disbursed:

- Verification Process: If there are discrepancies in the provided documentation or if additional verification is needed, this can extend the processing time.

- Loan Amount: Larger loan amounts might undergo more rigorous checks and verifications, potentially extending the disbursement time.

- Banking Details: The speed of fund transfer can also depend on the receiving bank and its processing times.

How Do I Repay My Loan from Letsatsi Finance?

Borrowers can opt for direct debit orders, where monthly instalments are automatically deducted from their bank accounts on specified dates. This method is hassle-free and ensures timely payments. Alternatively, clients can also make manual payments through bank transfers or at this lender’s branches.

The repayment plans are typically structured based on the loan amount, interest rate, and the borrower’s financial capacity. Whether it’s a short-term loan with quick repayments or a long-term loan spread over several months or years, this lender ensures that the repayment plan aligns with the borrower’s income and financial comfort.

Possible Fees and Penalties

Transparency is a hallmark of Letsatsi Finance. While they strive to provide competitive interest rates and favourable loan terms, it’s essential for borrowers to be aware of potential fees and penalties. Late payment or missed instalments can attract additional charges. These fees are outlined in the loan agreement, ensuring borrowers are aware of them from the outset. It’s always advisable to read the loan terms carefully and to reach out to their customer service for any clarifications.

Are Letsatsi Finance’s Loan Reviews Positive?

Upon reviewing Hellopeter’s official site, several negative reviews regarding Letsatsi loans exist. The website Hellopeter uses a trust index based on overall reviews, namely, scored on a 1 to 10 ranking. Letsatsi Finance scored rather poorly, with a 1.8 rating. However, it is essential to note that reviews regarding loans may be obscured as those who may not have qualified for a loan or have mismanaged their finances may be inclined to review negatively.

This institution staff have great attitude all the time and are very good people to work with especially Rustenburg branch next to court and Bp garage on the busy road.

So many banks and companies are not assisting workers in the private sector due to the negativity that COVID has impacted the country and yet I could secure a loan with this company.

I am frustrated with this company, after a week of applying for this loan i get told declined due to not having 2 or more salaries in the new account but you guys are too negligent to LOOK PROPERLY.

Dishonest. Tell you one price, pretend to process. Keep asking for more money. You never get the loan. They’ll leave you on hold for hours.

What are Letsatsi Finance’s Contact Details?

Those seeking to reach out to them can reach out through several branches across South Africa.

The following is a list of contacts details for regional branches:

- Bloemfontein branch: +27 51 430 0789

- Witbank branch: +27 13 690 2769

- East London branch: +27 43 722 1789

Customer Service

One of the cornerstones of any reputable financial institution is its approach to customer service, and Letsatsi Finance is no exception. The company places a significant emphasis on ensuring that every interaction with its clients is smooth, informative, and helpful. Whether it’s guiding a potential borrower through the application process, addressing queries about repayment, or assisting with any unforeseen challenges, their team is trained to handle it all with professionalism and empathy. Feedback from clients often highlights the friendly and approachable nature of the staff, making the borrowing experience even more seamless.

Alternatives to Letsatsi

While this lender offers a comprehensive range of financial solutions, it’s always wise for potential borrowers to explore alternatives and compare offerings. The South African financial landscape is dotted with numerous lenders, each with its unique set of offerings.

Comparison Table

To provide a clearer picture, here’s a brief comparison table showcasing Letsatsi Finance alongside a couple of other notable lenders:

| Lender | Loan Types | Loan Amounts | Interest Rates (p.a.) | Repayment Terms |

|---|---|---|---|---|

| Letsatsi Finance | – Short single-month – Short-term – Long-term – Debt consolidation | – R500 – R7 000 (Short) – Over R1 000 – R50 000 (Long) – Up to R100 000 (Debt Consolidation) | Regulated by NCR, includes service fees and insurance | – 1 month (Short single-month) – 2 to 6 months (Short-term) – 9 to 36 months (Long-term and debt consolidation) |

| Absa | Personal Loans | R250 – R350 000 | 6.55% – 60% | 1 month – 10 years (Special short-term: 2-6 months) |

| African Bank | Personal Loans | Up to R250 000 | 15% – 27.75% | 7 to 72 months |

| Capitec | Personal Loans | Up to R250 000 | 12.9% – 24.5% | Up to 84 months |

This table succinctly presents the key aspects of loan offerings by each lender, including the types of loans available, the range of loan amounts, interest rates, and repayment terms.

Pros and Cons of Letsatsi Loans

Pros of Letsatsi Finance

- Tailored Loan Offerings: Their ability to craft loan solutions based on individual requirements sets it apart.

- Transparent Processes: Borrowers appreciate the clarity in terms, interest rates, and fees, ensuring no hidden surprises.

- Exceptional Customer Service: Feedback often highlights the friendly and professional nature of their team.

Cons of Letsatsi Finance

- Limited Online Tools: While they offer several online services, there’s room for more advanced digital tools to enhance the borrowing experience.

- Branch Limitations: While they have a significant presence, some regions might benefit from more accessible branch locations.

Related Post: Challenor Finance Review

Conclusion

Letsatsi Finance offers several loan options with a low-interest-rates. Clients can expect approval for their loan within 60 minutes and receive their loan the same day. They offer flexible and affordable financial solutions. There are several branches across South Africa. Despite this, they do not accept loan applications from those recently employed as they require a working history of no less than six months. Additionally, they are less inclined to offer loans to those under a debt review.

Frequently Asked Questions about Letsatsi Finance

Typically, once all required documents are submitted, loan approval can take anywhere from a few hours to a couple of days, depending on the specifics of the loan.

Letsatsi prides itself on transparency. All fees, including potential penalties for late payments, are outlined clearly in the loan agreement.

Yes, Letsatsi allows borrowers to prepay their loans. It’s advisable to consult with their customer service for specifics regarding any associated fees or terms.

Letsatsi employs stringent data protection measures, ensuring all personal and financial information is stored securely. They adhere to all data protection regulations and prioritize client privacy.

Any changes to the loan amount post-approval would require a reassessment. It’s best to contact Letsatsi directly to discuss potential adjustments.