Fasta is a Fintech company in South Africa situated in the Western Cape. The business has been operating since 2017. This company offers quick loan solutions for online as well as for in-store items. A loan from Fasta is typically between R500 to R800 000 with an interest rate of 3% per month. Fasta Loans is a secure digital lending platform that makes use of innovative and scalable technology. They offer financial solutions to a wide variety of merchants as well as online.

Fasta Loans is registered and regulated through the NCA (National Credit Authority). This entails they follow and adhere to the proper fair, just, and secure lending practices within South Africa.

What Fasta Loans Have to Offer

Fasta loan amounts range between R500 to R8000. They offer a choice regarding their instalments which range from 1 to 3. Their lending platform will simply require you to register your name, surname, and password. Prior to this, you will also need to provide additional details such as income, expenses, and payslips. Fasta will then assess the information provided and offer a loan amount and interest rate based on this assessment.

Upon being given a proposed loan amount and interest rate, clients can then choose the number of instalments. These instalments range from 1 to 3 months. After which, the loan amount will be deposited in the requested bank account. Additionally, Fasta operates as a credit checkout facility for online shopping. Though only through specified merchants that provide instant loans for online purchases.

Cash Bank Credit Facility

This application process takes roughly 3 minutes to complete. Once approved, the loan amount can be deposited in 5 minutes. Fasta will then deposit credit directly to your specified bank account. The amount should be seen immediately but is dependent on your bank as to when it will reflect.

In-store Credit

On Fasta loan’s official site, www.fasta.co.za, they offer in-store credit to customers. This in-store credit is essentially a credit voucher. Once approved, they can make use of this voucher/funds immediately, and they can then make purchases online through designated merchants.

Online Credit

In the checkout process, there are designated and participating online merchant stores. Clients have the option to pay using the FASTA instant credit option. With this credit, the funds are paid directly to the merchant allowing you to receive your purchases sooner.

Can I Only Find Payday Loans at Fasta?

Fasta loans offer Payday loans with a repayment period of 1 to 3 monthly instalments. This is ideal for those seeking more affordable Payday loans. Most credit providers do not offer more than two months to repay. This is ideal for those seeking fast access to affordable emergency funds.

How do I Know if Fasta Loan is Legit?

For those who are unsure of the Fasta loan’s legitimacy, they are registered through the NCR (national credit regulator). This means that they are regulated by an outside governing body overseeing the correct lending practices. In addition, their online platform is secured through McAfee, meaning their site is devoid of malware and spam. Fasta’s online platform is secured through Redblade, which is regarded as the best end-to-end digital software for online financial transactions.

Related post: Secured vs. Unsecured Loans

Who can apply for a Fasta Loan?

Criteria for Potential Borrowers

Fasta loans are accessible to a wide range of individuals, but there are basic criteria that one must meet to be eligible. Firstly, applicants must possess a valid RSA ID number, ensuring that they are legally recognized residents or citizens of South Africa. Additionally, applicants must be 18 years or older, aligning with the legal age of contractual accountability.

Another crucial criterion is having a verifiable income for the last 90 days. This income verification is a standard procedure that helps Fasta determine your ability to repay the loan. Lastly, applicants must have access to internet banking, as the entire application process, including the disbursement of funds, is conducted online.

Differences from Other Loan Providers

Fasta distinguishes itself through its emphasis on speed and convenience. Unlike traditional loan providers that may require physical meetings or a plethora of documents, Fasta simplifies this process by making it entirely online and minimizing paperwork. Their system is designed to facilitate quick decision-making, allowing for instant loan approvals and immediate fund disbursements upon acceptance.

Another notable difference is the flexibility in repayment terms offered by Fasta. Borrowers can choose to repay their loans in one, two, or three instalments, providing some level of flexibility based on their financial capability and planning. This approach offers customers a certain degree of autonomy and adaptability in managing their loans and financial obligations.

About Arcadia Finance

Arcadia Finance offers a hassle-free solution for securing loans from a variety of banks and lenders. Just complete a no-cost application and be presented with options from up to ten different lenders. Our lending partners are all reputable, operating under the strict guidelines of South Africa’s National Credit Regulator.

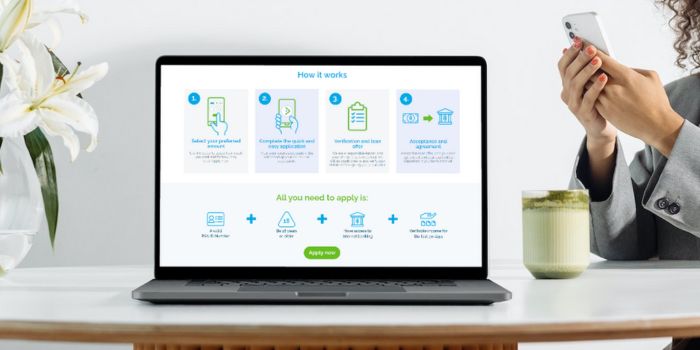

Requirements of the Fasta Loan Application

Before you apply for your potential loan through Fasta loans, you may require the following.

- South African ID

- Access to online banking

- 3 months’ payslips

- You are over the age of 18.

Once you have submitted the above information, Fasta loans will then begin their online assessment. Where they will assess your financial position and your ability to afford the repayments. This is solely based on your income, additional debts, as well as expenses. This assessment verifies if you can afford any additional credit instalments. If in the case where an application is denied, this is due to Fasta only offering responsible loans. Additionally, Fasta loans will not offer loans to individuals that cannot afford to repay or cause themselves financial hardship.

Related Post: Hoopla loan review

Simulation of a Loan at Fasta

Step-by-step Guide to Applying for a Loan with Fasta

- Visit the Fasta website: Start by accessing the official Fasta website.

- Select Loan Amount: Use the slider on the homepage to choose the desired loan amount and repayment term.

- Click ‘Apply Now’: This will redirect you to the application page.

- Fill in Details: Provide all the necessary details, including personal information, RSA ID number, and income details.

- Verification: Fasta will conduct credit checks and verify the details provided.

- Loan Offer: If approved, you will receive a loan offer detailing the terms and conditions.

- Acceptance: If you agree to the terms, accept the offer.

- Fund Disbursement: Once accepted, the loan amount will be deposited into your bank account.

Eligibility Check

Fasta aims to make the loan application process as seamless as possible. To assist potential borrowers, they offer tools to pre-check eligibility. Before diving deep into the application process, users can utilize these tools to get an idea of their chances of approval. This preliminary check is based on basic information and does not guarantee loan approval but provides a general

How Much Money Can I Request from Fasta?

When applying for a loan with Fasta, the amount of money you can request varies based on certain factors, but there are established minimum and maximum thresholds. You can apply for a loan starting from a minimum amount, which is relatively low, making it accessible for minor financial needs or emergencies. On the other end of the spectrum, Fasta offers loans up to a maximum amount of R8,000. This cap is set to ensure that loans remain manageable for borrowers and align with responsible lending practices.

Fasta also provides personalized loan offers. This means that the loan amount and terms you are offered are tailored based on your financial situation and creditworthiness. This personalized approach ensures that the loan aligns with your financial capacity and repayment ability.

How Long Does It Take to Receive My Money from Fasta?

Fasta prides itself on its quick processing times. Once your application is approved, the disbursement of funds is quite prompt. In many cases, borrowers receive their money almost immediately after accepting the loan offer. However, the actual time may vary based on certain factors such as the time of approval and the operational hours of your bank.

How Do I Repay My Loan from Fasta?

Repaying a loan to Fasta is designed to be as straightforward as the application process. Borrowers are presented with repayment plans that align with their loan terms, allowing for repayments in one, two, or three instalments. These options provide some flexibility, enabling borrowers to choose a plan that suits their financial situation.

Additionally, it’s essential to be aware of fees and penalties that may apply. For instance, late payments or failure to meet repayment obligations could incur additional costs. Ensuring that repayments are made according to the agreed terms is crucial to avoid any extra charges and maintain a healthy credit profile.

Do Fasta Loans Let me Use an Online Loan Calculator?

Yes, Fasta loans make use of an online calculator where clients can calculate potential loan fees. This is a free service that requires minimal documentation. They offer an immediate deposit of funds, with the option to choose up to 1 to 3 instalments. They offer a second option to deposit funds as cash on a digital card.

How can Fasta Loan’s interest rate change loan payments?

Fasta loan’s interest rates are fixed. You can expect a rate between 0% to 5%. However, this rate will be subject to factors such as your credit profile.

Are Fasta Loans Reviews Positive?

Upon review of Fasta loan’s previous clients, testimonials regarding their services are mixed. However, this is expected with any review. Though, those who have reviewed positively praise their simplicity and access to potential loan amounts. Amounts can reflect within a few hours of submitting their application. Additionally, clients reviewed positively regarding their instalment options, where they can choose their instalment plan from 1 to 3 months. This instalment option makes their repayment plans more flexible and affordable.

Customer Service

Customer service is a crucial aspect of any financial service, and Fasta provides avenues for customers to seek assistance and ask questions. If you have further queries or need clarification on any aspect of the loan process, Fasta’s customer service team is available to assist.

Having access to reliable customer support ensures that any uncertainties or issues you encounter can be promptly addressed, enhancing your overall experience and confidence in the service. It’s always advisable to reach out and seek professional guidance if you have any uncertainties or questions regarding your loan or the application process.

What are Fasta Loans’ Contact Details?

Since Fasta loans is mainly an online lending platform, there is currently no direct phone number for client queries. However, queries can be made on the official site through their help desk. Those that require an email address may use the following email address support@fasta.co.za. Their offices are located at Dock Road Junction, Cnr. Stanley & Dock Road on the 3rd Floor, Spaces in Cape Town.

Alternatives to Fasta

While Fasta offers a unique blend of convenience and speed in the loan application process, there are other credit comparison portals available for those looking to explore alternative options. These platforms provide a range of offers from various lenders, allowing borrowers to compare and choose the best fit for their needs.

Comparison Table

| Lender Name | Loan Amount Range | Interest Rate | Repayment Term | Additional Fees | Special Features |

|---|---|---|---|---|---|

| Fasta Loan | R800.00 to R8,000.00 | 3% | Up to 4 months | Monthly service fee: R69.00 | Instant online issuance, various credit types |

| Absa Personal Loans | R250 to R350,000 | Variable | 12 to 84 months | Service and initiation fees | Flexible for personal and business needs |

| African Bank Personal Loans | Up to R250,000 | 15% to 27.75% | 7 to 72 months | Insurance rates: 5.04% to 5.4% | Fixed monthly instalments, online application |

| Capitec Personal Loans | Up to R250,000 | 12.9% to 24.5% | 1 to 84 months | Initiation fee, monthly service fee | Online estimates, personalised offers |

Pros and Cons

Pros

- Speed and Convenience: Fasta’s online platform is designed for quick and easy loan applications, making funds accessible almost immediately after approval.

- Transparency: All fees, charges, and interest rates are clearly outlined, ensuring borrowers are not caught off guard by unexpected costs.

- Flexible Repayment Terms: Borrowers have the option to choose their repayment plans, allowing for better financial planning and management.

Cons

- Loan Amount Limit: The maximum loan amount offered by Fasta is R8,000, which might not be sufficient for borrowers with more substantial financial needs.

- Short-term Focus: Fasta’s loans are more suited for immediate or emergency financial needs, and might not be the best fit for long-term financial planning or larger investments.

- Online Dependence: Since all transactions, including the application and fund disbursement, are conducted online, those without reliable internet access or online banking facilities might find it challenging to access Fasta’s services.

Conclusion

Fasta loans are ideal for borrowers who need affordable short-term loan solutions. For those seeking a fast loan, online purchases, or affordable emergency funds. The online application process requires minimal documentation. With an expected loan deposit within a few hours.

Fasta provides several instant credit options. They offer loan deposits directly into your bank account or loaded onto a virtual credit card for later use. Lastly, clients can pay directly to their desired online merchant. However, there are limitations regarding the amounts as they may not fully cover some purchases from designated merchants. Their repayment plan offers the choice of between 1, 2, or 3 instalments each month. This gives more flexibility and affordability to their clients.

Frequently Asked Questions

After your loan application is approved, Fasta aims to disburse the funds almost immediately. However, the actual receipt of funds may depend on your bank’s operational hours and processing times.

Fasta’s application process is entirely online, and you typically won’t need to upload documents. However, you should be prepared to provide details such as your RSA ID number and have access to internet banking for verification purposes.

Fasta conducts credit checks as part of their responsible lending policy. While a poor credit history may affect your application, it doesn’t necessarily mean you will be ineligible. Each application is assessed on an individual basis.

Yes, early repayment is usually possible, and it might save you some money on interest and fees. It’s advisable to contact Fasta’s customer service for specific guidance based on your loan agreement.

Missing a repayment could result in additional charges or fees. It’s essential to contact Fasta as soon as possible if you’re having trouble making a repayment, as they may be able to offer assistance or advice.