We all understand the ins and outs of everyday life, where money is a part of everything, and we cannot live out it. We live in a day and age where money matters and life would merely be highly challenging without it. Every South African is limited within the confines of their monthly budget and their options from where they reside. With limited options, how can you reach your financial goals more quickly? A loan may be just the solution you need.

Key Takeaways

- Variety of Loan Options: There are several types of loans available, including personal loans for larger, long-term funding needs and payday loans for quick, short-term cash boosts. Each has specific requirements and conditions tailored to different financial needs and goals.

- Regional Differences: Loan options and conditions, such as interest rates, can vary significantly across different regions in South Africa. It’s essential for borrowers to consider these regional differences when applying for loans.

- Credit Accessibility for Pensioners: Despite facing more challenges in obtaining credit, pensioners still have options available based on their monthly earnings. Pensioners should explore these options or consider support from family and friends if proof of income is insufficient.

What is a Personal Loan?

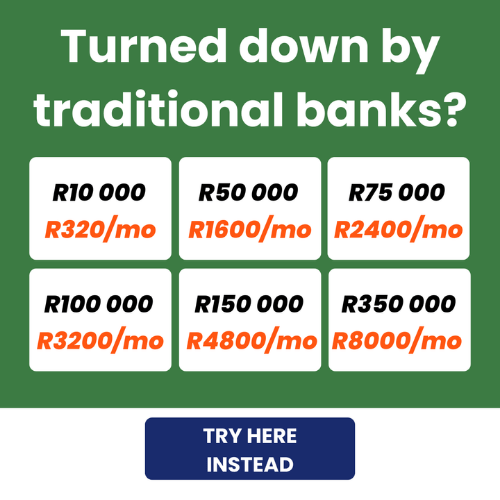

A personal loan is usually an unsecured loan, serving as a versatile financial solution if

you’re facing an unexpected expense. These loans can vary, starting from as little as R1 000 to as much as R350 000. The repayment terms are flexible, ranging from a minimum of 7 months to a maximum of 72 months. Although not always the case, repayments are commonly set at an annual interest rate of 27.25%. You only need to start making monthly payments once your loan application is approved and you’ve received the funds, over the period you have selected.

Why You May Need a Personal Loan

Credit providers offer personal loans to those seeking to reach their financial goals quicker or take the next step in life. You may need a loan for a variety of reasons, such as a purchase of a car, a home loan, or the capital to start a new business. You may also need the funds to take that dream vacation for your honeymoon or that amazing TV.

However, gathering these funds simply from your monthly income alone will probably be challenging and lengthy, if not extremely difficult. To make these dreams of yours a reality, look no further than a personal loan from your accredited credit provider.

When considering a personal loan in South Africa, age can be a critical factor. Discover How Old Do You Have to Be to Get a Personal Loan to see if you meet the requirements to access the financial support you need.

Why Compare Personal Loans?

Comparing personal loans is a straightforward strategy to ensure you secure a deal that fits your budget, from the loan amount and repayment terms to the interest rate. With numerous providers offering varied terms, comparing these options is not only sensible but essential. It ensures you make an informed decision and choose a loan that suits your financial circumstances best before committing to any agreement.

Why Use Arcadia Finance?

- 100% free: The application is free and does not include any hidden fees.

- Quick & easy: The whole application process is done online in minutes.

- Convenient: Compare up to 19 banks & lenders with one application.

- Non-binding: You decide if you want to accept or decline your offers.

- Safe: Your personal data is safe with us.

Loan Options

When it comes to loans, they come in many forms, with a wide variety of terms and conditions; these can range from short-term loans, such as Payday loans, to long-term loans, which are Personal loans.

Payday Loans

Payday Loans are smaller cash loans. As a short-term loan, this is for acquiring funds which usually range up to around R2500. With short-term loans, you will usually repay them within a few months. This type of loan is for those who are in a cash crunch and need a temporary boost in their finances.

Requirements for Payday loans: The essential requirements to qualify are simply that you are older than 18 years, have proof of residence, an official certificate issued by SARS( South African Revenue Service), and three months’ worth of bank statements.

Personal Loans

Personal Loans are where you can attain a more considerable amount of funds. This is ideal if you are looking to make larger purchases for which you do not currently have the necessary funds. Namely, these items can range from home to buying your dream car, new furniture for your home, starting/expanding your business, or even for those who are considering debt consolidation into a particular loan. With personal loans, you can expect more significant sums of money with a personal loan, and additionally, loan term lengths will be longer.

Pensioner Loan Options

Pensioners find it harder to obtain credit; despite this, they still have credit options. This is dependent on what they earn each month. However, for home loans, the limit is usually around 60 years old. Unfortunately, those with little to no proof of income for a loan should seek assistance from a relative or friend willing to lend them money.

Business Loans

Business Loans are specifically designed for entrepreneurs and business owners looking to finance their business needs. These loans can range from small amounts to substantial sums, depending on the business requirements and the lender’s policies. Business loans can be used for various purposes such as expanding operations, purchasing new equipment, increasing working capital, or even starting a new business venture.

Requirements for a Business Loan: Certain banks offer loans to acquire an asset, such as a vehicle or property. These loan amounts are typically higher than a personal loan, with terms ranging from 10 years. The requirements usually entail documents that showcase the registration of the business within South Africa, bank statements, your ID, and possibly any other additional documents such as proof of residence and employee information.

Personal loans can offer immediate financial relief for urgent needs, but planning for the future is equally important. Discover effective strategies to save for your retirement, balancing short-term needs with long-term goals.

About Arcadia Finance

Arcadia Finance makes the loan process more straightforward and efficient. Our platform enables you to complete a free application and receive loan offers from up to 19 lenders. Rest assured, all our lending partners are trustworthy and fully compliant with the regulations of the National Credit Regulator of South Africa.

Loan Options by Region

Not all loans are equal. We look into varying provinces and locations for the best and most suitable loans based on your area. A little-known fact is loan options tend to vary by region and location. Interest rates on home loans can differ for each province in South Africa. The cost of doing business and even the competition between credit providers play into the final rates on your potential loan. So for those planning to move or possibly relocate within South Africa or other residences, it can be helpful to understand which regions have the highest and lowest rates and their available options.

Cape Town

Instant Cash Loans

The home of Table Mountain and the legislative capital of South Africa, you won’t be short on options for instant cash loans. For your online options, check sites such as Wonga, Hoopla Loans, Konga, and LittleLoans. Though they have lower loan amounts than traditional banks, they have fewer requirements for their instant cash loans.

Personal Loans options

Absa, Nedbank, or South African Bank are your best bet for larger loans. With stricter requirements, you will have to earn a certain amount of income each month. If you seek smaller loans, you should look online for credit providers similar to Konga.

Bank options for consolidation loans

Suppose you have several loans and wish to consolidate your debt into a singular repayment plan. Certain banks make use of this credit tool. Nedbank, Standard Bank, and FNB will enable you to reduce your debt of up to three loans to approximately R300 000.

Small loan Companies on Gumtree

This online site, in addition to goods and services, also offers small loans. Namely, this is through their advertisements. Those who wish to attain a small loan should consider Finbond as their first option.

Pretoria

Instant cash loans in Pretoria

In Pretoria and looking for an instant cash loan? Get cash quickly through Xcelsior. This is easily done via SMS or an online application, where you can expect a fast turnaround time to attain these funds.

Payday loans

Need a boost such as a payday loan? Kwalaflo Loans offers same-day online loans, Where clients may borrow amounts of up to R2000 with virtually little to no hassles.

Consolidation loans in Pretoria

If you have several debts, you want to consolidate them into a particular loan for a simple and beneficial repayment plan. Trounce will place debts together with the result that makes repayments more affordable and manageable. Through Trounce, you can expect a singular repayment plan with a fixed interest rate and improve your credit score.

» Find out more: How many private loans can you really hold?

Durban

Bridge loans

Those who find themselves in an emergency, such as a car accident, resulting in the damage of their vehicle, are awaiting a payout and repairs. A bridge loan may be the solution, where a loan is taken to enable costs to be covered. These costs are namely repairs and additionally may be provident fund payments. With this loan, you will protect your immediate costs, and once paid by your insurance or company, you will repay the loan with the acquired funds. Those who need a bridge loan and resides within Durban can do so through the company Bridge Loan.

Business loans

We all know that starting or looking to expand your business requires some form of capital. This is namely through a business loan. For those seeking a business loan, there are lenders in Durban that may assist you. In Durban, two credit companies come to mind for business loans. Mercantile and Ithala Bank are well-known business loan providers. They will require your company’s documents and verify account information with your bank provider and your documents, such as your ID.

Bloemfontein

Cash Loan

Letsatsi offers short-term loans valued at R8 000 with terms of up to 6 months. Long-term loans can amount to R100 000 with a period of 9 months to 3 years. They only require two consecutive payslips and three months’ bank statements.

Bridging Loans

Marlin Credit Services is a company that works in this niche under the rules and regulations set by the NCR. To apply for these loans, you should contact them since no online application is available.

What is the Best option for Payday Loans in Bloemfontein?

Little Loans provides payday loans of a leading figure of R8 000. They are easy to apply to; all you need to do is fill out an online application with your personal and financial information. The best thing about Little Loans is that loan applications are processed quickly and that you will only have to provide your ID, proof of residency, and being able to confirm that you are employed and that you will be employed during the loan term.

How to Apply for a Loan with Arcadia Finance

Applying for a loan at Arcadia Finance is simple and convenient. Begin your application by visiting our website, where our dedicated and experienced team is ready to assist you with any questions throughout the process. You will need to provide basic information, including details about your income and expenses, as well as your desired loan amount and preferred repayment term. Once you submit your application, our team will promptly review the details and respond with a decision as quickly as possible.

5 Banks Leading the Charge in Personal Loans

African Bank

African Bank stands out with its “Choose your Break” offer, allowing borrowers a payment holiday for a month on qualifying personal loans. This bank, under the curatorship of the South African Reserve Bank, is a top choice for many in South Africa due to its local control and tailored loan solutions.

FNB

Known for its innovative approach to banking, FNB offers a January break from loan payments for customers who keep their personal loans up to date. This feature, coupled with no penalty fees for early loan repayment, enhances FNB’s appeal as a leading financial institution.

Nedbank

To secure a Nedbank personal loan, applicants need to meet certain criteria including permanent employment or a minimum monthly net salary of R3,500, electronically paid into their account. Other requirements include a valid South African ID, recent payslips or an employment letter, bank statements from the last three months, and proof of residence. Nedbank’s robust reputation is backed by its long-standing presence and customer-focused banking services.

Capitec

Capitec disrupts traditional banking norms with a fresh approach, making it a significant player in South Africa’s banking sector. Their personal loans include complimentary retrenchment and death cover, offering substantial security through their credit protection plan, subject to specific terms.

Absa

Since joining the Barclays Group in 2013, Absa has maintained its strong standing in South Africa. Absa personal loans come with an optional Credit Protection Plan and the flexibility to make additional payments, which can significantly reduce the total interest paid on the loan over time.

Comparison of Personal Loan Options at Leading Banks

| Bank Name | Loan Options Available | Loan Amounts | Repayment Terms | Key Loan Features |

|---|---|---|---|---|

| African Bank | Personal loans with payment holiday | Varies by applicant | Up to 84 months, with payment break | “Choose your Break” payment holiday option |

| FNB | Personal loans with January break | Up to R300,000 | Up to 60 months | January payment break, no early repayment penalties |

| Nedbank | Standard personal loans | Depends on eligibility | Varies, tailored to customer needs | Strict eligibility criteria, comprehensive documentation required |

| Capitec | Personal loans with death cover | Up to R250,000 | Up to 84 months | Includes retrenchment and death cover |

| Absa | Personal loans with credit protection | Up to R350,000 | Flexible, allows additional payments | Optional Credit Protection Plan, part of Barclays Group |

This enhanced table includes the key loan features for each bank, which helps in understanding the unique selling propositions and additional benefits they offer with their personal loan products.

Questions to Ask Yourself Before Taking Out a Personal Loan

Is a personal loan the most suitable option for your financial situation? Before making a decision, consider these key questions:

Do I Truly Need a Personal Loan?

Evaluate whether borrowing is necessary. Alternative options such as an overdraft, credit card, or even selling assets may provide the funds you need without taking on debt. Avoid taking out loans for non-essential expenses, such as holidays or luxury purchases.

Am I Eligible for a Loan?

Check whether you meet the necessary requirements by using a personal loan calculator. This tool estimates your likely repayment amount based on different interest rates. Avoid applying with multiple lenders simultaneously, as doing so can negatively impact your credit score.

Can I Borrow the Exact Amount I Require?

Only take out the amount you need, as borrowing more than necessary can result in additional costs due to higher interest charges and extended repayment periods.

What Will the Total Cost of the Loan Be?

Calculate the full cost of the loan, factoring in interest rates, fees, and repayment terms. Ensure that the monthly instalments are manageable within your budget to avoid financial strain.

Which Lender Offers the Most Favourable Terms?

Compare lenders to find the best interest rates and repayment terms. If you intend to settle the loan early, check whether early repayment penalties apply, as some lenders charge additional fees for early settlement.

Conclusion

The optimal personal loan options for South African residents combine flexibility, affordability, and accessibility. African Bank, FNB, Nedbank, Capitec, and Absa stand out by offering distinctive features designed to address diverse financial needs, such as payment holidays and credit protection plans. These banks demonstrate a dedication to customer satisfaction and financial empowerment through their range of offerings, catering to various income levels and requirements. Whether individuals prioritize low interest rates, minimal fees, or inclusive eligibility criteria, they can access competitive and innovative financial solutions to efficiently and responsibly achieve their financial objectives.

Frequently Asked Questions

A personal loan functions as an amount of money borrowed from a financial institution, which you are obligated to repay over an agreed period, usually with interest. This loan can either be secured, backed by collateral, or unsecured, based solely on your creditworthiness. Typically, you receive a lump sum and repay the loan in fixed monthly installments.

The timeframe for receiving the funds of a personal loan varies by lender. Generally, you can expect to receive the funds within a few days after your application is approved. Some lenders offer same-day funding, while others may take a week or longer.

Yes, applying for a loan can impact your credit score. When you apply, the lender typically conducts a “hard inquiry” on your credit report to evaluate your creditworthiness. This inquiry can temporarily lower your credit score by a few points. However, making timely payments can help improve your score over time.

The costs of a personal loan comprise the interest rate and any fees charged by the lender, such as origination or administration fees. The interest rate can vary widely based on factors like your credit score, income, loan amount, and loan term. It’s crucial to compare the Annual Percentage Rate (APR) from multiple lenders to comprehend the total cost of the loan.

In addition to maintaining a satisfactory credit score, applicants typically need to provide proof of income, verification of employment, identity proof (e.g., passport or driver’s license), and sometimes proof of residence. Lenders may also assess your debt-to-income ratio to ascertain your ability to repay the loan.